Indian Stock Market Weekly Wrap-Up (22–26 Sept 2025): Nifty, Sensex, INR & Commodity Outlook

By CapitalKeeper | Weekly Market Wrap-Up | Indian Equities | Market Moves That Matter

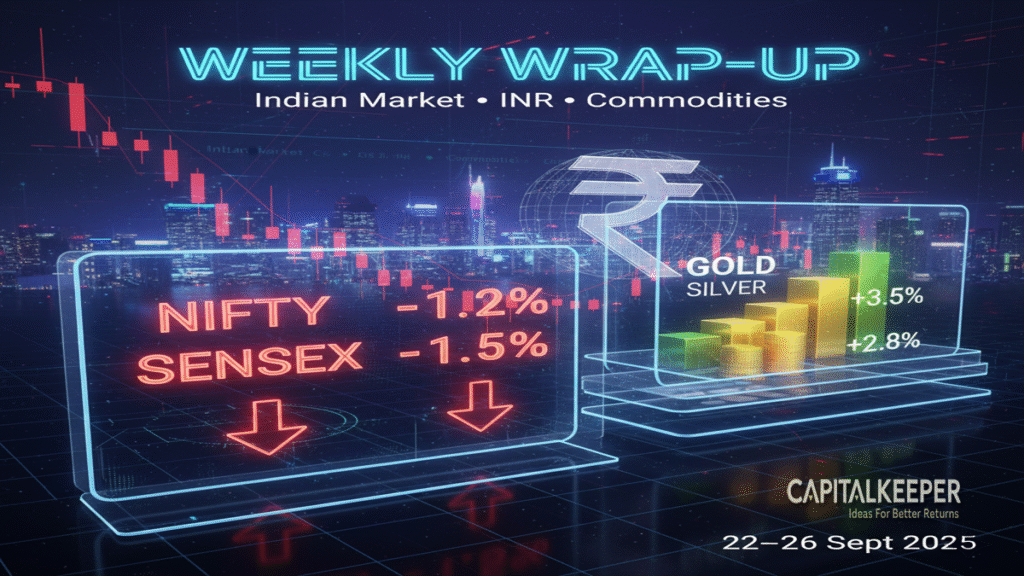

Weekly Market Wrap-Up (22nd–26th Sept 2025): Volatility Strikes Indian Equities, INR, and Commodities

Read the detailed weekly wrap-up of Indian stock markets, INR, and commodities (22–26 Sept 2025). Nifty and Sensex witnessed high volatility, Bank Nifty corrected sharply, while commodities remained mixed. Forecast for the coming week included.

Introduction

The Indian stock market witnessed a sharp shift in sentiment during the week of 22nd–26th September 2025, as global economic cues, persistent volatility in crude oil, and foreign institutional investor (FII) activity kept traders on their toes. Despite opening on a firm footing on Monday, Indian indices failed to sustain momentum, closing the week deep in red.

The Nifty 50, Bank Nifty, Sensex, and Fin Nifty all ended lower, reflecting a cautious tone in both domestic and global markets. Meanwhile, the Indian Rupee (INR) remained under mild pressure against the US Dollar, while commodity markets showed a mixed performance with gold gaining safe-haven demand and crude oil experiencing sharp intraday swings.

Indian Stock Market Performance (22–26 Sept 2025)

- Monday, 22nd Sept 2025 (Opening Levels):

- Nifty 50: 25,238.10

- Bank Nifty: 55,429.30

- Sensex: 82,159.97

- Fin Nifty: 26,528.40

- Friday, 26th Sept 2025 (Closing Levels):

- Nifty 50: 24,654.70

- Bank Nifty: 54,389.35

- Sensex: 80,426.46

- Fin Nifty: 25,985.25

This sharp correction marked one of the weakest weekly closes in September, reflecting global uncertainty and sectoral pressure.

Nifty 50: Heavy Selling Drags Below 24,700

The Nifty 50 slipped from 25,238.10 to 24,654.70, losing nearly 584 points during the week.

- Selling pressure was visible in IT, banking, and auto stocks, while FMCG and selective pharma offered defensive support.

- Mid-cap and small-cap indices also underperformed, signaling profit booking across the board.

- Technically, Nifty breached its crucial support near 24,800, opening the door for a possible retest of 24,400–24,300 zones if global cues remain weak.

Bank Nifty: Financials Under Stress

The Bank Nifty declined from 55,429.30 to 54,389.35, a fall of over 1,000 points.

- PSU banks witnessed stronger selling compared to private banks.

- Concerns over loan growth moderation and rising bond yields added to the cautious sentiment.

- The index now has a crucial support near 54,000, and a breakdown could drag it toward 53,200 levels.

Sensex: Losing Grip Below 81,000

The Sensex dropped from 82,159.97 to 80,426.46, erasing nearly 1,733 points in the week.

- Market breadth remained weak, with more losers than gainers.

- Foreign investors turned net sellers, further accelerating the decline.

- Unless the index sustains above 81,200, a recovery rally might remain elusive.

Fin Nifty: Volatility Reflects Broader Uncertainty

The Fin Nifty also ended lower, closing the week at 25,985.25, down from 26,528.40.

- Insurance and NBFC counters saw strong selling pressure.

- Volatility in the options segment suggested hedging activity by institutional players.

INR Performance: Pressure Against the Dollar

The Indian Rupee (INR) weakened slightly during the week against the US Dollar (USD), primarily due to:

- Rising crude oil prices increasing import bills.

- Dollar index (DXY) strengthening as the US Fed maintained its hawkish tone.

- FIIs turning sellers, leading to additional outflows.

The INR hovered around ₹84.20–₹84.40 per USD, and further weakness could be expected if crude sustains above $90 per barrel.

Commodity Market Wrap

Commodities presented a mixed picture for the week:

Gold: Safe-Haven Buying Resumes

Gold prices surged as investors sought safety amid global equity market volatility.

- Domestic gold prices hovered near ₹63,500 per 10g, showing resilience.

- A potential breakout above ₹64,000 could push gold toward new highs.

Crude Oil: Choppy but Elevated

Crude oil traded in a volatile range but remained above $89–$90 per barrel, as supply-side constraints persisted.

- OPEC+ production cuts supported prices, but global demand concerns capped the rally.

- Indian refiners may face margin pressure if crude sustains at elevated levels.

Silver & Industrial Metals

Silver followed gold’s rally, while industrial metals like copper and aluminum traded mixed, reflecting uncertainty in Chinese demand recovery.

Key Market Drivers (22–26 Sept 2025)

- Global Cues: US Fed’s hawkish commentary and rising bond yields weighed heavily on equities worldwide.

- FII Selling: Foreign portfolio investors turned aggressive sellers in Indian markets, adding pressure to indices.

- Rising Crude Oil: Persistent rise in crude prices sparked inflationary concerns.

- Currency Fluctuations: INR weakness further dampened sentiment in import-dependent sectors.

- Sectoral Rotation: Defensive sectors (FMCG, pharma) held relatively better, while cyclical sectors (banks, autos, IT) witnessed stronger declines.

Forecast for the Upcoming Week (29th Sept – 3rd Oct 2025)

Looking ahead, markets are likely to remain volatile with a cautious bias.

- Nifty Outlook: Immediate support lies at 24,400–24,300, while resistance is seen near 24,950–25,050.

- Bank Nifty Outlook: Key support at 54,000, with resistance around 55,000–55,200.

- INR: Likely to stay under pressure if crude sustains above $90; watch for RBI interventions.

- Gold: Expected to stay bullish above ₹63,000, targeting ₹64,500+.

- Crude Oil: May remain volatile between $88–$92 per barrel, depending on geopolitical and supply-demand factors.

Investor Strategy:

- Adopt a buy-on-dips approach in quality large caps.

- Focus on defensive sectors like FMCG, pharma, and IT for stability.

- Traders should maintain strict stop-losses due to heightened volatility.

Conclusion

The week of 22nd–26th September 2025 was dominated by volatility, heavy FII selling, and global uncertainty. While the market correction has opened up attractive entry points for long-term investors, traders need to remain cautious due to heightened risks in the short term.

Going forward, investors should watch global central bank commentary, crude oil trends, and FII flows to gauge market direction. Defensive plays may continue to offer relative safety until broader stability returns.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in