Tokenomics Explained 13th Sept 2025: How Supply, Demand & Burning Affect Crypto Prices

By CapitalKeeper | Beginner’s Guide | Crypto Capital | Market Moves That Matter

Discover how tokenomics drives crypto prices through supply, demand, and token burning. Learn why tokens like Bitcoin, Ethereum, and BNB rise faster while others fail, with real-world case studies and insights for investors.

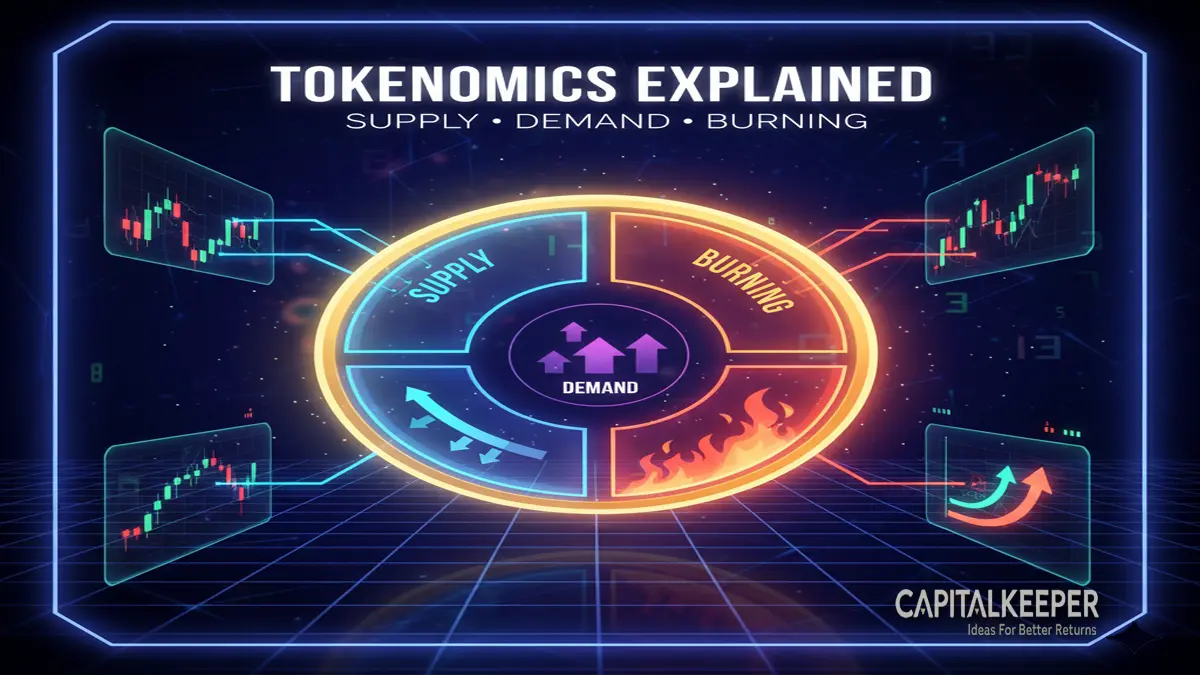

Tokenomics Explained: How Supply, Demand, and Burning Affect Prices

Introduction

Why does Bitcoin (BTC) keep hitting new highs while some altcoins fade away? Why do tokens like Ethereum (ETH) and Binance Coin (BNB) seem resilient, while projects like Terra’s LUNA collapsed spectacularly?

The answer lies in tokenomics — the economic framework that governs how a cryptocurrency works. For investors, understanding tokenomics is as important as analyzing company fundamentals in traditional stock investing. Poorly designed tokenomics can destroy value, while strong tokenomics can create sustainable long-term growth.

This guide breaks down supply mechanics, demand drivers, and burning mechanisms, showing you why some tokens rise faster than others.

🔹 What Is Tokenomics?

Tokenomics (short for token economics) refers to the design of a token’s economic system, including:

- Total and circulating supply

- Issuance schedule (inflation/deflation)

- Utility of the token (use cases)

- Incentives for holders and users

- Burning or supply reduction mechanisms

Think of it as the DNA of a cryptocurrency. Just as central banks control money supply in traditional finance, tokenomics governs value in crypto.

🔹 Supply: Scarcity vs Inflation

One of the strongest price drivers is supply design.

✅ Fixed Supply (Scarcity Model)

- Bitcoin (BTC): Hard cap of 21 million.

- Scarcity creates long-term upward pressure, especially as halving events reduce new issuance.

✅ Inflationary Supply

- Dogecoin (DOGE): No maximum cap, with 10,000 new DOGE minted per block.

- Works for high-velocity transactions but risks long-term value dilution.

✅ Deflationary Supply

- BNB: Binance commits to quarterly token burns until supply is reduced to 100 million.

- A shrinking supply, combined with utility, strengthens value.

Investor takeaway: Always analyze if a token has capped, inflationary, or deflationary supply before investing.

🔹 Demand: Why People Buy Tokens

Even with limited supply, a token won’t grow without demand. Demand drivers include:

1. Utility

- Example: Ethereum (ETH) is needed for gas fees across smart contracts.

- Strong demand = sustained growth.

2. Speculation

- Meme coins like Shiba Inu (SHIB) thrive on hype-driven demand.

- Volatile, often short-lived.

3. Network Effects

- The more people use a token, the stronger its value becomes.

- Example: Uniswap’s UNI benefits from being central to decentralized trading.

4. Rewards & Staking

- Tokens with staking yields or liquidity incentives encourage holding.

- Example: Aave (AAVE) attracts users with lending rewards.

Investor takeaway: Strong real-world demand + limited supply is a winning formula.

🔹 Token Burning: Creating Scarcity

Burning tokens means permanently removing them from circulation, making remaining tokens scarcer.

Types of Burning

- Manual Burns: Scheduled by teams (BNB quarterly burns).

- Automatic Burns: A percentage of every transaction is destroyed (e.g., Safemoon).

- Fee-based Burns: Ethereum’s EIP-1559 upgrade burns base transaction fees.

Why It Matters

- Creates deflationary pressure

- Increases scarcity and investor confidence

- Shows project commitment to long-term value

Projects with regular, transparent burns often see sustained upward momentum.

🔹 Case Studies: Tokenomics in Action

✅ Ethereum (ETH)

- EIP-1559 introduced fee burning, making ETH partially deflationary.

- Demand grows as ETH powers DeFi, NFTs, and Layer-2 solutions.

- Strong utility + deflation = long-term sustainability.

✅ Binance Coin (BNB)

- Used for exchange fee discounts, staking, and DeFi ecosystems.

- Regular quarterly burns reduce supply.

- Scarcity + utility keeps BNB among the top tokens.

❌ Terra (LUNA) Collapse

- UST stablecoin relied on minting LUNA to maintain its peg.

- Hyperinflation occurred when UST lost confidence.

- Lesson: Weak tokenomics can destroy a multibillion-dollar ecosystem overnight.

🔹 Key Metrics to Analyze

When evaluating tokenomics, focus on:

- Market Cap = Price × Circulating Supply

- Fully Diluted Valuation (FDV): Market cap if all tokens are in circulation.

- Emission Schedule: Rate of new token issuance.

- Burn Rate: Speed of supply reduction.

- Utility Case: Is there genuine real-world demand?

Investor rule: Don’t just look at price — study the tokenomics behind it.

🔹 Why Some Tokens Rise Faster

- Bitcoin: Scarcity + institutional adoption.

- Ethereum: Utility in DeFi and NFTs + burning.

- BNB: Exchange dominance + quarterly burns.

- Meme coins: Hype-driven but fragile.

Projects that balance scarcity and utility grow faster than those with unlimited issuance and weak demand.

🔹 Final Thoughts

In crypto, hype may bring short-term gains, but tokenomics determines long-term survival.

- Strong tokenomics = scarcity, demand, and utility.

- Weak tokenomics = inflation, hype, and collapse.

As an investor in 2025, analyzing tokenomics is not optional—it’s the foundation of smart investing. Before buying any token, ask:

- Does it have capped or deflationary supply?

- Is there real demand beyond speculation?

- Does the project use burns or incentives to protect value?

By answering these questions, you’ll be able to spot projects with moonshot potential 🚀 while avoiding the next rug pull.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply