Pre-Market Insights 28 Aug 2025: Nifty, Bank Nifty Key Levels & Sector Trends

By CapitalKeeper | Pre Market Opening | Indian Equities | Market Moves That Matter

Stay ahead with today’s pre-market analysis (28 Aug 2025). Nifty closed at 24,712, Bank Nifty at 54,450. Key support & resistance levels, GIFT Nifty outlook, sectoral trends, and strategy for the day.

Pre-Market Analysis: 28th August 2025 – Nifty, Bank Nifty, Sensex & FinNifty with Sectoral Outlook

Indian equity markets are set for a crucial session today (Thursday, 28th August 2025) after witnessing volatile swings in the last few trading days. With Nifty closing at 24,712.05 (-0.6%), Bank Nifty at 54,450.45 (-1.2%), Sensex at 80,786.54 (-0.8%), and FinNifty at 25,952.60 (-0.7%), traders are eyeing early cues from GIFT Nifty and global markets to set the tone for the day.

The broader sentiment suggests that if markets reverse from lower levels, holding long positions for 3–5 working days may deliver strong gains, especially in select sectors showing signs of accumulation.

🔎 Global & GIFT Nifty Cues

- GIFT Nifty is hovering near 24,735–24,750, indicating a slightly positive to flat opening in line with global sentiment.

- US markets closed mixed:

- Dow Jones: marginally higher (+0.2%)

- Nasdaq: weaker (-0.3%) due to profit booking in tech

- S&P 500: flat (-0.1%)

- Asian markets are trading cautiously this morning, with Nikkei and Hang Seng slightly lower, while Kospi is in green.

- Crude oil remains steady around $78.50/barrel, a neutral sign for Indian energy stocks.

- Dollar Index (DXY ~104.2) and US bond yields are stable, showing no major stress in global liquidity.

Overall, global cues indicate sideways to mildly positive sentiment, with traders awaiting Friday’s US inflation data.

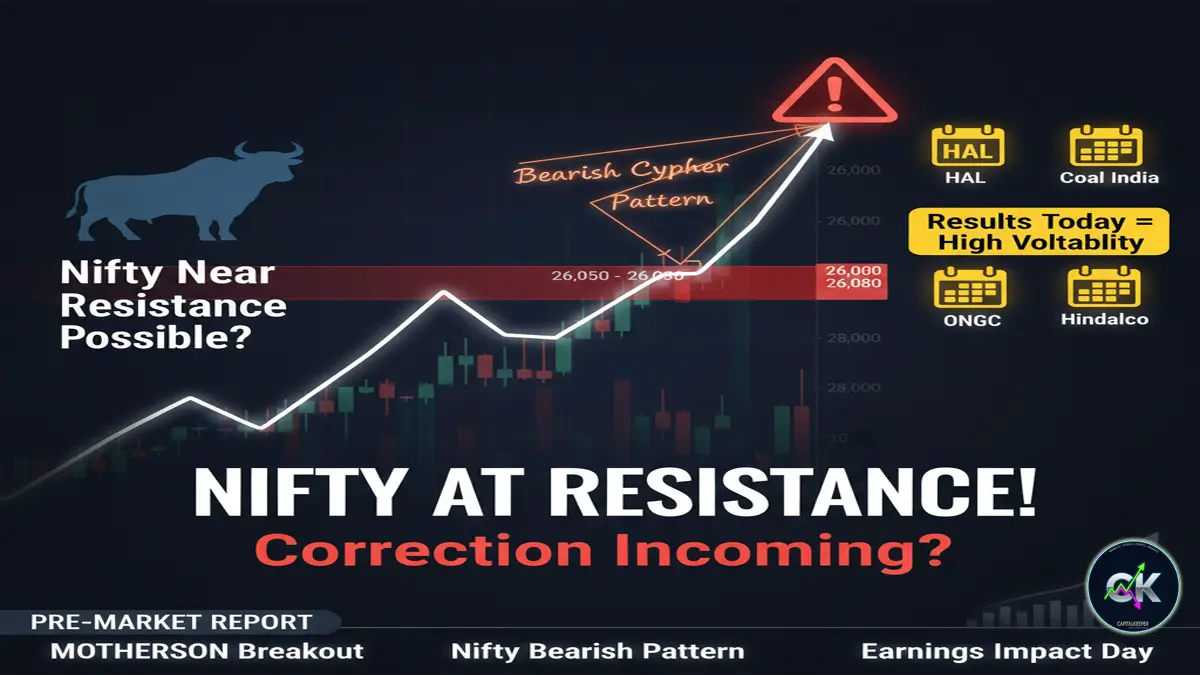

🔹 Technical Outlook

Nifty (24,712.05)

- Support Levels: 24,400 / 24,450 / 24,495 / 24,567 / 24,630

- Resistance Levels: 24,810 / 24,873 / 24,945 / 25,050

📌 View: Nifty has formed a near-term base at 24,450–24,500 zone. As long as it sustains above this level, we may see a bounce towards 24,810–25,050. A breakdown below 24,400 may trigger deeper corrections.

Bank Nifty (54,450.45)

- Support Levels: 53,955 / 54,100 / 54,240 / 54,300

- Resistance Levels: 54,600 / 54,750 / 54,900 / 55,050 / 55,230 / 55,455

📌 View: Bank Nifty remains weak but is approaching oversold territory. Private banks may trigger a reversal rally if index sustains above 54,600. Immediate weakness resumes below 53,955.

Sensex (80,786.54)

- Support: 80,200–80,300 zone

- Resistance: 81,500–81,800 zone

📌 View: Consolidation phase; needs a breakout above 81,500 for bullish momentum.

FinNifty (25,952.60)

- Support: 25,750 / 25,600

- Resistance: 26,200 / 26,400

📌 View: Volatile structure; movement will be in line with Bank Nifty and financial services stocks.

📊 Sectoral Outlook

The market is expected to show stock-specific action with the following sectors on radar:

1. Banking (Especially Private Banks)

- After days of selling, HDFC Bank, ICICI Bank, Kotak Bank may see short covering.

- PSU banks may remain rangebound, but SBI could remain resilient.

2. Smallcaps (Nifty Smallcap 100)

- The smallcap space has been outperforming and may continue attracting retail and HNI participation.

- Stock-specific breakouts likely in infra, energy, and mid-tier IT names.

3. Financial Services

- NBFCs, insurance, and fintech stocks may see buying on dips.

- Watch HDFC AMC, Bajaj Finance, ICICI Lombard for momentum trades.

4. PSE & Defence

- PSU stocks including power & defence (BEL, HAL, BDL, Cochin Shipyard) remain strong.

- With government support and robust order book visibility, dips could attract buyers.

5. Energy & Power

- NTPC, Power Grid, Adani Energy expected to stay strong on demand outlook.

- Renewables theme (Green hydrogen & solar stocks) remain medium-term bullish.

🔔 Trading Strategy for Today

- Nifty: Buy on dips near 24,500–24,550 with SL below 24,400. Targets: 24,810–25,050.

- Bank Nifty: Watch for reversal above 54,600; aggressive buying only above 55,050. SL below 53,950.

- Positional View: If markets hold support zones today, expect a 3–5 day upward move across banks, smallcaps, and PSUs.

📅 Conclusion

The market setup for 28th August 2025 looks range-bound with potential for reversal from support zones. A flat to mildly positive open is expected, but sustained buying in private banks, smallcaps, and PSU/defence stocks will be the deciding factor for the next few sessions.

👉 Traders should remain selective, use strict stop-losses, and track global cues.

👉 Short-term investors can accumulate strong energy, PSU, and banking names on dips.

If Nifty holds 24,450+ and Bank Nifty stays above 54,600, a rally towards higher resistance levels could unfold in the coming days.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply