Nifty Monthly Expiry Analysis 30 Sept 2025 – Key Support & Resistance Levels | Market Outlook

By CapitalKeeper | Nifty & Bank Nifty | Indian Equities | Market Moves That Matter

Stay ahead with today’s Nifty Monthly Expiry analysis (30 Sept 2025). Get key support & resistance levels, Bank Nifty strategy zones, FII data, PCR trends, VIX insights, and intraday trading strategies for Nifty, Bank Nifty, and Fin Nifty.

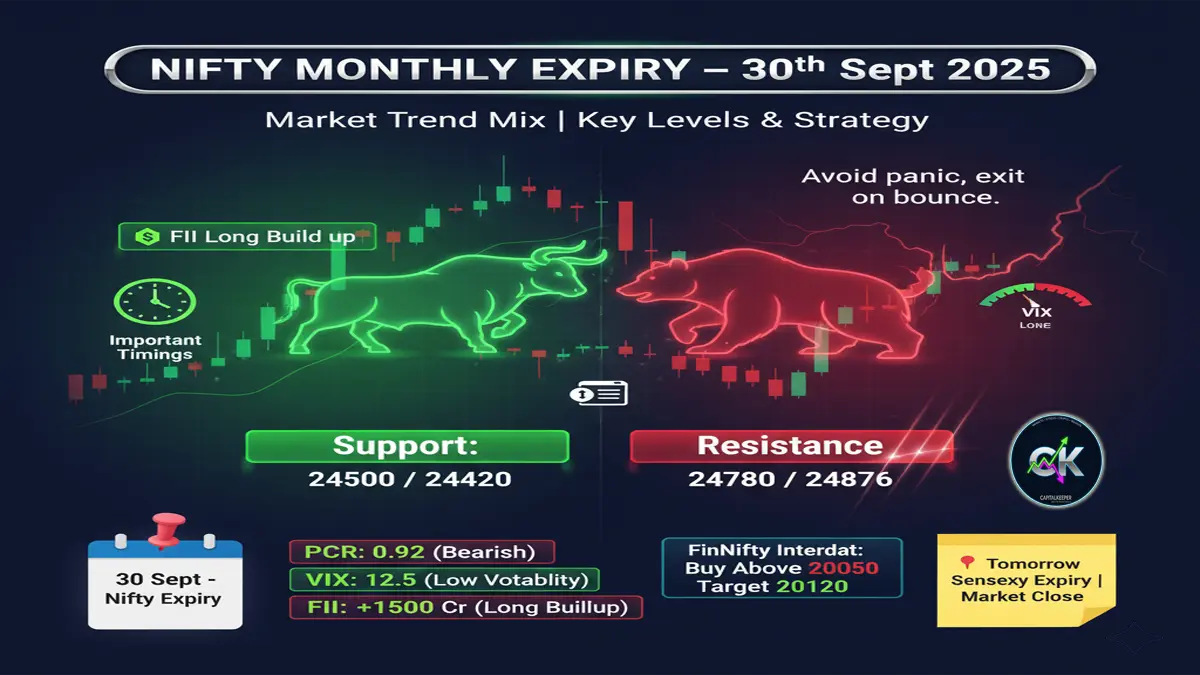

📰 Nifty Monthly Expiry & Market Outlook – 30th September 2025

The last trading session of September brings with it monthly expiry volatility, making today’s session critical for both short-term traders and positional investors. With Nifty trading at 24,634.90, the market continues to exhibit sideways consolidation, where intraday levels and option positioning will dictate moves.

Adding more weight to today’s trading session, tomorrow marks the Sensex weekly expiry, and on Thursday, the market will remain closed, compressing market activity into the next two sessions. This setup often creates sharp intraday swings, especially around key support and resistance levels.

🔎 Key Observations

✅ Trend Mix – Expiry Pressure

Today’s trade carries a mixed bias. Nifty will need to sustain above critical support levels to gather strength. Avoid panic in lower levels, but use bounce backs as exit opportunities, especially for weak positions.

✅ FII & Sentiment Data

- FII Index Longs: 16% (up from 14%) – showing increasing institutional buying interest.

- Nifty PCR: 0.71 (up from 0.63) – indicates slightly improved sentiment, but still neutral-bearish.

- Bank Nifty PCR: 0.87 (up from 0.71) – a recovery from oversold levels, indicating possible stabilization.

- India VIX: 11.36 (down by 0.5%) – volatility remains low, keeping intraday ranges in check.

The data suggests a slight bullish undertone, though range-bound volatility should persist until expiry is out of the way.

📊 Nifty Technical Outlook (24,634.90)

🔹 Resistance Levels (till 3rd October)

- 24,780

- 24,876

- 24,945

- 25,030

🔹 Support Levels

- 24,420

- 24,480

- 24,540

- 24,585

📌 View:

Nifty is trading in a wide 600-point range, where 24,150–24,300 remains a strong support cluster. On the upside, 24,876 and 25,030 act as stiff hurdles. A breakout above 25,030 may open the path to 25,250+. However, a breakdown below 24,150 could trigger a dip toward 23,900.

📊 Bank Nifty Technical Outlook (54,461)

🔹 Support Levels

- 54,000

- 54,100

- 54,240

🔹 Resistance Levels

- 54,600

- 54,750

- 54,855

- 55,000

- 55,140

- 55,245

- 55,335

📌 View:

Bank Nifty is holding above 54,000, showing relative resilience compared to Nifty. As long as it stays above 54,240, momentum may pick up toward 54,855–55,140 zones. However, a dip below 54,000 could invite fresh selling pressure toward 53,700.

📊 Fin Nifty Technical Outlook (26,008)

Fin Nifty continues to follow the broader market trend, currently at 26,008.

🔹 Key Zones for Intraday

- Support: 25,920 / 25,850

- Resistance: 26,150 / 26,275

📌 Intraday Strategy:

- Buy near dips at 25,920–25,950 with a target of 26,150 and stop-loss below 25,850.

- Short near 26,250–26,300 with a target of 26,050 and stop-loss above 26,350.

⏰ Important Timings to Watch Today

- 12:18 PM

- 1:14 PM

- 2:09 PM

- 2:55 PM

The first hour’s high/low till 10:30 AM will remain a decisive marker. Intraday reversals often align with these time slots, making them crucial for traders.

🔔 Sectoral View

📌 IT Stocks – Relief Bounce, But Exit on Strength

IT stocks are showing signs of a rebound. However, given global macro cues and Fed uncertainties, traders should avoid panic selling at lows but exit on bounce backs.

📌 PSU Banks – Holding Well

Public sector banks continue to show relative strength, supported by domestic flows. Above 7,600 (index level), fresh momentum may be seen.

📌 FMCG – Rangebound Trade

FMCG remains in a narrow consolidation range. A decisive break below 56,000 may push it toward 53,500.

🎯 Expiry Special – Straddle Idea

For Nifty Monthly Expiry, volatility may contract after the first half. Traders can consider:

📌 Nifty 24,650 Straddle (ATM):

- Sell 24,650 CE & Sell 24,650 PE.

- Hedge with OTM options for risk control.

- Benefit if Nifty trades within 200–250 point range today.

This strategy is only for experienced traders with risk management discipline.

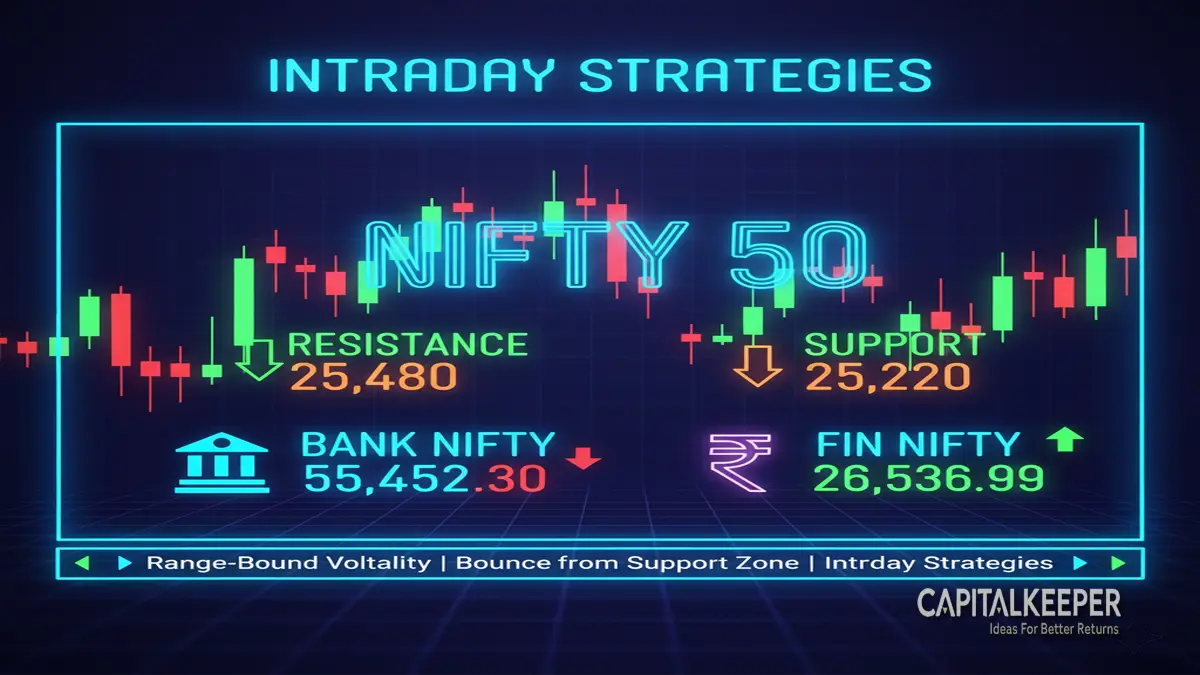

📈 Intraday Trading Strategies

🔹 Nifty (24,634.90)

- Buy on Dips: Near 24,420–24,480, with target 24,780–24,876.

- Sell on Rise: Near 25,030, with target 24,700, stop-loss above 25,080.

🔹 Bank Nifty (54,461)

- Buy Above: 54,600 for targets 54,855–55,140.

- Sell Below: 54,000 for targets 53,700–53,850.

🔹 Fin Nifty (26,008)

- Buy on Dips: Near 25,920 with target 26,150.

- Sell on Rise: Near 26,275 with target 26,050.

📌 Conclusion

The 30th September 2025 monthly expiry promises to be a volatile but opportunity-rich session. With FII positions improving and PCR recovering, the undertone remains slightly positive. However, traders should remain cautious as expiry swings can trap both bulls and bears.

- Avoid panic in lower levels.

- Use bounce backs as exit opportunities for weak longs.

- Focus on first-hour levels and expiry-specific straddles.

With Nifty trapped between 24,150 support and 25,030 resistance, the breakout direction will decide momentum into October.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply