Section 194C vs 194M: Key Differences in TDS Explained

By CapitalKeeper | Beginner’s Guide | Indian Sock Market | Market Moves That Matter I 06th June 2025

⚖️ Difference Between Section 194C and 194M: A Clear Guide for Taxpayers

As TDS (Tax Deducted at Source) continues to play a vital role in India’s tax ecosystem, two sections often create confusion for individual taxpayers, freelancers, and business owners: Section 194C and Section 194M.

Though both deal with TDS on payments for contractual or professional services, they apply to different categories of payers and payment contexts.

Here’s a clear breakdown to help you understand when to apply 194C vs 194M and how to stay compliant.

🧾 Quick Definitions

🔹 Section 194C

This section mandates TDS deduction on payments to contractors and subcontractors by entities engaged in business or profession.

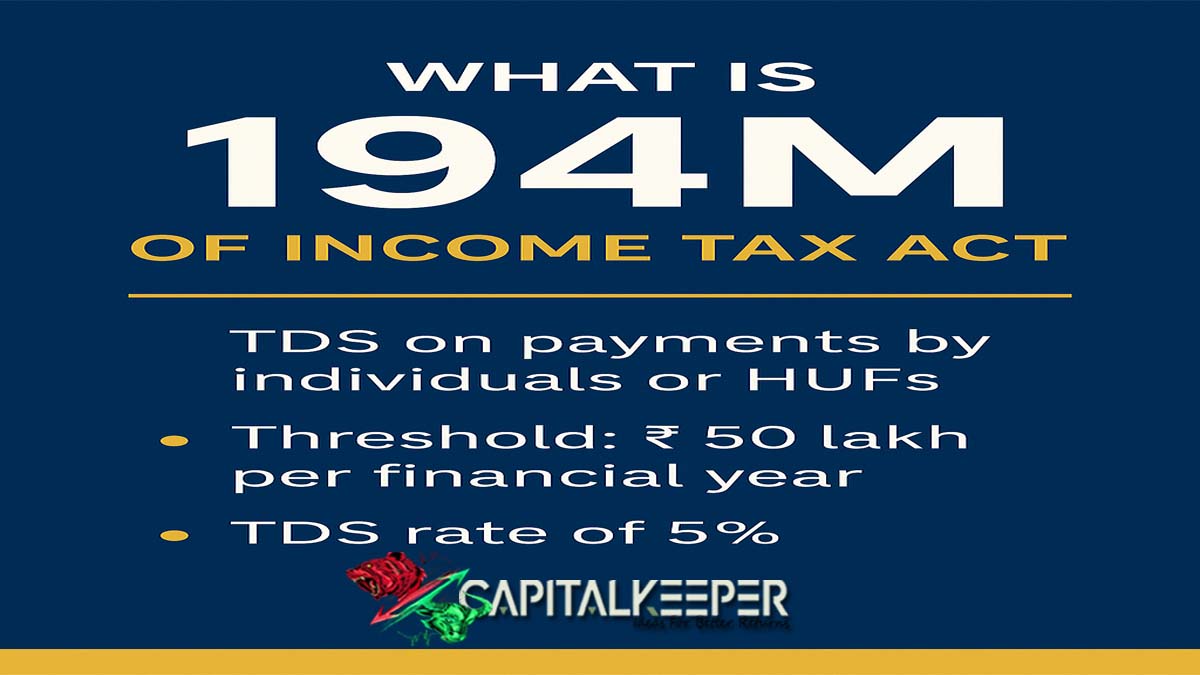

🔹 Section 194M

Applies to individuals or HUFs not covered under tax audit, who make large payments for contractual work or professional services exceeding ₹50 lakh per financial year.

🧮 Comparative Table: Section 194C vs 194M

| Feature | Section 194C | Section 194M |

|---|---|---|

| Applicable To | Businesses and professionals subject to tax audit | Individuals and HUFs not under tax audit |

| Type of Payment | Contractual work (incl. supply of labor, materials) | Contractual work, professional fees, commission |

| Threshold Limit | ₹30,000 per contract or ₹1,00,000 aggregate/year | ₹50 lakh aggregate in a financial year |

| TDS Rate | 1% (individual/HUF), 2% (others) | 5% flat |

| PAN Requirement of Payee | Mandatory | Mandatory |

| TAN Requirement | Required | ❌ Not Required |

| TDS Filing Form | Form 26Q | Form 26QD |

| TDS Certificate | Form 16A | Form 16D |

| TDS Deposit Due | 7th of next month | Within 30 days of month end in which payment made |

💼 Practical Examples

✅ Section 194C Example

ABC Pvt. Ltd. hires a contractor for office renovation worth ₹1.2 lakh. Since they are a company and payment exceeds the threshold, TDS @2% is applicable.

✅ Section 194M Example

Mr. Mehta, a salaried individual, pays ₹60 lakh to a wedding planner and interior designer combined. Since the total exceeds ₹50 lakh, TDS @5% is applicable under 194M, even though he’s not running a business.

📌 Key Takeaways

- Nature of the Payer Matters:

Section 194C applies to businesses, while 194M covers individuals and HUFs making large payments. - TAN Not Required for 194M:

This is a relief for individuals who can use PAN and Form 26QD for compliance. - Higher Threshold in 194M:

TDS under 194M applies only when payments exceed ₹50 lakh, whereas 194C has much lower limits.

❗ Penalties for Non-Compliance

Non-deduction or late deduction of TDS can attract:

- Interest under Section 201(1A)

- Penalty up to the amount of tax not deducted

- Disallowance of expense under Section 40(a)(ia) (for 194C)

🧠 Analyst’s Perspective: When to Use What?

If you’re a business entity making payments to vendors or service providers, you’re under 194C. If you’re an individual spending big on personal or professional services (e.g., home construction, wedding), 194M applies.

Many high-net-worth individuals unknowingly fall under 194M — especially when hiring architects, decorators, or consultants for personal projects.

📌 Conclusion: Understand Your Role as a Payer

The core difference between 194C and 194M lies in the payer’s identity and the nature of the transaction. Whether you’re running a business or just managing large personal payments, it’s crucial to comply with the right TDS section to avoid penalties.

When in doubt, consult your CA or tax advisor, especially before initiating high-value payments.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Leave a Reply