Hybrid Mutual Funds in 2025: Are They the Best of Both Worlds? | CapitalKeeper

By CapitalKeeper | Beginner’s Guide | Mutual Funds | Market Moves That Matter

Hybrid Mutual Funds in 2025: Are They the Best of Both Worlds?

Hybrid mutual funds are gaining popularity among Indian investors for offering equity-like growth with debt-like stability. In 2025’s volatile markets, are they the ideal bridge between risk and return? Let’s explore their types, benefits, and strategies.

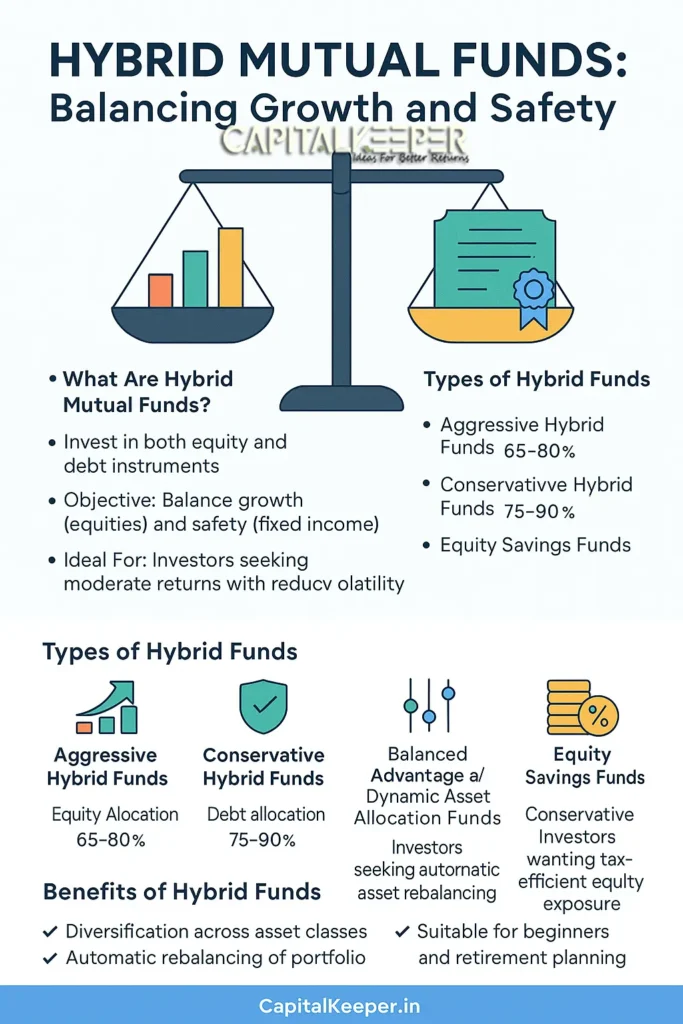

1. What Are Hybrid Mutual Funds?

- Definition: Funds that invest in both equity and debt instruments in varying proportions.

- Objective: Balance growth (equities) and safety (fixed income).

- Ideal For: Investors seeking moderate returns with reduced volatility.

2. Types of Hybrid Funds

a) Aggressive Hybrid Funds

- Equity Allocation: 65–80%

- Who Should Invest: Growth-oriented investors with moderate risk appetite.

b) Conservative Hybrid Funds

- Debt Allocation: 75–90%

- Who Should Invest: Risk-averse investors preferring steady returns.

c) Balanced Advantage/Dynamic Asset Allocation Funds

- Allocation: Varies dynamically based on market valuations.

- Who Should Invest: Investors seeking automatic asset rebalancing.

d) Equity Savings Funds

- Mix: Equity + Arbitrage + Debt

- Who Should Invest: Conservative investors wanting tax-efficient equity exposure.

3. Benefits of Hybrid Funds

- Diversification across asset classes

- Automatic rebalancing of portfolio

- Tax-efficient if equity-oriented

- Suitable for beginners and retirement planning

4. Key Risks to Consider

- Equity exposure can still cause volatility

- Debt portion sensitive to interest rate changes

- Returns may lag pure equity funds in bull markets

5. Performance Snapshot (2025)

(Approximate trailing returns as of July 2025)

| Fund Name | 1-Year Return | 3-Year CAGR |

|---|---|---|

| ICICI Prudential Equity & Debt Fund | 16% | 12% |

| HDFC Balanced Advantage Fund | 15% | 11.5% |

| SBI Equity Hybrid Fund | 14% | 10.8% |

Who Should Invest in Hybrid Funds?

- First-time mutual fund investors

- Conservative investors seeking stability + moderate growth

- Retirement planners wanting balanced exposure

Build a Balanced Portfolio Today!

Want equity growth but afraid of volatility? Hybrid funds may suit you.

Subscribe to CapitalKeeper Newsletter for curated hybrid fund insights every month.

Explore Free Tools:

- SIP Calculator – Plan hybrid fund SIPs

- Lumpsum Calculator – Check growth projections

Next Read:

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Leave a Reply