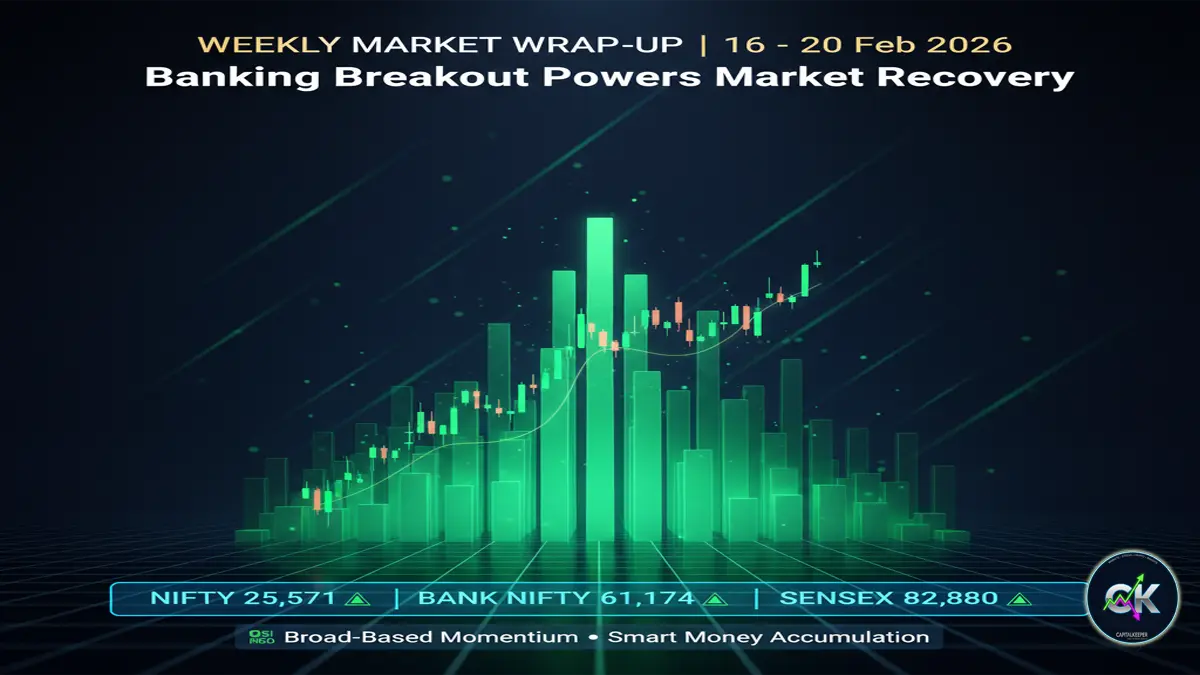

Weekly Wrap-Up 16–20 Feb 2026: Nifty Recovers, Bank Nifty Surges Past 61,000 | Indian Market, INR & Commodities Review

Updated: 21th February 2026

Category: Weekly Wrap-Up | Market Analysis

By CapitalKeeper Research Desk

Indian stock market weekly wrap-up (16–20 Feb 2026): Nifty rebounds, Bank Nifty leads rally, Sensex steady, INR stable and commodities mixed. Full analysis with next week outlook.

Weekly Wrap-Up: Indian Stock Market, INR & Commodity Review

16th February 2026 – 20th February 2026

The third week of February 2026 brought a steady recovery in Indian equity markets after the recent corrective phase. The benchmarks opened the week on a cautious note but gradually gained strength, led primarily by banking and financial stocks. While volatility persisted in select sectors, the broader structure of the market showed resilience.

The Nifty 50 managed to climb back above 25,550 levels, while Bank Nifty delivered a strong breakout above the psychological 61,000 mark. Sensex remained stable with selective stock-specific participation, and Fin Nifty extended its outperformance trend.

This detailed weekly wrap-up covers index performance, sector rotation, institutional behavior, INR movement, commodity trends, and what traders and investors should watch in the upcoming week.

Weekly Market Snapshot

| Index | Opening (16 Feb 2026) | Closing (20 Feb 2026) | Weekly Change |

|---|---|---|---|

| Nifty 50 | 25,423.60 | 25,571.25 | ▲ Recovery |

| Bank Nifty | 59,947.80 | 61,172.00 | ▲ Strong Rally |

| Sensex | 82,480.40 | 82,814.71 | ▲ Positive |

| Fin Nifty | 27,955.65 | 28,210.60 | ▲ Continued Strength |

The overall tone of the market remained constructive, with financial stocks driving the majority of gains.

Nifty 50: Gradual Recovery with Controlled Momentum

Nifty started the week near 25,400 and initially faced resistance around 25,600. However, consistent buying in banking and select heavyweights helped the index recover steadily.

Key Observations:

- Support zone held firmly near 25,300–25,350

- Buyers emerged aggressively on dips

- Mid-week consolidation followed by breakout attempts

- Strong closing suggests accumulation rather than short covering

The structure indicates that the correction seen in the previous week was more of a healthy pullback rather than a trend reversal.

Technically, Nifty is currently forming a higher-low structure on the daily chart, which supports the bullish bias.

Bank Nifty: Clear Leadership Phase

Bank Nifty once again proved why it remains the market’s strongest pillar. From an opening of 59,947, the index rallied sharply to close above 61,170 — marking a decisive breakout.

What Fueled the Rally?

- Strong participation from private banks

- Continued strength in PSU banking stocks

- Institutional accumulation in financial majors

- Positive sentiment around credit growth

The breakout above 61,000 is technically significant. It signals renewed strength and could potentially attract fresh long positions in the coming week.

Fin Nifty: Financials Continue to Outperform

Fin Nifty extended its positive momentum, closing at 28,210.60. The index has been outperforming broader benchmarks consistently, reflecting sustained interest in NBFCs, insurance, and diversified financial services companies.

This continued outperformance strengthens the case that financials are currently the backbone of the Indian equity market.

Sensex: Stability Amid Sector Rotation

Sensex moved from 82,480 to 82,814 during the week, reflecting a modest but stable upward trend. Unlike Bank Nifty’s sharp rally, Sensex displayed a gradual climb supported by heavyweight stocks in banking, energy, and infrastructure.

The index is currently consolidating within a defined range, awaiting a fresh trigger for directional expansion.

Sectoral Trends This Week

Banking & Financial Services

Clear leaders. Most large-cap banks registered steady gains. NBFC stocks attracted fresh buying interest.

IT Sector

Remained range-bound. Select mid-cap IT stocks showed bounce attempts, but overall momentum was subdued.

FMCG

Defensive plays saw mild accumulation but lacked aggressive momentum.

Auto

Mixed performance with stock-specific action dominating the sector.

Infrastructure & Capital Goods

Selective buying seen in infrastructure and capital goods stocks, indicating long-term accumulation.

Institutional Activity

Institutional participation played a crucial role in the week’s recovery.

- Domestic Institutional Investors (DIIs) supported markets during dips.

- Foreign Institutional Investors (FIIs) showed selective buying in banking and financials.

This balanced flow prevented deeper corrections and provided a strong base for recovery.

INR Weekly Movement

The Indian Rupee remained largely stable against the dollar throughout the week. Currency stability reduced volatility concerns and supported foreign investment flows.

A stable rupee environment typically strengthens investor confidence and provides macro stability to equity markets.

Commodity Market Review

Gold

Gold prices remained steady as global uncertainty balanced risk appetite in equities. The metal did not witness extreme volatility.

Silver

Silver showed slight firmness due to industrial demand expectations.

Crude Oil

Crude prices stayed relatively controlled. Stability in oil prices helped ease inflation concerns and supported broader market sentiment.

Overall, commodity markets remained balanced, without exerting significant pressure on domestic equities.

Technical Outlook & Key Levels

Nifty Important Levels

- Immediate Resistance: 25,800

- Major Resistance: 26,000

- Support: 25,300

- Strong Support: 25,000

A sustained move above 25,800 may open doors for a rally toward 26,000.

Bank Nifty Important Levels

- Resistance: 61,800

- Support: 60,000

As long as Bank Nifty holds above 60,000, bullish momentum may continue.

Market Sentiment Analysis

The current sentiment can be described as cautiously optimistic. The recent correction appears absorbed, and financial stocks are leading a renewed attempt at upward expansion.

However, resistance levels are still nearby. Traders must remain disciplined and avoid chasing extended moves.

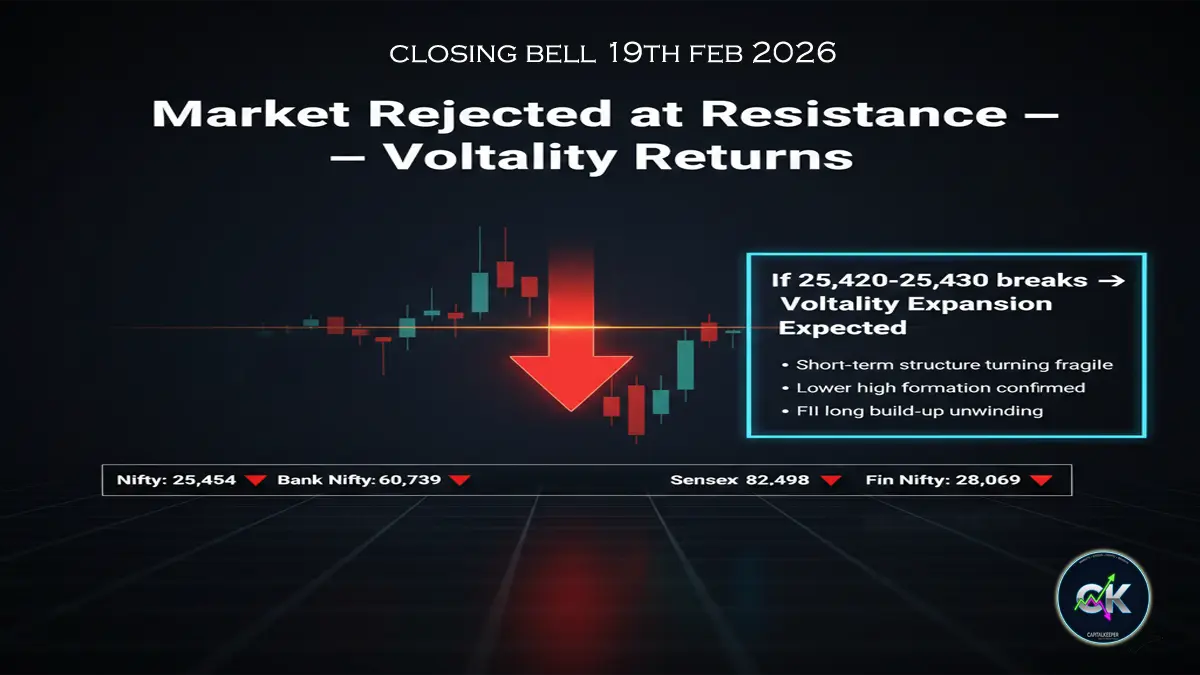

Forecast for Upcoming Week (23–27 Feb 2026)

Bullish Scenario

If Nifty sustains above 25,600 and breaks 25,800 decisively:

- Move toward 26,000 possible

- Banking sector may extend gains

- Midcaps could participate more actively

Bearish Scenario

If Nifty falls below 25,300:

- Consolidation may deepen

- IT and FMCG may drag indices

Most Likely Outcome

Range-bound movement with a slight bullish bias unless global cues turn negative.

Strategy for Traders & Investors

Short-Term Traders

- Focus on Bank Nifty setups

- Trade breakouts with strict stop-loss

- Avoid over-leveraging near resistance

Swing Traders

- Accumulate strong financial stocks on dips

- Look for infrastructure breakouts

Long-Term Investors

- Continue systematic investments

- Use corrections for gradual accumulation

- Focus on sector leaders rather than speculative counters

FAQs

1. Why did the market recover this week?

Strong buying in banking and financial stocks supported the recovery.

2. Which sector led the rally?

Banking and financial services sector led the rally.

3. Is the market trend bullish now?

Short-term trend shows recovery, but resistance zones must be crossed for confirmation.

4. What level should traders watch next week?

25,800 on Nifty and 61,800 on Bank Nifty are key levels.

5. Is this a breakout or just consolidation?

Currently, it appears to be a recovery within consolidation. A breakout confirmation requires sustained movement above resistance.

Final Takeaway

The week ending 20th February 2026 reaffirmed that financial stocks remain the driving force behind market momentum. The recovery in Nifty and the strong breakout in Bank Nifty indicate resilience after recent consolidation.

As markets approach key resistance zones, disciplined trading and selective accumulation remain essential. The broader structure remains constructive, but confirmation above resistance levels will determine whether the next major rally phase begins.

Investors should stay focused on quality, maintain risk management, and watch institutional flows closely in the coming week.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply