Nifty, Bank Nifty & Fin Nifty Intraday Strategies 03 Sept 2025 | Indian Stock Market Outlook Today

By CapitalKeeper | Nifty & Bank Nifty | Indian Equities | Market Moves That Matter

Get today’s detailed market analysis for 03/09/2025. Key support & resistance levels for Nifty, Bank Nifty, and Fin Nifty intraday strategies. Learn PCR, VIX, and FII positioning insights.

Nifty & Bank Nifty Technical Outlook – 03 September 2025

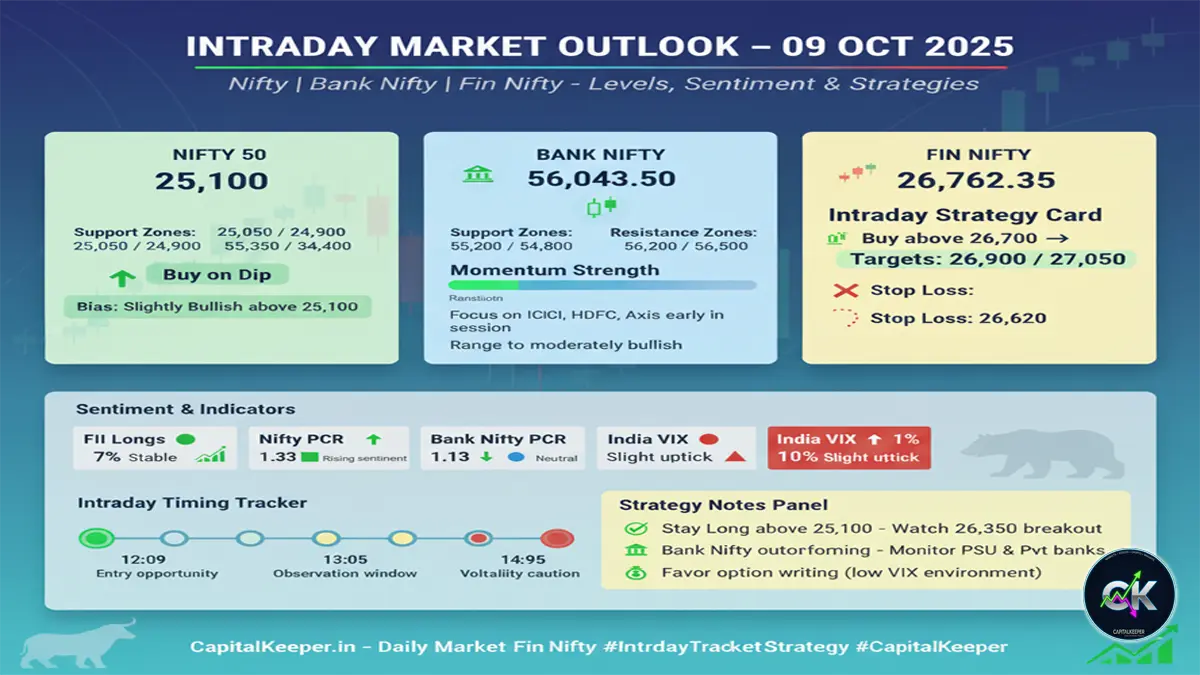

The Indian stock market opened today with a cautious undertone, as traders weighed overnight cues alongside domestic technical setups. With FII long positions declining to 8% (from 9%), the market sentiment reflects mild weakness and indecision. Moreover, the India VIX edged up by 1% to 11.40, suggesting slightly elevated risk levels.

Today’s session comes with an important trading caveat – Thursday’s cash market buying won’t be sold on Friday due to the combined settlements of 4th and 5th September. This settlement structure may lead to heightened volatility, especially toward the closing hours.

🕒 Important Timings to Watch

Intraday market momentum often respects timing cycles. For today (03/09/2025), traders should track the following windows:

- 12:52 PM – Midday breakout/breakdown possibility.

- 02:00 PM – Institutional activity window.

- 02:41 PM (Caution) – A high-risk reversal timing; avoid fresh longs.

🔑 Derivatives & Sentiment Indicators

- FII Long Positions: At 8% (from 9%), signaling reduced institutional confidence.

- Nifty PCR: At 0.99 (down from 1.14) – indicates balanced positioning but leaning slightly toward call writers.

- Bank Nifty PCR: At 0.86 (down from 0.91) – shows weak put writing, implying possible downside risk.

- India VIX: At 11.40 (up 1%) – signals caution as traders price in higher intraday swings.

These metrics suggest a neutral-to-bearish bias, where traders must remain nimble with positions.

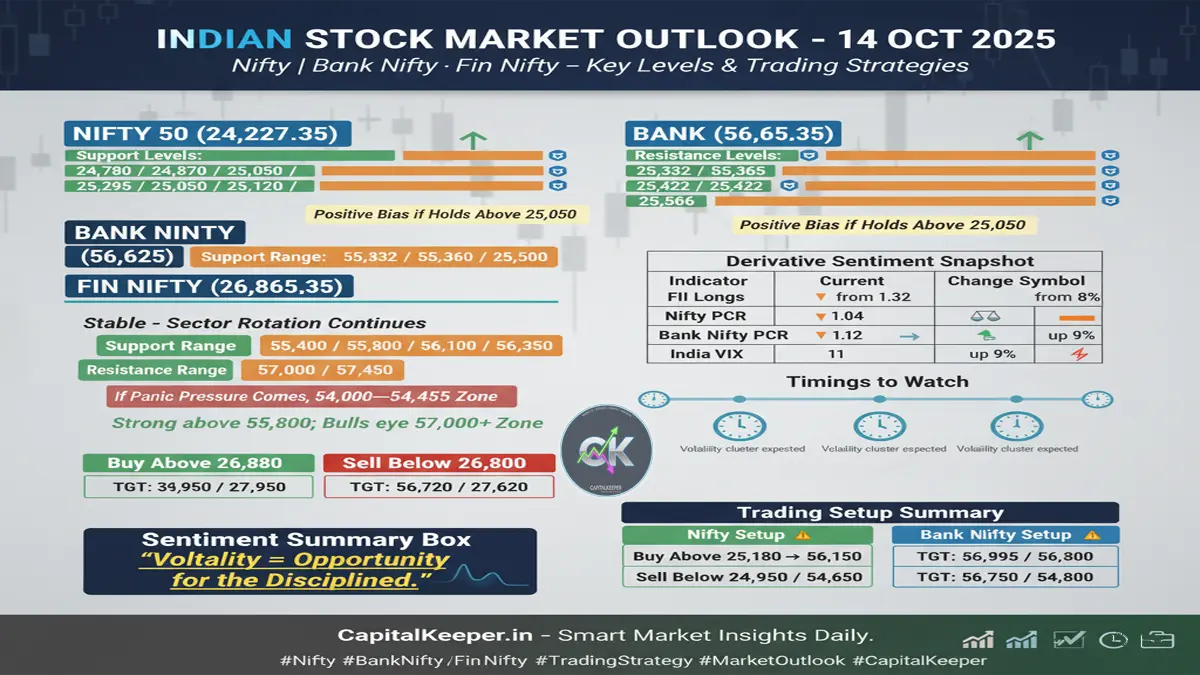

📈 Nifty Technical View (24576.30)

🔹 Support Levels

- 24,180 – Strong support base, below which sharp selling may trigger.

- 24,243 / 24,310 / 24,360 – Cluster support levels; watch for accumulation.

- 24,450 / 24,525 – Critical intraday support zones.

🔹 Resistance Levels

- 24,600 – First resistance to cross for any bullish momentum.

- 24,665 / 24,720 / 24,774 / 24,828 – Multiple overhead barriers.

👉 View: Nifty is in a consolidation phase, with indecisiveness reflecting in narrow price action. Sustaining above 24,600 could revive bullish momentum, while slipping below 24,450 may invite quick selling pressure.

🏦 Bank Nifty Technical View (53,758)

🔹 Support Levels

- 53,200 – Strong positional support.

- 53,400 / 53,550 – Intraday supports; holding above these could keep momentum sideways.

🔹 Resistance Levels

- 53,700 / 53,850 / 54,000 – Immediate resistances.

- 54,100 / 54,255 / 54,420 / 54,600 / 54,855 / 55,050 – Multiple upside resistances.

👉 View: Bank Nifty continues to underperform relative to Nifty. Unless the index crosses 54,100–54,420, sustained upside is unlikely. Weakness in private banks is a concern, while PSU banks may lend selective support.

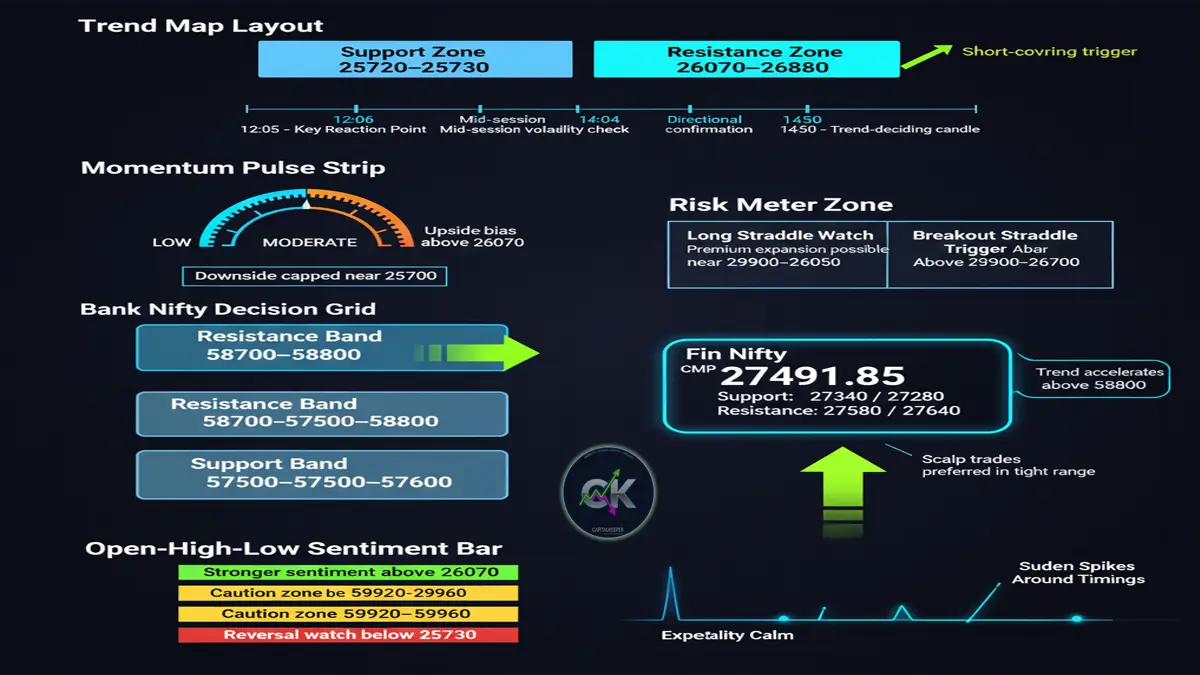

💹 Financial Nifty Intraday Strategies (Now 25,581)

Fin Nifty reflects a cautious structure similar to Bank Nifty. With consolidation at play, traders should watch for breakouts from narrow ranges.

🔹 Support Levels

- 25,650 / 25,550 – Intraday base zones.

- 25,400 – Major swing support.

🔹 Resistance Levels

- 25,880 / 26,000 – Immediate hurdles.

- 26,150 / 26,300 – Trend confirmation levels.

👉 Intraday Trading Strategies:

- Bullish Setup: Go long above 25,880 with targets of 26,000–26,150. Keep a stop-loss at 25,720.

- Bearish Setup: Short below 25,650, eyeing 25,550 → 25,400. Stop-loss at 25,800.

- Sideways Play: If Fin Nifty trades between 25,650–25,880, use range-bound strategies like selling OTM options.

📊 Market Psychology & Caution

- Overnight longs are not advised given settlement structure.

- Volatility may spike near 2:41 PM, a danger zone for intraday reversals.

- Traders must stay disciplined with stop-losses and avoid over-leveraging.

🌐 Sectoral Watch

- IT & Pharma may see defensive buying as markets consolidate.

- Banking remains a concern due to weak private bank participation.

- Auto & Infra sectors continue to hold relative strength.

✅ Conclusion

The Indian market on 03 September 2025 demands caution. With FII positioning weak, PCR ratios softening, and VIX inching up, traders should avoid aggressive bets. The bias remains neutral-to-bearish, with intraday opportunities in Fin Nifty and Bank Nifty for nimble traders.

Discipline, timing awareness, and respecting key levels are essential to navigate today’s session.

✨ Final Note: Avoid carrying aggressive overnight positions. The Thursday + Friday combined settlement adds complexity, which could result in sudden spikes or dips. Stay light, trade quick, and protect capital.omentum blindly. Trade light, use strict stop-losses, and let the market confirm its next trend before going big.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply