What is Option Premium & How is it Calculated? | Complete Guide for Traders | 02 Aug 2025

By CapitalKeeper | Beginner’s Guide | Indian Equities | Market Moves That Matter

What is Option Premium & How it is Calculated?

Options trading has gained massive popularity in the Indian stock market, especially in indices like Nifty and Bank Nifty. One term that every trader must understand before entering the derivatives market is Option Premium. The premium forms the cost of buying an option and determines whether your trade will be profitable or not.

In this article, we will explore:

- What is option premium?

- Components of premium (Intrinsic Value & Time Value)

- Factors affecting option premium (Greeks & market conditions)

- Methods to calculate option premium with examples

1. What is Option Premium?

Option Premium is the price paid by the buyer of an option contract to the seller (also called the writer) for acquiring the rights associated with the option.

- Call Option Buyer pays a premium to have the right (but not obligation) to buy an asset at a fixed price (strike price) before expiry.

- Put Option Buyer pays a premium to have the right (but not obligation) to sell an asset at a fixed price before expiry.

For the buyer, the premium is the maximum loss they can incur in the trade. For the seller, the premium received is their maximum profit, but they face unlimited risk in the market movement.

Key Point:

The premium changes continuously during market hours based on factors like the underlying asset price, volatility, and time to expiry.

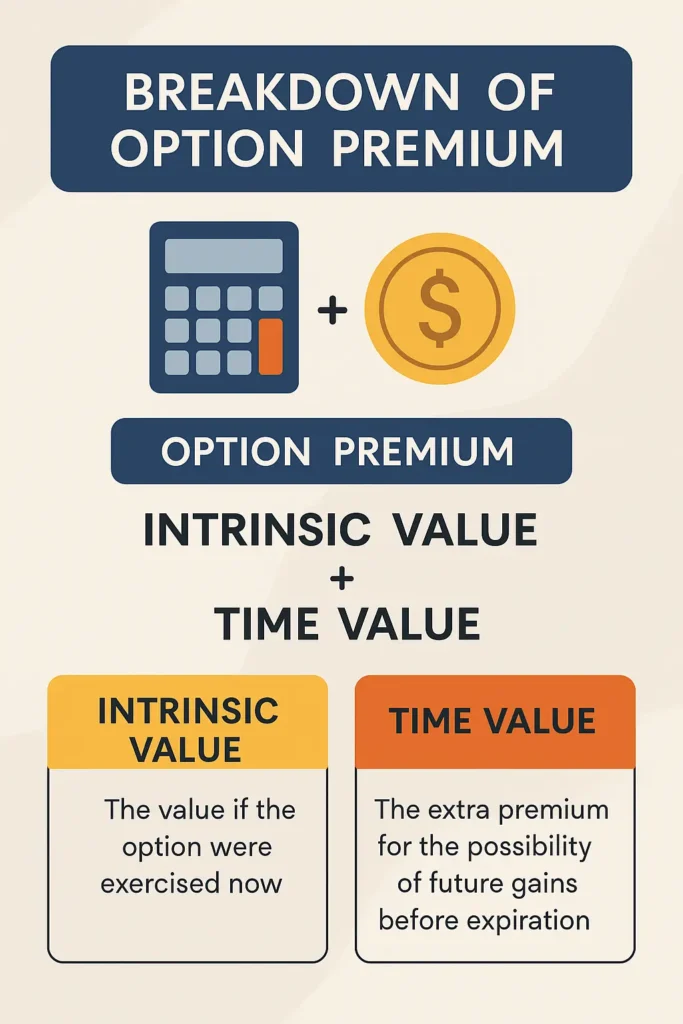

2. Components of Option Premium

The option premium consists of two major components:

(a) Intrinsic Value (IV)

- It represents the real value of an option if exercised at the current moment.

- For Call Options:

Intrinsic Value = Current Market Price (CMP) – Strike Price (if positive, else 0) - For Put Options:

Intrinsic Value = Strike Price – Current Market Price (if positive, else 0)

Example:

- Nifty CMP = 24,700

- Call Option Strike = 24,600 → IV = 24,700 – 24,600 = 100 points

- Put Option Strike = 24,800 → IV = 24,800 – 24,700 = 100 points

(b) Time Value (TV)

- It represents the extra premium traders are willing to pay for the possibility of favorable price movement before expiry.

- Formula: Time Value = Total Premium – Intrinsic Value

- Time value declines as the option approaches expiry (known as Theta decay).

3. Factors Affecting Option Premium

Option pricing is influenced by multiple factors, often referred to as the Option Greeks and market conditions:

(i) Underlying Asset Price (Delta)

- A rise in the underlying price increases Call premiums and decreases Put premiums (and vice versa).

(ii) Strike Price

- Options closer to the current market price (At-the-Money) have higher time value than deep In-the-Money or Out-of-the-Money options.

(iii) Time to Expiry (Theta)

- Longer duration options carry higher time value. As expiry nears, the premium erodes rapidly.

(iv) Volatility (Vega)

- Higher implied volatility increases both Call and Put premiums, as the probability of large price movement rises.

(v) Interest Rates & Dividends (Rho)

- Rising interest rates slightly increase Call premiums and decrease Put premiums.

- Expected dividends can impact pricing, especially in stock options.

4. How is Option Premium Calculated?

There are two ways to calculate option premium: Basic Calculation and Option Pricing Models.

A. Basic Calculation (Intrinsic + Time Value)

The simplest way is to add intrinsic value and time value:

Option Premium = Intrinsic Value + Time Value

Example:

- Nifty CMP = 24,700

- Call Strike = 24,600

- Market Premium = 180

Intrinsic Value = 24,700 – 24,600 = 100

Time Value = 180 – 100 = 80

B. Black-Scholes Option Pricing Model (Advanced)

Professional traders and institutions use mathematical models like Black-Scholes to price options accurately. It factors in:

- Current price of underlying

- Strike price

- Time to expiry

- Risk-free interest rate

- Implied volatility

Black-Scholes Formula (simplified): C=S0⋅N(d1)−X⋅e−rt⋅N(d2)C = S_0 \cdot N(d_1) – X \cdot e^{-rt} \cdot N(d_2)C=S0⋅N(d1)−X⋅e−rt⋅N(d2)

Where:

- CCC = Call option price

- S0S_0S0 = Current stock price

- XXX = Strike price

- rrr = Risk-free interest rate

- ttt = Time to maturity

- N(d1),N(d2)N(d_1), N(d_2)N(d1),N(d2) = Cumulative normal distribution values

(Put option price can be derived using Put-Call Parity.)

5. Practical Example: Nifty Option Premium Calculation

- Nifty CMP: 24,700

- Strike Price (Call): 24,600

- Expiry: 7 days

- Implied Volatility (IV): 12%

- Risk-free rate: 6%

Using Black-Scholes calculator (commonly available on broker platforms):

- Calculated Premium ≈ 175–180 points (varies with real-time IV)

Breakdown:

- Intrinsic Value = 100 points

- Time Value = 75–80 points

6. Importance of Understanding Option Premium

- Helps identify overpriced or underpriced options.

- Enables better entry and exit decisions for intraday and positional trades.

- Crucial for option strategies like spreads, straddles, and strangles.

- Minimizes losses by understanding Theta decay near expiry.

7. Tips for Traders

- Always check IV (Implied Volatility) before entering an option trade.

- Avoid buying Out-of-the-Money options with zero intrinsic value near expiry.

- Consider hedging strategies if selling options to manage risk.

- Use broker-provided option chain analysis tools for real-time premium insights.

- Study option Greeks (Delta, Vega, Theta) to understand premium fluctuations.

Conclusion

Option premium is the foundation of options trading. Whether you are buying or selling, understanding its calculation helps you gauge risk, reward, and time sensitivity of your trades. For beginners, focus on intrinsic and time value first, and gradually explore advanced models like Black-Scholes as you gain experience.

A clear grasp of premium dynamics not only improves trade timing but also enhances overall profitability in the derivatives market.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.