Top Traders Who Bounced Back: Lessons from Market Crashes

By CapitalKeeper | Beginner’s Guide | Indian Equities | Market Moves That Matter

Discover how elite traders adapted during market crashes like 2008, 2020 & 2022, the strategies they used, and key recovery lessons for retail investors.

💥 How Top Traders Adapted to Market Crashes and Recovered

Market crashes are inevitable — but how you respond can define your trading career. Some traders panic, others freeze, and a select few adapt and thrive. In this blog, we’ll explore how top traders responded to historical market crashes and the powerful lessons we can learn from their comebacks.

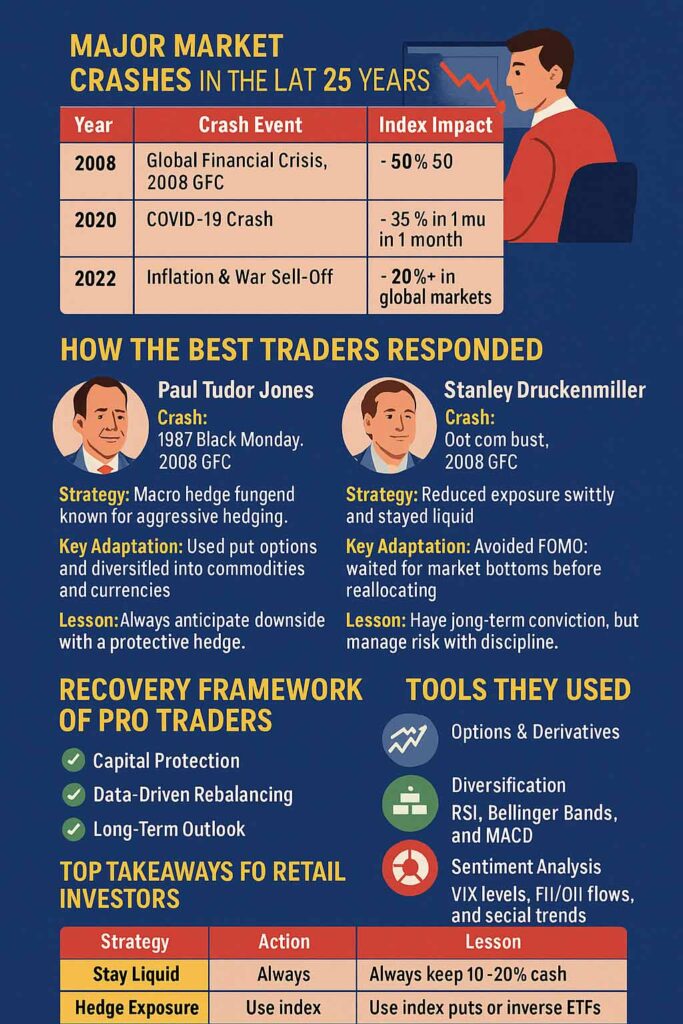

📉 Major Market Crashes in the Last 25 Years

| Year | Crash Event | Index Impact |

|---|---|---|

| 2008 | Global Financial Crisis | -50% S&P 500 |

| 2020 | COVID-19 Crash | -35% in 1 month |

| 2022 | Inflation & War Sell-Off | -20%+ in global markets |

🔍 How the Best Traders Responded

1. Paul Tudor Jones – Risk Reduction First

- Crash: 1987 Black Monday, 2008 GFC

- Strategy: Macro hedge fund legend known for aggressive hedging.

- Key Adaptation: Used put options and diversified into commodities and currencies.

- Lesson: Always anticipate downside with a protective hedge.

2. Stanley Druckenmiller – Cash is a Position

- Crash: Dot-com bust, 2008 GFC

- Strategy: Reduced exposure swiftly and stayed liquid.

- Key Adaptation: Avoided FOMO; waited for market bottoms before reallocating.

- Lesson: Preservation of capital > maximizing return during panic.

3. Cathie Wood – Innovation Bias & Recovery

- Crash: 2022 Tech Meltdown

- Strategy: Held conviction in disruptive tech (ARKK).

- Key Adaptation: Didn’t rotate out — instead doubled down on oversold positions.

- Lesson: Have long-term conviction, but manage risk with discipline.

4. Rakesh Jhunjhunwala – India’s Big Bull

- Crash: 2008, 2013 Taper Tantrum

- Strategy: Used crisis as entry point to buy high-quality Indian equities.

- Key Adaptation: Bought cyclicals and financials at deep discounts.

- Lesson: Buy great businesses when fear dominates the market.

🔄 Recovery Framework of Pro Traders

✅ Capital Protection: Limit exposure in high-volatility regimes.

✅ Data-Driven Rebalancing: Shift allocation based on macro signals, not emotion.

✅ Long-Term Outlook: Zoom out. Down cycles are temporary.

✅ Continuous Learning: Post-crash analysis is a trader’s goldmine.

🛠️ Tools They Used

- Options & Derivatives: For hedging and volatility trades.

- Diversification: Across asset classes like gold, bonds, global equities.

- Technical Indicators: RSI, Bollinger Bands, and MACD to time entry/recovery.

- Sentiment Analysis: VIX levels, FII/DII flows, and social trends.

📚 Top Takeaways for Retail Investors

| Strategy | Action |

|---|---|

| Stay Liquid | Always keep 10–20% cash |

| Hedge Exposure | Use index puts or inverse ETFs |

| Don’t Chase Bottoms | Wait for confirmation before jumping in |

| Learn from History | Study what worked in past crashes |

💡 Final Thoughts

Every market crash rewrites the rules — but history shows that adaptability, discipline, and strategy always win. Whether you’re a day trader or a long-term investor, studying how top traders turned crisis into opportunity is the key to your resilience.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Leave a Reply