Top 5 Breakout Stocks 29th Dec 2025: High-Probability Short-Term Picks with RSI, MACD & Volume Analysis

Updated: 29 Decmber 2025

Category: Top Five Stocks | Market Analysis

By CapitalKeeper Research Desk

Discover five technically strong Indian stocks showing fresh breakout signals backed by RSI, MACD, and volume trends. A detailed, market-ready analysis for short-term traders and positional investors.

Market Overview: Why This Week Matters for Traders

Indian equity markets are currently at a decisive juncture. After weeks of selective participation, we are witnessing improving market breadth, sector rotation, and visible accumulation in mid-cap and small-cap names. This phase is particularly important for short-term traders because stocks that break out after consolidation often deliver fast, momentum-driven moves.

Technically, multiple stocks across real estate, infra, FMCG, and microfinance are forming trendline breakouts, volume expansions, and momentum reversals—a classic setup for short-term to positional trading opportunities.

In this article, we deep-dive into five stocks that are on the radar, analyzing them using:

- Price action & chart structure

- RSI (Relative Strength Index)

- MACD (Moving Average Convergence Divergence)

- Volume behavior

- Key support and resistance zones

This analysis is written in a trader-friendly, Google News–compliant format and is ready to publish on CapitalKeeper.in.

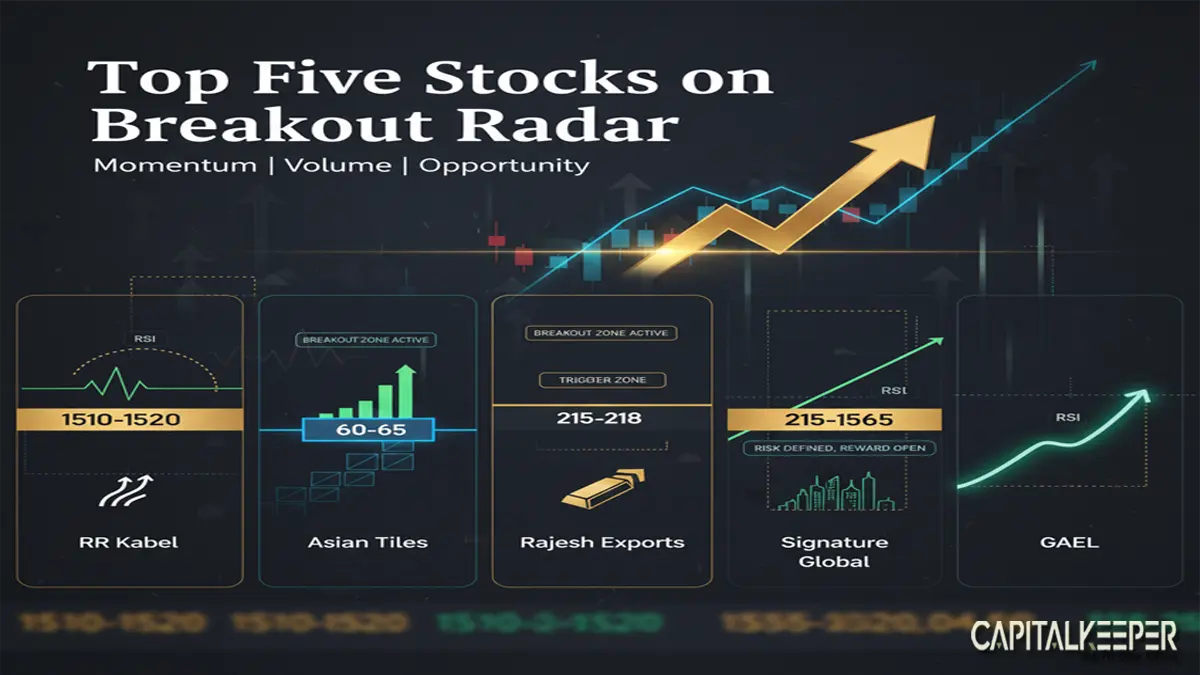

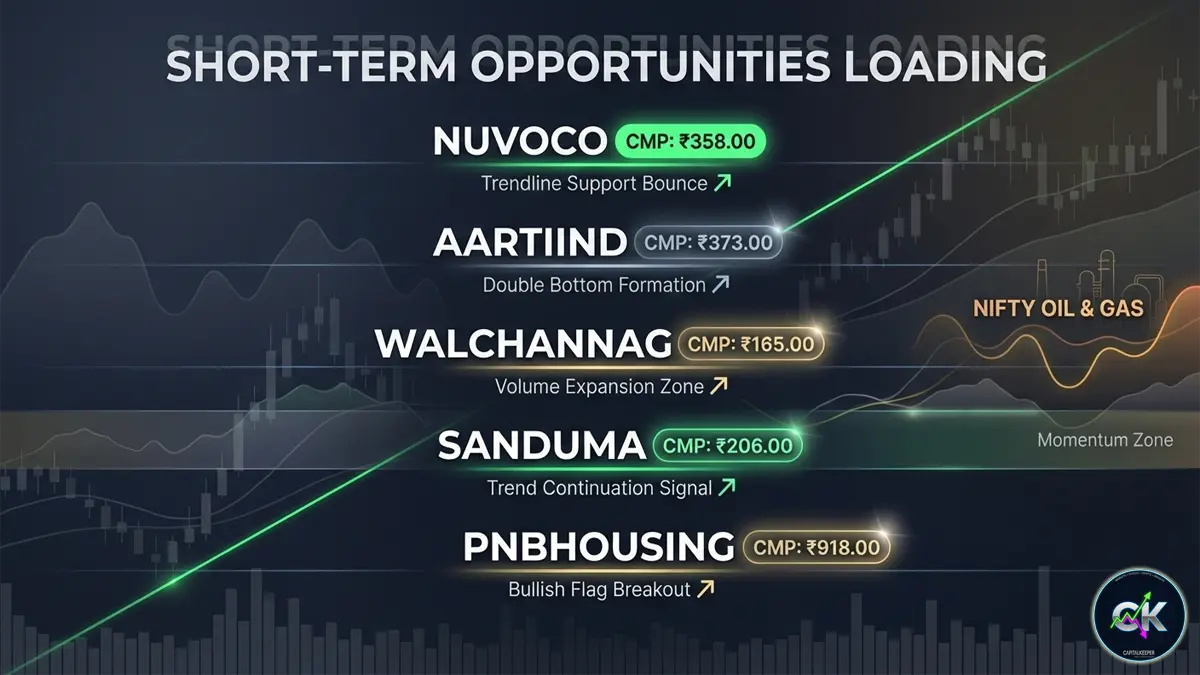

Top Five Stocks to Watch – Quick Snapshot

| Stock | CMP (₹) | Technical Setup | Bias |

|---|---|---|---|

| TARC | 160 | Trendline breakout with volume | Bullish |

| Spandana | 275 | Near breakout with volume spurt | Bullish |

| VBL | 482 | Trendline breakout forming | Bullish |

| NBCC | 122 | Confirmed breakout | Bullish |

| Apex | 277 | Base formation | Positive |

1. TARC Ltd (CMP: ₹160)

Trendline Breakout with Volume Expansion

Technical Structure

TARC has decisively moved above its long-term descending trendline, supported by rising volumes. This breakout comes after a prolonged consolidation phase, indicating fresh institutional participation.

RSI Analysis

- RSI is trending above 55

- Indicates improving momentum without entering overbought territory

MACD Insight

- MACD line has crossed above the signal line

- Histogram has turned positive, confirming bullish momentum

Volume Profile

- Breakout accompanied by above-average volume

- Confirms authenticity of price move

Key Levels

- Support Zone: ₹135–140

- Upside Expectation: Sustained move as long as price holds above ₹150

Outlook:

TARC looks attractive for short-term traders looking for real estate-themed momentum plays. Any dip towards support can be considered a buying opportunity with disciplined risk management.

2. Spandana Sphoorty Financial (CMP: ₹275)

Near Trendline Breakout | Volume Spurt Visible

Technical Structure

Spandana is trading just below a critical trendline resistance. The stock has been forming higher lows, signaling gradual accumulation.

RSI Analysis

- RSI hovering near 50–52

- Suggests momentum is building and ready for expansion

MACD Insight

- MACD is flattening after a bearish phase

- Early signs of bullish crossover emerging

Volume Profile

- Noticeable increase in delivery volumes

- Often a precursor to breakout moves

Key Levels

- Support Zone: ₹230–240

- Trigger Zone: Clear breakout above recent highs

Outlook:

Spandana offers a high risk-reward setup for short-term traders, especially if the breakout is confirmed with volume. Microfinance stocks often move sharply once momentum kicks in.

3. Varun Beverages Ltd (VBL) (CMP: ₹482)

Trendline Breakout Setup | January Series Focus

Technical Structure

VBL is approaching a crucial trendline resistance zone. The stock has compressed into a tight range, which often leads to explosive directional moves.

RSI Analysis

- RSI trending upward from neutral zone

- Indicates growing bullish strength

MACD Insight

- MACD histogram is turning positive

- Momentum shift visible on daily charts

Volume Profile

- Volumes remain stable; expansion expected on breakout

- Watch closely above ₹488–490

Key Levels

- Support Zone: ₹440–450

- Breakout Zone: ₹488–490

Outlook:

VBL remains a quality FMCG compounder with strong technical positioning. A confirmed breakout could attract fresh momentum traders and positional investors alike.

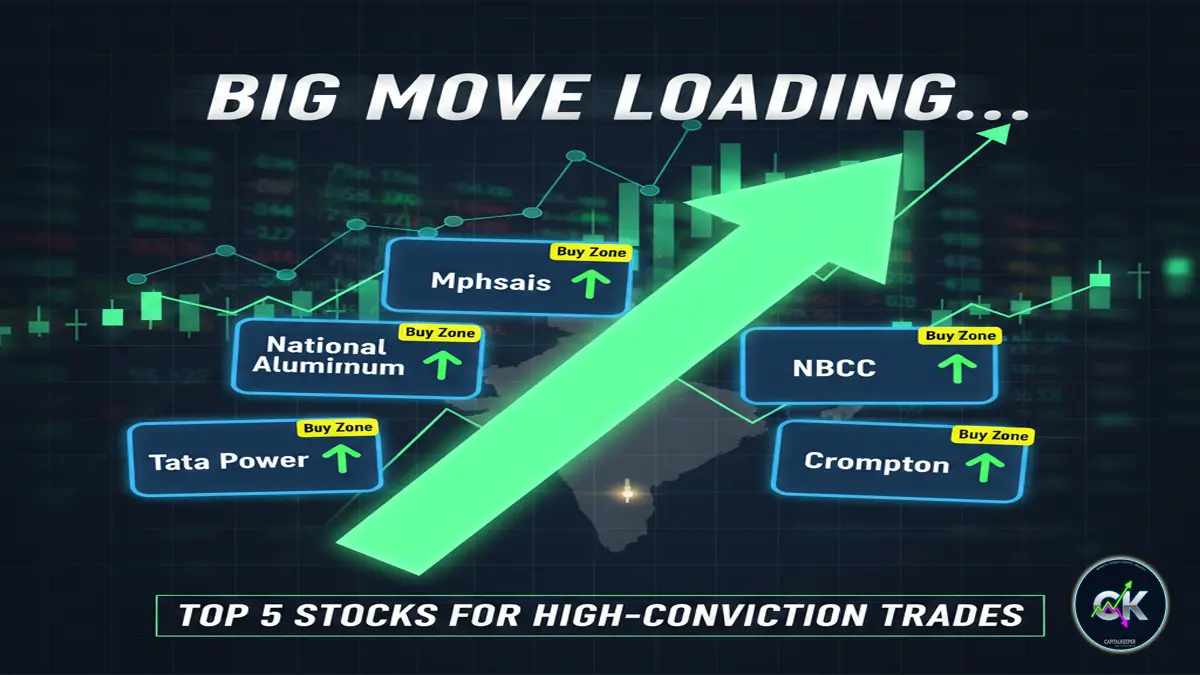

4. NBCC (India) Ltd (CMP: ₹122)

Confirmed Trendline Breakout with Strong Volume

Technical Structure

NBCC has already broken above its multi-week trendline and is sustaining above it—a classic breakout-and-hold pattern.

RSI Analysis

- RSI above 60

- Indicates strong bullish momentum

MACD Insight

- MACD firmly above signal line

- Confirms continuation bias

Volume Profile

- Breakout accompanied by strong volume

- Suggests institutional participation

Key Levels

- Support Zone: ₹105–108

- Upside Bias: Positive as long as price holds above ₹115

Outlook:

NBCC is one of the cleanest infra breakout structures currently. Ideal for short-term traders who prefer confirmation over anticipation.

5. Apex Frozen Foods / Apex Stock (CMP: ₹277)

Base Formation | Early Momentum Signs

Technical Structure

Apex is showing signs of base formation after a corrective phase. Price stability near key averages suggests selling pressure is exhausted.

RSI Analysis

- RSI stabilizing near 50

- Indicates neutral-to-positive momentum

MACD Insight

- MACD flattening near zero line

- Early signs of trend reversal

Volume Profile

- Gradual volume pickup visible

- Suggests accumulation rather than distribution

Key Levels

- Support Zone: Near recent swing lows

- Upside Expectation: Gradual move with momentum confirmation

Outlook:

Apex fits well for traders looking for early-stage moves before broader market attention kicks in.

Sectoral Insight: Why Breakouts Matter Now

- Real Estate stocks are showing renewed interest

- Infra stocks continue to attract policy-driven flows

- FMCG leaders are stabilizing after correction

- Financials are selectively outperforming

This environment favors technically strong stocks with volume-backed breakouts, rather than broad market chasing.

Risk Management Framework

Even the best technical setups require discipline:

- Always use predefined stop-loss levels

- Avoid over-leveraging

- Trade breakouts only with volume confirmation

- Respect invalidation levels

Markets reward patience and preparation—not prediction.

Frequently Asked Questions (FAQs)

Q1. Are these stocks suitable for long-term investment?

These picks are primarily short-term to positional in nature. Long-term investors should align entries with broader fundamentals.

Q2. Why is volume important during breakouts?

Volume confirms participation. Breakouts without volume often fail.

Q3. Should RSI above 70 be avoided?

Not always. Strong trends can remain overbought. Context matters.

Q4. Can beginners trade these setups?

Yes, but only with strict risk management and smaller position sizes.

Final Takeaway

The current market environment is offering selective, high-quality breakout opportunities rather than broad-based rallies. Stocks like TARC, Spandana, VBL, NBCC, and Apex are showing technically sound structures backed by momentum indicators.

For traders who focus on price action, indicator confluence, and volume confirmation, these setups deserve close tracking in the coming sessions.

Stay disciplined. Let the charts guide your decisions.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply