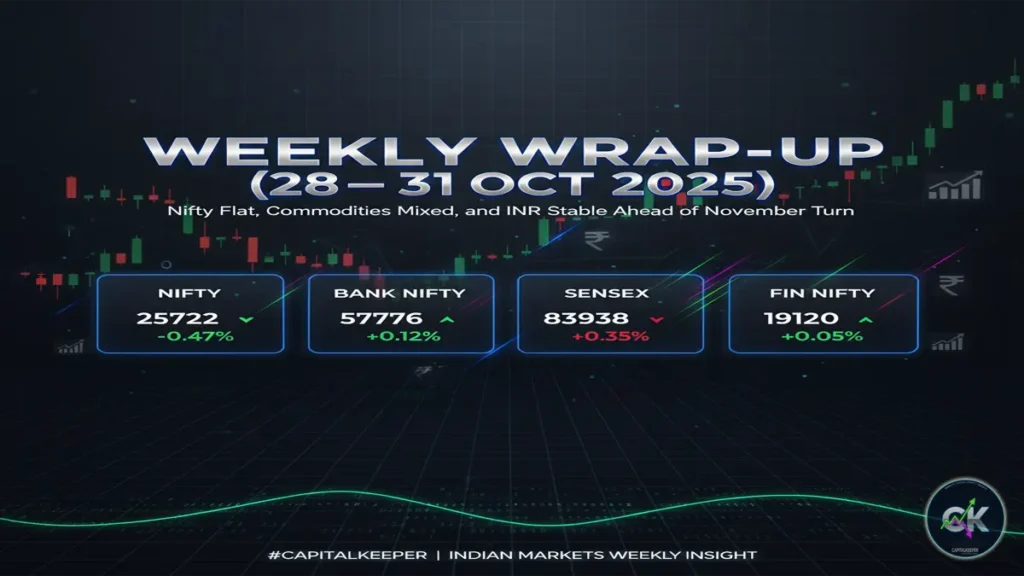

Weekly Market Wrap (Oct 27–31, 2025): Nifty Ends Flat, Bank Nifty Resilient, Commodities Stay Mixed Ahead of November Rally

By CapitalKeeper | Weekly Market Wrap| Indian Equities | Market Moves That Matter

Indian markets witnessed a range-bound week from Oct 27–31, 2025, as Nifty slipped marginally while Bank Nifty held firm. INR remained steady near 83.25 per USD and commodities like gold and crude traded mixed. Here’s a detailed analysis and forecast for the upcoming week.

🧭 Weekly Wrap-Up: Indian Stock Market, INR & Commodities (Oct 27–31, 2025)

As October 2025 drew to a close, Indian markets showcased a week of quiet consolidation, with traders awaiting key macroeconomic triggers and earnings season cues. The Nifty 50 and Sensex slipped slightly amid profit-booking in frontline stocks, while Bank Nifty remained resilient thanks to strength in select private and PSU banking counters. On the currency front, the INR held steady against the US dollar, supported by robust FII inflows and easing crude prices. Commodities, on the other hand, reflected a mixed sentiment, with gold inching higher and crude oil staying volatile around $86–87 per barrel.

Let’s break down the week in detail 👇

📊 Market Performance Overview

| Index | Opening (Oct 27) | Closing (Oct 31) | Weekly Change |

|---|---|---|---|

| Nifty 50 | 25,843.20 | 25,722.10 | 🔻 -121.10 (-0.47%) |

| Bank Nifty | 57,796.45 | 57,776.35 | 🔻 -20.10 (-0.03%) |

| Sensex | 84,297.39 | 83,938.71 | 🔻 -358.68 (-0.42%) |

| Fin Nifty | 27,447.40 | 27,138.85 | 🔻 -308.55 (-1.12%) |

The benchmark indices traded in a tight range, with Nifty oscillating between 25,680 and 25,880 for most of the sessions. The lack of directional movement indicates short-term consolidation before a potential breakout as the market transitions into November.

🔹 Key Market Highlights

- Midcap and Smallcap indices underperformed, slipping over 0.8% on profit-booking after a strong October run.

- IT stocks corrected mildly as investors booked profits after the sector’s robust quarterly performance.

- Auto and FMCG stocks outperformed on festive season demand optimism.

- Banking sector remained stable, with PSU banks showing marginal strength on improving credit growth data.

💡 Sectoral Analysis

🏦 Banking & Financials

The Bank Nifty showed remarkable stability despite Nifty’s weakness. Heavyweights like HDFC Bank, ICICI Bank, and SBI helped the index hold ground near 57,700. Improved credit offtake and stable deposit growth provided comfort to investors.

- PSU Banks saw continued traction after Q2 earnings showed healthy net interest margins and reduced NPAs.

- Private Banks consolidated but remain strong candidates for a November upside as liquidity conditions improve.

Outlook:

Short-term resistance seen near 58,400–58,600, with support at 57,200. A breakout above resistance could fuel a rally toward 59,000 levels in the coming week.

💻 IT Sector

IT counters like Infosys, TCS, and Tech Mahindra traded mildly lower amid mixed global cues from the US tech earnings. The Nasdaq remained volatile, weighing on sentiment. However, most large-cap IT names continue to exhibit strong order pipelines and margin recovery potential.

Outlook:

Consolidation likely to continue; investors can accumulate quality IT stocks on dips for medium-term targets.

🚘 Auto & FMCG

The festive period supported auto and consumption-driven stocks, with demand momentum holding strong. Maruti Suzuki, Hero MotoCorp, and Tata Motors remained firm, while FMCG names like HUL and Nestle showed resilience.

Outlook:

With festive sales data expected to remain positive, these sectors could lead the next leg of market recovery.

⚙️ Infrastructure & Capital Goods

Infra and engineering stocks such as L&T, Siemens, and BEL were range-bound but remained on investors’ radar due to steady order inflows. Government’s focus on capex and smart city projects continues to support sentiment.

Outlook:

Sector remains structurally strong; traders may expect fresh momentum once policy clarity emerges post-state election results.

💹 Currency Check: Indian Rupee Performance

The Indian Rupee (INR) traded stable through the week, hovering near ₹83.22–83.28 per USD, supported by easing crude oil prices and inflows into debt markets. The US Dollar Index (DXY) remained around 104.7, while US Treasury yields softened slightly after weaker-than-expected US consumer confidence data.

RBI intervention and comfortable forex reserves also helped maintain stability.

Exporters continued to hedge positions, and importers benefited from relative rupee strength.

Forecast:

The INR is expected to remain in the ₹83.00–83.35 band next week. Any sharp crude move or FII outflows could push it beyond ₹83.40, but near-term outlook remains stable.

🪙 Commodity Market Overview

🟡 Gold

Gold prices remained buoyant, gaining around 1.3% during the week as investors turned to safe-haven assets amid geopolitical tensions and lower US bond yields. MCX Gold closed near ₹72,800 per 10 gm, marking another weekly gain.

- Demand from festive buying in India added support.

- The global spot gold price hovered around $2,440 per ounce, indicating continued bullishness.

Outlook:

Gold is likely to trade in the ₹72,500–₹73,800 range with a positive bias unless global yields rise sharply.

🛢️ Crude Oil

Crude oil remained volatile throughout the week. Brent hovered between $85–88 per barrel, influenced by fluctuating Middle East supply risks and OPEC commentary. On MCX, crude traded near ₹7,300 per barrel, reflecting mild weakness due to a stronger rupee.

Outlook:

Short-term support is seen at ₹7,150, while resistance lies near ₹7,450. Broader trend remains sideways-to-bearish if global demand growth moderates.

🌾 Other Commodities

- Silver: Slightly underperformed gold, ending near ₹90,000/kg due to profit booking.

- Base Metals: Copper and zinc saw mild corrections amid Chinese demand concerns.

- Natural Gas: Gained modestly due to approaching winter demand in Europe and Asia.

🌍 Global Market Snapshot

- US Markets: Volatile but largely positive on expectations of a rate pause by the Federal Reserve.

- Asian Markets: Mixed performance; Nikkei gained while Hang Seng underperformed due to property sector stress.

- European Markets: Steady ahead of ECB policy announcements.

Global risk sentiment remains balanced, supporting Indian markets’ resilience despite mild corrections.

🔮 Market Forecast: Outlook for Week (Nov 3–7, 2025)

As we step into the first week of November, market sentiment appears cautiously optimistic. With Q2 earnings largely priced in, focus will shift toward global data releases, domestic auto sales, and central bank commentary.

📈 Key Levels to Watch

- Nifty Support: 25,650 / 25,500

- Nifty Resistance: 25,950 / 26,100

- Bank Nifty Range: 57,200–58,600

💭 Forecast Summary

- Equities: Likely to witness mild upside if global cues remain supportive; expect sector rotation into infra and auto.

- INR: Stable near current levels with low volatility.

- Gold: May stay elevated; traders advised to book partial profits near ₹73,800.

- Crude: May remain range-bound; OPEC meeting next week to guide direction.

Sentiment Barometer: 🌤️ Cautious Optimism with Focus on Festive Demand & Policy Outlook

🧠 CapitalKeeper Insight

Despite short-term choppiness, India’s macro fundamentals remain robust, backed by stable corporate earnings, moderating inflation, and strong festive consumption. Traders should adopt a buy-on-dip strategy around support zones and stay stock-specific rather than index-focused.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in