Top Intraday Trading Rules Every Trader Must Follow for Consistent Profits

Updated: 23 November 2025

Category: Educational | Market Analysis

By CapitalKeeper Research Desk

Top Intraday Trading Rules Every Trader Must Have Known

Intraday trading is one of the most exciting and fast-paced areas of the financial market. The thrill of riding short-term price swings, the speed of execution, and the ability to compound returns daily attract thousands of new traders every year. But intraday markets don’t reward excitement they reward discipline, structure, and rule-based execution.

Without a trading framework, even skilled traders can suffer unexpected losses. The difference between consistent traders and emotional traders isn’t strategy it’s adherence to rules.

This comprehensive guide covers the top intraday trading rules every trader must follow, including actionable insights using RSI, MACD, and volume, risk management techniques, psychology tips, time-frame selection, and execution discipline.

✅ Meta Description (155 Characters)

Discover the essential intraday trading rules every trader must follow. Learn how RSI, MACD, and volume improve accuracy, reduce losses, and enhance trade discipline.

What Makes Intraday Trading Different?

Unlike swing or positional investing, intraday trades are squared off within the same trading session—usually between market open and close. That means:

- High volatility within compressed time frames

- Emotional and psychological pressure

- Faster decision-making

- No overnight risk

- Higher leverage exposure

Due to this dynamic environment, traders must focus not just on finding entries but on avoiding costly mistakes.

✅ Top Intraday Trading Rules Every Trader Must Follow

1. Trade Only Liquid and High-Volume Stocks

Intraday positions require quick entry and exit. Illiquid stocks increase slippage, widen spreads, and trap traders.

What to look for:

- Average daily volume above 1 million shares

- Tight bid–ask spreads

- Stocks with strong institutional participation

- High F&O activity (for derivatives traders)

High-volume stocks offer smoother breakouts, clearer trend patterns, and more reliable indicator signals.

2. Respect Trend and Market Direction

The first rule in intraday trading: trade with the trend not against it.

Trend-checking checklist:

- Higher highs & higher lows → bullish trend

- Lower highs & lower lows → bearish trend

- Moving averages sloping in same direction

- Sector index confirming price movement

Fighting the trend may feel brave but ends up expensive.

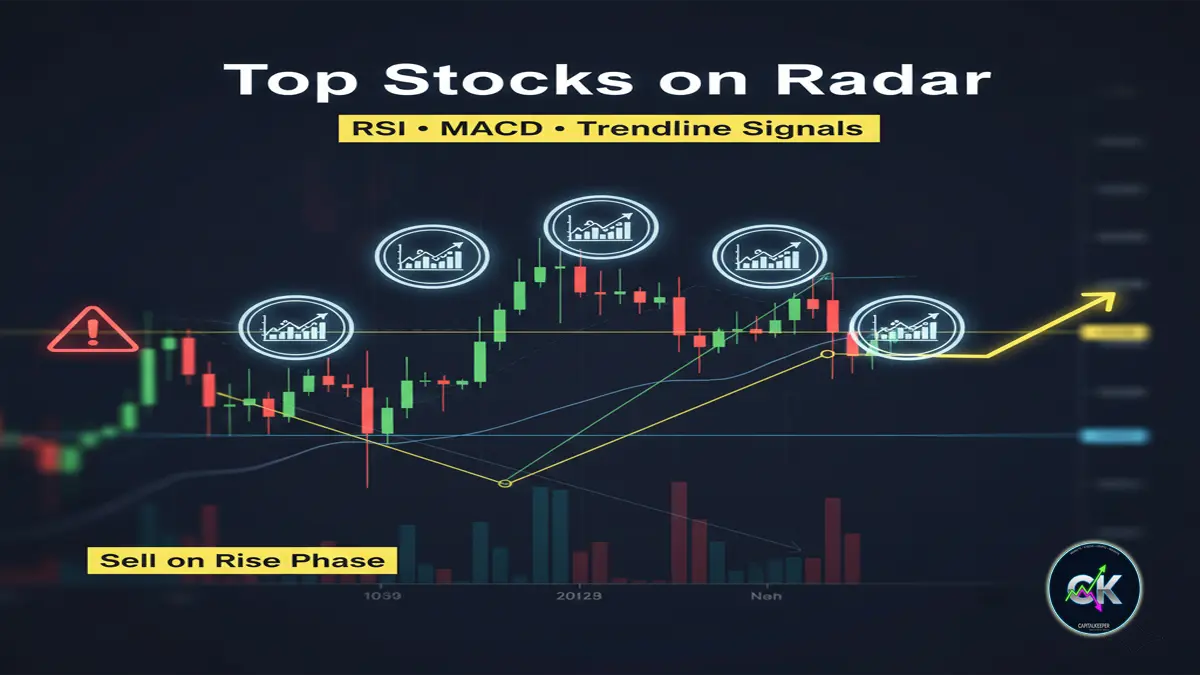

3. Use RSI to Measure Intraday Momentum

RSI isn’t just for swing trading it’s extremely effective intraday when used correctly.

RSI signals for intraday:

- Above 60 → momentum long opportunities

- Below 40 → momentum short setups

- RSI divergence near key support/resistance → caution

- Avoid buying when RSI > 75 or selling when RSI < 25 unless trend strongly supports it

RSI shouldn’t be used alone but as a supporting filter.

4. Confirm Trades With MACD Trend Strength

MACD helps identify whether momentum is strengthening or fading—crucial in intraday trades.

Intraday MACD confirmation:

- Bullish crossover above zero → strong long setup

- Bearish crossover below zero → strong short setup

- Flat MACD histogram → avoid choppy markets

- Late crossover after breakout → risk of exhaustion

When RSI and MACD align, probability of success significantly increases.

5. Volume Must Validate the Trade Setup

Volume is the truth-teller of the market. Price can be manipulated—volume cannot.

Ideal intraday volume markers:

- Breakouts require higher-than-average volume

- Trend continuation supported by rising volume

- Avoid trades during declining volume phases

- Sudden volume spike without price movement may indicate trap

Volume + RSI + MACD = high-confidence trade.

6. Use Proper Stop-Loss and Stick to It

Intraday risk escalates quickly. A delayed exit can wipe out multiple winning trades.

Stop-loss guidelines:

- Risk 0.5%–1% of trading capital per trade

- Use structure-based stop not emotional stop

- Never widen stop-loss after entry

- Trailing SL helps protect profits

A stop-loss is not a suggestion it’s a shield.

7. Never Trade Without a Predefined Target

Targets prevent overtrading, panic exits, and greed-driven decisions.

Methods:

- Risk–reward ratio of 1:2 or 1:3

- ATR-based dynamic targets

- Previous session high/low reference

Book profits don’t wait for “more.”

8. Avoid Trading During Extremely Volatile News Events

Economic announcements can cause unpredictable price behavior.

Examples:

- RBI policy decisions

- Union Budget

- US inflation data

- Corporate earnings

- Geopolitical statements

Unless skilled in news trading stay out. Capital preservation > thrill seeking.

9. Limit Number of Trades Per Day

Overtrading increases fatigue, emotional bias, losses, and brokerage costs.

Ideal for beginners:

- 2–5 trades per day

- Quality > quantity

Let the market come to you never chase entries.

10. Follow a Trading Journal

The most underestimated rule.

A journal reveals:

- Winning patterns

- Losing habits

- Emotional triggers

- Time-of-day performance

- Strategy efficiency

Professional traders track everything amateurs track nothing.

✅ Table: Disciplined Trader vs Emotional Trader

| Factor | Disciplined Trader | Emotional Trader |

|---|---|---|

| Entry | Based on setup & confirmation | Based on impulse |

| Stop-loss | Always placed & respected | Adjusts or ignores |

| Indicators | Uses RSI, MACD & volume | Blindly follows tips |

| Risk | Fixed position sizing | Random lot sizes |

| Trades per day | Selective | Overtrades |

| Exit | Structured | Greedy or fearful |

| Psychology | Calm | Reactive |

Best Time Frames for Intraday Trading

| Style | Time Frame |

|---|---|

| Scalping | 1–5 min |

| Short-term intraday | 5–15 min |

| Trend trading | 15–30 min |

| Conservative | 30–60 min |

Start with 15-minute charts balanced for clarity and execution.

Golden Rule — Protect Capital First

Intraday success isn’t about the biggest winners—it’s about small, controlled losses and consistent discipline. Longevity creates profitability.

✅ Internal Links for CapitalKeeper.in

- Learn How to Identify True Breakout Stocks — /how-to-identify-true-breakout-stocks

- Read our Nifty & Bank Nifty Daily Analysis — /nifty-today-analysis

- Beginner-friendly RSI Indicator Guide — /understanding-rsi-indicator

- Explore Position Sizing & Risk Management — /risk-management-for-traders

✅ FAQs — Intraday Trading Rules

1. How much capital should beginners use for intraday trading?

Start small trade only risk capital, preferably 5–10% of savings, until consistency develops.

2. Can someone trade intraday without indicators?

Yes, but combining price action with RSI, MACD, and volume increases accuracy.

3. Should intraday traders carry positions overnight?

No square off before market close to avoid overnight risk.

4. What is the biggest mistake new intraday traders make?

Overtrading and ignoring stop-loss.

5. Is intraday trading suitable for everyone?

No requires emotional discipline, capital protection mindset, time commitment, and patience.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply