India Market Weekly Wrap 17–21 November 2025: Nifty Hits New Zone of Strength as INR & Commodities React to Global Cues

Updated: 22 November 2025

Category: Weekly Wrap Up | Market Analysis

By CapitalKeeper Research Desk

A complete weekly wrap of the Indian stock market, INR movement, gold, crude, and global cues for 17–21 Nov 2025. Includes forecasts and sector outlook for the coming week.

Weekly Market Wrap (17th – 21st November 2025)

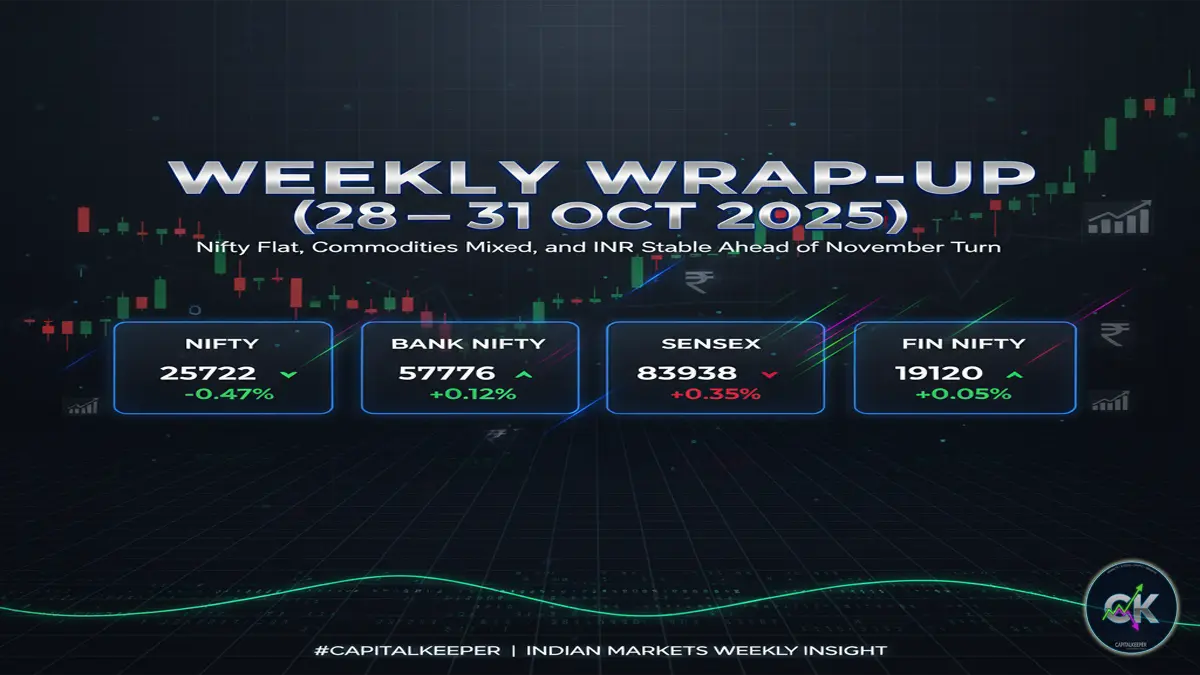

Nifty Open (17 Nov): 25,948.20 → Nifty Close (21 Nov): 26,068.15

Bank Nifty Open: 58,696.30 → Close: 58,867.70

Sensex Open: 84,700.50 → Close: 85,231.92

Fin Nifty Open: 27,550.55 → Close: 27,566.15

The trading week from 17th to 21st November 2025 unfolded as a steady upward grind for the Indian equity market. While global risk sentiment oscillated between optimism and caution, Indian indices held their ground, reflecting strong domestic liquidity, robust earning cues, and persistent buying in selective large-cap sectors.

Despite intraday volatility triggered by US Fed commentary, crude oil swings, and geopolitical headlines, the Indian markets showcased resilience—closing the week comfortably in the green. Alongside equities, the Indian Rupee, gold, and crude oil experienced directional shifts driven by macroeconomic factors and dollar movement.

This weekly wrap provides a complete breakdown across equities, currency, commodities, sector rotation, FII–DII flows, and the forecast for the upcoming week.

Weekly Index Movement Summary Table

| Index | Monday Open (17 Nov) | Friday Close (21 Nov) | Weekly Trend |

|---|---|---|---|

| Nifty 50 | 25,948.20 | 26,068.15 | ▲ Mildly Bullish |

| Bank Nifty | 58,696.30 | 58,867.70 | ▲ Gradual Upside |

| Sensex | 84,700.50 | 85,231.92 | ▲ Positive Bias |

| Fin Nifty | 27,550.55 | 27,566.15 | ➖ Range-Bound |

Market Overview: A Week Driven by Stability & Sectoral Rotation

The 17–21 November week was characterised by low-volatility upward momentum, supported by:

- Softening US 10-year yields

- Dovish Fed commentary hinting at sustained rate pauses

- Continued mutual fund SIP inflows above ₹17,000 crore

- Broad-based Q2 earnings stability

Investors adopted a selective buying strategy, shifting focus from midcaps to frontline blue chips as valuations in the broader market stretched.

📍 Nifty 50: Steady Momentum with Controlled Volatility

Nifty moved from 25,948.20 to 26,068.15, gaining around 120 points through the week.

This was mainly supported by:

Key Drivers

- Recovery in IT after global tech earnings remained positive

- Banks stabilizing despite FII selling early in the week

- Auto stocks outperforming due to festival-season sales

- Energy pack (Reliance, ONGC, Coal India) offering support during dips

- Metal stocks reacting positively to China’s fresh stimulus signals

Technical Snapshot

- Support Zone: 25,900 → 25,720

- Resistance Zone: 26,150 → 26,280

- RSI remained between 57–61, indicating a balanced trend without overbought signals.

- Price continued trading above 20-DMA & 50-DMA, validating short-term strength.

Nifty maintained its structure of higher lows, indicating a controlled upward bias.

📍 Bank Nifty: Quiet Strength, No Major Breakout

Bank Nifty moved from 58,696.30 → 58,867.70, adding ~171 points.

The index struggled to break out decisively as PSU banks stayed mixed and private banks remained muted.

Major Drivers

- HDFC Bank showed accumulation signs near support

- Kotak Bank stabilized after previous week’s selling

- SBI consolidated after a sharp October rally

- Mid-tier banks (IDFC First, Federal, Bandhan) remained highly volatile

Technical View

- Support: 58,200

- Resistance: 59,250

- Lacks momentum for a major breakout until heavyweights participate

📍 Sensex: Large-Caps Take the Lead

Sensex moved from 84,700.50 → 85,231.92, gaining more than 530 points.

Large-cap participation remained strong as investors shifted away from overheated midcaps/smallcaps.

Top Contributors:

- Reliance

- HDFC Bank

- ICICI Bank

- Tata Motors

- Infosys

The 30-stock index maintained strong buoyancy reflecting the stability in large caps.

📍 Fin Nifty: Flat Week with Slight Positivity

Fin Nifty remained narrow-range, closing with minor gains.

Fin services stocks underperformed banks, keeping the index in consolidation mode.

- NBFCs like Bajaj Finance remained range-bound

- Insurance stocks posted minor gains

- Asset management companies saw renewed interest

📉 Indian Rupee (INR) Weekly Movement

The Indian Rupee traded with a slightly stronger bias during the week, supported by:

- Weakening US Dollar Index (DXY slipping below 103.5)

- RBI’s active OMO operations

- Lower crude oil prices aiding sentiment

Range: 83.12 – 83.25

Closing Bias: Mild appreciation

INR’s stability helped foreign inflows remain steady during the week.

📈 Commodity Market Wrap: Gold, Silver & Crude Oil

Gold

Gold remained supported as global yields softened.

- Range: ₹63,800 – ₹64,550 per 10 gm

- Weak USD + geopolitical tensions kept bullion firm

- Domestic gold ETFs saw inflows ahead of year-end demand

Silver

More volatile than gold due to industrial demand concerns.

- Range: ₹75,200 – ₹76,850

- China stimulus increased buying interest mid-week

Crude Oil

Crude experienced a pullback as supply conditions stabilized.

- Brent traded between $80–82.4/barrel

- US inventory rise pulled prices lower mid-week

- Lower crude supported India’s inflation outlook

Sector-Wise Weekly Performance

Top Performing Sectors

- IT

- Auto

- Metals

- PSU Energy

- Pharma (selective)

Underperformers

- FMCG (cooling post-festival)

- Realty (profit booking)

- Smallcap & Midcap Index (valuation fatigue)

FII–DII Activity

- FII: Mixed flows, net marginal sellers

- DII: Continued strong buying, supporting dips

- Mutual fund SIP inflows remained strong, adding to market stability.

Forecast for the Upcoming Week (25–29 November 2025)

Based on technical structure, global cues, and macroeconomic data, the coming week is likely to present a mildly positive bias with consolidation.

Key Levels to Watch

Nifty:

- Support: 25,880 / 25,720

- Resistance: 26,150 / 26,280

Bank Nifty:

- Support: 58,200

- Resistance: 59,250 / 59,600

Triggers for next week

- US FOMC minutes

- Crude oil price movements

- Dollar Index volatility

- Monthly expiry position adjustments

- China’s policy announcements

- Domestic macro signals

What Investors Should Do

✔ Stay invested in large-cap quality stocks

✔ Buy the dips in Metals, IT, Auto

✔ Avoid chasing midcaps & smallcaps at high valuations

✔ Keep allocation high in defensive stocks

✔ Track Bank Nifty for a potential breakout above 59,250

📌 FAQs

1. Why did Nifty remain stable during the week of 17–21 November 2025?

Strong domestic liquidity, steady global cues, and supportive sector rotation anchored the index despite intraday volatility.

2. Did Bank Nifty show strength?

Yes, but momentum remained limited. A breakout above 59,250 is necessary for a trend acceleration.

3. How did INR behave?

INR slightly appreciated as the US Dollar index weakened and crude oil softened.

4. What’s the outlook for the next week?

Markets may continue a consolidation-with-positive-bias trend unless global volatility spikes.

5. Which sectors may outperform?

IT, Auto, Metals, and selective Pharma have favourable setups for the coming week.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply