Independence Day Special: From Political Freedom to Financial Freedom – India’s Market Journey & Top Stocks for a Self-Reliant Future

By CapitalKeeper | Pre Market Opening | Indian Equities | Market Moves That Matter

Celebrate India’s 79th Independence Day with a deep dive into Sensex & Nifty’s journey from 1947 to 2025. Discover the nation’s economic rise, women’s growing role in investing, and top self-reliance-driven stocks shaping India’s future.

Independence Day Special: From Political Freedom to Financial Freedom – India’s Market Journey & Stocks for a Self-Reliant Future

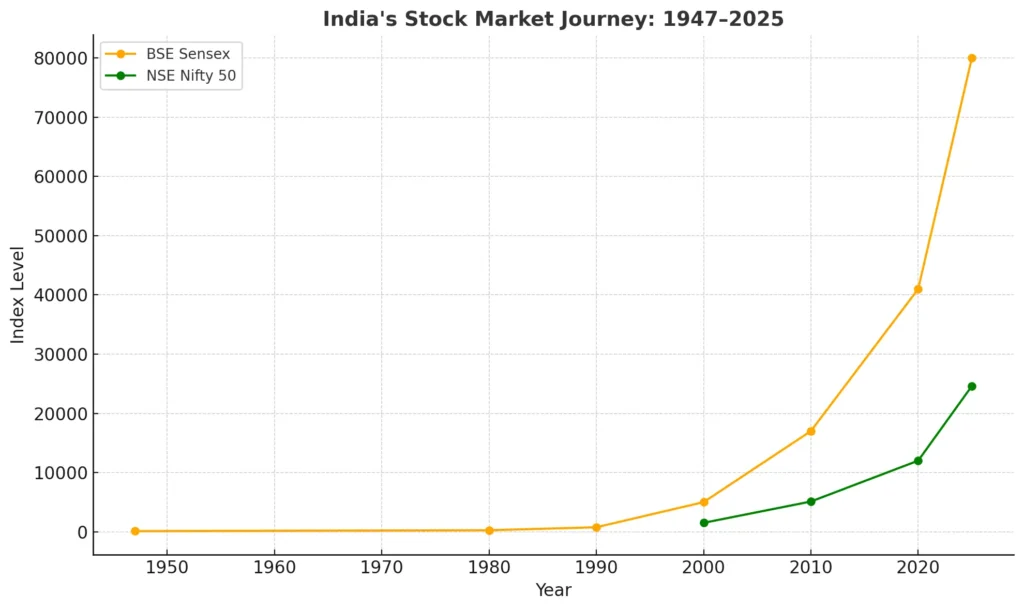

1. A Journey from 1947 to 2025 – Historical Market Reflection

When India gained independence in 1947, the Bombay Stock Exchange (BSE) was already functioning, but the Sensex as we know it today did not exist. Stock trading was limited, participation was low, and the market capitalisation was a fraction of today’s size.

The Sensex, launched in 1986 with a base year of 1978–79 at 100 points, has witnessed a phenomenal rise over the decades, reflecting India’s economic growth story:

| Year | Sensex Level | Key Milestone |

|---|---|---|

| 1947 | 150 (estimated index equivalent) | India’s independence |

| 1986 | 100 (Base year) | Sensex launched |

| 1991 | 450 | Economic liberalisation |

| 2003 | 3,000 | Post-dot-com recovery |

| 2008 | 21,000 | Pre-global crisis peak |

| 2020 | 25,000 | COVID-19 market crash |

| 2025 | 80,500 | Record highs amid robust growth |

The Nifty 50, introduced in 1996 with a base value of 1,000, similarly mirrors India’s modern growth story.

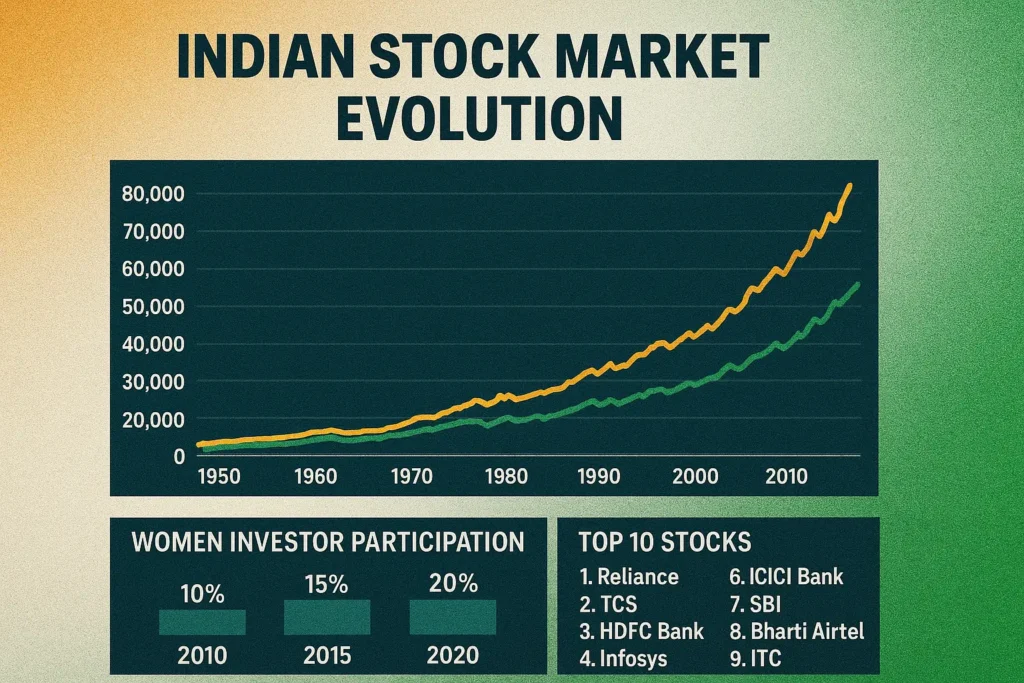

2. Women Empowerment – The Rising Force in Investing

The post-independence era saw women mostly excluded from formal investing, but the last two decades have transformed the landscape.

- 2000: Less than 5% of retail investors were women.

- 2025: Women now make up over 25% of direct market investors and 30% of mutual fund SIP holders.

- Growth Drivers: Digital platforms, financial literacy programs, and a cultural shift towards equality.

📊 (Chart: Women’s participation in investing over time)

Women investors are no longer just participants—they are active decision-makers, equity traders, and even startup investors. This is a powerful symbol of financial freedom.

3. Top 10 Stocks for Financial Independence

Banking & Financial Inclusion

- HDFC Bank – Consistent compounding and credit access leader.

- SBI – Nation’s largest bank with deep rural reach.

Consumer & Rural Growth

- HUL – Stable FMCG giant.

- ITC – Diversified, high-yielding, and rural-linked.

Technology & Digital India

- Infosys – Innovation-led IT giant.

- TCS – Consistent performer and global leader.

Strategic & Energy Security

- HAL – Defence self-reliance champion.

- NTPC & NTPC Green – Power and renewable growth.

Healthcare

- Dr. Reddy’s – Pharma R&D powerhouse.

Industrial Moats

- Asian Paints – Brand dominance and steady returns.

💡 Portfolio Mix:

- Core stability: HDFC Bank, ITC, Infosys, Asian Paints.

- Growth acceleration: HAL, NTPC Green, Dr. Reddy’s.

- Defensive cushion: HUL, NTPC.

4. Conclusion – Freedom Beyond Borders

Independence Day is not just about looking back—it’s about building a stronger, self-reliant future. Just as India moved from political dependence to sovereignty, individuals too can progress from financial uncertainty to independence.

By investing in India’s strongest and most self-reliant companies, and by encouraging greater participation from women investors, we ensure the wealth of the nation is in the hands of its people.

This Independence Day, let’s pledge not just to protect our country’s borders, but to secure our financial future as well.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply