Best Mutual Funds to Invest in August 2025 – Top Equity & Hybrid Picks | CapitalKeeper

By CapitalKeeper | Beginner’s Guide | Mutual Funds | Market Moves That Matter

Discover the best mutual funds to invest in August 2025. Expert picks across equity, hybrid, and tax-saving funds with performance insights and SIP suggestions.

Best Mutual Funds to Invest in August 2025: Top Equity & Hybrid Picks

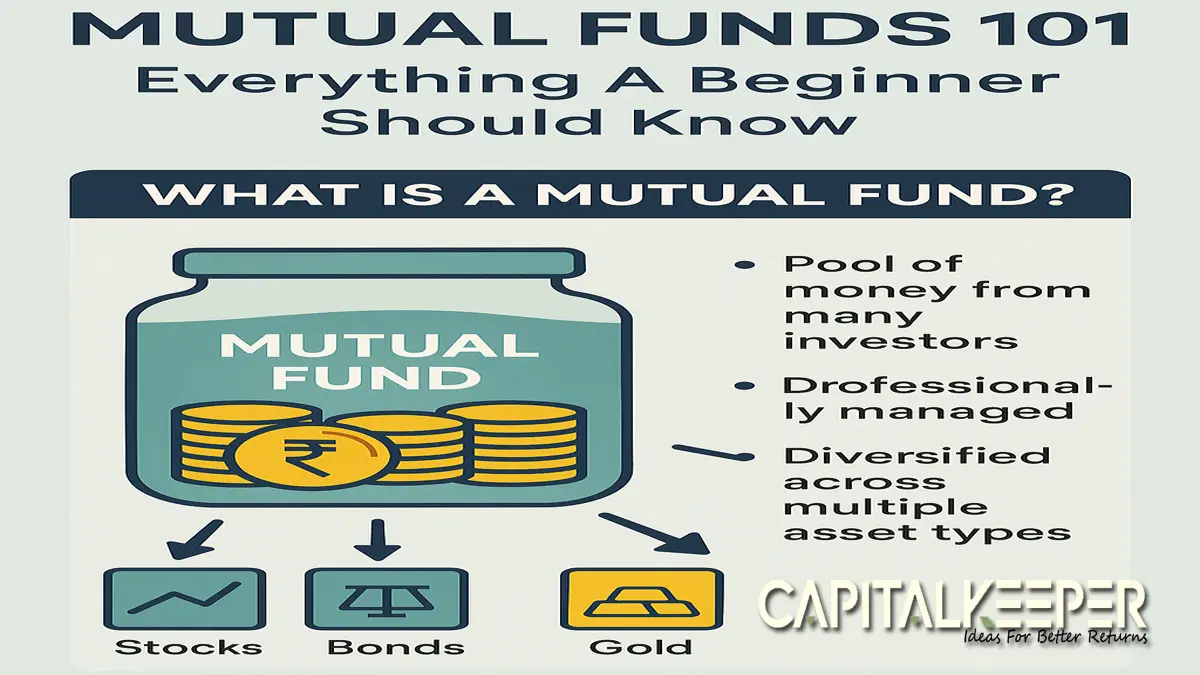

The mutual fund market continues to evolve with dynamic sector rotations, changing interest rates, and fresh inflows from retail investors. As of August 2025, here are our expert-curated mutual fund picks across categories for long-term investors and SIP planners. (For educational purposes only — not financial advice)

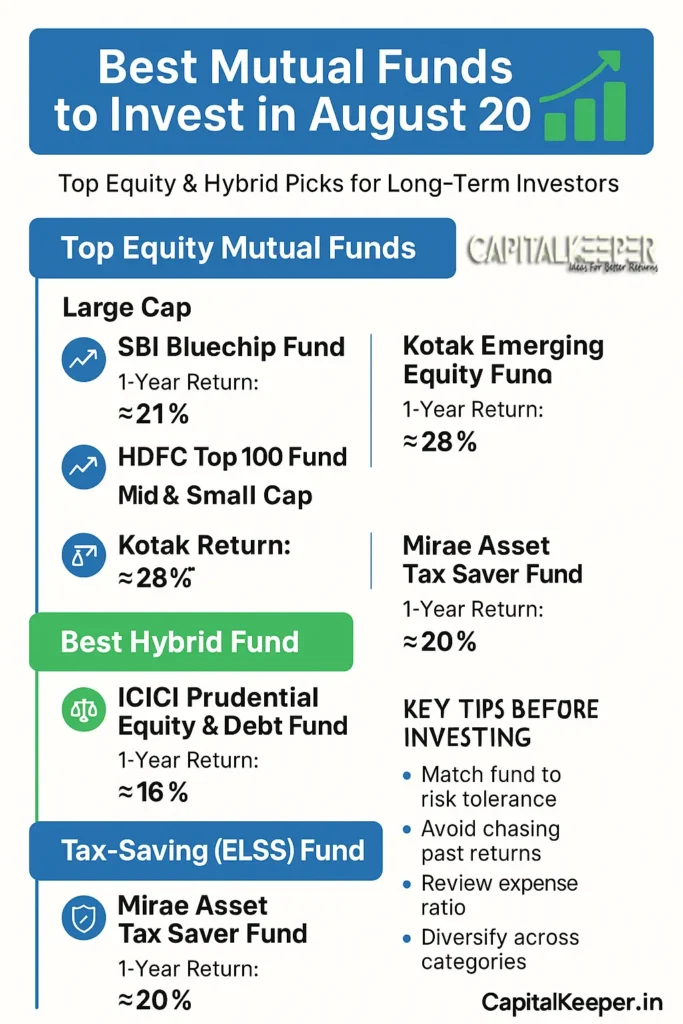

1. Top Equity Mutual Funds (Large Cap)

a) SBI Bluechip Fund – Direct Plan Growth

- 1-Year Return: 21%

- 3-Year CAGR: 15%

- Why Pick? Strong portfolio of top Nifty 50 stocks, low expense ratio, consistent outperformance.

b) HDFC Top 100 Fund – Direct Plan Growth

- 1-Year Return: 19%

- 3-Year CAGR: 14%

- Why Pick? Focus on large-cap leaders with steady risk-adjusted returns.

2. Top Mid & Small Cap Funds

a) Kotak Emerging Equity Fund

- 1-Year Return: 28%

- 3-Year CAGR: 20%

- Why Pick? Good diversification, early-stage growth companies with potential.

b) Nippon India Small Cap Fund

- 1-Year Return: 32%

- 3-Year CAGR: 22%

- Why Pick? Aggressive growth potential for long-term SIP investors.

3. Best Hybrid Funds

ICICI Prudential Equity & Debt Fund

- 1-Year Return: 16%

- 3-Year CAGR: 12%

- Why Pick? Balanced mix of equity and debt; ideal for moderate risk profiles.

4. Tax-Saving (ELSS) Fund

Mirae Asset Tax Saver Fund

- 1-Year Return: 20%

- Lock-in: 3 years (Section 80C benefit)

- Why Pick? High-quality equity portfolio + tax savings.

SIP vs Lumpsum Approach

- SIP: Best for averaging entry points, suitable for salaried investors.

- Lumpsum: Prefer in bullish trends or with bonus/inheritance funds.

(Use our SIP Calculator or Lumpsum Calculator to compare projections.)

Key Tips Before Investing

- Match fund category to risk tolerance and time horizon

- Avoid chasing only high past returns

- Review expense ratio and fund manager tenure

- Diversify across 2–3 categories, not just one

Stay Ahead of the Market!

Get monthly curated mutual fund recommendations and SIP insights straight to your inbox.

Subscribe to CapitalKeeper Newsletter and never miss an update.

Plan Your Investments:

- SIP Calculator – Estimate your monthly growth

- Lumpsum Calculator – Plan one-time investments

Next Read:

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Leave a Reply