Commodity Market Wrap-Up for May 28, 2025, analyzing the daily movements of Gold, Silver, Crude Oil, and Natural Gas, along with pertinent global cues.

By CapitalKeeper | Wrap-Up | Indian Commodities | Market Moves That Matter

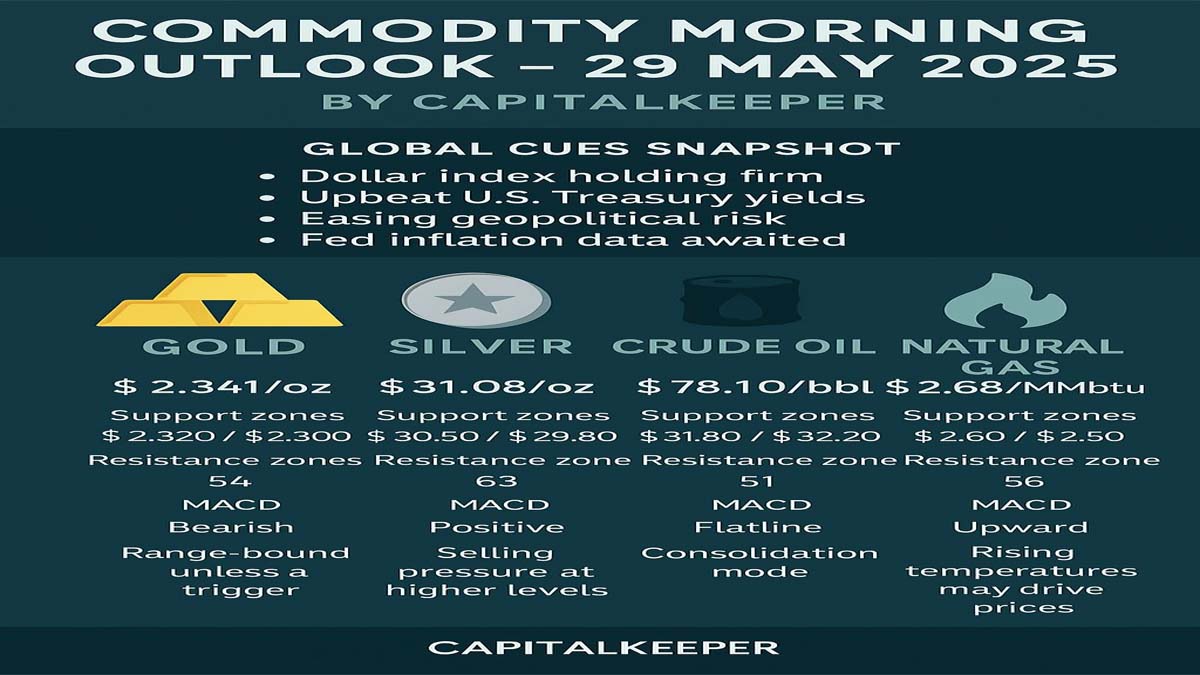

🟡 Gold: Consolidation Amid Global Uncertainty

- Price Movement: Gold prices in India remained steady on May 28, 2025. In Mumbai, Pune, and Nagpur, 24K gold was priced at ₹95,430 per 10 grams, while Delhi saw ₹95,270, and Chennai and Kolkata were at ₹95,120 .

- Global Factors: The stability in gold prices can be attributed to mixed global cues. While concerns over inflation and geopolitical tensions persist, a stronger U.S. dollar and anticipation of interest rate decisions have kept gold’s upward momentum in check .

- Technical Outlook: Gold is currently consolidating within a range, with key support at ₹94,500 and resistance at ₹96,000. A breakout above ₹96,000 could signal renewed bullish momentum.

⚪ Silver: Minor Gains Amid Industrial Demand

- Price Movement: Silver prices saw a slight uptick, with futures trading at ₹96,340 per kg, up by ₹752 or 0.79% .The Economic Times

- Global Factors: The modest gains in silver are supported by steady industrial demand and a slight increase in safe-haven buying. However, the stronger dollar and cautious investor sentiment have limited significant upside.

- Technical Outlook: Silver faces immediate resistance at ₹97,000, with support at ₹95,500. A move above ₹97,000 could open the path to ₹98,500 in the near term.

🛢️ Crude Oil: Prices Rise on OPEC+ Decisions and Geopolitical Tensions

- Price Movement: Crude oil prices rose more than 1% on Tuesday, May 28, 2025, with Brent futures climbing 84 cents to $71.91 per barrel, and U.S. West Texas Intermediate (WTI) crude futures also rising 84 cents to $68.42 .

- Global Factors: The increase in oil prices is attributed to OPEC+’s supply decisions and potential U.S. sanctions on Russia, impacting global market trends .

- Technical Outlook: Crude oil is exhibiting bullish momentum, with immediate resistance at $73.00 and support at $70.00. A sustained move above $73.00 could lead to further gains towards $75.00.

🔵 Natural Gas: Market Lacks Conviction Despite Price Boost

- Price Movement: Natural Gas Services Group, Inc. (NYSE:NGS) shareholders observed a 25% share price boost, yet the market might still lack some conviction on the stock’s future performance .

- Global Factors: The natural gas market is experiencing volatility due to changing LNG market dynamics, as evidenced by Australia Pacific LNG’s recent AUD2 billion cut to its LNG contract price .

- Technical Outlook: Natural gas prices are facing resistance at $4.60 per MMBtu, with support at $4.20. A breakout above $4.60 could signal a bullish trend, while a drop below $4.20 may indicate further downside.

🌐 Global Cues Influencing Commodity Markets

- Economic Indicators: The average interest rate for a 30-year, fixed-rate conforming mortgage loan in the U.S. is 6.922%, indicating a higher borrowing cost environment .

- Stock Market Movements: India’s benchmark indices opened flat on Wednesday, May 28, 2025, with positive global cues being weighed down by domestic factors .

- OPEC+ Decisions: OPEC+ is set to gather for a quota review before making key decisions on July output, which could significantly impact oil prices .

Note: The above analysis is based on available data as of May 28, 2025. Investors are advised to consider multiple factors and consult financial experts before making investment decisions.

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Leave a Reply