Indian Stock Market Trend Mix – 14 August 2025 | Nifty & Bank Nifty Key Levels, Timing Alerts & Market Outlook

By CapitalKeeper | Nifty & Bank Nifty | Indian Equities | Market Moves That Matter

Discover the 14 August 2025 Indian stock market Trend Mix with Nifty & Bank Nifty support/resistance levels, crucial intraday timings, FII positions, PCR updates, India VIX analysis, and outlook for the long weekend.

Intraday Market Analysis – 14 August 2025 – Indian Stock Market Trend Mix: Nifty & Bank Nifty Key Levels & Insights

The Indian equity market is gearing up for an interesting session on 14 August 2025, with Nifty and Bank Nifty both positioned at crucial technical junctures. With a long weekend ahead (Fri/Sat/Sun holiday stretch), traders can expect pockets of volatility as institutions and retail participants adjust positions before the extended break.

In today’s Trend Mix, we’ll break down the support and resistance levels, important intraday timings, derivative data, and market sentiment indicators like PCR and India VIX to help you plan your intraday and short-term trades with more precision.

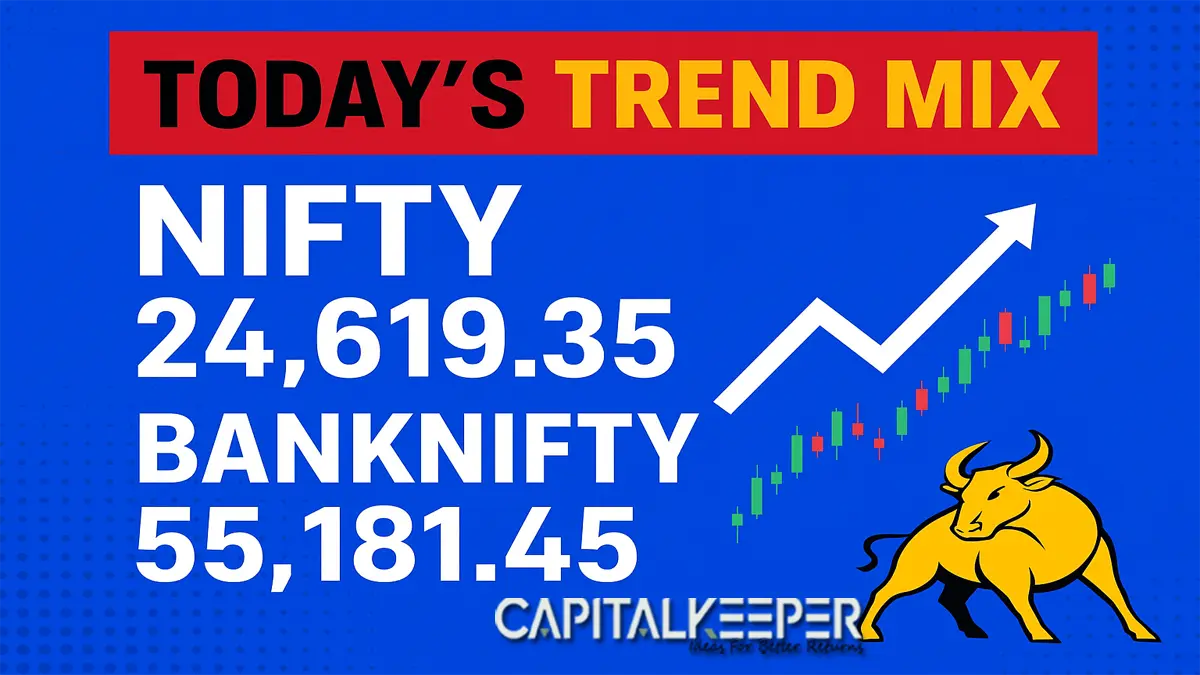

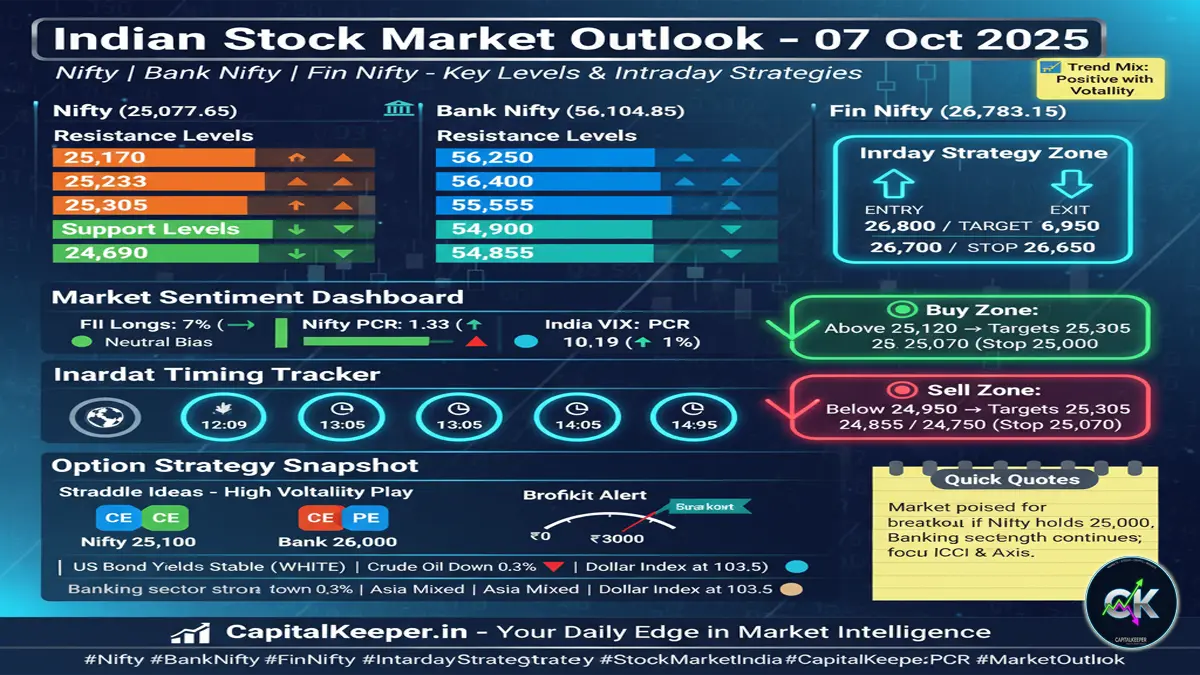

Nifty 50 Analysis (CMP: 24,619.35)

The Nifty has been trading in a well-defined channel with both upside momentum and downside risk in play. The market is currently testing resistance levels but has a strong support cushion as per technical levels.

🔹 Key Support Levels:

- Immediate Supports: 23,955 / 24,060 / 24,145

- Mid-Tier Supports: 24,243 / 24,345 / 24,450

- Critical Swing Support: 24,510

These support zones will be crucial for buy-on-dip traders looking to enter on pullbacks. If Nifty respects these levels during intraday dips, it could provide attractive entry points for positional long positions.

🔹 Key Resistance Levels:

- First Resistance Zone: 24,666 / 24,720 / 24,765

- Breakout Levels: 24,855 / 24,966

If Nifty breaches 24,720 with volume and sustains, a short-term breakout rally towards 24,966 cannot be ruled out.

Bank Nifty Analysis (CMP: 55,181.45)

Bank Nifty has been a mixed performer recently, with intraday swings creating opportunities for both long and short traders. The financial index is near its pivot zone, and today’s session could determine its next trend.

🔹 Key Support Levels:

- Base Supports: 54,300 / 54,555 / 54,750

- Mid Supports: 54,900 / 55,000

Holding above 55,000 will be important for bulls. A break below 54,750 may invite quick selling pressure.

🔹 Key Resistance Levels:

- Immediate Hurdles: 55,365 / 55,485 / 55,650

- Breakout Zone: 55,800 / 55,950 / 56,100

Sustaining above 55,650 can trigger momentum buying towards 56,100.

Important Intraday Timings – 14 August 2025

Intraday traders should watch the following time-based market inflection points today:

- 12:23 PM – Possible reversal or breakout attempt.

- 1:20 PM – Volatility spike likely due to institutional orders.

- 2:13 PM – Second half directional move setup.

- 3:00 PM – Last-hour expiry-related adjustments before long weekend.

These timings have historically aligned with algo-driven volatility bursts and can be used for scalp trades or risk adjustments.

Derivatives Data & Sentiment Indicators

📌 FII Index Long Positions:

Currently at 9%, up from earlier lows. This suggests foreign investors are gradually building directional positions, albeit cautiously.

📌 Nifty PCR (Put-Call Ratio):

Now at 1.08, up from 0.78. A PCR above 1 indicates more put writing, which is generally bullish in the short term.

📌 Bank Nifty PCR:

At 0.75, slightly down from 0.76. Indicates balanced positioning with a slight inclination towards calls, meaning traders are still hedging upside moves.

📌 India VIX:

Volatility index at 12.14, down by 1%. Low volatility generally favors range-bound trading but can precede sharp moves when triggered by news or data.

Fin Nifty Key Technical Levels for the Day

- Support Zones: 26,240 / 26,150 / 26,080

- Resistance Zones: 26,360 / 26,420 / 26,500

🔹 Trading Tip: Fin Nifty respects these levels well — intraday reversals often occur here.

Market Outlook – Long Weekend Factor

The long weekend (Friday, Saturday, Sunday) can influence both F&O and cash market positions:

- Traders may book profits early to avoid holding risk over the holiday period.

- Lower volumes in the second half can cause erratic price swings.

- Option sellers may look to capitalize on time decay ahead of market closure.

Trading Strategies for 14 August 2025

- For Nifty:

- Bullish Plan: Buy near 24,345–24,450 with SL below 24,243, targeting 24,720–24,855.

- Bearish Plan: Short below 24,145 with SL above 24,243, targeting 24,060 and 23,955.

- For Bank Nifty:

- Bullish Plan: Long above 55,485 for targets 55,650–55,950.

- Bearish Plan: Short below 54,750 for targets 54,555–54,300.

- Intraday Tip: Use VWAP + price action confirmation around the key intraday timings for high-probability entries.

Risk Management Reminders

- Keep stop-loss orders strictly in place, especially before long weekends.

- Avoid over-leveraging in weekly options due to potential gap openings after holidays.

- Track global cues – US inflation data and crude oil prices can influence sentiment.

Conclusion

The Indian markets are poised for a technical play ahead of the long weekend. Nifty and Bank Nifty are both near significant pivot zones, and traders can expect momentum shifts around the given intraday timings.

FII positioning, improving PCR, and low VIX all point towards a cautiously optimistic sentiment, but traders should remain agile to adapt to intraday volatility.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply