Nifty, Bank Nifty & Fin Nifty Intraday Analysis Today (18 Aug 2025) | Key Levels & Market Trend

By CapitalKeeper | Nifty & Bank Nifty | Indian Equities | Market Moves That Matter

Read today’s (18 Aug 2025) intraday market analysis for Nifty, Bank Nifty & Fin Nifty with support-resistance levels, PCR data, FII positions, India VIX, and key timings. Stay ahead with Capital Keeper’s trading insights.

Intraday Market Outlook for 18th August 2025 – Nifty, Bank Nifty & Fin Nifty

Market Sentiment: Positive Bias with a Caution Tag

The Indian indices are expected to open with positive bias today, but traders should remember a key rule: “Don’t chase big gap-ups.” A strong opening may look attractive, yet history suggests that excessive enthusiasm in gap-up sessions often results in profit-booking pressure as the day progresses.

👉 As per today’s outlook, closing is expected below today’s opening levels. This means even if the market starts strong, cautious traders should look for selling opportunities on rallies rather than chasing highs.

Additionally, tomorrow (19th August 2025) might be a cautious day — hence, holding overnight long positions could be risky. Short-term traders are advised to book profits intraday and avoid unnecessary overnight exposure.

🔔 Important Intraday Timings to Watch (18th August 2025)

Certain time windows often witness sharp volatility or directional moves. Today’s key time zones are:

- 12:02 PM – Possible directional move

- 1:16 PM (Caution) – Market may see volatility & trap moves

- 2:03 PM – Intraday shift possible

- 3:00 PM – Final hour moves (profit booking or short covering)

Traders should mark these timings and observe price action closely around them.

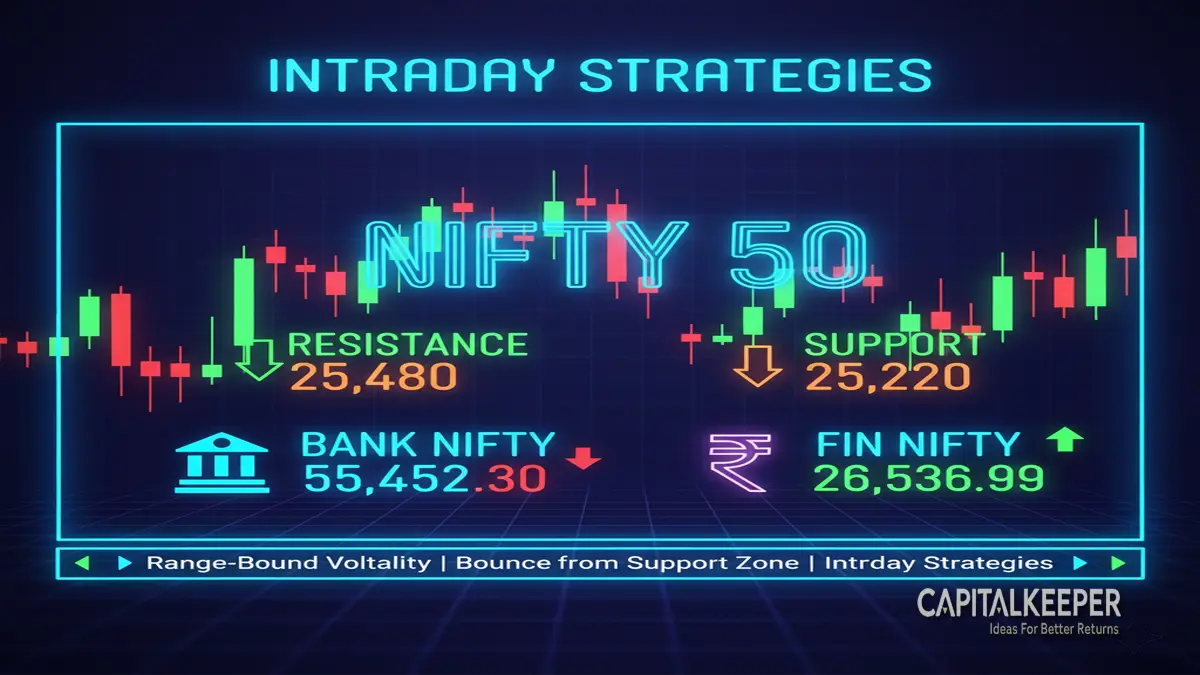

📈 Nifty 50 Outlook (CMP 24,631.30)

🔹 Support Levels

- 24,150

- 24,243

- 24,333

- 24,423

- 24,522 / 24,594

🔹 Resistance Levels

- 24,810

- 24,900

- 24,975

- 25,050

- 25,120 / 25,257

🔹 Strategy for Traders

- If Nifty sustains above 24,810, a quick upside attempt toward 24,900–24,975 may happen.

- However, given the cautionary trend, selling near resistance levels could give better risk-reward opportunities.

- A failure to hold above 24,423 will bring pressure and could drag Nifty toward 24,243–24,150.

👉 Ideal Intraday Play: Sell on Rise near 24,810–24,975 zone with strict SL at 25,050.

🏦 Bank Nifty Outlook (CMP 55,341.85)

🔹 Support Levels

- 54,300

- 54,555

- 54,720

- 54,900

- 55,050 / 55,200

🔹 Resistance Levels

- 55,500

- 55,770

- 55,950

- 56,100

- 56,250 / 56,400

🔹 Strategy for Traders

- Bank Nifty is close to its resistance cluster (55,500–55,770). Any gap-up opening into this zone may invite profit booking.

- For safe traders, look for short entries around 55,770–55,950 with downside potential toward 55,200–55,050.

- Aggressive intraday bulls should only buy above 56,100 with targets of 56,250–56,400.

👉 Ideal Intraday Play: Fade rallies near resistance; downside supports at 54,900 / 55,050.

💹 Fin Nifty Outlook – Intraday Playbook

Fin Nifty, which captures the strength of banks, NBFCs, and financial service companies, often acts as a faster-moving cousin of Bank Nifty. With volatility intact, today’s session is crucial.

🔹 Key Levels to Track

- Support: 26,350 / 26,420 / 26,580

- Resistance: 26,850 / 26,920 / 27,040

🔹 Strategy for Traders

- If Fin Nifty holds above 26,780, intraday long positions can aim for 26,850–26,970.

- Failure to sustain above 26,520 could drag it back toward 26,350.

- The structure suggests short-covering possible in dips, but overall bias remains sell on rise due to broader market view.

👉 Ideal Intraday Play: Buy dips near 26,620–26,650 with SL below 26,550; targets 26,850–26,970.

🌍 Market Internals & Sentiment Check

- FII Index Long Positions: 8.30% → Still at a cautious low, suggesting FIIs are not yet building heavy longs.

- Nifty PCR (Put Call Ratio): 0.88 → Neutral to slightly bearish, indicating calls are being written at higher levels.

- Bank Nifty PCR: 0.71 → Bearish tilt; more calls than puts indicate upside may be capped.

- Sensex PCR: 0.89 → Balanced but cautious.

- India VIX: 12.36 (up by 1.73%) → Slight increase in volatility expectations; intraday swings likely.

Inference: Market internals support the “sell on rise” strategy. With VIX rising, sudden wild moves are expected around key intraday timings.

📊 Practical Learning Takeaways (For Training Purposes)

- Don’t Chase Gap-Ups: Today’s instruction is clear — big gap-up openings often trap late buyers. Wait for price action confirmation.

- Respect Time-Based Moves: Watch for volatility spikes around 12:02, 1:16, 2:03, and 3:00.

- Follow PCR & VIX: Both ratios are hinting at caution — keep risk small and trades quick.

- Nifty Range: Likely between 24,333–24,975.

- Bank Nifty Range: Likely between 55,050–55,950.

- Fin Nifty Range: Likely between 26,620–26,840.

- Closing Note: Market may end below opening levels → So intraday longs should not carry positions overnight.

✅ Conclusion

The 18th August 2025 market session is poised for a positive yet tricky start, but with clear caution signals for intraday traders. While Nifty, Bank Nifty, and Fin Nifty may all attempt higher levels, resistance zones are likely to trigger profit booking. Traders are advised to:

- Sell on rise near resistance clusters

- Book profits quickly in gap-ups

- Avoid overnight longs ahead of a potentially cautious day tomorrow

With volatility intact, today offers an excellent learning day for intraday discipline: respect levels, watch the clock, and never ignore risk management.

💡 Have a profitable week ahead, and trade safe!

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply