Weekly Market Wrap(Oct 6–10, 2025): Nifty, Sensex Rally; Bank Nifty Surges; Gold Hits New Highs

By CapitalKeeper | Weekly Market Wrap | Indian Equities | Market Moves That Matter

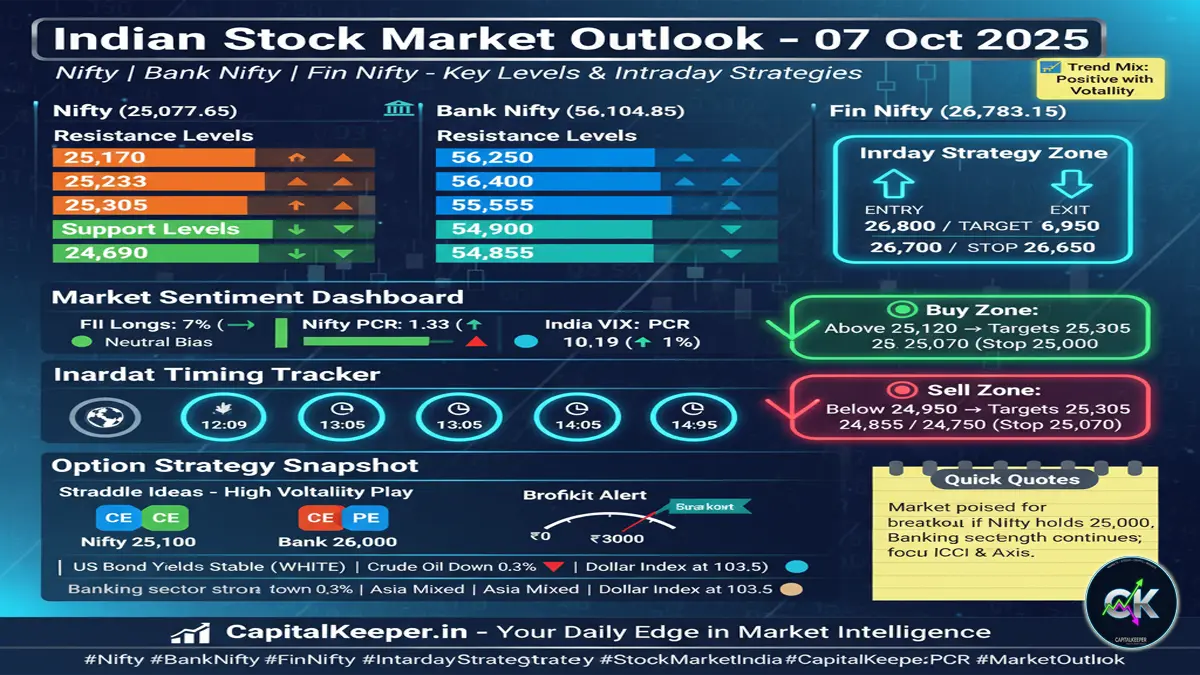

Indian markets posted strong gains in the week of Oct 6–10, 2025: Nifty up 369 pts, Bank Nifty rallies 775 pts, Sensex climbs. Rupee strengthens; gold & silver soar. Full wrap and outlook ahead.

1. Weekly Performance Overview: Oct 6–10, 2025

Opening (Monday, Oct 6):

- Nifty 50: 24,916.55

- Bank Nifty: 55,834.70

- Sensex: 81,207.17

- Fin Nifty: 26,532.30

Closing (Friday, Oct 10):

- Nifty 50: 25,285.35

- Bank Nifty: 56,609.75

- Sensex: 82,582.82

- Fin Nifty: 26,842.25

Weekly Gains:

- Nifty: +368.80 points ( +1.48%)

- Bank Nifty: +775.05 points ( +1.39%)

- Sensex: +1,375.65 points ( +1.69%)

- Fin Nifty: +309.95 points ( +1.17%)

The week delivered a clear rebound with Bank Nifty leading and strong support from financials and cyclicals. Broad indices pulled ahead, and investor confidence returned amid easing external concerns.

2. Key Drivers & Sentiment Shifts

⚖️ Financials & Bank Strength

Financials led the charge this week. Several private banks reported upticks in deposit growth, easing credit spreads, and better-than-expected Q3 previews. This helped Bank Nifty outperform the broader market.

📈 Foreign Inflows & Domestic Participation

Foreign Institutional Investors (FIIs) turned net buyers midweek, particularly in banks, autos, and consumer names. Domestic investment flows, including mutual funds, also supported momentum.

🌍 Global Cues & Softening Dollar

A mild pullback in the U.S. dollar index gave breathing room to emerging markets. Some dovish central bank murmurs abroad eased rate pressure fears, improving risk-attractiveness in equities.

🪙 Rupee & Forex Relief

The Indian rupee strengthened modestly, aided by reduced crude prices and sustained inflows. Times of India reported that the rupee appreciated by 7 paise to settle at ₹88.72/USD on Friday, driven by domestic market strength and easing crude.

3. Commodities & Precious Metals

Gold

Gold continued its upward trend. On October 6, it hit a record ₹1,19,000+ per 10 g in India, driven by buying ahead of festival season and global safe-haven demand.

However, by week’s end, profit-taking began. Analysts suggest that despite short-term corrections, structural demand is still strong.

Silver

Silver had a spectacular run, with articles noting sharp jumps of ₹8,500 in a single day on festival-driven demand, hitting historic highs.

Industrial as well as investment interest remains robust, especially given supply constraints and increased ETF flows. Emkay projects further room for upside (20%) from current levels.

Crude & Base Metals

Crude oil traded under pressure, partly due to lower demand prospects and easing supply tightness. This helped ease inflation fears domestically.

Base metals had a mixed showing copper dipped amid global demand worries, while aluminum held up relatively better.

4. Sector Insights & Technical Signals

- Banking & Financials: The clear trend leader. Many banks crossed key resistances midweek, triggering momentum buying.

- Automobiles & Capital Goods: Riding the recovery wave, these sectors saw strong inflows, particularly from cyclical bets.

- IT & Pharma: Soft to mixed performance. Pharma bore more stress due to regulatory uncertainties.

- Consumables / FMCG: Moderately stable, as defensive accumulation emerged in some names.

Technical Observations:

- Nifty successfully reclaimed 25,200 and showed support in the 25,000–25,100 zone.

- Bank Nifty crossing 56,400–56,500 will be key for continuing its run.

- A slip below 25,100 in Nifty could invite a retest of 24,800.

5. INR & Macro Backdrop

Rupee strength (to ₹88.72/USD) helped ease input cost inflation worries for corporates.

Headline inflation and fiscal deficit trajectory stayed within manageable bounds, giving policymakers room to support growth.

Meanwhile, mutual fund flows in September moderated, but gold & silver ETFs saw record inflows reflecting risk hedging rather than pure equity bets.

6. Forecast: Next Week (Oct 13–17, 2025)

🔮 What to Watch

- U.S. Fed rhetoric (especially post-September inflation data)

- Q2 earnings season in India

- Crude oil direction and its impact on core inflation

- Continued flows (FII + mutual funds)

📈 View & Strategy

- Nifty: Likely range — 25,100 to 25,600. A breakout past 25,400 could target 25,800+.

- Bank Nifty: Support near 56,000, resistance around 56,800–57,200.

- Precious Metals: Gold may consolidate between ₹1,18,500–₹1,21,500, silver could see further strength.

- Rupee: Expected to stay stable to modestly firm unless external shocks reemerge.

Tactical Approach:

- Participate in strong momentum names in banking, autos, and cyclicals.

- Use commodity (gold/silver) exposures as partial hedges.

- Avoid over-leveraging—watch for sudden policy or global shifts.

7. Summary Table

| Index / Asset | Weekly Move | Key Message |

|---|---|---|

| Nifty 50 | +368.8 pts (+1.48%) | Recovered with strong breadth |

| Bank Nifty | +775 pts (+1.39%) | Financials led the charge |

| Sensex | +1,375 pts (+1.69%) | Large caps rebounded |

| Fin Nifty | +309.95 pts (+1.17%) | Financial index mirrored banking rally |

| INR/USD | Strengthened to ₹88.72 | Eased inflation pressures |

| Gold | Record highs, mild correction | Strong structural demand |

| Silver | Historic rally | Industrial + investment demand |

| Crude / Metals | Volatile / mixed | Demand worries and supply cues |

8. Final Thoughts

The week beginning October 6, 2025 delivered a much-needed rebound in Indian equities, driven by banking, inflows, and global easing. While the caution remains—especially given global uncertainties—markets have shown resilience.

Going into October 13–17, the bias leans slightly bullish, provided no major shock arrives. Equities and commodities both present selective opportunities, with risk control being crucial.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply