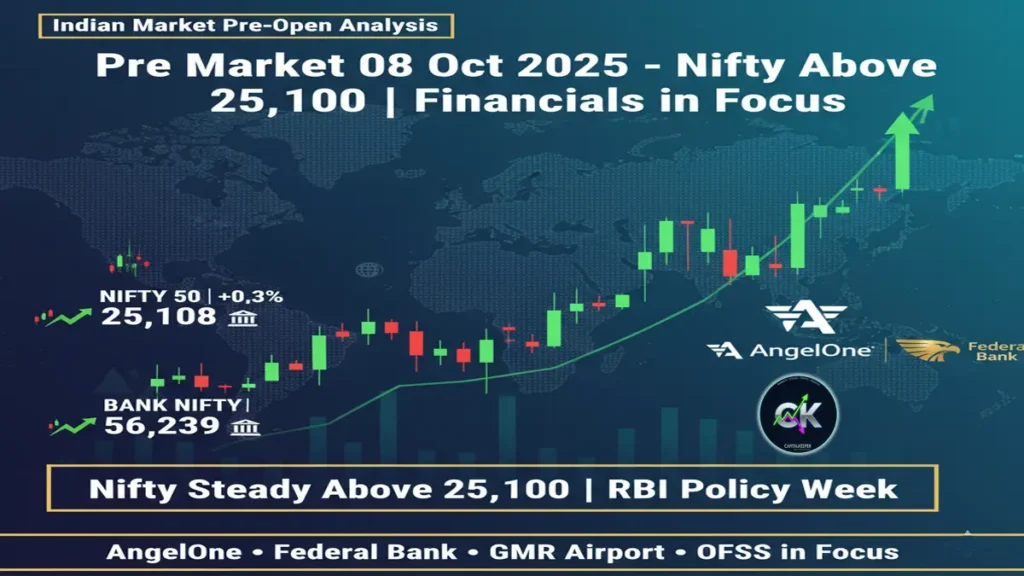

Pre Market Outlook 08 October 2025: Nifty Above 25,100, Financials Lead, PSU Banks & AngelOne in Focus

By CapitalKeeper | Pre Market Opening | Indian Equities | Market Moves That Matter

🌅 Pre-Market Analysis – 08 October 2025 | Indian Stock Market Overview

After a strong start to the week, the Indian stock market enters the 08th October 2025 session on a steady-to-bullish footing, supported by financial strength, PSU bank momentum, and stable global cues. The benchmark indices — Nifty at 25,108.30, Bank Nifty at 56,239.35, Sensex at 81,926.75, and Fin Nifty at 26,777.30 — all closed higher on Tuesday, continuing the bullish structure established last week.

Early trends from Gift Nifty suggest another positive start for domestic equities, with levels hovering near 25,160–25,180, signaling sustained buying interest from foreign and domestic institutions.

🌍 Global Market Snapshot

The global setup continues to support Indian equities:

- U.S. Markets: The Dow Jones and S&P 500 ended marginally higher amid declining bond yields and easing inflation fears. Tech and financial sectors outperformed, adding confidence to Asian sentiment.

- Europe: European indices remained firm as energy prices stabilized and ECB commentary hinted at a prolonged rate pause.

- Asia: Asian markets opened in green; Nikkei and Kospi gained nearly 0.3% each, while Hang Seng extended its recovery for the third consecutive session.

- Crude Oil: Brent around $82.5/barrel, providing comfort for India’s macro environment.

- US Dollar Index: Remains under 104, signaling no major forex headwinds for emerging markets.

📊 Conclusion: The overall global environment remains mildly risk-on, supporting the possibility of further upside in Indian equities.

💹 Gift Nifty Outlook

Gift Nifty (SGX) is trading near 25,160–25,180, indicating a gap-up to flat opening for Nifty 50.

Foreign Institutional Investors (FIIs) have shown consistent long build-up in index futures, while Domestic Institutional Investors (DIIs) continue to buy into dips — suggesting strong undercurrent support near 24,900.

📈 Indian Market Recap (07 October 2025 Closing)

| Index | Close | Daily Change | Sentiment |

|---|---|---|---|

| Nifty 50 | 25,108.30 | ▲ +31 pts | Mildly Bullish |

| Bank Nifty | 56,239.35 | ▲ +134 pts | Strong |

| Sensex | 81,926.75 | ▲ +136 pts | Positive |

| Fin Nifty | 26,777.30 | ▲ +65 pts | Bullish |

The indices consolidated near resistance but showed buying resilience on dips. Banking, financial services, and auto stocks were the key gainers, while selective profit booking was seen in IT and metals.

🧭 Nifty 50 – Technical Analysis

Nifty continues to form higher lows, maintaining a positive structure above 24,900 support.

Key Levels:

- Support: 24,880 – 24,720

- Resistance: 25,200 – 25,450

- Upside Target: 25,300+ if sustained above 25,150

- Downside Risk: Below 24,850 could trigger quick intraday dips.

Indicators:

- RSI: 61 – comfortably in bullish territory.

- MACD: Positive crossover maintained.

- Volume Profile: Fresh accumulation near 24,900–25,000 zones, indicating smart money buying.

🔹 Bias: Buy on dips till 24,880 holds; focus on high-volume breakouts in BFSI, PSU banks, and midcaps.

🏦 Bank Nifty – Technical Setup

The Bank Nifty remains the strongest pillar of the market, closing at 56,239, supported by heavyweights like ICICI Bank, Kotak Bank, and SBI.

Support: 55,750 – 55,400

Resistance: 56,500 – 56,950

- Sustaining above 56,500 could open doors for 57,000–57,300.

- PSU banks show renewed momentum — PNB, Bank of Baroda, and Union Bank are likely to stay active.

🔹 Bias: Bullish with “buy on dips” approach near 55,700–55,900.

🏭 Sector-Wise Pre-Market Setup

🔹 Banking & Financials (Positive)

Financials remain in control. Federal Bank, ICICI, and HDFC Bank continue to show volume-supported buying. Expect selective strength to continue ahead of the RBI policy outcome.

🔹 IT (Neutral to Weak)

IT stocks remain under pressure due to U.S. visa and margin concerns. OFSS shows speculative option activity but broader IT sentiment is soft.

🔹 Auto & Consumption (Stable)

The festive demand theme continues. Tata Motors, Hero MotoCorp, and Maruti could remain range-bound but biased upward.

🔹 Pharma (Selective Positive)

Mankind Pharma and Cipla continue to attract accumulation at lower levels — a good defensive bet in case of volatility.

🔹 Infra & PSU (Strong Bias)

Infra names like GMR Airports and PSU entities like BHEL and ONGC show momentum; expect continued buying on dips.

🔥 Stocks to Watch Today (Educational Purpose Only)

1️⃣ AngelOne (CMP ₹2,250)

- Setup: Bullish positional

- Buy 40% at CMP, add more near ₹2,150

- Stoploss: ₹2,000

- Targets: ₹2,700 / ₹2,900 / ₹3,100

- Strong breakout structure on weekly charts; momentum intact in financial tech space.

- #cash #positional

2️⃣ OFSS (Oracle Financial Services) – 9500 CE @ ₹230

- Stoploss: ₹150

- Target: ₹10,000 (in cash)

- Stable breakout continuation play; follow price with strict risk management.

3️⃣ Federal Bank (CMP ₹199.17)

- October expiry 200 CE @ ₹1.95

- Stoploss: ₹188 (in cash)

- Target: ₹200–₹208

- Momentum within the PSU and private bank space; could test round figure mark.

4️⃣ GMR Airports (CMP ₹89)

- 93 CE @ ₹1.10

- Cash Target: ₹93 / ₹97 / ₹102

- Capital Risk: ₹7,000 only.

- Positive derivative activity; steady OI buildup.

5️⃣ Trent 4500 PE @ ₹55

- Stoploss: ₹50

- Hedge idea for risk control; to be used only for risk-defined setups.

⚠️ Note: All setups are shared for educational analysis purposes. Not buy/sell recommendations.

🌐 Macro & Event Watch

- RBI Policy Outcome Tomorrow (09 Oct):

Market expects a status quo, but commentary on liquidity and inflation will be key for banking and NBFCs. - Crude Oil Trend:

Brent below $83 is a relief for OMCs and logistics players. - FII Flow:

Continued inflows into banking and PSU names strengthen domestic sentiment. - US Yields & Dollar Index:

Stability here is crucial; any sudden spike may induce short-term volatility.

🧭 Intraday & Swing Trading Scenarios

| Scenario | Action Plan | Expected Move |

|---|---|---|

| 1️⃣ Nifty holds 25,150+ | Long bias; add positions in financials | Upside 25,300–25,450 |

| 2️⃣ Nifty range 24,950–25,150 | Stock-specific trades only | Neutral |

| 3️⃣ Nifty slips below 24,850 | Profit-booking / minor pullback | Down to 24,700–24,600 |

📊 Technical Summary

| Index | Bias | Short-Term View | Strategy |

|---|---|---|---|

| Nifty 50 | Bullish | 24,900–25,450 | Buy on dips |

| Bank Nifty | Bullish | 55,700–56,950 | Accumulate banks |

| Sensex | Positive | 81,000–82,300 | Range-bound upward |

| Fin Nifty | Strong | Above 26,750 | Upside potential |

📅 Conclusion

The 08 October 2025 pre-market setup suggests a constructive and moderately bullish tone. Nifty’s ability to hold above 25,000 continues to reinforce strength, led by financials, PSU banks, and midcap momentum.

While short-term volatility may occur ahead of RBI commentary, the underlying structure remains strong with visible accumulation in major banking and infrastructure names.

Strategy: Continue with a Buy-on-Dips approach, stay long on financials & PSU themes, and manage risk via defined stop-losses.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in