What Is a Counterparty? Understanding Counterparty Risk in Trading and Finance

By CapitalKeeper | Beginner’s Guide | Indian Sock Market | Market Moves That Matter I 20th June 2025

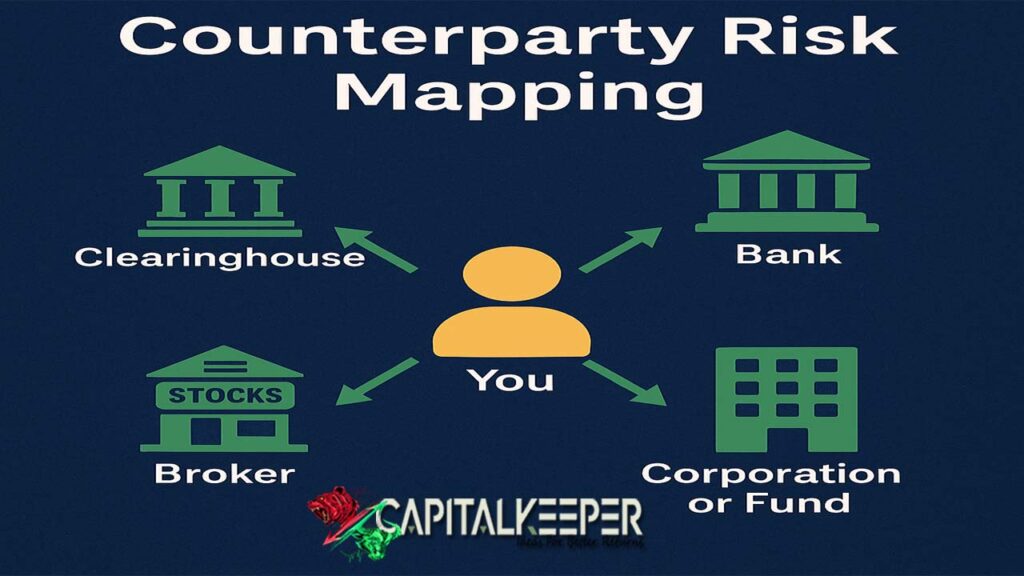

Every financial transaction involves two or more participants. When you buy or sell a security, enter a loan agreement, or trade a derivative, the other side of the transaction is referred to as your counterparty.

Understanding who the counterparty is and more importantly, the risk associated with them defaulting is critical to both retail and institutional investors.

📌 What Is a Counterparty?

A counterparty is any party (individual, institution, broker, bank, fund, or clearing house) that takes the opposite position in a financial transaction.

✅ In simple terms:

- If you’re buying, the counterparty is selling.

- If you’re lending, the counterparty is borrowing.

🔍 Examples of Counterparties Across Markets

| Market | Example | Counterparties |

|---|---|---|

| Stock Trading | Buying TCS shares on NSE | You vs Another Investor (via Broker) |

| Derivatives | Options contract on Nifty | Buyer vs Writer (Exchange acts as middleman) |

| Bond Market | Corporate bond investment | You vs Issuing Company |

| Forex | Buying USDINR | You vs Broker (or Interbank dealer) |

| Mutual Funds | Redeeming units | You vs AMC/Fund House |

⚠️ What Is Counterparty Risk?

Counterparty risk is the probability that the other party in a contract fails to fulfill their side of the deal, either due to insolvency, fraud, or operational error.

🎯 Real-Life Examples:

- A corporate bond defaults → Issuer fails to repay

- In an OTC derivative, the hedge fund disappears before settlement

- A broker delays payouts due to internal issues (Karvy case)

🧠 Key Factors That Determine Counterparty Risk

- Creditworthiness – Are they AAA-rated or junk status?

- Regulatory Oversight – Are they governed by SEBI, RBI, or any global watchdog?

- Nature of Contract – Is it an OTC agreement or exchange-traded?

- Exposure Limit – How large is your exposure to this party?

- Duration of Contract – Longer contracts = higher cumulative risk

🔄 Counterparty Risk in Exchange-Traded vs OTC Markets

| Feature | Exchange-Traded | OTC (Over-the-Counter) |

|---|---|---|

| Example | NSE F&O, MCX | Currency forwards, private swaps |

| Counterparty | Clearing Corporation | Bank or Fund |

| Risk | Minimal (backed by clearinghouse) | Higher |

| Margining | Yes | Often customized |

| Transparency | High | Low |

🧠 In India, NSE Clearing Ltd and Indian Clearing Corporation Ltd (ICCL) act as central counterparties to reduce systemic risk in stock and F&O trades.

🛡️ How to Manage Counterparty Risk

- Use Reputed Brokers and DPs – Check SEBI registration & investor complaint history

- Diversify Across Institutions – Don’t put all your capital with one counterparty

- Use Collateral & Margining – Always have proper collateral in derivatives

- Read Credit Ratings for Bonds – CARE, CRISIL, ICRA ratings matter

- Stay on Regulated Platforms – Avoid unregulated crypto/forex dealers

- Track Exposure Limits – Institutions often cap exposure to any one party to limit impact

🧾 Real Case Studies

📌 Lehman Brothers Collapse (2008)

Many banks and funds had derivatives and bond exposure to Lehman. When it filed for bankruptcy, counterparty risk crystallized leading to a global financial crisis.

📌 Karvy Stock Broking Scam (India, 2019)

Clients couldn’t access their own shares because Karvy misused pledged securities. Though NSE and SEBI intervened, it shows retail traders are exposed to counterparty risk even today.

🧭 Why It Matters to You as a Trader or Investor

- Derivatives Trader? Know who stands behind your contract.

- Bond Investor? Know how likely the issuer is to repay.

- Mutual Fund Investor? Know which institutions the AMC deals with.

- Retail Investor? Ensure your broker is secure and SEBI-registered.

📌 Conclusion: Don’t Just Trade the Market—Know Who You’re Trading With

Counterparty risk may seem invisible until something goes wrong. Whether you’re a casual trader or portfolio manager, evaluating your counterparty is as important as analyzing your asset.

🔐 In a world of increasing digital financial transactions, trust, transparency, and regulation are your best shields against counterparty failure.

📌 For more real-time updates, trade setups, and investment insights follow us on [Telegram] and subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

CapitalKeeper | Turning Market Noise into Market Wisdom

🔗 Visit CapitalKeeper.in

Leave a Reply