SIP vs Lumpsum: Which Mutual Fund Investment Strategy is Better in 2025? | CapitalKeeper

By CapitalKeeper | Beginner’s Guide | Mutual Funds | Market Moves That Matter

SIP vs Lumpsum: Which Mutual Fund Investment Strategy Should You Choose in 2025?

When investing in mutual funds, one of the biggest questions is how to invest — systematically (SIP) or all at once (lumpsum)? Both methods have unique advantages and suit different investor profiles. Here’s a 2025-focused breakdown to help you choose wisely.

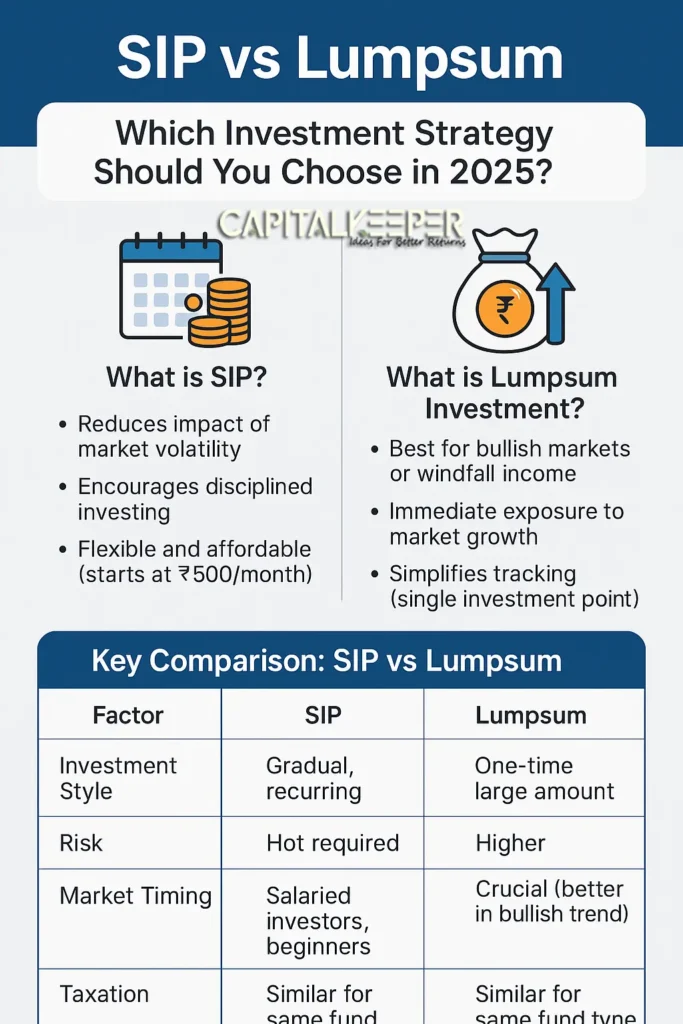

1. What is SIP (Systematic Investment Plan)?

- Definition: Invest a fixed amount periodically (monthly/quarterly).

- Benefits:

- Reduces impact of market volatility (rupee-cost averaging)

- Encourages disciplined investing

- Flexible and affordable (starts at ₹500/month)

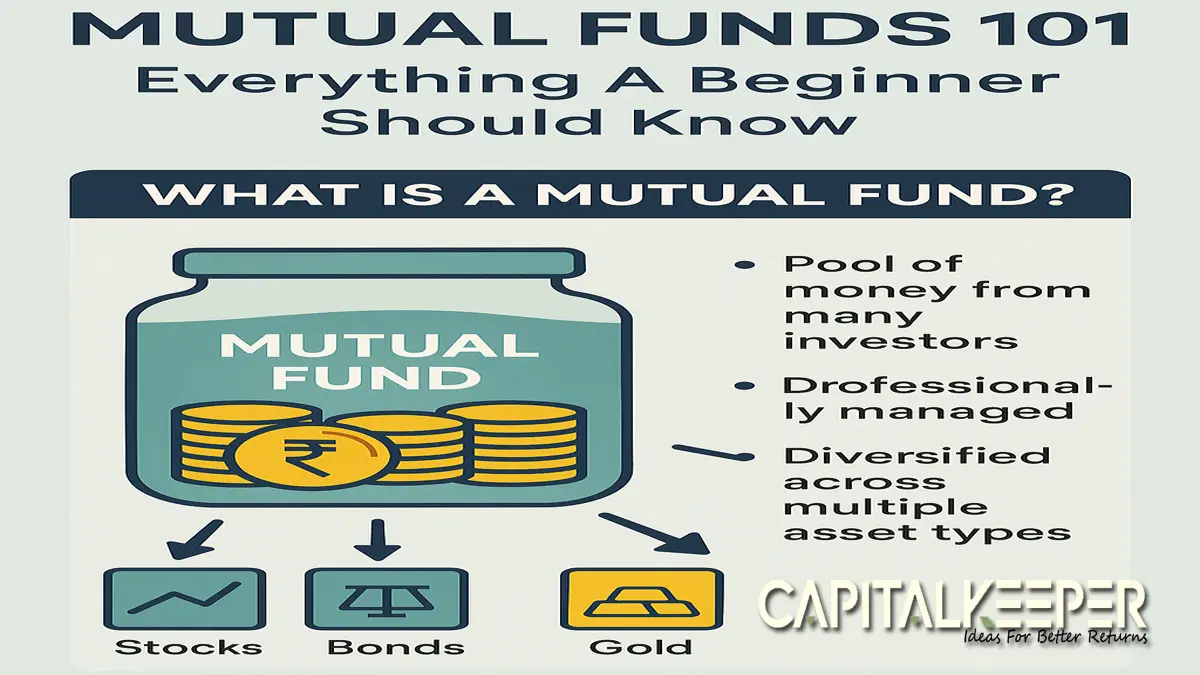

2. What is Lumpsum Investment?

- Definition: Invest a large amount in one go.

- Benefits:

- Best for bullish markets or windfall income

- Immediate exposure to market growth

- Simplifies tracking (single investment point)

3. Key Comparison: SIP vs Lumpsum

| Factor | SIP | Lumpsum |

|---|---|---|

| Investment Style | Gradual, recurring | One-time, large amount |

| Risk | Lower (averages cost over time) | Higher (timing risk involved) |

| Market Timing | Not required | Crucial (better in bullish trend) |

| Best For | Salaried investors, beginners | Investors with surplus funds |

| Taxation | Similar for same fund type | Similar for same fund type |

4. Which Strategy Works Best in 2025?

- SIP: Ideal amid market volatility — helps navigate fluctuations.

- Lumpsum: Works in strong uptrend phases (post-correction opportunities).

- Hybrid Approach: Combine both — start SIPs for long-term goals, invest lumpsum during market dips.

Example Calculation

- Scenario: ₹5 lakh to invest; market expected 12% CAGR over 5 years.

- Lumpsum: ₹5 lakh grows to ₹8.8 lakh in 5 years.

- SIP (₹10,000/month for 5 years): Grows to ₹8 lakh (benefits from cost averaging).

(Use our SIP Calculator and Lumpsum Calculator to check projections for your goals.)

Pro Tips

- Use SIP for long-term wealth creation and regular cash flow.

- Use Lumpsum after market corrections or for bonus/one-time inflows.

- Always align method with goal horizon and risk profile.

Plan Your Perfect Investment Strategy!

Unsure whether SIP or lumpsum is right for you? Get expert insights, calculators, and recommendations tailored to your goals.

Subscribe to CapitalKeeper Newsletter for smart investing tips weekly.

Try Our Free Tools:

- SIP Calculator – Compare monthly returns

- Lumpsum Calculator – Project lump sum growth

Next Read:

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Leave a Reply