What is Positional Trading? – Strategy, Benefits & Risks Explained

By CapitalKeeper | Pre Market Opening | Indian Equities | Market Moves That Matter

What is Positional Trading? A Complete Guide for Long-Term Market Players

Learn what positional trading is, how it works, its strategies, benefits, and risks. Explore the difference between positional trading, swing trading, and intraday to find the right approach.

Introduction

When it comes to stock market trading, investors often debate between short-term speculation and long-term investing. Somewhere in the middle lies positional trading, a strategy designed for those who don’t want the stress of intraday trading but still seek better returns than traditional long-term investing.

Positional trading involves holding stocks, commodities, or indices for weeks, months, or even years, depending on price trends and fundamentals. Unlike day traders who thrive on volatility, positional traders rely on patience, technical analysis, and strong conviction.

In this guide, we’ll explore what positional trading is, how it works, strategies involved, advantages, disadvantages, and whether it suits your trading style.

What is Positional Trading?

Positional trading is a market strategy where traders hold their positions for an extended period, ranging from a few weeks to several months or longer, with the expectation of capturing larger price movements.

Key features of positional trading:

- Trades are based on longer-term technical patterns and fundamentals.

- Positions are held overnight, often spanning multiple market sessions.

- Requires less daily monitoring compared to intraday or swing trading.

- Focuses on trend-following and macroeconomic factors.

Simply put, positional traders believe in the saying: “The big money is in the big move.”

Difference Between Positional Trading, Swing Trading, and Intraday

| Feature | Intraday Trading | Swing Trading | Positional Trading |

|---|---|---|---|

| Holding Period | Same day | Few days to 2 weeks | Weeks to months/years |

| Risk Exposure | High (short-term volatility) | Moderate | Moderate to High (overnight & macro risks) |

| Time Commitment | Full-time monitoring | Daily/weekly checks | Occasional review |

| Return Potential | Small, frequent gains | Medium-term profits | Larger moves, higher gains |

| Tools Used | Intraday charts, volume | Technical indicators | Technical + Fundamental analysis |

👉 Positional trading suits traders who prefer a longer horizon and have the patience to ride trends.

Strategies for Positional Trading

To succeed in positional trading, traders use a combination of technical indicators, fundamental research, and market sentiment. Some popular strategies include:

1. Trend Following Strategy

- Identify major uptrends or downtrends using moving averages (50, 100, 200-day).

- Enter trades in the direction of the trend.

- Example: Buying Nifty when it breaks above its 200-day moving average.

2. Breakout Trading

- Wait for a stock/index to break out of key resistance levels or chart patterns (triangle, cup & handle, rectangle).

- Enter once volume confirms breakout.

- Example: A stock crossing ₹500 resistance with strong volume.

3. Support & Resistance Strategy

- Buy near strong support zones and sell near resistance zones.

- Works well in range-bound markets.

4. Fundamental Positional Trades

- Use earnings growth, sectoral themes, or macroeconomic trends to pick long-term trades.

- Example: Buying PSU banks before a government recapitalization plan.

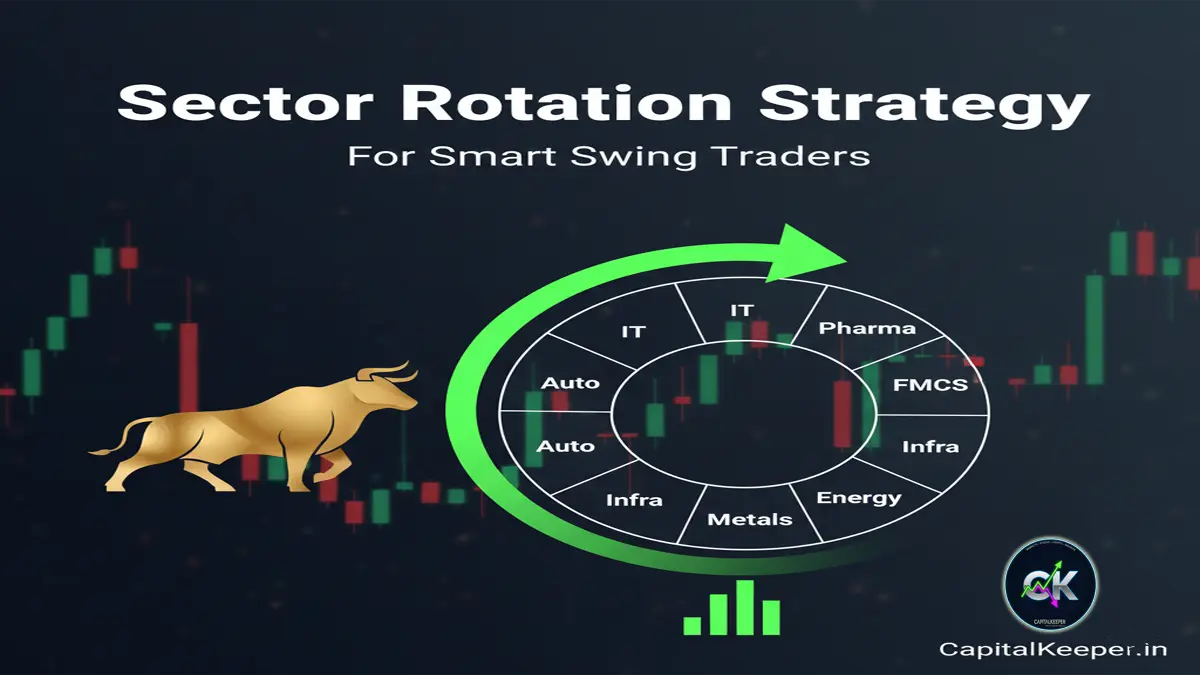

5. Sector Rotation Strategy

- Identify strong-performing sectors (like IT, Pharma, Infra) and take positions in leading stocks.

Tools & Indicators Used in Positional Trading

- Moving Averages (MA) – Identify long-term trend direction.

- Relative Strength Index (RSI) – Spot overbought/oversold zones.

- MACD (Moving Average Convergence Divergence) – Confirm trend strength.

- Fibonacci Retracement – Identify possible entry points in trending stocks.

- Fundamental Ratios – P/E, P/B, EPS growth, Debt-to-equity for stock selection.

Advantages of Positional Trading

- Less Stressful Than Intraday

- No need to monitor markets tick-by-tick.

- Higher Return Potential

- Captures major market moves instead of small daily fluctuations.

- Leverages Both Technical & Fundamental Analysis

- Combines the best of short-term and long-term strategies.

- Works in Multiple Markets

- Can be applied to stocks, indices, commodities, and even crypto.

- Lower Transaction Costs

- Fewer trades compared to intraday, reducing brokerage and slippage.

Risks of Positional Trading

- Overnight & Gap Risks

- Global news, earnings announcements, or government policies can cause price gaps.

- Requires Patience

- Some trades may take months to play out, testing trader’s conviction.

- Higher Capital Lock-In

- Unlike intraday, funds remain tied up for longer durations.

- Trend Reversals

- A strong reversal against your trade can wipe out profits if stop-loss is ignored.

Risk Management in Positional Trading

- Always use stop-loss levels (based on ATR or support levels).

- Diversify across sectors and asset classes.

- Avoid over-leveraging with margin trades.

- Keep track of earnings announcements and global events.

- Regularly review and adjust positions.

Taxation on Positional Trading in India

- Equity Delivery:

- If held >1 year → Long-Term Capital Gains (LTCG) @ 10% (above ₹1 lakh).

- If held <1 year → Short-Term Capital Gains (STCG) @ 15%.

- Futures & Options (F&O):

- Considered business income, taxed as per income slab rates.

- Losses can be set off against other business income.

Example of a Positional Trade

Imagine Infosys trading at ₹1,400. After studying charts, you notice a breakout above ₹1,380 resistance with high volume. Fundamentals also show rising global IT demand.

- Entry: ₹1,400

- Target: ₹1,550 (technical projection)

- Stop-loss: ₹1,330

If Infosys reaches ₹1,550 in 6 weeks, your positional trade yields 10.7% returns, outperforming short-term noise.

Is Positional Trading Right for You?

You should consider positional trading if:

- You can dedicate time for weekly/monthly analysis but not daily tracking.

- You prefer bigger, long-term moves instead of small intraday profits.

- You have the patience to wait out market volatility.

However, if you enjoy fast-paced decision-making, intraday or swing trading may suit you better.

Conclusion

Positional trading is an effective strategy for traders who want to ride longer-term trends without the stress of daily monitoring. By combining technical indicators, fundamental analysis, and disciplined risk management, positional traders can achieve substantial returns.

That said, it requires patience, conviction, and proper planning to avoid risks like overnight gaps and trend reversals. For those seeking a balance between long-term investing and active trading, positional trading offers the best of both worlds.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply