By CapitalKeeper | Multi Bagger | Indian Equities | Market Moves That Matter

The Indian stock market is a goldmine for patient investors who can spot future giants early. After analyzing 100+ stocks across sectors, here are 5 high-conviction picks (small, mid, and large caps) that could deliver multi-bagger returns (5X-10X) in 3-5 years.

Why These Stocks?

✅ Strong Moats: Competitive advantages in growing sectors.

✅ Scalable Businesses: Potential to 10X revenue/profits.

✅ Smart Money Interest: FIIs/DIIs accumulating shares.

✅ Undervalued Growth: Trading below intrinsic value.

Market Snapshot: The Big Picture

- Nifty 50: 24,7500 (Fairly valued)

- Sectors to Watch:

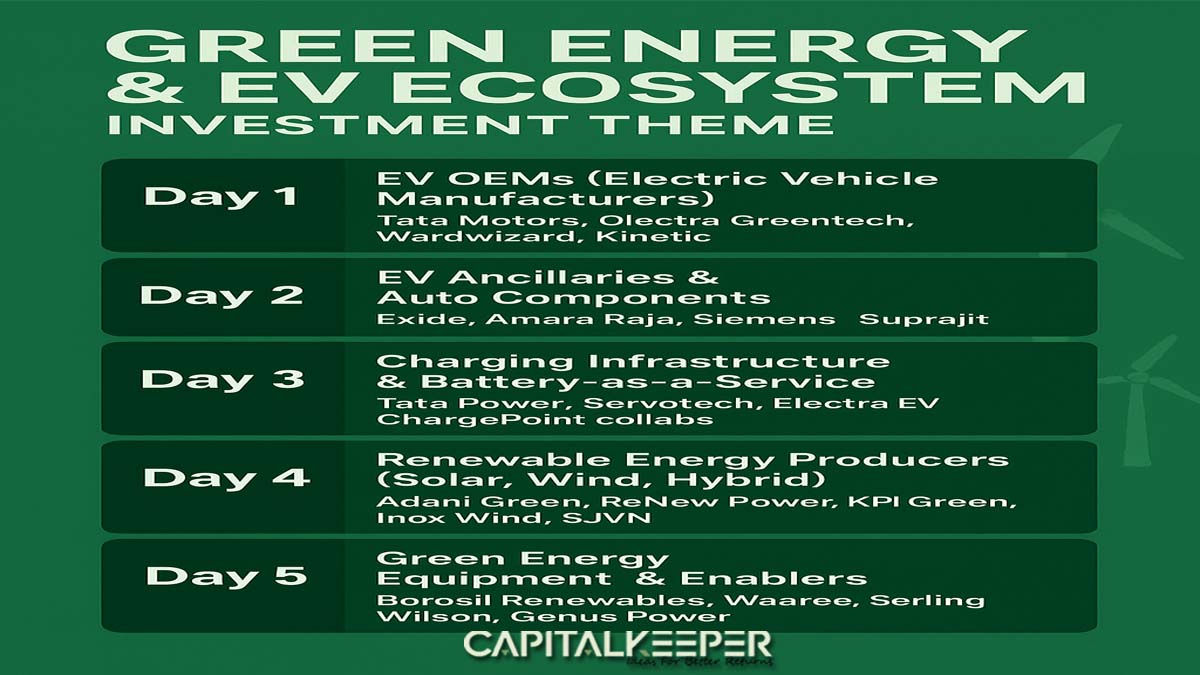

- EV/Green Energy (Govt’s ₹20K cr push)

- Pharma/API (China+1 beneficiary)

- Fintech (UPI/digital lending boom)

- Key Catalyst: PLI schemes, export opportunities

5 Multi-Bagger Stocks for 2024-2030

1. [Large Cap] Tata Power (NSE: TATAPOWER)

Why 5X Potential?

- India’s #1 renewable energy play (Solar, EV charging, power distribution).

- Expanding into rooftop solar (10M homes by 2030).

- Global ESG push – Big FII interest.

Fundamentals:

- Revenue CAGR: 18% (5 yrs)

- Debt reduction underway (from ₹50K cr to ₹35K cr).

- Target Price (5Y): ₹800-1,000 (vs ₹450 today).

Entry Strategy:

- Buy in dips (₹300-400 range).

- Hold for EV infrastructure boom.

2. [Mid Cap] KPIT Technologies (NSE: KPITTECH)

Why 10X Potential?

- Tesla of India’s software (Autonomous vehicles, AI-driven mobility).

- Partnered with Mercedes, BMW, VW for next-gen car tech.

- Revenue CAGR: 35%+ (next 3 yrs).

Fundamentals:

- ROE: 28% (Super-efficient).

- Target Price (5Y): ₹3,500+ (vs ₹1,600 today).

Entry Strategy:

- Accumulate below ₹1,350.

- Hold for global auto-tech dominance.

3. [Small Cap] Suzlon Energy (NSE: SUZLON)

Why 5X Potential?

- Wind energy leader (70% market share).

- Debt-free + ₹10,000 cr order book.

- Govt’s 500GW renewable target by 2030.

Fundamentals:

- Revenue CAGR: 25% (next 5 yrs).

- Target Price (5Y): ₹250+ (vs ₹70 today).

Entry Strategy:

- Buy in ₹65-75 range.

- Hold for wind energy revival.

4. [Mid Cap] Laurus Labs (NSE: LAURUSLABS)

Why 7X Potential?

- API & CRAMS leader (Cancer/HIV drugs).

- US/EU outsourcing shift from China.

- Margin expansion (from 18% to 25%+).

Fundamentals:

- Revenue CAGR: 20%+ (next 5 yrs).

- Target Price (5Y): ₹2,000+ (vs ₹600 today).

Entry Strategy:

- Buy below ₹600.

- Hold for pharma outsourcing boom.

5. [Small Cap] Easy Trip Planners (NSE: EASEMYTRIP)

Why 10X Potential?

- India’s #1 bootstrapped travel tech firm.

- Profitable + zero debt (Rare in startups).

- Post-COVID travel surge (2X users since 2023).

Fundamentals:

- Revenue CAGR: 30%+ (next 5 yrs).

- Target Price (5Y): ₹200+ (vs ₹50 today).

Entry Strategy:

- Buy in ₹11-15 range.

- Hold for digital travel monopoly.

Multi-Bagger Investing Rules

🔹 Hold 3-5 Years: No panic during corrections.

🔹 Diversify: Don’t put all money in 1 stock.

🔹 Track Quarterly Results: Growth must continue.

How to Track These Stocks?

📊 Charts: TradingView (Technical trends)

📰 News: Moneycontrol (Corporate updates)

Final Thought

“The biggest wealth is created by holding great businesses – not timing the market.”

💬 Which stock excites you most? Comment below!

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and subscribe to our newsletter!

📌 Next Week: “How to Build a Multi-Bagger Portfolio?” – Subscribe! 🚀

“When the market rests, you prepare. Successful traders treat weekends as planning sessions—not vacations.” – CapitalKeeper

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Leave a Reply