Stock Market Weekly Wrap 07–11 July 2025: Midcap Resilience, Nifty Trend & Market Outlook

By CapitalKeeper | Sunday Digest | Indian Equities | Market Moves That Matter

CapitalKeeper Sunday Digest

Catch CapitalKeeper’s Weekly Wrap-Up for 07–11 July 2025 with market reaction, sector analysis, global cues, and midcap momentum. Plan your trades for the coming week with trend insights and technical data.

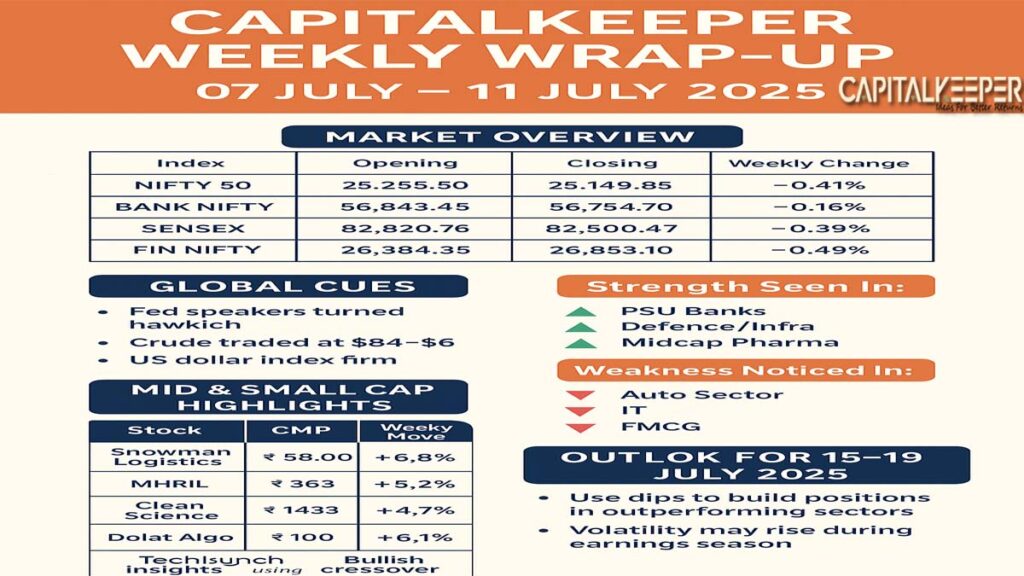

📌 Market Overview: Nifty Held Ground, Midcaps Held Power

| Index | Opening | Closing | Weekly Change | Sentiment |

|---|---|---|---|---|

| NIFTY 50 | 25,255.50 | 25,149.85 | –0.41% | Rangebound / Slightly Weak |

| BANK NIFTY | 56,843.45 | 56,754.70 | –0.16% | Relative Strength |

| SENSEX | 82,820.76 | 82,500.47 | –0.39% | Mild Profit Booking |

| FIN NIFTY | 26,984.35 | 26,853.10 | –0.49% | Flat-to-Weak |

| INDIA VIX | 13.95 | 14.10 | Slight Rise | Controlled Volatility |

🌍 Global Cues Recap

🔹 US Markets

- Fed speakers turned slightly hawkish, signalling caution around rate cuts in the short term.

- S&P 500 stayed flat, while tech stocks cooled off after a strong June.

- Dollar index remained firm near 105.2, putting some pressure on emerging market flows.

🔹 Crude & Currency

- Brent Crude traded between $84–$86/barrel, mildly inflationary.

- USD/INR stayed stable around ₹83.45; no major depreciation fears.

🔹 Other Global Themes

- Chinese markets showed signs of recovery on policy easing news.

- European inflation cooled, boosting global risk-on appetite mid-week.

📊 Market Observations: What Moved India?

🔼 Strength Seen In:

- PSU Banks: Continued leadership, especially Canara Bank and SBI.

- Defence/Infra: BEML, BEL, IRCON extended upmoves on strong volumes.

- Midcap Pharma: Positive movement in Sequent, Granules, Strides.

🔽 Weakness Noticed In:

- Auto Sector: Maruti and Bajaj Auto saw profit booking after June sales data.

- IT: Ahead of Q1 results, tech stocks like Infosys, TCS stayed muted.

- FMCG: Sector remained sideways due to no immediate trigger.

📈 Mid & Small Cap Highlights

While large-caps consolidated, mid and small-cap stocks outperformed with sector-specific breakouts. Here’s what stood out:

| Stock | CMP | Weekly Move | Technical Insight |

|---|---|---|---|

| Snowman Logistics | ₹60.00 | +6.8% | Volume-backed breakout, MACD positive |

| MHRIL | ₹363 | +5.2% | Sustained breakout, weekly RSI 64 |

| Clean Science | ₹1452 | +4.7% | Higher High weekly closing, diverging MACD |

| Dolat Algo | ₹101 | +6.1% | Bullish crossover, rising accumulation |

| ITI Ltd | ₹320 | +3.9% | Trendline breakout & RSI nearing 70 |

These stocks have continued their momentum from the past 2–3 weeks, indicating strong hands and F&O interest (where applicable).

🧾 Derivatives & Sentiment Check

| Metric | Current Level | Interpretation |

|---|---|---|

| Nifty PCR | 0.91 | Neutral-to-Cautious |

| FII Index Longs | 23% | Mild bullish positioning |

| India VIX | 14.10 | No panic, but eyes on events |

🔮 Market Outlook for 15–19 July 2025

🔭 Technical Range Expectation

| Index | Support Zone | Resistance Zone | Bias |

|---|---|---|---|

| NIFTY 50 | 24,980 / 24,750 | 25,350 / 25,600 | Rangebound with dips buying |

| BANK NIFTY | 56,100 / 55,600 | 57,400 / 57,800 | Mildly bullish |

| FIN NIFTY | 26,600 / 26,300 | 27,000 / 27,200 | Sideways to positive |

🧭 Strategy for Traders

- Don’t short aggressively; use dips to build positions in outperforming sectors.

- Focus on stock-specific trades, especially in sectors like:

- Capital Goods

- Railways

- Defence

- Midcap Pharma

- Use trailing SL in all positional trades as volatility may rise with earnings season.

🧠 CapitalKeeper Pro Tips

- Track MACD Divergences: Clean Science and Elgi Equip are classic textbook setups.

- Breakouts Without Volume = Avoid: Wait for confirmation with 2–3x avg volume.

- Sector Rotation = Opportunity: Follow PSU to Private Bank shift closely this week.

- Use Option Data: Max pain zones and PCR help define index range limits for intraday scalping.

🔑 Closing Thought

The market continues to digest global events, but the real action lies in the mid and small-cap universe. Stock-specific volume breakouts are giving clear technical edges. With earnings season around the corner, brace for high beta action in select names, but stay away from hype and focus on price + volume + structure.

📢 Stay tuned to CapitalKeeper.in for:

- Morning Market Briefs

- Opening Bell Reports

- Mid Day Live Market Reports

- Closing Bell Reports

- Intraday Stock Ideas

- Technical Breakout Watchlists

- Weekend Educational Series

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Leave a Reply