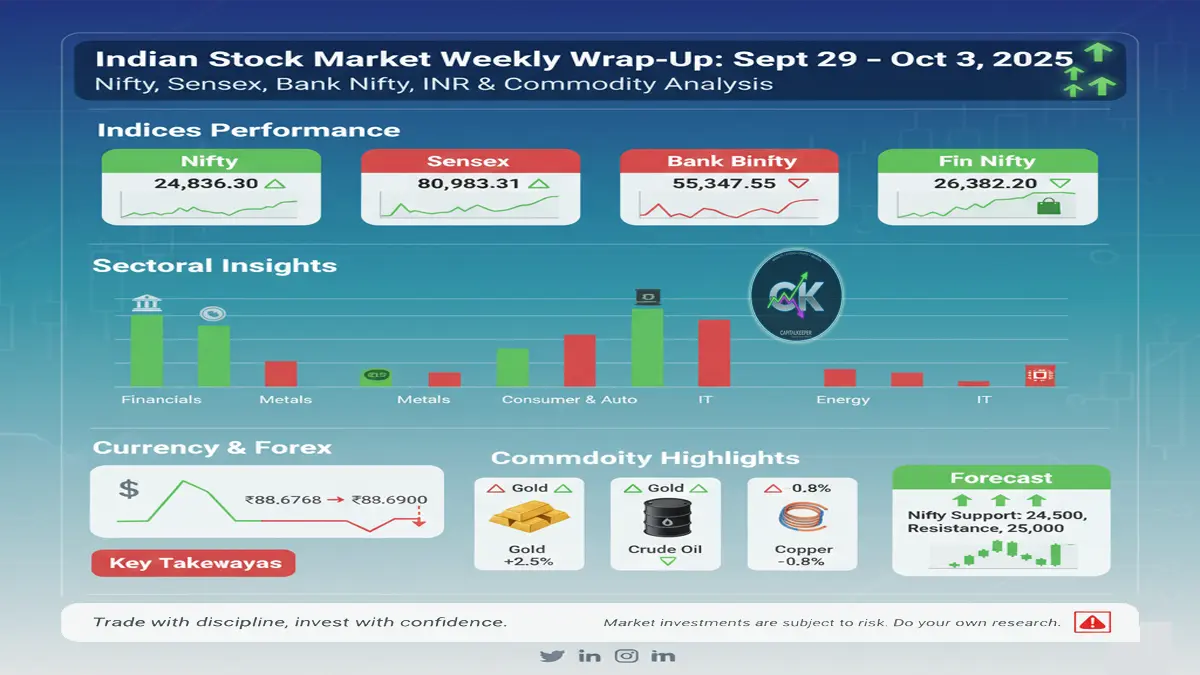

Indian Stock Market Weekly Wrap-Up (Sept 29 – Oct 3, 2025): Nifty, Sensex, Bank Nifty, INR, and Commodities Analysis

By CapitalKeeper | Weekly Wrap Up | Indian Equities | Market Moves That Matter

Explore the Indian stock market’s performance from September 29 to October 3, 2025. Detailed insights on Nifty, Sensex, Bank Nifty, INR, and commodities, along with forecasts for the upcoming week.

📊 Indian Stock Market Weekly Wrap-Up: September 29 – October 3, 2025

The Indian stock market displayed a mix of cautious optimism and underlying challenges during the week of September 29 to October 3, 2025. While benchmark indices showed modest gains, concerns over currency depreciation and global economic factors kept investors on edge.

🟢 Benchmark Indices Performance

- Nifty 50: Opened at 24,728.55 on Monday and closed at 24,894.25 on Friday, marking a weekly gain of approximately 0.67%.

- BSE Sensex: Started the week at 80,588.77 and ended at 81,207.17, reflecting a rise of about 0.77%.

- Bank Nifty: Opened at 54,460.40 and closed at 55,589.25, gaining around 2.07% over the week.

- Fin Nifty: Started at 26,016.90 and ended at 26,426.75, up approximately 1.58%.

📉 Sectoral Insights

- Financials: Despite a positive start, financial stocks faced pressure mid-week, leading to a slight pullback by Friday.

- Metals: The Nifty Metal index surged by 1.82% on Friday, driven by strong performances from Tata Steel and Power Grid, each rising by 3%.

- Consumer & Auto: These sectors showed resilience, contributing to the overall positive sentiment in the market.

💱 Indian Rupee (INR) Outlook

The Indian Rupee faced significant pressure during the week:

- Opening Rate (Sept 29): 88.6768

- Closing Rate (Oct 3): 88.6900

The rupee’s depreciation was attributed to factors such as strong dollar demand from importers, outflows from Indian equities, and ongoing U.S.-India trade tensions. Analysts are closely monitoring the 88.80 mark, previously the rupee’s lifetime low, as a crucial level that might prompt further central bank action.

📈 Commodity Market Highlights

- Gold: Touched a lifetime high of ₹1,15,253 per 10 grams on Monday, driven by expectations of U.S. Federal Reserve rate cuts and a softer dollar.

- Crude Oil: Prices remained volatile, influenced by global supply concerns and geopolitical tensions.

- Copper: Futures rose by 1.82% on Friday, attributed to higher spot demand and increased bets by market participants.

📉 Forex Reserves

India’s foreign exchange reserves decreased to $700.24 billion as of September 26, down from $702.9 billion on September 12.The Reserve Bank of India continues to intervene selectively in the foreign exchange market to moderate undue volatility in the rupee.

🔮 Forecast for the Upcoming Week (October 6–10, 2025)

📈 Stock Market Outlook

- Nifty 50: The index is expected to face resistance around the 24,950–25,000 levels. A decisive breakout above this range could lead to a rally towards 25,200.

- Sensex: Anticipated to test the 81,500–81,800 levels. Sustained trading above these levels may open up targets towards 82,200.

- Bank Nifty: The index could find support around 55,200. A move above 55,800 may lead to a retest of 56,000 levels.

💱 INR Forecast

The rupee may continue to face downward pressure due to persistent global uncertainties and domestic challenges. A breach of the 88.80 mark could lead to further depreciation, with the next support level around 89.00.

📊 Sectoral Focus

- Financials: Watch for any policy announcements from the Reserve Bank of India that could impact liquidity and lending rates.

- Metals: Given the recent surge, profit-booking may occur; however, long-term prospects remain positive due to infrastructure developments.

- Consumer & Auto: These sectors may benefit from festive season demand, potentially boosting earnings.

📌 Conclusion

The week of September 29 to October 3, 2025, was characterized by cautious optimism in the Indian stock market. While benchmark indices showed modest gains, concerns over currency depreciation and global economic factors kept investors vigilant. As we move into the next week, market participants should stay informed about global developments, central bank policies, and sector-specific news to navigate the evolving landscape effectively.

Note: The information provided in this blog is based on the data available up to October 3, 2025. Market conditions are subject to change, and readers are advised to conduct their own research or consult with financial advisors before making investment decisions.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply