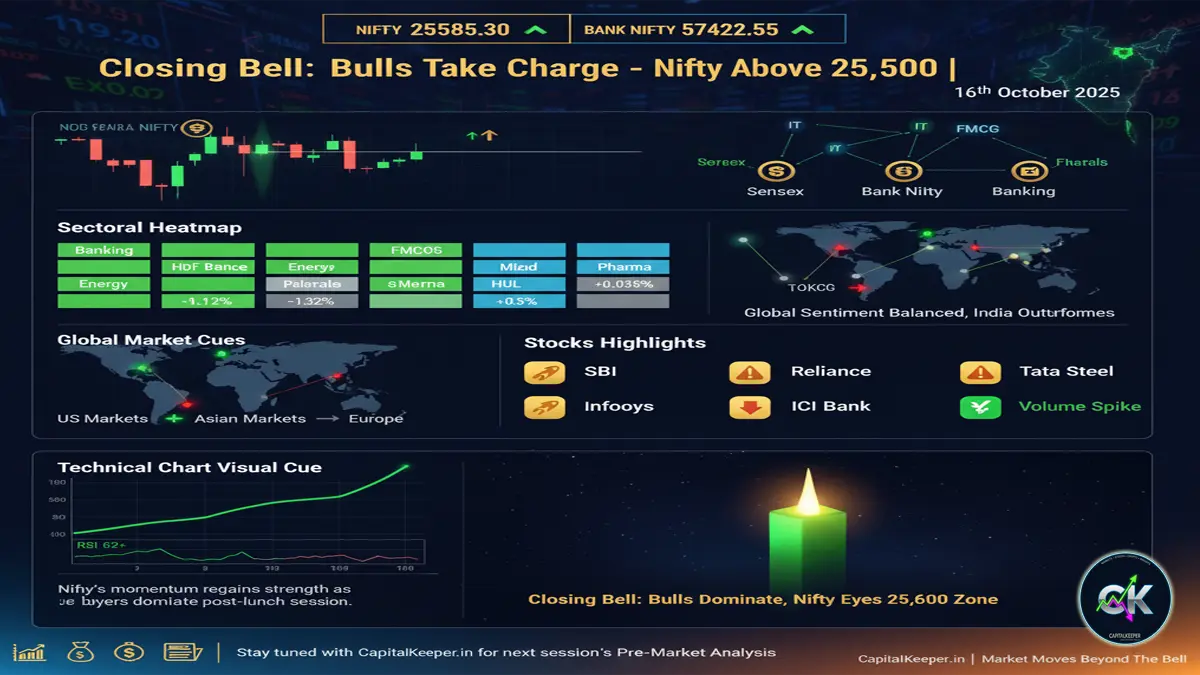

Closing Bell 16 October 2025: Nifty Surges Above 25,500, Bank Nifty Nears 57,500 as Bulls Regain Momentum

By CapitalKeeper | Closing Bell | Indian Equity | Market Moves That Matter

Indian stock market ends on a strong note on 16 October 2025 with Nifty closing at 25,585 and Bank Nifty at 57,422. Sensex slips marginally, while Fin Nifty gains amid firm global cues. Read detailed market analysis, sectoral performance, and key technical takeaways for investors.

🛎️ Closing Bell: 16 October 2025 – Bulls Take Charge as Nifty Regains Momentum Above 25,500

The Indian equity market wrapped up Thursday’s session (16 October 2025) on a buoyant note, supported by a recovery in banking, auto, and energy stocks. After a volatile start, Nifty 50 reclaimed the 25,500 mark, signaling renewed optimism among traders. Despite mild selling pressure in select IT counters, broader market sentiment stayed constructive with rotational buying seen across large-cap names.

📊 Market Summary

| Index | Open | Close | Change | Sentiment |

|---|---|---|---|---|

| Nifty 50 | 25,394.90 | 25,585.30 | ▲ +190.40 | Bullish |

| Bank Nifty | 57,139.95 | 57,422.55 | ▲ +282.60 | Positive |

| Sensex | 82,794.79 | 82,467.66 | ▼ -327.13 | Mild Weakness |

| Fin Nifty | 27,214.15 | 27,381.20 | ▲ +167.05 | Bullish |

The session witnessed sectoral divergence, with banks, financials, and autos leading the rally, while IT and FMCG stocks underperformed. Market breadth remained neutral but turned positive by the closing bell as large-cap indices absorbed mid-session volatility.

🌏 Global Market Overview

Global markets painted a mixed-to-positive picture, as investors tracked the US Federal Reserve’s minutes indicating no immediate rate hike and possible policy easing in early 2026.

- US Futures traded in the green, with Nasdaq and S&P 500 both up by 0.3%.

- European markets opened flat but edged higher as energy prices stabilized.

- Asian indices, including Nikkei and Hang Seng, closed with modest gains, setting a positive tone for Indian equities.

A stable global risk environment combined with declining crude oil prices and a steady rupee contributed to local market resilience.

💼 Sectoral Highlights

🏦 Banking & Financials

The Bank Nifty outperformed with a 0.5% gain, closing near 57,400, led by HDFC Bank, Axis Bank, and Kotak Mahindra Bank.

- HDFC Bank saw renewed buying interest as analysts reiterated long-term strength post-Q2 earnings.

- SBI and ICICI Bank held firm, supported by stable credit growth expectations.

Fin Nifty mirrored this sentiment, closing at 27,381.20, with insurance and NBFCs like Bajaj Finance and HDFC Life also contributing to the upside.

🚗 Auto Stocks Drive Momentum

Auto stocks continued their upward momentum, backed by robust festive-season demand.

- Maruti Suzuki, Tata Motors, and Hero MotoCorp gained between 1–2%.

- Analysts expect Q3FY26 auto volumes to remain strong, aided by rural recovery and lower financing costs.

⚡ Energy & PSU Stocks

Oil & gas names witnessed fresh buying as crude prices corrected below $82/bbl.

- ONGC and Coal India advanced amid strong production data and steady demand outlook.

- PowerGrid and NTPC added to PSU momentum, signaling investor preference for defensive energy counters.

💻 IT & FMCG Under Pressure

Weakness persisted in IT stocks following mixed guidance from global tech majors.

- Infosys and TCS faced mild profit booking, while Tech Mahindra slid 0.7%.

- FMCG majors like HUL and Britannia also traded weak on valuation concerns, limiting overall gains in the broader indices.

📈 Technical Overview – Nifty & Bank Nifty

Nifty 50: Technical Picture

- Opening: 25,394.90

- Intraday High: 25,610

- Intraday Low: 25,345

- Closing: 25,585.30

Nifty maintained a strong bullish tone, closing comfortably above the psychological 25,500 mark. The index is forming a short-term higher low pattern, indicating momentum buildup.

- Immediate Support: 25,440 / 25,300

- Resistance Zone: 25,650 / 25,780

- Next Target (Upside): 25,850 – 26,000

- RSI: 58 (rising)

- MACD: Positive crossover continues

A sustained close above 25,650 could open the path toward 26,000, while failure to hold 25,300 may trigger mild profit booking.

Bank Nifty: Technical Picture

- Opening: 57,139.95

- Closing: 57,422.55

Bank Nifty’s momentum continues to remain constructive with strong support around 57,000 and upside resistance near 57,700–57,850.

- RSI: 61 – in bullish territory

- Trend: Positive bias intact

- Short-Term View: Buy-on-dips near 57,050–57,100 for a move towards 57,800–58,000

🏦 Institutional Flows

According to provisional data,

- FIIs were net buyers worth ₹1,023 crore, showing renewed confidence in Indian equities.

- DIIs booked minor profits worth ₹358 crore.

Foreign inflows into large-cap banking and auto stocks remained robust, highlighting global investors’ preference for India’s macro stability.

🌐 Global & Domestic Cues

- US CPI data eased slightly, reinforcing hopes of a policy pivot by early 2026.

- Crude oil hovered near $82/bbl, easing inflationary pressure.

- USD-INR traded stable near 83.05, reflecting FX stability.

- India’s 10-year bond yield stayed anchored at 7.12%.

On the domestic front, improving GST collections and Q2 earnings optimism added to positive sentiment.

💬 Market Sentiment

Traders noted that despite intermittent volatility, the bullish undertone remains intact, supported by banking strength and FII inflows. The 25,300–25,650 range is emerging as a consolidation zone before the next breakout.

🧭 Outlook for Friday (17 October 2025)

- Bias: Positive above 25,500

- Nifty Support: 25,420 / 25,300

- Nifty Resistance: 25,650 / 25,800

- Bank Nifty Support: 57,050

- Bank Nifty Resistance: 57,850

Any breakout above 25,650–25,700 could trigger fresh long positions ahead of the upcoming weekly expiry.

🧠 Key Takeaways

- Nifty ends above 25,500 for the first time this week.

- Bank Nifty leads the rally, up over 0.5%.

- Global cues supportive; FIIs turn buyers.

- IT stocks drag marginally, but market breadth improves.

- Outlook remains positive with resistance near 25,800.

🕓 Conclusion

The Indian stock market closed the session of 16 October 2025 with a confident rebound, reflecting the return of bullish momentum after a cautious start to the week. Both Nifty and Bank Nifty displayed strength, aided by renewed buying from institutions and positive global signals.

While near-term volatility cannot be ruled out, the overall setup suggests the market may be preparing for another leg higher toward 26,000 levels in Nifty if global stability persists.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results. By using this website, you agree to the terms of this disclaimer

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply