Pre-Market Report 10 December 2025: Global Cues, FII-DII Trend, Technical Setup & Key Stock Picks

Updated: 10 December 2025

Category: Pre Market | Market Analysis

By CapitalKeeper Research Desk

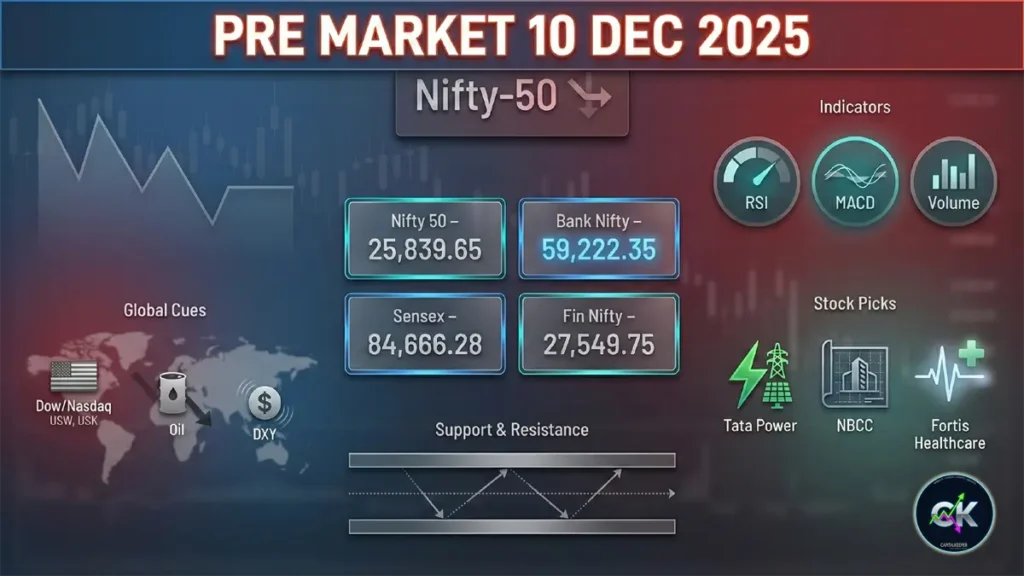

Indian Stock Market Pre-Market for 10 December 2025: Nifty closed at 25,839.65, Bank Nifty at 59,222.35, Sensex at 84,666.28, Fin Nifty at 27,549.75. Global cues mixed; FII sentiment weak. Detailed RSI–MACD–Volume analysis, support/resistance zones, and actionable stocks—Tata Power, NBCC, Fortis.

📍 Indian Stock Market Pre-Market Report – 10 December 2025

The Indian markets head into the session of 10 December 2025 after a volatile but crucial trading day that saw significant intraday swings across headline indices. Global signals continue to remain mixed, and domestic sentiment reflects caution from foreign participants, while domestic buying supports select pockets of strength. With Nifty slipping closer to the psychological 25,800 mark, traders are preparing for a session dominated by global triggers, options data alignment, and stock-specific momentum.

This detailed pre-market report covers India’s major indices, global market cues, currency moves, commodity influence, FII–DII activity, derivatives sentiment, and high-conviction stock ideas backed with RSI–MACD–Volume analysis.

This blog is structured in the preferred Google News format for clean indexing on CapitalKeeper.in.

🔹 Previous Close: Major Indices Snapshot (09 December 2025)

| Index | Previous Close |

|---|---|

| Nifty 50 | 25,839.65 |

| Bank Nifty | 59,222.35 |

| Sensex | 84,666.28 |

| Fin Nifty | 27,549.75 |

All four major indices ended with mild-to-moderate weakness as global risk appetite faded.

🌍 Global Market Overview

The global setup directly influences India’s opening bias. For 10 December 2025, signals are:

1️⃣ US Markets

The overnight session in the US moved sideways with a slightly downward tilt.

- Dow Jones: Flat to mildly negative

- Nasdaq: Selling in technology stocks

- S&P 500: Consolidation tone

Key Trigger:

Investors are awaiting inflation data due this week, which could determine the Federal Reserve’s next policy stance. Bond yields remained elevated, keeping risk assets under pressure.

2️⃣ European Markets

European stocks closed mixed as manufacturing numbers disappointed but services data displayed recovery.

- FTSE: Mildly higher

- DAX & CAC: Slight decline

3️⃣ Asian Markets (Early Session)

Asian markets opened weak this morning following the muted US close.

- Nikkei: Down

- Hang Seng: Under pressure due to tech selloff

- Kospi: Mildly negative

4️⃣ Currency & Commodity Cues

- Dollar Index (DXY): Above 104 levels; slightly strong

- USD/INR: Hovering around 84.15 – stable

- Crude Oil: Softening below $77; positive for India

- Gold: Marginal correction

Global cues collectively indicate a “cautious-to-weak” start for Indian equities.

📉 FII–DII Activity: What Smart Money Did

Foreign Institutional Investors (FIIs) continued to remain net sellers during the previous session. The risk-off tone in global equities is driving outflows from emerging markets.

- FIIs: Net Sellers

- DIIs: Strong Net Buyers

Domestic institutions are clearly absorbing supply and providing stability to Indian markets.

📊 Derivatives Setup: Nifty, Bank Nifty & Fin Nifty

Nifty Options Data

- Strong Call interest: 26,000 CE

- Heavy Put support: 25,500 PE

- PCR: Moderately stable

- Max Pain: Near 25,750

Interpretation:

The market remains range-bound with defined ceilings. Upside looks capped unless FIIs return with strength.

Bank Nifty Options Data

- Resistance visible at 59,800–60,000

- Support at 58,500

Bank Nifty is clearly consolidating.

Fin Nifty Options Data

Fin Nifty remains in a narrow band with domestic flows absorbing dips.

Major support: 27,300

📌 Key Levels for Today – 10 December 2025

Nifty 50

- Support: 25,720 / 25,580

- Resistance: 26,050 / 26,200

Momentum remains fragile; a gap-down open could test lower supports.

Bank Nifty

- Support: 58,850 / 58,500

- Resistance: 59,700 / 60,050

Sector remains range-bound with no dominant trend.

Fin Nifty

- Support: 27,350

- Resistance: 27,800

Stable compared to headline indices.

📌 Technical Analysis: RSI, MACD, Volume

Nifty Analysis

- RSI: Hovering near 48 → neutral to weak

- MACD: Bearish crossover continues → downside pressure

- Volume: Slightly higher on down-days → short-term weakness

- Price Action: Lower highs indicate sellers active at every bounce.

Bank Nifty Analysis

- RSI: 46 – weak but not oversold

- MACD: Flat/slightly negative

- Volume: No aggressive selling; consolidation pattern

- Conclusion: Breakout above 59,700 needed for strength.

Fin Nifty Analysis

- RSI: Near 52 → stable

- MACD: Slightly positive

- Volume: Consistent buying from DIIs

- Conclusion: Likely to outperform on dips.

⭐ Top Stocks to Watch – High Conviction Picks

1️⃣ BUY TATAPOWER @ 375

- Target: 430

- Stop-Loss: 350

Technical View:

- RSI above 55 indicating buildup of positive momentum

- MACD bullish crossover

- Strong volume accumulation visible for three consecutive sessions

- Price consistently making higher lows → short-term trend intact

Fundamental Angle:

Strong project pipeline, renewables expansion, and stable cash flows position Tata Power for medium-term upside.

2️⃣ BUY NBCC @ 108.35

- Target: 134

- Stop-Loss: 99

Technical Setup:

- RSI trending towards 60

- Volume breakout above 20-day average

- MACD trending upward

- Stock trading above key moving averages

Why This Matters:

NBCC benefits from government infra orders, redevelopment projects, and PSU catalysts.

3️⃣ BUY FORTIS @ 865.95

- Target: 1051

- Stop-Loss: 825

Technical Setup:

- RSI strong at 63

- MACD positive with expanding histogram

- Volume spike signals active institutional interest

Fundamental View:

Hospital occupancy growth, margin improvement, and expansion of premium services make Fortis structurally positive.

🧭 Market Outlook for 10 December 2025

Today’s session may begin on a cautious note due to global weakness. However:

- DII flows

- Crude oil softness

- Stable domestic earnings environment

…continue to support Indian equities on every meaningful dip.

Short-term traders should focus on stock-specific opportunities rather than broad index momentum.

📚 Internal Links

- Closing Bell Reports:

/closing-bell/ - Nifty & Bank Nifty Technical Zone:

/technical-analysis/ - Stock Picks & Strategies:

/stock-ideas/

❓ Frequently Asked Questions (FAQs)

1. Will the Indian market open lower on 10 December 2025?

Global cues indicate a soft start, but domestic buying may limit downside.

2. What are the strongest support levels for Nifty today?

Key supports are at 25,720 and 25,580.

3. Is Bank Nifty likely to break 60,000 soon?

Only if it sustains above 59,700 with strong volumes.

4. Are Tata Power, NBCC, and Fortis good short-term picks?

All three show strong technical patterns supported by volume and momentum.

5. Which sectors may outperform today?

Healthcare, power, and select PSU names look favourable.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in