Pre-Market Report 30th October 2025: Nifty Eyes 26,100 | Gift Nifty Steady | Breakout Radar on Yes Bank, Marico, CESC & Paytm

By CapitalKeeper | Pre Market Opening | Indian Equities | Market Moves That Matter

Stay ahead with the Pre-Market analysis for 30th October 2025 — Nifty near 26,100, Bank Nifty firm above 58,300. Gift Nifty indicates a cautious start as traders eye expiry dynamics. Stocks on radar: Yes Bank, Marico, CESC, and Paytm with short-term and positional targets.

Pre-Market Report – 30th October 2025

Market Outlook | Sector Trends | Key Technical Setups

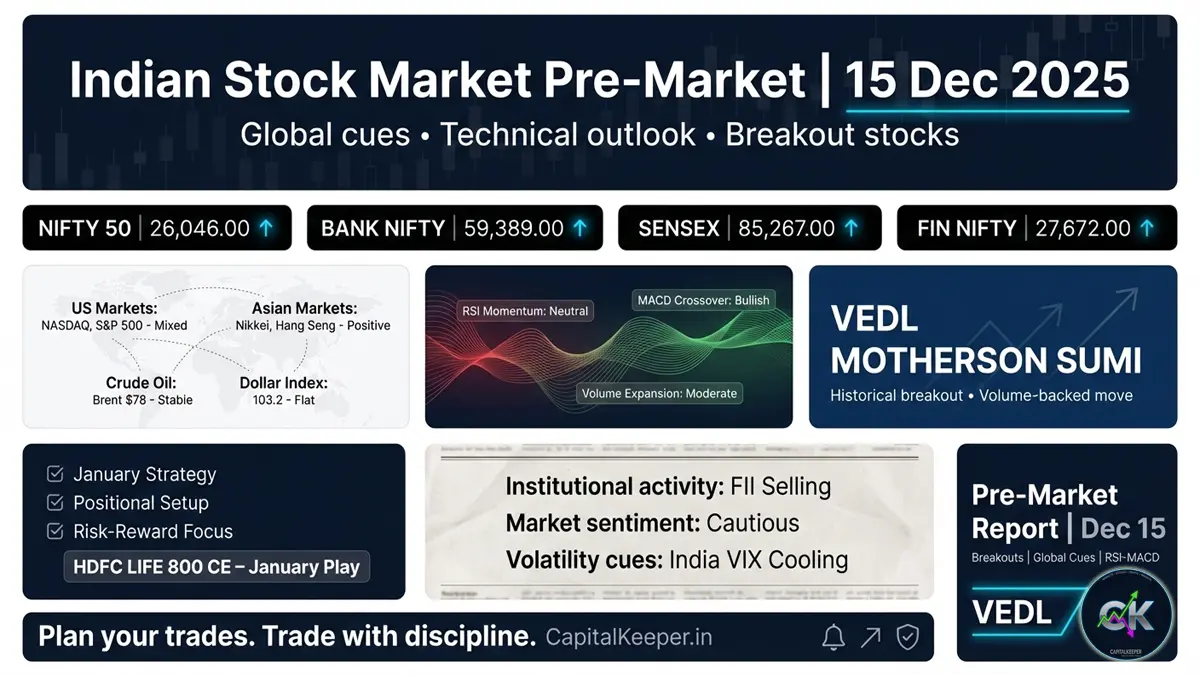

The Indian stock market enters the final trading session of October 2025 with bullish momentum, though volatility remains heightened ahead of expiry. On Wednesday, Nifty closed at 26,053.90, adding over 110 points; Bank Nifty settled at 58,385.25, showing relative strength with PSU banks and private financials leading the charge. The Sensex ended at 84,997.13, and Fin Nifty closed the day at 27,587.65 — signaling continued participation from financial stocks.

Let’s decode the pre-market setup for 30th October 2025, focusing on Gift Nifty trends, global market sentiment, and sectoral cues, along with today’s key technical stock ideas.

🌏 Global Market Overview & Gift Nifty Setup

Gift Nifty is trading marginally positive around the 26,090 mark, suggesting a flat-to-positive opening for domestic markets. The global backdrop remains mixed:

- US Markets: Dow Jones gained 0.25%, while Nasdaq slipped 0.10% as investors digested corporate earnings and awaited U.S. GDP data.

- Europe: CAC and DAX saw mild gains, while FTSE was flat due to energy sector weakness.

- Asia: Nikkei trades mildly positive; Hang Seng remains range-bound amid China’s real estate data disappointment.

The Dollar Index hovers near 104.2, while Brent crude stays around $88.40/barrel, indicating slight pressure on oil-sensitive sectors. Meanwhile, FIIs were marginal net buyers on Wednesday, indicating sustained inflow into large-cap names.

📊 Technical Outlook: Nifty, Bank Nifty & Fin Nifty

Nifty (Close: 26,053.90)

Nifty formed a bullish candle on daily charts and is consolidating near the upper trendline of its short-term channel.

- Support Zones: 25,920 – 25,850 (intraday)

- Resistance Zones: 26,120 – 26,240 (immediate hurdle)

- Trend: Bullish but overbought; mild retracement possible before fresh upmove.

A breakout above 26,240 could open the gate towards 26,400–26,500, while failure to hold 25,850 may trigger profit booking.

Bank Nifty (Close: 58,385.25)

Bank Nifty continues to outperform, driven by SBI, ICICI Bank, and Kotak Mahindra Bank.

- Support: 57,900

- Resistance: 58,600 – 58,900

- View: As long as it sustains above 57,900, the index remains in buy-on-dip mode.

However, traders should stay cautious near 59,000, which coincides with the upper channel resistance and expiry volatility.

Fin Nifty (Close: 27,587.65)

Fin Nifty is showing relative strength compared to Nifty and is expected to move towards 27,900 if it sustains above 27,450.

- Support: 27,400

- Resistance: 27,750 – 27,900

Sectoral leadership remains visible in insurance, NBFC, and private banks, while PSU financials may see mild profit booking.

📈 Sectoral Snapshot

| Sector | View | Key Levels | Notes |

|---|---|---|---|

| Banking & Financials | Bullish | Support 57,900 | Focus on SBI, HDFC Bank |

| Energy | Mixed | Resistance 36,500 (Nifty Energy) | Brent stable, ONGC watch |

| Auto | Range-bound | Support 19,200 | Maruti, Tata Motors under consolidation |

| FMCG | Mild Strength | Resistance 53,400 | ITC, Marico, HUL stable |

| IT | Cautious | Support 38,700 | TCS & Infosys show weak momentum |

| Pharma | Neutral | Resistance 23,150 | Needs breakout above key level |

🔍 Stocks to Watch – Technical Setups

1️⃣ YES BANK (CMP ₹22.69)

- Setup: Forming a rounding base on daily charts; breakout likely above ₹23.

- Buy: At CMP ₹22.70

- Stoploss: ₹21

- Targets: ₹25 – ₹26.50

- Derivatives Setup: November 24 CE @ ₹0.30, positional buying opportunity with risk-managed exposure.

- View: Low-risk setup with potential 10–15% upside in short term.

2️⃣ MARICO (November 730 CE @ ₹16–15)

- CMP: ₹721 zone

- Stoploss: ₹10

- Targets: ₹22 / ₹25 / ₹30+

- Chart View: The stock has completed a breakout retest from its 710 base zone. Sustaining above 725 may fuel a move towards 750–760.

- Positional Bias: Bullish; ideal for option traders with tight risk control.

3️⃣ CESC (CMP ₹181)

- Buy in Cash for Delivery

- Targets: ₹200 / ₹211

- Stoploss: ₹172

- Setup: Strong volume-based accumulation near breakout trendline. RSI rising from oversold territory; price structure turning positive.

- View: Looks good for positional delivery trade with a 10–15% upside.

4️⃣ PAYTM (CMP ₹1309)

- Setup: Post-consolidation breakout setup on weekly chart.

- Targets: ₹2000+ (medium-term positional)

- Stoploss: ₹1240

- View: After several weeks of sideways action, Paytm is showing strong base formation and potential for large upside momentum if it sustains above 1330–1350 levels.

📊 FII-DII Data Snapshot

- FIIs: +₹2,014 crore (Net Buyers)

- DIIs: –₹742 crore (Net Sellers)

Foreign institutional investors are rotating back into financials and select consumption names, while domestic funds booked profits in midcap energy and manufacturing stocks.

🌐 Global & Macro Cues to Watch

- US Q3 GDP data due tonight will drive risk sentiment.

- Crude oil and Dollar Index stability remains crucial for India’s macro stability.

- Rupee movement near ₹83.12 per dollar shows mild weakness but under control.

- Bond yields remain around 7.23%, not indicating immediate stress.

🧭 Technical View Summary

| Index | Bias | Key Support | Resistance | Comment |

|---|---|---|---|---|

| Nifty 50 | Bullish | 25,850 | 26,240 | Momentum intact; expiry volatility high |

| Bank Nifty | Bullish | 57,900 | 58,900 | PSU banks driving index |

| Fin Nifty | Strong | 27,400 | 27,900 | Fresh high possible |

| Sensex | Bullish | 84,300 | 85,200 | Midcap catch-up rally expected |

🧩 Market Sentiment & Expiry Setup

The overall market tone remains constructively bullish, though expiry-related adjustments may cause intraday whipsaws.

- Put OI buildup: 25,800–25,900

- Call OI buildup: 26,200–26,300

This suggests a range-bound expiry between 25,850–26,250 zones unless a breakout triggers fresh momentum.

Volatility Index (India VIX) hovers around 12.85 — still manageable, hinting traders are optimistic for November series.

🧠 Conclusion: Trade Cautiously with Bias to Buy on Dips

As we step into the expiry day, the market remains broadly positive, but traders should be wary of profit booking near highs.

Focus should stay on quality breakouts and volume-backed setups like:

- YES Bank for short-term momentum

- Marico for option-based expiry play

- CESC and Paytm for positional long setups

Stay disciplined with defined stop losses and avoid chasing gaps in the opening hour.

📌 Key Takeaways:

- Nifty strong above 25,850; watch 26,200–26,240 for breakout.

- Bank Nifty range 57,900–58,900 with positive undertone.

- Global cues mixed; U.S. data may trigger intraday volatility.

- Expiry volatility high — trade with controlled leverage.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply