Stock Market Beginner’s Weekly Guide: Trading Tips, Indicators & Strategies

By CapitalKeeper | Weekly Education | Stock Market | Episode 1

Entering the world of stock trading can be overwhelming for beginners. The markets move fast, influenced by news, earnings, and investor psychology. But with the right knowledge and discipline, even newcomers can begin their trading journey with confidence and clarity. That’s where CapitalKeeper steps in.

This is the first edition of our weekly educational series, where we guide beginners through every major aspect of stock market trading—from technical indicators to risk management strategies. This ongoing blog series is designed to provide consistent learning so you can trade smarter every week.

Why Trading Education Matters

Before you invest a single rupee, understanding the “how” and “why” of the stock market is crucial. Too many traders lose money because they jump into trades without knowledge or structure.

Here’s what you’ll gain from following this weekly CapitalKeeper series:

- A structured understanding of technical and fundamental analysis

- Tips and real-time examples from the Indian market

- Trading psychology insights

- Updates on profitable setups and risk control

What is Financial Market ?

A financial market is a word that describes a marketplace where bonds, equity, securities, currencies are traded. Few financial markets do a security business of trillions of dollars daily, and some are small-scale with less activity. These are markets where businesses grow their cash, companies decrease risks, and investors make more cash. A Financial Market is referred to space, where selling and buying of financial asset sand securities take place. It allocates limited resources in the nation’s economy. It serves as anagent between the investors and collector by mobilizing capital between them.

Key Stock Market Terms:

- Stock/Share: A unit of ownership in a company.

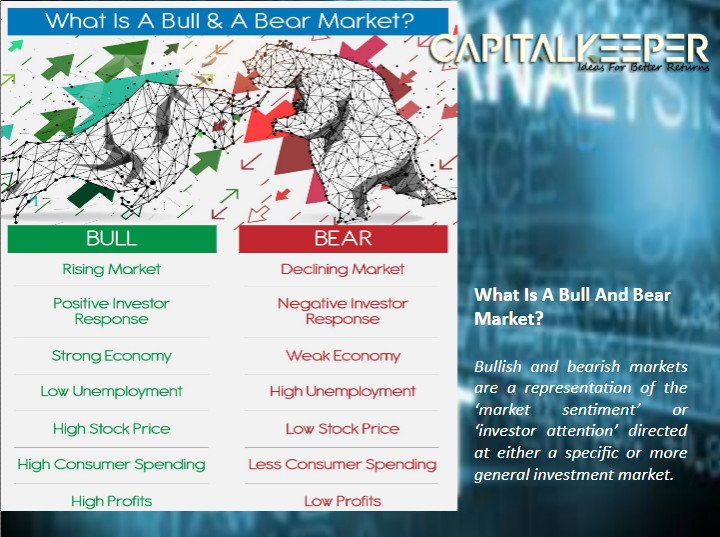

- Bull Market: A rising market trend.

- Bear Market: A declining market trend.

- Volume: Number of shares traded in a period.

- Liquidity: How easily a stock can be bought/sold without affecting its price.

1. Understand the Basics: What Is Trading?

Trading involves buying and selling financial instruments—such as stocks, options, or futures—with the aim of profiting from short-term price fluctuations. There are different styles of trading:

- Intraday Trading: Buying and selling within the same day

- Swing Trading: Holding positions for a few days to weeks

- Positional Trading: Medium-term trading, holding stocks for a few months

CapitalKeeper Pro Tip: Start with intraday or swing trading using virtual money or small capital to build confidence.

2. Essential Trading Rules for Beginners

- Risk only what you can afford to lose

- Never trade without a stop loss

- Don’t overtrade or chase trades

- Keep emotions away – fear and greed kill profits

- Follow one or two strategies consistently before experimenting

3. Essential Trading Tips for Beginners

Tip #1: Start with a Solid Education

- Learn key concepts (technical vs. fundamental analysis).

- Follow financial news (Bloomberg, CNBC, Yahoo Finance).

- Read books like The Intelligent Investor by Benjamin Graham.

Tip #2: Paper Trade Before Using Real Money

- Use a simulator (e.g., TradingView, ThinkorSwim) to practice without risk.

- Track your performance and refine strategies.

Tip #3: Set Clear Goals & Risk Tolerance

- Define if you’re a day trader, swing trader, or long-term investor.

- Never risk more than 1-2% of your capital on a single trade.

Tip #4: Keep Emotions in Check

- Avoid FOMO (Fear of Missing Out) and panic selling.

- Stick to your trading plan.

Tip #5: Diversify Your Portfolio

- Don’t put all your money into one stock/sector.

- Spread risk across different assets (stocks, ETFs, bonds).

4. Popular Trading Strategies

Strategy #1: Buy and Hold (Long-Term Investing)

- Best for beginners; invest in strong companies and hold for years.

- Example: Investing in blue-chip stocks like Apple or Microsoft.

Strategy #2: Swing Trading (Short-to-Medium Term)

- Hold stocks for days to weeks, capitalizing on price swings.

- Uses technical analysis (charts, trends).

Strategy #3: Day Trading (Intraday Trading)

- Buy and sell within the same day to profit from small price movements.

- Requires quick decision-making and strict risk management.

Strategy #4: Momentum Trading

- Ride stocks with strong upward/downward trends.

- Use indicators like Relative Strength Index (RSI).

Strategy #5: Scalping (Ultra-Short Term)

- Make multiple small trades in minutes to capture tiny profits.

- High-frequency, requires low-latency platforms.

5. Must-Know Technical Indicators

Indicators help predict price movements. Here are the top ones:

Indicator #1: Moving Averages (MA)

- Simple Moving Average (SMA): Average price over a period.

- Exponential Moving Average (EMA): Gives more weight to recent prices.

- Use: Identify trends (e.g., 50-day & 200-day MA crossover).

Indicator #2: Relative Strength Index (RSI)

- Measures overbought (70+) or oversold (30-) conditions.

- Helps spot reversals.

Indicator #3: MACD (Moving Average Convergence Divergence)

- Shows momentum via two moving averages.

- Signal line crossovers indicate buy/sell opportunities.

Indicator #4: Bollinger Bands

- Shows volatility—price tends to stay within upper/lower bands.

- A squeeze indicates a potential breakout.

Indicator #5: Volume & Support/Resistance

- Volume: Confirms trend strength.

- Support/Resistance: Key price levels where stocks bounce or reverse.

6. Entry & Exit Strategies for Beginners

Breakout Strategy: Buy when the price breaks above key resistance with volume.

- Pullback Strategy: Buy during a retracement to moving averages in an uptrend.

- Reversal Strategy: Use RSI divergence or candlestick reversal patterns near support/resistance zones.

Always define your target and stop-loss level. Risk-Reward Ratio should ideally be at least 1:2.

7. Importance of a Trading Journal

Keeping a record of your trades is essential for learning:

- Document entry/exit levels, reasons for trade, outcome

- Review weekly to identify mistakes and successes

Use Google Sheets or trading journal apps to track your performance.

8. Risk Management Is Non-Negotiable

Risk Management Rules

Even the best traders lose sometimes. Protect your capital with these rules:

✅ Use Stop-Loss Orders – Automatically sell if the price drops below a set level.

✅ Position Sizing – Never risk more than 1-2% per trade.

✅ Avoid Overtrading – Stick to high-probability setups.

✅ Keep a Trading Journal – Track wins/losses to improve.

9. How CapitalKeeper Helps New Traders

CapitalKeeper is your daily guide to market insights. Here’s how we help:

- Daily blog posts: Opening Bell, Mid-Day, and Closing Bell

- Sector-wise market analysis

- Intraday top stock picks with RSI, MACD, and price action analysis

- Weekly educational series like this

- Commodity and Index reports for better diversification

You don’t need to learn everything in one day. Our weekly format helps you master one concept at a time.

10. Next Week’s Preview

In Week 2, we’ll dive deeper into Candlestick Patterns & Chart Reading—essential skills for spotting trends and reversals.

📌 Action Step: Open a demo account this week and test these strategies risk-free!

🔔 Follow this series every week to master stock market trading!

Weekly Plan (What’s Coming Next Week)

Next week, we’ll cover:

- Candlestick patterns (Doji, Hammer, Engulfing)

- How to identify strong support and resistance

- Real-life examples from Nifty 50 and Bank Nifty

Final Thoughts

Trading is not gambling. It’s a skill. With proper education, discipline, and guidance from CapitalKeeper, anyone can build a profitable journey in the Indian stock market.

Stay tuned every Sunday for our educational update under the Beginner’s Guide section.

Bookmark CapitalKeeper.in for real-time updates, insights, and learning tools.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and subscribe to our newsletter!

Educational Blog Disclaimer

Episode [1]: Stock Market Beginner’s Weekly Guide

1. Educational Purpose Only

This blog series is purely for educational and informational purposes. The content, including stock examples, strategies, and market analysis, is not financial advice. Always consult a SEBI-registered advisor before making investment decisions.

2. No Guarantee of Returns

Past performance ≠ future results. Stocks, mutual funds, and other securities carry market risks. We do not claim any stock will deliver profits or multi-bagger returns.

3. Conflicts of Interest

- The author/blog may hold positions in discussed stocks.

- This is not a recommendation to buy/sell any security.

4. Data Accuracy

While we strive for accuracy, market data (prices, ratios, etc.) may change after publishing. Verify figures from NSE/BSE/Moneycontrol before acting.

5. Your Responsibility

Investing requires due diligence. You are solely responsible for your capital allocation.

6. Regulatory Compliance

This content adheres to SEBI’s Investor Protection Guidelines. No paid promotions or undisclosed partnerships are involved.

ଲୁହା ଓ ଜଳ - odianews.co.in

[…] MORNING HIGHLIGHT ଜ୍ୟୋତିଷ ଓ ରାଶିଫଳ Stock Market Education […]