Nifty, Bank Nifty & Fin Nifty Intraday Analysis Today (20 Aug 2025) | Key Levels & Trading Strategies

By CapitalKeeper | Nifty & Bank Nifty | Indian Equities | Market Moves That Matter

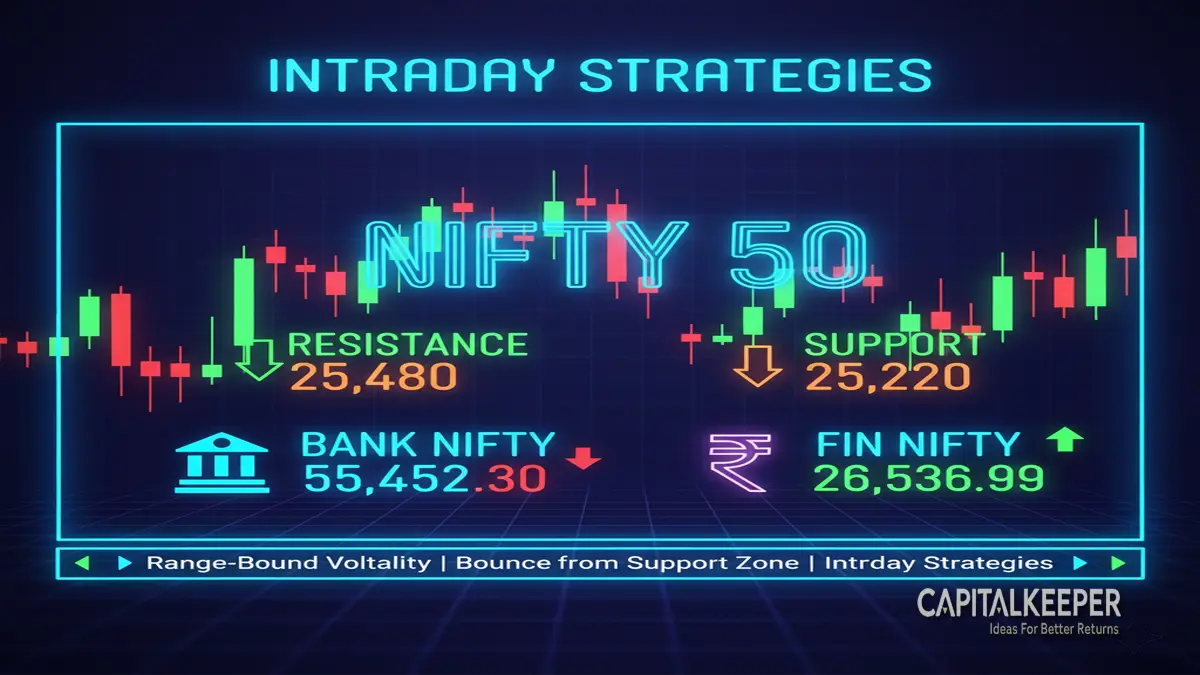

Get expert intraday trading insights for 20th August 2025. Nifty (24963.90), Bank Nifty (55610), and Fin Nifty (26442.60) with key support & resistance levels, FII data, India VIX, and strategic entry/exit points. Perfect for day traders.

Intraday Market Analysis: Nifty, Bank Nifty & Fin Nifty – 20th August 2025

The Indian equity market has been witnessing high-volatility sessions this month, and today, 20th August 2025, is no different. The market opened with mixed global cues, and traders are carefully watching intraday patterns along with institutional flows. With FII long positions stable at 10%, India VIX holding steady at 11.86, and a mix of support–resistance levels across indices, today’s trading session presents both opportunities and risks.

Below is the detailed intraday outlook for Nifty, Bank Nifty, and Fin Nifty, along with timing-based strategies, key support–resistance zones, and trader psychology insights.

🔹 Market Sentiment at a Glance

- FII Index Long Positions: 10% (unchanged from yesterday’s 8.30%). This indicates moderate institutional conviction but not an aggressive build-up of longs.

- India VIX: 11.86 (unchanged) – suggesting volatility is controlled but intraday swings around key time windows remain possible.

- Trend Mix: Neutral to slightly positive bias, with traders advised to avoid chasing gaps and instead rely on technical levels for entries.

🔹 Important Intraday Timings to Watch

Based on time cycle analysis, certain time windows often create mini-trend reversals or directional bursts. For today, 20th August 2025, the important zones are:

- 12:57 PM → Midday volatility window; intraday reversal possible.

- 14:05 PM → Caution; directional breakouts often emerge here.

- 14:55 PM → Last-hour expiry-like movement; watch out for wild swings.

📌 Traders should remain alert during these windows, as both Nifty and Bank Nifty may attempt quick breakouts or sharp pullbacks.

🔹 Nifty Intraday Analysis (24963.90)

Nifty closed yesterday around 24,876 and today’s levels suggest buyers are still in control, but overhead resistance could cap sharp upside.

✅ Key Levels for Nifty

- Support Zones:

- 24,600 → First support (psychological & technical).

- 24,675 → Minor intraday cushion.

- 24,720/24,777 → Strong intraday demand zone.

- 24,850 → If broken, may trigger profit-booking.

- Resistance Zones:

- 25,050 → First hurdle; intraday sellers may emerge.

- 25,140 → Strong intraday resistance.

- 25,200–25,300 → High supply zone; difficult to cross without strong buying.

🎯 Intraday Strategy for Nifty

- Long Trades:

Enter near 24,675–24,720 with SL below 24,600, targeting 24,975–25,050. - Short Trades:

If Nifty fails near 25,050–25,140, consider shorts with SL above 25,200, targeting 24,850–24,720.

⚠️ Avoid chasing longs in a gap-up opening. The strategy should be to “buy dips and sell resistance.”

🔹 Bank Nifty Intraday Analysis (55,610)

Bank Nifty remains the center of action for intraday traders due to its volatility. The index has been consolidating around 55,500–55,700 levels, and today’s moves may provide a breakout setup.

✅ Key Levels for Bank Nifty

- Support Zones:

- 54,900 → Major cushion for bulls.

- 55,200 → Minor support zone.

- 55,350 → Strong intraday demand.

- Resistance Zones:

- 55,800 → First resistance to watch.

- 55,950 → Critical intraday hurdle.

- 56,100–56,655 → Strong supply zone; major breakout if crossed.

🎯 Intraday Strategy for Bank Nifty

- Bullish Setup:

Buy on dips near 55,200–55,350, keeping SL below 55,000, for targets of 55,800–56,100. - Bearish Setup:

If Bank Nifty faces rejection near 55,950–56,100, short with SL above 56,200, targeting 55,500–55,350.

🔑 Note: Since PCR has fallen slightly (0.77 yesterday → 0.76 today), expect range-bound but choppy intraday action.

🔹 Fin Nifty Intraday Analysis (26,442.60)

The Financial Services Index (Fin Nifty) often mirrors Bank Nifty but provides cleaner intraday moves for option writers and directional traders. Currently, Fin Nifty is showing slight weakness compared to Nifty, as it struggles below 26,500.

✅ Key Zones for Fin Nifty

- Support Levels:

- 26,300 → First intraday support.

- 26,200 → Strong base.

- 26,000 → Breakdown below this could trigger selling.

- Resistance Levels:

- 26,550 → First upside hurdle.

- 26,700 → Key supply zone.

- 26,850 → Strong breakout level; if crossed, bullish momentum may accelerate.

🎯 Intraday Strategy for Fin Nifty

- Buy on Dips:

Enter longs near 26,200–26,300, SL below 26,000, targeting 26,550–26,700. - Sell on Rise:

Short near 26,700–26,850, SL above 26,900, targeting 26,300.

📊 Since Fin Nifty is closely tied to Bank Nifty’s movement, traders should align positions with sectoral strength.

🔹 Trading Psychology & Risk Management

- Avoid Overtrading → With volatility concentrated around specific timings (12:57, 14:05, 14:55), focus trades around those windows instead of chasing every candle.

- Gap-Up Openings → Do not buy aggressively; wait for dips.

- Trailing Stop Loss → As markets test resistance, keep trailing SL to protect profits.

- Position Sizing → Limit intraday exposure to avoid emotional exits.

- Overnight Risk → Given FII positioning at just 10% and muted VIX, overnight longs remain risky. Prefer square-off by close.

🔹 Final Outlook

- Nifty → Range 24,675–25,050, bias positive but capped at higher levels.

- Bank Nifty → Range 55,200–56,100, intraday breakout watch above 55,950.

- Fin Nifty → Range 26,200–26,700, follow Bank Nifty for confirmation.

- Overall Bias → Neutral to positive, but rallies may face resistance. Traders should book profits quickly instead of holding with high risk.

📌 Takeaway: Today’s session (20th August 2025) looks like a consolidation with breakout possibilities in the last two hours. Trade with discipline, respect levels, and use time windows for best risk-reward setups.ange plays are the best strategy.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply