Pre Market 10 July 2025: Nifty Eyes Rebound Near Support; PSU Banks, Pharma, Metals Stay Strong as Global Cues Remain Stable

By CapitalKeeper | Pre Market Opening | Indian Equities | Market Moves That Matter

📰 Pre-Market Outlook – 10 July 2025 | CapitalKeeper.in

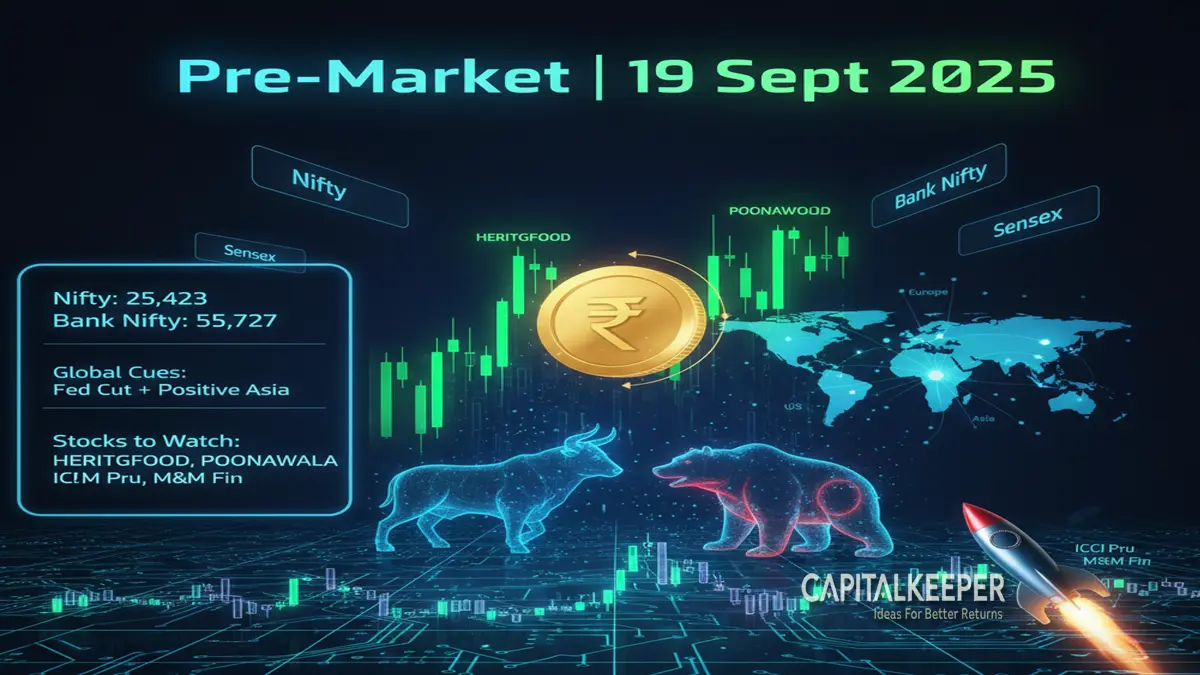

Nifty closed at 25,476.10, nearing support. Gift Nifty signals flat-to-positive open. PSU Banks, Pharma, and Metals remain bullish. Global markets stable ahead of US data. Read full sector view and trade levels for today.

📊 Market Recap – 09 July 2025

| Index | Close | Move |

|---|---|---|

| Nifty 50 | 25,476.10 | ▼ -46.40 pts |

| Bank Nifty | 57,199.75 | ▼ -56.55 pts |

| Sensex | 83,625.89 | ▼ -86.62 pts |

| Fin Nifty | 26,988.05 | ▼ -28.80 pts |

After showing strength earlier in the week, markets saw mild profit booking amid cautious global sentiment and ahead of key data from the US. However, broader market trend remains intact as indices held above key support zones.

🌐 Global Market Snapshot – 10 July 2025

- Gift Nifty trades mildly positive around 25,500–25,515, suggesting a flat-to-positive open.

- US Markets ended slightly lower ahead of CPI and jobless data:

- Dow Jones: ▼ -0.17%

- Nasdaq: ▼ -0.24%

- S&P 500: ▼ -0.18%

- Asian Markets: Mixed open; Nikkei trades flat, Hang Seng mildly positive.

- Crude Oil: $70.35/barrel – no major volatility.

- Dollar Index: 104.45 – steady.

- India VIX: 12.20 – remains subdued, volatility low.

🎯 Eyes on US CPI Data Tonight – will influence risk sentiment globally.

📈 Technical Analysis – Key Index Levels

🔹 Nifty 50 (Close: 25,476.10)

- Resistance Levels:

- 25,557 / 25,620 / 25,725

- Support Zones:

- 25,380 / 25,255 / 25,155

📌 Nifty pulled back slightly but held above key support at 25,380. Watch 25,620 as breakout zone for the week.

🔹 Bank Nifty (Close: 57,199.75)

- Resistance Levels:

- 57,450 / 57,750 / 57,900

- Support Levels:

- 56,950 / 56,700 / 56,300

✅ Bullish structure intact as long as index holds above 56,950.

📊 Sector-Wise Trend – 10 July 2025

✅ Bullish or Positive Bias

| Sector | View | Insight |

|---|---|---|

| PSU Banks | Bullish | Continues to lead; strength in SBI, BOB |

| Pharma | Bullish | Steady buying interest, safe-haven rotation |

| Metals | Bullish | Rising demand, technical breakout signs |

| Midcaps | Positive bias | Broader strength persists |

⚖️ Mixed/Neutral Trend

| Sector | Notes |

|---|---|

| IT | Mixed due to global tech pressure |

| FMCG | Defensive but underperforming |

| Auto | Volatile; selective buying recommended |

| Financial Services | Slightly underperforming vs. Bank Nifty |

| Energy & PSEs | Flat trend; breakout awaited |

🧠 Derivative Data & FII Sentiment

- FII Index Longs: 29.85%

- Shorts: 70.15%

- Nifty PCR: 0.78 | Bank Nifty PCR: ~0.91

- India VIX: 12.20 ▼ — Low volatility supports dip buying

FIIs remain short-heavy but are slowly unwinding, indicating shifting bias if breakout levels are taken out.

🧭 CapitalKeeper’s Strategy – 10 July 2025

- Focus on PSU Banks, Pharma, and Metals for long opportunities.

- Nifty must hold 25,380 to remain bullish; any dip toward 25,255 is a buying opportunity.

- Bank Nifty above 57,450 → Fresh momentum toward 57,900.

- Avoid aggressive trades before US CPI data (release at night).

- Trailing SL essential – volatility may pick up post-2:00 PM IST.

🎯 Key Trade Levels

| Index | Support Levels | Resistance Levels |

|---|---|---|

| Nifty 50 | 25,380 / 25,255 | 25,557 / 25,620 / 25,725 |

| Bank Nifty | 56,950 / 56,700 | 57,450 / 57,750 / 57,900 |

| Fin Nifty | 26,800 / 26,620 | 27,120 / 27,280 |

📢 Stay tuned: 11 July (Friday) remains the most important day of the week as per study cycles — may trigger “greed rally” if supported by global momentum.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Leave a Reply