Opening Bell 30 June 2025: Nifty Near Resistance, Bank Nifty Support & Global Cues Watch

By CapitalKeeper | Market Opening | Intraday Ideas | Market Moves That Matter

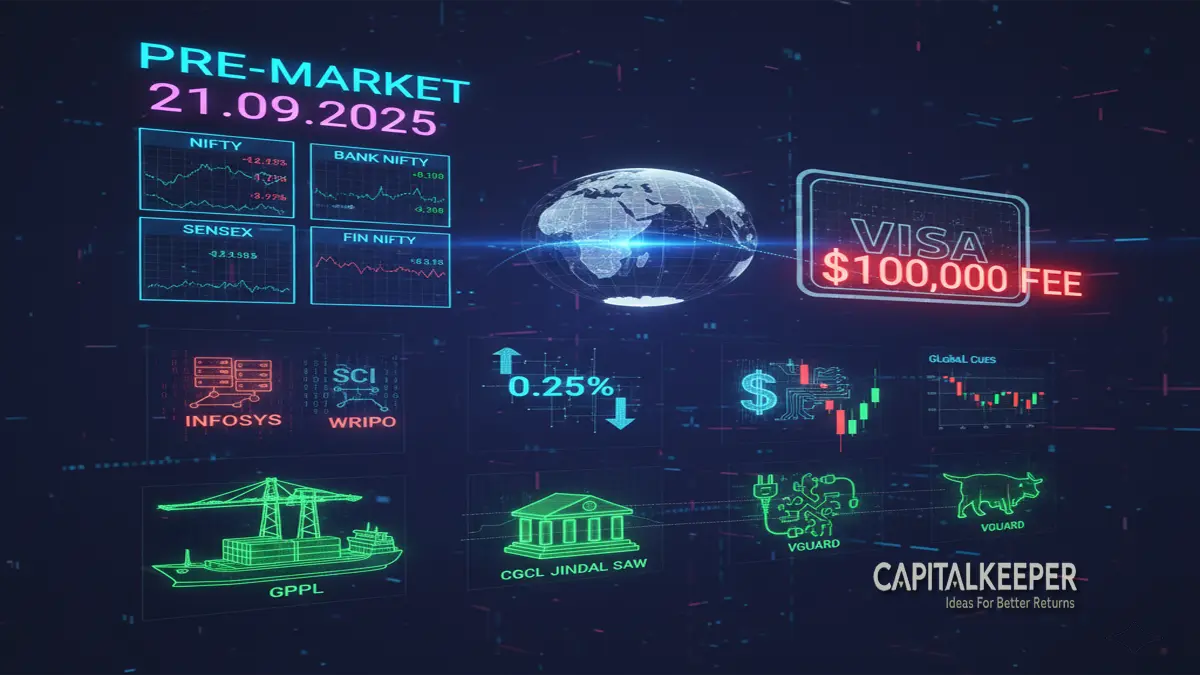

Indian stock market opens flat on 30 June 2025. Nifty facing resistance near 25,750. Bank Nifty hovers near 57,600 resistance. Sector-wise outlook, intraday stock picks and global cues.

📊 Market Snapshot (as of 9:20 AM IST)

| Index | Previous Close | Open | Current Trend |

|---|---|---|---|

| Nifty 50 | 25,637.80 | 25,661.60 | Rangebound |

| Bank Nifty | 57,529.95 | 57,234.79 | Volatile |

| Sensex | 84,058.90 | 84,027.33 | Flat |

| Fin Nifty | 27,344.05 | 27,364.35 | Steady |

🌐 Global Market Cues

- US Markets: Closed mixed on Friday; Dow fell 0.2%, Nasdaq gained 0.4%.

- Asian Markets: Nikkei and Hang Seng slightly positive amid China data optimism.

- SGX Nifty: Indicates cautious opening; tracking global peers.

- Brent Crude: Hovering near $84 per barrel.

- Dollar Index: Firm near 105, keeping pressure on EM currencies.

🔥 Technical Outlook

- Nifty Resistance: 25,750 zone – crucial gap fill level. Sustaining above could trigger further bullish momentum.

- Nifty Support: 25,450–25,500 zone – watch for dips to hold.

- Bank Nifty Resistance: 57,600 zone – cluster resistance area.

- Bank Nifty Support: 57,000 level – strong immediate cushion.

🏦 Sectoral Focus

| Sector | Trend | Key Highlights |

|---|---|---|

| 🔋 Energy | Positive | BPCL, ONGC gaining on firm crude prices |

| 🚀 IT | Neutral | Mixed cues from global peers |

| 🏗️ Infra | Positive | Railway stocks, capital goods upbeat |

| 🏦 Banks | Rangebound | PSU Banks stable; private banks mixed |

| 🚗 Auto | Strong | Tata Motors, M&M showing early strength |

✅ Intraday Stocks on Radar

- BPCL (CMP ₹332) – Oil marketing gainers, target ₹338–₹342.

- M&M (CMP ₹3,181) – Strong delivery data, target ₹3,290.

- Tata Power (CMP ₹405) – Power sector buzz, target ₹428.

- Axis Bank (CMP ₹1,219) – Range breakout candidate, target ₹1,270.

- IRCON (CMP ₹204) – Infra momentum continues, target ₹223.

📢 Today’s Events & News

- India Fiscal Data: Government to release April–June fiscal deficit data post market.

- US PMI Data: Key global macro watch later tonight.

- Monsoon Update: Widespread rains may support agri, FMCG stocks.

🔎 CapitalKeeper Take

“Nifty and Bank Nifty are at key resistance zones. A clean break above 25,750 in Nifty and 57,600 in Bank Nifty could extend the rally into expiry week. Traders should watch global cues and sector rotation closely.”

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Leave a Reply