Weekly Market Wrap 16–20 June 2025 | Nifty Outlook, Midcap Momentum & Global Cues

By CapitalKeeper | Weekly Wrap-Up | Indian Sock Market | Market Moves That Matter I 22th June 2025

Catch CapitalKeeper’s detailed Weekly Wrap-Up for 16–20 June 2025. Understand Nifty, Bank Nifty, global trends, midcap action, and what to expect in the week ahead with key stock insights.

📌 Weekly Market Snapshot

| Index | Weekly Open | Weekly Close | Change % | Sentiment |

|---|---|---|---|---|

| NIFTY 50 | 24,787.65 | 25,112.40 | +1.31% | Rangebound Bullish |

| BANK NIFTY | 55,567.70 | 56,252.85 | +1.23% | Stronger Momentum |

| SENSEX | 81,354.85 | 82,408.17 | +1.29% | Steady |

| FIN NIFTY | 26,294.10 | 26,648.70 | +1.35% | Recovered with Banks |

🌍 Global Cues That Mattered

- US Fed Policy Signals Dovish Shift

- The U.S. Fed hinted at no further rate hikes this year.

- Inflation softened to 3.1% YoY — aiding risk-on sentiment.

- Asian Markets Steady

- Japan’s Nikkei touched fresh highs; Shanghai consolidated.

- Global tech continued rallying — supportive for Indian IT sentiment.

- Crude Oil Stable (~$83–85)

- No inflationary spike — good for Indian macros.

- USD/INR Range-Bound (~₹83.40)

- Foreign flows into Indian equities remained consistent.

📈 What Moved Indian Markets

🔼 Market Reaction: Calm with Bullish Undertones

- Markets opened flat but gathered strength by mid-week as global cues aligned positively.

- FII buying resumed marginally, while DII support stayed robust.

- India VIX remained under 14, indicating confidence and stability in price action.

🧭 Sectoral Performance (16–20 June)

🔥 Outperformers

| Sector | Key Drivers |

|---|---|

| PSU Banks | Canara Bank, Bank of Baroda led the rally on improved credit growth. |

| Power & Energy | NTPC, Tata Power surged with volume on strong demand outlook. |

| Capital Goods | Elgi Equip, Siemens benefited from infra growth optimism. |

| Midcap Pharma | Strides, Granules rose on product approvals and momentum. |

❄️ Underperformers

| Sector | Remarks |

|---|---|

| FMCG | ITC weakness post-block deal; muted rural recovery. |

| Metals | Weak global demand weighed on Tata Steel, Hindalco. |

| Select IT | Consolidation before Q1 earnings. |

| Auto | Minor profit booking seen. |

🔍 Midcap & Small Cap Stock Highlights

The broader market outshined Nifty again, especially stocks showing volume breakouts and trendline setups.

| Stock | CMP | Weekly Move | Technical View |

|---|---|---|---|

| Clean Science | ₹1433 | +6.2% | MACD positive divergence, volume spike |

| ITI Ltd | ₹309 | +5.9% | Trendline breakout with rising OI |

| Dolat Algo | ₹100 | +7.1% | Weekly MACD & RSI crossover |

| MHRIL | ₹363 | +4.5% | Sustaining above resistance breakout |

| Snowman Logistics | ₹58 | +6.8% | Weekly close above trendline |

🔮 What to Expect Next Week (Starting 24 June 2025)

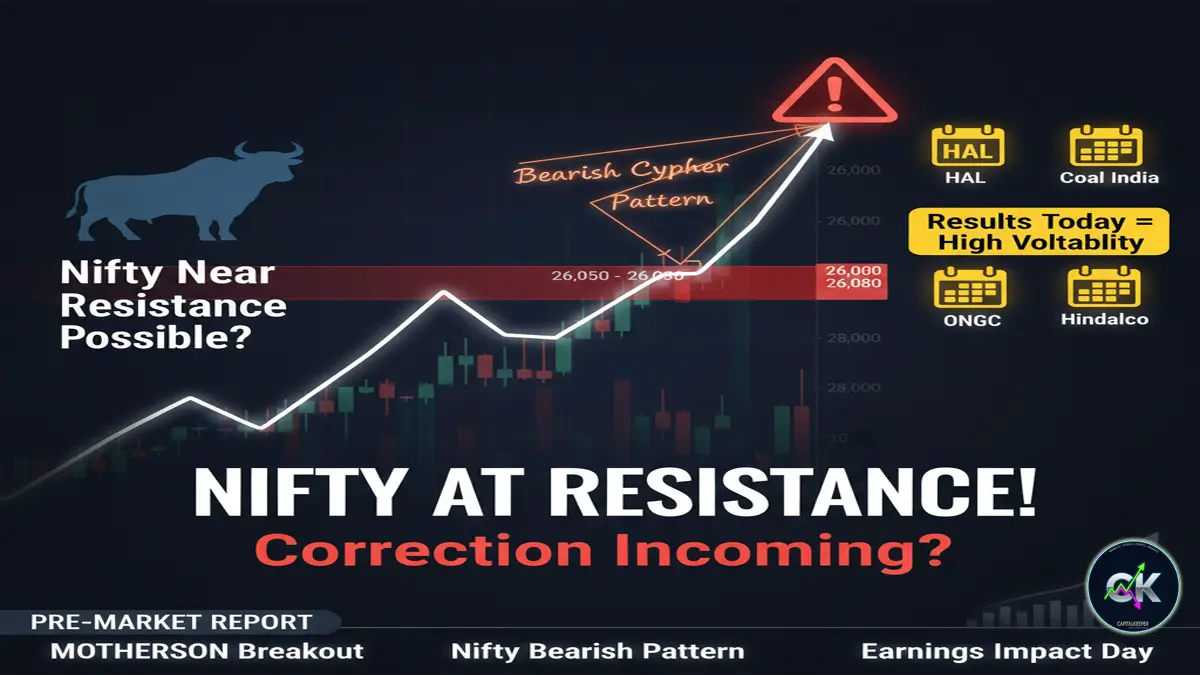

⚠️ Market Outlook

- Nifty likely to trade between 24,900–25,500.

- Bank Nifty could test 57,000 on sustained strength in PSU names.

- Volatility may rise mid-week due to global macro data (US GDP & Eurozone inflation).

📊 Focus Themes

- Continue riding midcap momentum, especially in:

- Power & Infra (KEC Intl, IRCON)

- Capital Goods (ABB, Bharat Bijlee)

- Railways/Defense (Titagarh, BEML)

- Watch for signs of rotation into:

- Private Banks and

- Consumer Discretionary stocks.

🧠 Pro Tips for Traders

- Avoid overtrading: Use trailing stop-loss in profitable trades.

- Focus on volume: All breakouts must be supported by strong volume.

- Stick to risk-reward setups: Only enter trades with minimum 1:2 R:R ratio.

- Plan Monday entries on Sunday — chart watchlists in advance.

📢 Key Events to Watch

- US GDP Data – 26 June

- Eurozone Inflation – 27 June

- India Monthly Derivatives Expiry – 27 June

- Corporate Results (Midcap-focused) Begin Trickle-In

🧾 Final Take

The Indian market continues to reflect macro strength with sectoral rotation in full swing. The midcap and small-cap space remains the hotspot for returns, but requires selectivity and disciplined exits. Global calm, domestic flows, and technical structure all support a buy-on-dips bias next week.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

CapitalKeeper | Turning Market Noise into Market Wisdom

🔗 Visit CapitalKeeper.in

Dematerialisation vs. Rematerialisation: Key Differences Explained for Modern Investors

How to Manage F&O Drawdowns Like a Hedge Fund Manager | Smart Capital Preservation Tactics

Leave a Reply