Intraday Trading Outlook for Nifty, Bank Nifty & Fin Nifty – Key Levels & Strategy | 07 August 2025

By CapitalKeeper | Nifty & Bank Nifty | Indian Equities | Market Moves That Matter

Get expert intraday trading insights for Nifty, Bank Nifty, and Fin Nifty on 07 August 2025. Discover key support & resistance levels, PCR data, FII positions, India VIX movement, and time-based trade setups to plan your trades smartly.

🔍 Intraday Trading Outlook – 07th August 2025

Trend Mix: Market Consolidating with Last Hour Positivity

The Indian equity markets started on a volatile note this Thursday, with mixed sentiments seen across sectors and index heavyweights. While global cues remain neutral and the RBI policy is now behind us, traders are advised to remain cautious and avoid chasing moves prematurely.

🌐 Market Context & Sentiment Check

- FII Index Long Positions remain steady at 9%, suggesting no aggressive long build-up from institutional players just yet.

- India VIX is currently at 11.96, up by 2%, indicating marginal rise in expected short-term volatility.

- Put Call Ratios (PCR):

- Nifty PCR at 0.74, down from 0.83, indicating a slight decrease in put writing – a hint that traders are booking profits and might be expecting resistance.

- Bank Nifty PCR is unchanged at 0.82, showing balance but no aggressive upside expectations.

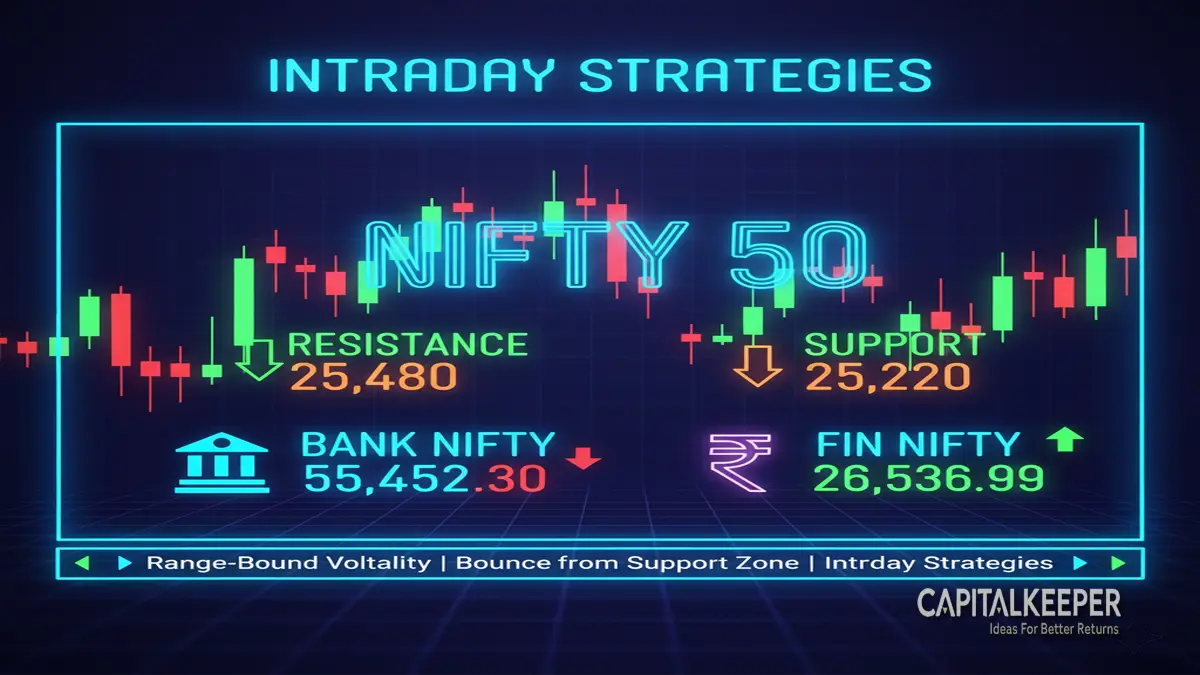

🧭 Key Intraday Support & Resistance Levels

📈 Nifty Index (CMP: 24,574.20)

- Support Zones:

- 24,300 (Major)

- 24,375 (Minor)

- 24,450 (Intraday Bounce Zone)

- Resistance Zones:

- 24,540 (Previous Resistance)

- 24,585 (Key Breakout Level)

- 24,655 / 24,765 (Profit Booking Zones)

🔸 Strategy:

Wait for a 30-minute candle close above 24,585 for bullish confirmation, targeting 24,655–24,765.

Conversely, intraday short can be considered below 24,450, targeting 24,375–24,300.

🏦 Bank Nifty (CMP: 55,411.15)

- Support Levels:

- 54,750

- 54,900

- 55,140

- Resistance Levels:

- 55,455 (Immediate Hurdle)

- 55,650 / 55,755 (Short Covering Expected)

- 55,950 / 56,100 (Positional Resistance)

🔸 Strategy:

Buy near 55,140 if it holds, with stop loss below 54,900 and targets around 55,650–55,755.

Aggressive intraday shorts can be tried below 54,900, targeting 54,750.

💹 Fin Nifty (Follow-Up Outlook)

Although exact levels weren’t mentioned, Fin Nifty is closely tracking Bank Nifty, with financial services and NBFCs showing neutral to mild strength.

Best practice: Wait for confirmation through sectoral leaders like HDFC Ltd, Bajaj Finance, and ICICI Lombard before entering Fin Nifty trades.

🕰️ Important Timings to Watch

- 12:25 PM – Intraday volatility often spikes here.

- 1:42 PM – Likely short-covering or directional clarity post-European market cues.

💡 Pro Tip: Avoid over-trading between 11:00 AM to 12:30 PM unless there’s a breakout or news flow.

📊 Sectoral Snapshot

- IT & Auto remain muted, while Private Banks and Infra are showing early signs of strength.

- Metal stocks may see some recovery if global commodity prices stabilize.

- Stock-specific action in stocks like SBI, HDFC Bank, Tata Steel, and L&T.

🎯 Summary for Intraday Traders

| Index | Intraday Bias | Key Level to Watch | Strategy |

|---|---|---|---|

| Nifty | Mildly Bullish | 24,585 | Buy above 24,585; Sell below 24,450 |

| Bank Nifty | Range Bound | 55,140 | Buy near support; Sell below 54,900 |

| Fin Nifty | Watch Banks | NA | Track HDFC, Bajaj Fin; Avoid aggression |

🧠 Final Thoughts

Markets are at a decision-making zone post-RBI policy, and traders should maintain discipline and avoid over-leveraging. A mixed trend indicates range-bound moves with a potential for directional breakouts only post 1:30 PM.

💬 “Sometimes the best trade is no trade. Be patient, trade with logic—not emotion.”

📈 Stay tuned on CapitalKeeper.in

Get real-time intraday updates, technical setups, and positional trade ideas for Nifty, Bank Nifty, and top-performing stocks.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Leave a Reply