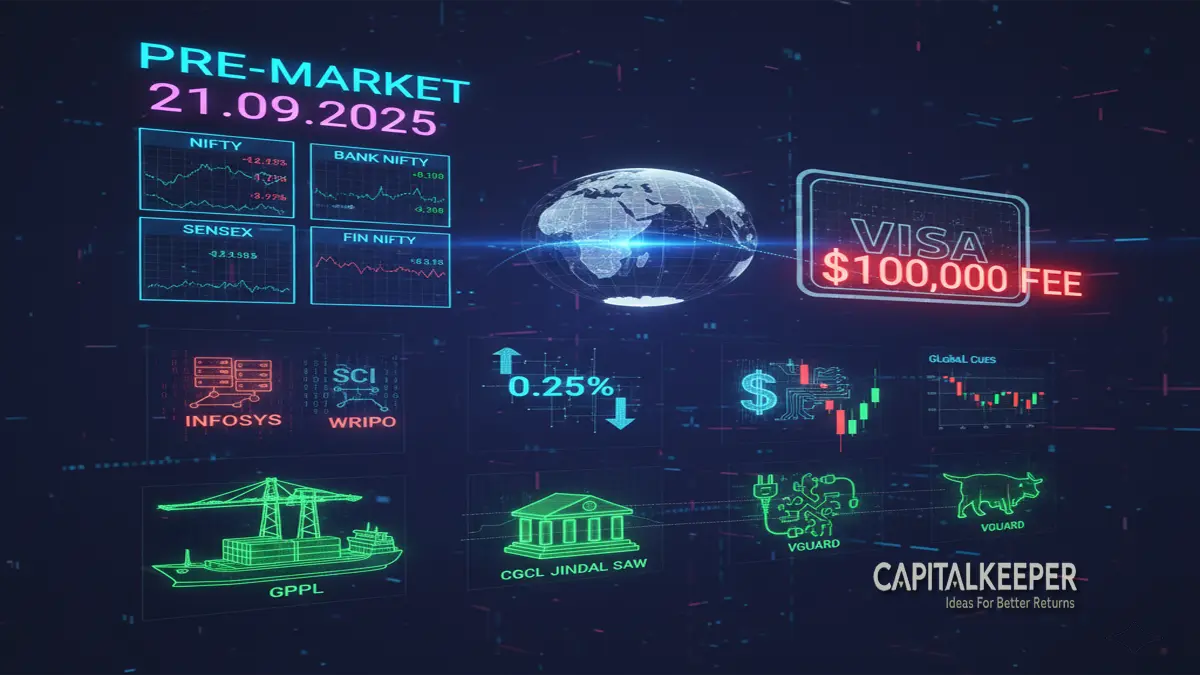

Pre-Market Report 22 Sept 2025 | Nifty, Bank Nifty, Sensex, Fin Nifty with Global Cues & H-1B Impact

By CapitalKeeper | Pre Market Opening | Indian Equities | Market Moves That Matter

📊 Pre-Market Report | 22nd September 2025 – Indian Stock Market Outlook

Indian stock market pre-market outlook for 22 Sept 2025: Nifty 25,327, Bank Nifty 55,459, Sensex 82,626, Fin Nifty 26,528. Gift Nifty trends, sector-wise cues, US H-1B visa shock impact on IT, and breakout stock ideas with targets & stop-loss.

🔹 Market Recap – 19th September 2025

On the last trading session, Indian indices closed slightly weak amid global uncertainties:

- Nifty 50: 25,327.05

- Bank Nifty: 55,458.85

- Sensex: 82,626.23

- Fin Nifty: 26,527.60

Volatility was elevated, led by global developments and IT sector drag. While PSU banks and infra counters managed resilience, IT stocks came under heavy selling pressure after the US announced fresh H-1B visa restrictions.

🌍 Global Market Cues

- US Markets: Dow Jones ended marginally higher, but Nasdaq slipped as IT sector underperformed following the H-1B shock.

- Federal Reserve: The recent 0.25% rate cut is still being digested; bond yields softened, boosting financials.

- Asian Markets: Mostly mixed; Nikkei traded flat, Hang Seng under pressure due to tech weakness.

- Gift Nifty: Trading around 25,350–25,400, indicating a mildly positive to flat opening for Indian equities.

🇺🇸 H-1B Visa Shock – What It Means for India 🇮🇳

In a surprise policy move, the US imposed a $100,000 fee on new H-1B visas (renewals remain unaffected).

🔎 Market Impact:

- IT Stocks Hit: Infosys, Wipro, and Tech Mahindra slipped 2–4%, reflecting immediate concerns on margins.

- Rising Sponsorship Costs: Sponsorship is now costlier than annual salaries of many Indian techies abroad.

- Shift to India: Firms may repatriate projects to India → boost offshoring business.

- Talent Ghar Wapsi: Many Indian professionals may return home, improving domestic talent pool.

- Nasscom Warning: Industry bodies flagged possible disruptions in US client delivery.

💡 Takeaway: Short-term sentiment negative, but long-term India’s domestic IT delivery model could strengthen.

📌 Sector-Wise Outlook

🔹 IT Sector

- Likely under pressure today after the H-1B shock.

- Infosys, Wipro, Tech Mahindra may see further selling, but medium-term valuations attractive if offshoring gains traction.

🔹 Banking & Financials

- Benefitting from Fed rate cut, bond yields easing.

- Private banks showing resilience; PSU banks continue to attract positional longs.

🔹 Infrastructure & Shipping

- Strong traction in SCI, GPPL, Jindal Saw reflecting bullish sentiment in logistics and infra.

- Government infra push remains a key support driver.

🔹 FMCG & Consumer Durables

- V-Guard and select mid-cap consumer names are showing bullish momentum with improving rural demand outlook.

📈 Technical View – Index Levels

- Nifty 50: Support at 25,180–25,200; Resistance at 25,500–25,600. A breakout above 25,600 may trigger fresh highs.

- Bank Nifty: Support at 55,100; Resistance at 56,200. Trend remains positive until 55,000 is held.

- Sensex: Range-bound between 82,000 – 83,500; bias positive.

- Fin Nifty: Key support at 26,400, resistance near 26,800–27,000.

Momentum indicators (RSI, MACD) suggest consolidation, but dip-buying remains the strategy.

🚀 Stocks to Keep on Radar

🔹 CGCL – CMP ₹190

- Breakout momentum visible.

- Target: 225 | Stop-loss: 175

🔹 GPPL – CMP ₹157

- Strong accumulation with shipping theme tailwinds.

- Target: 205 | Stop-loss: 147

🔹 Jindal Saw – CMP ₹212

- Trendline breakout with infra push.

- Target: 252 | Stop-loss: 194

🔹 SCI – CMP ₹220

- Benefiting from global shipping boom.

- Target: 265 | Stop-loss: 192

🔹 V-Guard – CMP ₹374

- Positive trend in consumer durables.

- Target: 430 | Stop-loss: 348

📝 Strategy for Traders

- Intraday: Expect flat-to-positive start; IT under pressure, but infra and shipping sectors may outperform.

- Swing Trades: Focus on SCI, GPPL, Jindal Saw, V-Guard for short-term momentum.

- Positional: Keep an eye on IT stocks on dips – valuations may become attractive after near-term correction.

📊 Conclusion

The 22nd September 2025 pre-market session is set against the backdrop of US H-1B visa policy shock. While IT may drag indices in the near term, infra, shipping, and consumer stocks provide support. Global cues remain mildly positive, and Gift Nifty indicates a stable opening.

👉 Traders should adopt a sector-rotation strategy – stay cautious on IT, but ride momentum in infra, shipping, and select mid-caps.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply