India’s Stock Market Pre-Market Outlook – 03 December 2025 | Nifty, Bank Nifty, Global Sentiment & Key Trade Setups

Updated: 03 Decmber 2025

Category: Pre Market | Market Analysis

By CapitalKeeper Research Desk

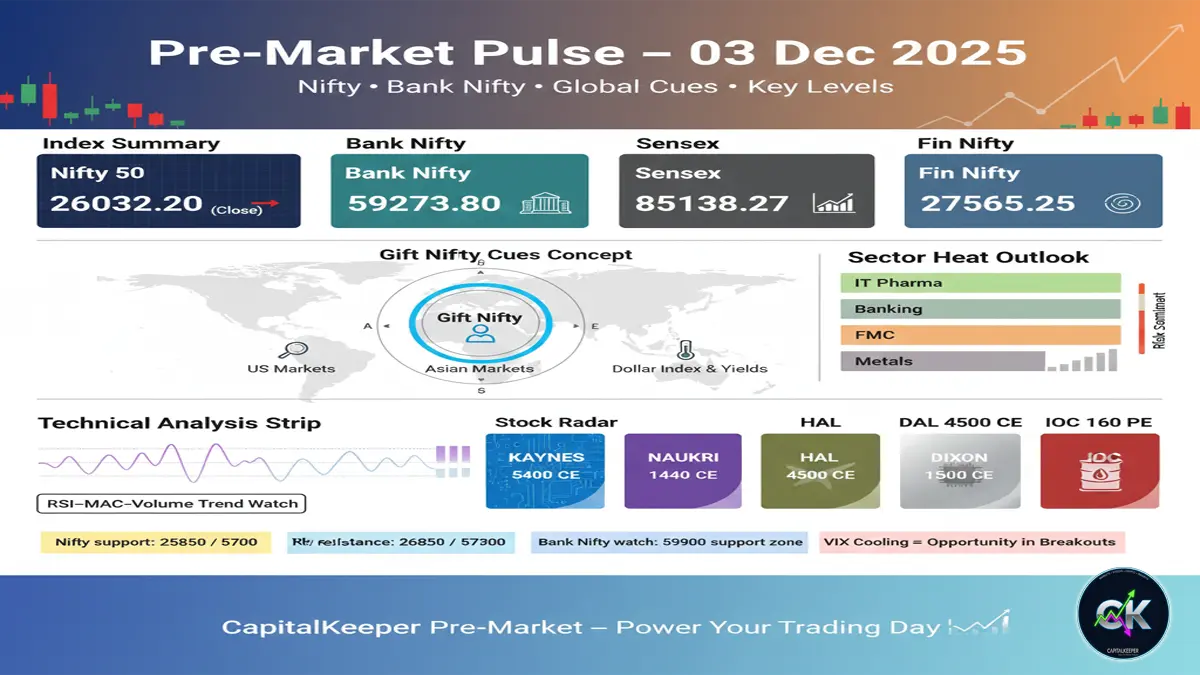

Pre-Market Report for 03 December 2025: Nifty closes at 26,032, Bank Nifty at 59,273, Sensex at 85,138, Fin Nifty at 27,565. Global cues, macro signals, key levels, sector trends, FII–DII flows, and premium stock/option setups with RSI, MACD & volume analysis. Early morning guide for traders on CapitalKeeper.in.

INDIAN STOCK MARKET PRE-MARKET REPORT (03 DECEMBER 2025)

The Indian equity market steps into December’s first full trading week with a tone that reflects cautious optimism tempered by persistent global uncertainties. After a mild corrective move in the previous session, benchmark indices settled lower but not alarmingly so, suggesting more of a consolidation phase rather than a breakdown.

Here’s how the key indices closed on 02 December 2025:

| Index | Close |

|---|---|

| Nifty 50 | 26,032.20 |

| Bank Nifty | 59,273.80 |

| Sensex | 85,138.27 |

| Fin Nifty | 27,565.25 |

The broader market sentiment remains steady, although the tone leans towards stock-specific momentum rather than index-led direction.

GLOBAL MARKET OVERVIEW

The global landscape plays a decisive role in shaping today’s pre-market setup. Overnight trends provided a mixed but manageable picture.

🟦 US Markets

U.S. indices saw a mild pullback as traders assessed upcoming macro data and interest-rate projections. Despite the slip, the correction remains orderly, with volatility subdued.

🟧 Asian Markets

Asian equities opened with a stabilizing undertone. Japan maintained strength in exporters while China displayed signs of fatigue due to ongoing concerns about internal demand recovery.

🟩 Dollar Index & Bond Yields

The Dollar Index hovered within a stable range, signaling no immediate shock for emerging markets. Bond yields softened slightly, offering support to risk assets.

🟨 Crude Oil

Crude remained steady, reducing pressure on energy import costs and helping maintain inflation expectations.

👉 Global Sentiment Summary

While the mood is not exuberant, it is stable enough for Indian markets to respond with resilience. Traders can expect a mildly positive to range-bound start unless sudden global news intervenes.

KEY DOMESTIC CUES

1. Market Breadth

Despite index-level declines, midcaps and thematic pockets showed life. Stock pickers remain in control.

2. FII–DII Flows

Institutional activity continues to remain evenly matched. Neither side is aggressively buying nor selling, reflecting a wait-and-watch stance.

3. Volatility Index

India VIX remains in a comfortable zone, providing a supportive backdrop for options traders.

NIFTY 50 PRE-MARKET ANALYSIS

Nifty retreated slightly, but price action didn’t break below crucial support clusters. Market behaviour hints at consolidation rather than trend reversal.

Important Levels

- Support: 25,950 / 25,820

- Resistance: 26,200 / 26,350

RSI, MACD & Volume View

- RSI sits near neutral territory—not overheated, not oversold.

- MACD is slowing but not in a sharp bearish slope.

- Volumes indicate routine profit booking, not long unwinding.

The structure keeps the bullish medium-term outlook intact.

BANK NIFTY PRE-MARKET ANALYSIS

Bank Nifty remains in a tight range influenced by lack of decisive movement in heavyweight banks.

Key Levels

- Support: 59,000

- Resistance: 59,800

There’s no heavy selling pressure—just the absence of strong buying.

FIN NIFTY & SENSEX OUTLOOK

Fin Nifty has been attempting to stabilize even as financial stocks move selectively. Sensex remains index-heavy but stable.

Overall, global and domestic cues indicate a range-bound to mildly positive day.

SECTORAL OUTLOOK FOR THE DAY

Likely to Perform Well

- Pharmaceuticals

- Defence & Manufacturing

- Consumer Tech

- Select Metals

Cautious Zones

- Oil Marketing

- PSU Banks

- Auto (profit-booking phase)

STOCK & OPTIONS TRADE SETUPS

(With RSI–MACD–Volume Analysis)**

Below are your well-defined levels and directional bias based on technical indicators.

1️⃣ KAYNES – 5400 CE @ 210

- Stop-Loss: 190

- Targets: 230 / 250

Technical Snapshot

- RSI: Trending upward from mid-zones—indicates strength building.

- MACD: Shows early bullish crossover signs.

- Volume: Rising gradually, confirming accumulation.

Bias: Positive. The stock exhibits breakout potential.

2️⃣ NAUKRI – 1440 CE @ 18.65

- Stop-Loss: 15

- Targets: 24 / 30 / 35+

Technical Snapshot

- RSI: Maintains healthy strength without overextension.

- MACD: Momentum increasing with a supportive histogram.

- Volume: Fresh buying interest visible.

Bias: Uptrend continuation likely.

3️⃣ HAL – 4500 CE @ 137.90

- Stop-Loss: 120

- Targets: 155 / 170

Technical Snapshot

- RSI: Stays well-positioned, showing sustained bullishness.

- MACD: Indicates upward push intact.

- Volume: Consistent inflow—not excessive but steady.

Bias: Favourable for further upside.

4️⃣ DIXON – 15000 CE @ 254–260

- Stop-Loss: 240

- Targets: 300 / 350 / 400+

Technical Snapshot

- RSI: Strong and positioned for continuation.

- MACD: Rising momentum, clean upward curve.

- Volume: Expansion suggests persistent interest.

Bias: Solid bullish structure.

5️⃣ IOC CMP 162.34 – 160 PE @ 2.75

- Stop-Loss: SL if IOC cash goes above 166.50

- Targets: 155 / 153

Technical Snapshot

- RSI: Turning downward from mid-range—sign of pressure.

- MACD: Weakening slope, bearish bias emerging.

- Volume: Selling pressure visible.

Bias: Short-term bearish.

PRE-MARKET SUMMARY

The market enters today’s session with global cues that are steady, not threatening. Domestic indicators add support to the idea of a sideways-to-positive opening. Index-level volatility may stay muted, but stock-specific action remains robust—especially in growth, manufacturing, and pharma names.

Your option trade setups offer balanced opportunities with well-defined risk levels.

INTERNAL LINKS FOR CAPITALKEEPER.IN

You may internally link these pages for deeper engagement:

- Nifty & Bank Nifty Daily Analysis

- Stock Options Strategies Guide

- RSI–MACD Trading Framework Explained

- Premium Stock Research Section

- Weekly F&O Expiry Outlook

📌 FAQ SECTION

1. How is the Indian market expected to open today?

Based on global cues and domestic indicators, the Indian market may witness a range-bound to slightly positive opening.

2. Are Nifty and Bank Nifty showing signs of weakness?

Not decisively. Both indices appear to be consolidating rather than reversing their broader trend.

3. Which sectors look favourable for today?

Pharma, defence, consumer tech, and select metal stocks appear relatively stronger.

4. Is IOC likely to correct further?

Short-term indicators suggest ongoing weakness as long as the cash price stays below the defined SL zone.

5. Are today’s option trades suitable for conservative traders?

These trades are directional and require discipline. Conservative traders may reduce position size or avoid high-volatility CE setups.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply