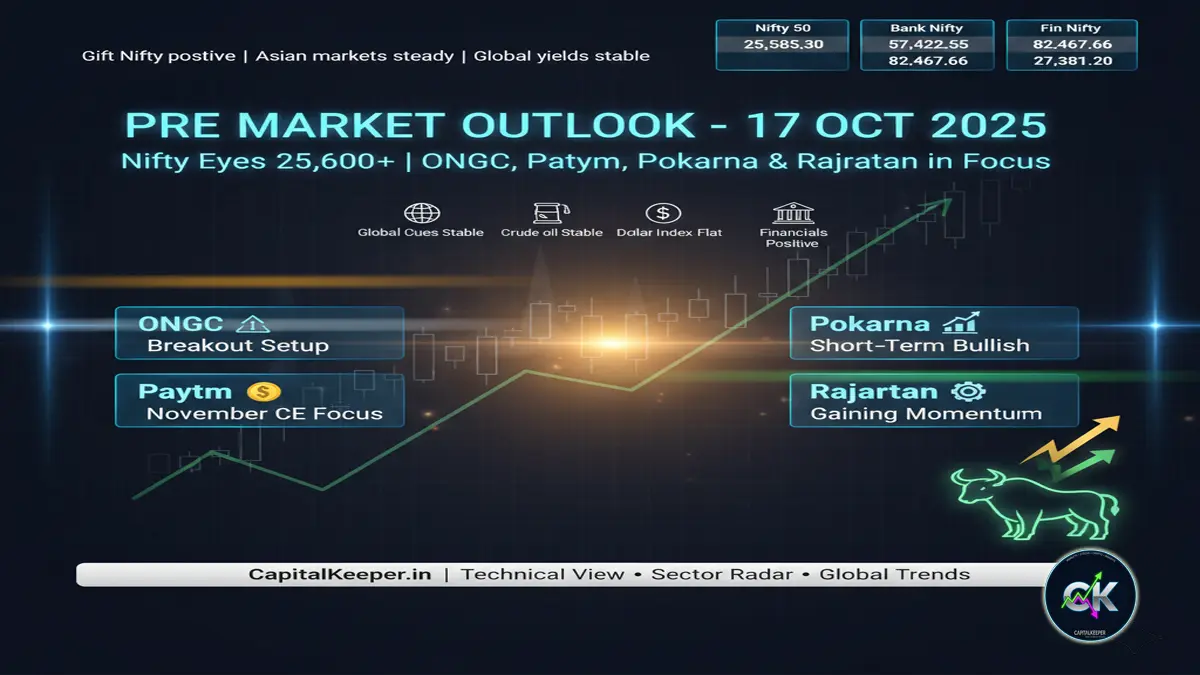

Pre Market 17 Oct 2025: Nifty Eyes 25,600+; ONGC, Paytm, Pokarna, and Rajratan on Traders’ Radar | Sector & Global Market Outlook

By CapitalKeeper | Pre Market Opening | Indian Equities | Market Moves That Matter

Indian stock market pre-open outlook for 17th Oct 2025 Nifty holds strong above 25,500, Bank Nifty leads with 57,400, while ONGC, Paytm, Pokarna, and Rajratan look active on charts. Check Gift Nifty cues, global trends, and key support-resistance zones before the bell.

Pre Market Report — 17 October 2025

Market Set for a Positive Start; Eyes on ONGC, Paytm, Pokarna, and Rajratan

The Indian equity market closed on a firm note on 16th October 2025, with benchmarks showing renewed strength led by financials, energy, and mid-cap plays. As we head into Friday’s trade (17th October 2025), early cues indicate a steady to positive opening, supported by stable global markets and strong domestic flows.

🔹 Market Snapshot (As of 16 Oct Close)

- Nifty 50: 25,585.30 ▲ (+1.0%)

- Bank Nifty: 57,422.55 ▲ (+1.1%)

- Sensex: 82,467.66 ▲ (+1.0%)

- Fin Nifty: 27,381.20 ▲ (+1.0%)

- Gift Nifty: Trading near 25,620, indicating a mildly positive opening tone.

The strong close above 25,500 indicates that bulls are regaining control, especially after two weeks of consolidation. The near-term outlook remains optimistic as long as Nifty holds above 25,400 on closing basis.

🌏 Global Market Cues

Global cues are largely neutral-to-positive, giving domestic markets some breathing space.

- Dow Jones: up 0.6%

- NASDAQ: higher by 0.8%, led by tech stocks

- Asian Markets: Nikkei and Hang Seng trading firm

- Brent Crude: steady around $83/bbl

- Dollar Index: near 104.75

- US 10-year yield: hovers around 4.6%

The moderation in yields and stable oil prices support emerging market sentiment, while global equities look balanced heading into the weekend.

📊 NIFTY Technical Overview

Nifty has once again tested the 25,500–25,600 zone, which remains a critical short-term hurdle.

However, a sustained breakout above 25,650 can open the door toward 25,800–26,000 in the coming sessions.

Support: 25,380 / 25,200

Resistance: 25,650 / 25,850

👉 Trend remains positive as long as the index stays above 25,300.

🏦 BANK NIFTY Technical View

Bank Nifty continues to outperform broader indices with a strong close at 57,422.55.

The momentum is being driven by private sector lenders like ICICI Bank and Kotak Bank, while PSU banks are adding rotational strength.

Key Levels:

- Support: 56,800 / 56,300

- Resistance: 57,650 / 58,200

A sustained move above 57,650 could trigger further short covering toward 58,200+.

💡 Stocks to Watch Today

1️⃣ ONGC – Call Option Trade Idea

- CMP: ₹250 CE @ ₹7 (November Series)

- Stop Loss: ₹4.5

- Target: ₹10.5 – ₹15

ONGC has been showing bullish reversal signs on daily charts with strong OI buildup on the call side. Crude stability adds support. Sustaining above ₹245 could propel the stock toward ₹260–₹270 range.

2️⃣ Paytm – Positional Option Setup

- 1300 CE @ ₹64–65 (November Series)

- Stop Loss: ₹50

The stock has formed a base near ₹1200 and now appears ready for a short-term reversal. A sustained move above ₹1300 can trigger momentum toward ₹1375–₹1420 zones.

3️⃣ Pokarna Ltd – Short-Term Radar Stock

- CMP: ₹764

Pokarna has given a breakout from consolidation with above-average volumes. The price structure indicates accumulation on dips. A move above ₹780 could invite buying interest for short-term gains up to ₹830–₹860.

4️⃣ Rajratan Global Wire – On Radar

- CMP: ₹325

Rajratan is seeing fresh momentum after long underperformance. Strong base around ₹310-₹315 with higher delivery data signals short-term potential. Watch for volume confirmation for a breakout toward ₹340–₹350.

📈 Sectoral Overview

🔸 Banking & Financials:

Continue to lead the recovery. Private banks like ICICI, HDFC Bank, and Axis Bank maintain strong technical structures, with PSU banks expected to see selective action.

🔸 Energy & Oil:

Supported by ONGC, HPCL, and BPCL, energy counters show stability amid sideways crude movement. Attractive levels for medium-term investors.

🔸 IT Sector:

Still mixed, with some profit booking visible after recent gains. Focus shifting to large caps like Infosys and TCS post earnings.

🔸 Midcaps & Smallcaps:

Momentum returning in midcap names such as Pokarna, Rajratan, and Minda Corp as traders rotate into short-term opportunities.

💬 Global and Domestic Drivers to Track

- Fed comments hinting at elevated valuations may keep global equities cautious.

- Rupee stability near 83/$ remains a key support for FII flows.

- Domestic macros remain robust: GST collections steady, inflation within RBI range.

Overall, liquidity-driven sentiment continues to support dips.

🧭 Trading Strategy for the Day

- Tone: Mildly bullish to range-bound.

- Approach: Buy-on-dips remains effective near key support zones.

- Avoid: Overleveraging at higher resistance areas (25,650+).

- Focus sectors: Energy, BFSI, Midcap breakout plays.

⚙️ Key Market Levels for 17 Oct 2025

| Index | Support | Resistance | View |

|---|---|---|---|

| Nifty 50 | 25,380 | 25,850 | Bullish bias |

| Bank Nifty | 56,800 | 58,200 | Outperformance likely |

| Sensex | 81,900 | 82,900 | Positive |

| Fin Nifty | 27,200 | 27,550 | Buy on dips |

📊 Conclusion

The Indian markets are positioned on a firm footing, supported by steady global cues, healthy domestic macros, and sector rotation in play.

Nifty above 25,500 keeps the short-term trend bullish, while Bank Nifty’s momentum adds conviction to the rally.

Stocks like ONGC, Paytm, Pokarna, and Rajratan are set to remain in focus for active traders, with potential for near-term moves backed by solid technical structures.

Stay nimble, trade with defined risk, and align with the trend — the market rewards patience and precision.

🧠 CapitalKeeper Insight:

“Strong support zones and disciplined trade setups define the day’s edge — avoid chasing rallies, position for structured breakouts.”

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

Subscribe Now , Join Telegram the Crypto Capital Club, Get Free Crypto Updates

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply