Opening Bell 15 Sept 2025: Nifty, Bank Nifty at Supply Zones, Metals & PSU Banks Breakout in Focus

By CapitalKeeper | Market Opening | Intraday Ideas | Market Moves That Matter

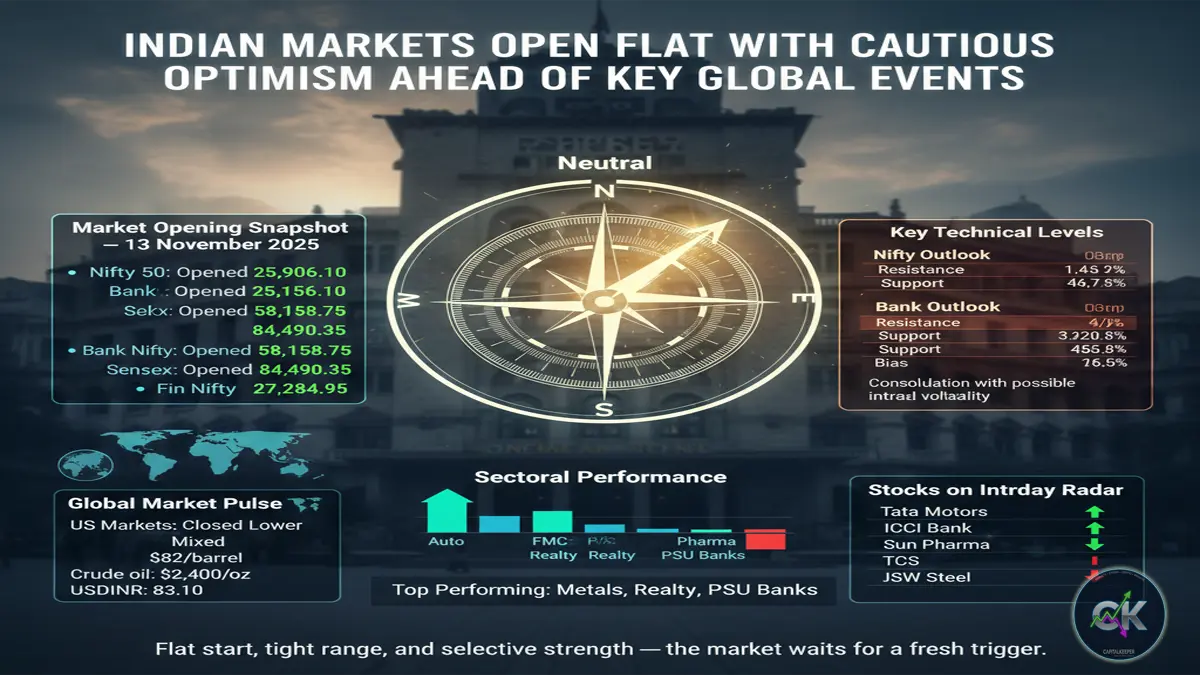

Indian Stock Market Opening Bell 15 Sept 2025 – Nifty faces 25200 resistance, Bank Nifty capped at 55000. Metals, Financials, and PSU Banks show breakout signals. Read full technical analysis with intraday picks and sector outlook.

Opening Bell: Indian Stock Market Outlook – 15th September 2025

Market Recap – 12th September 2025

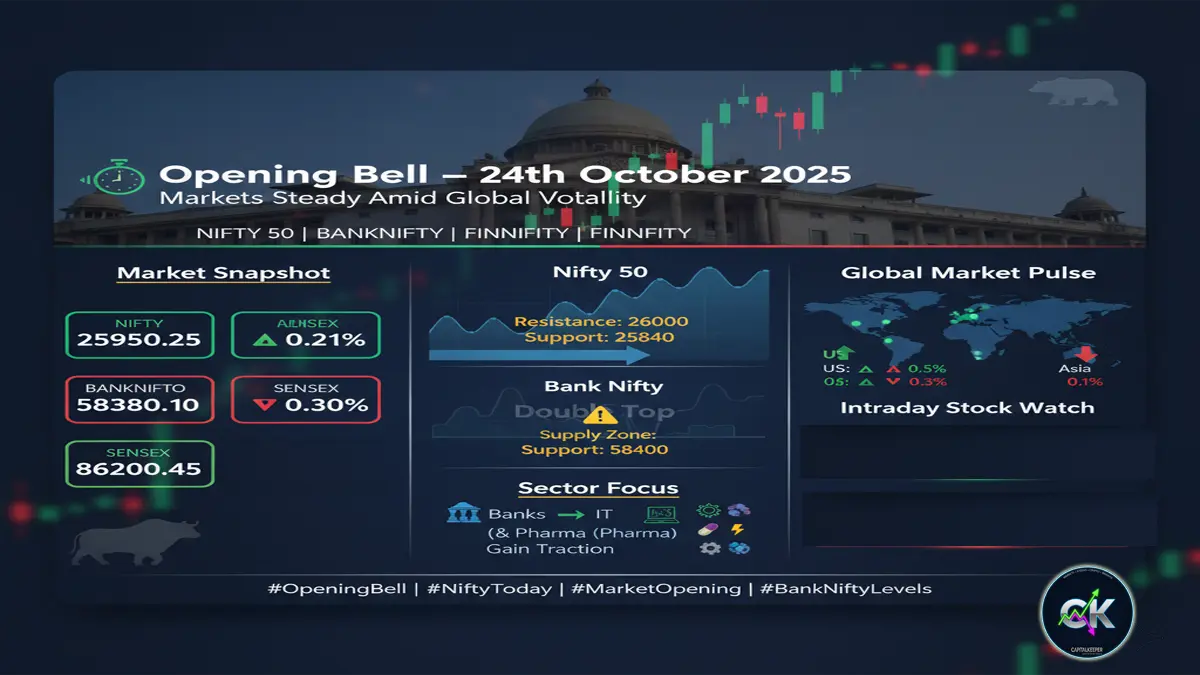

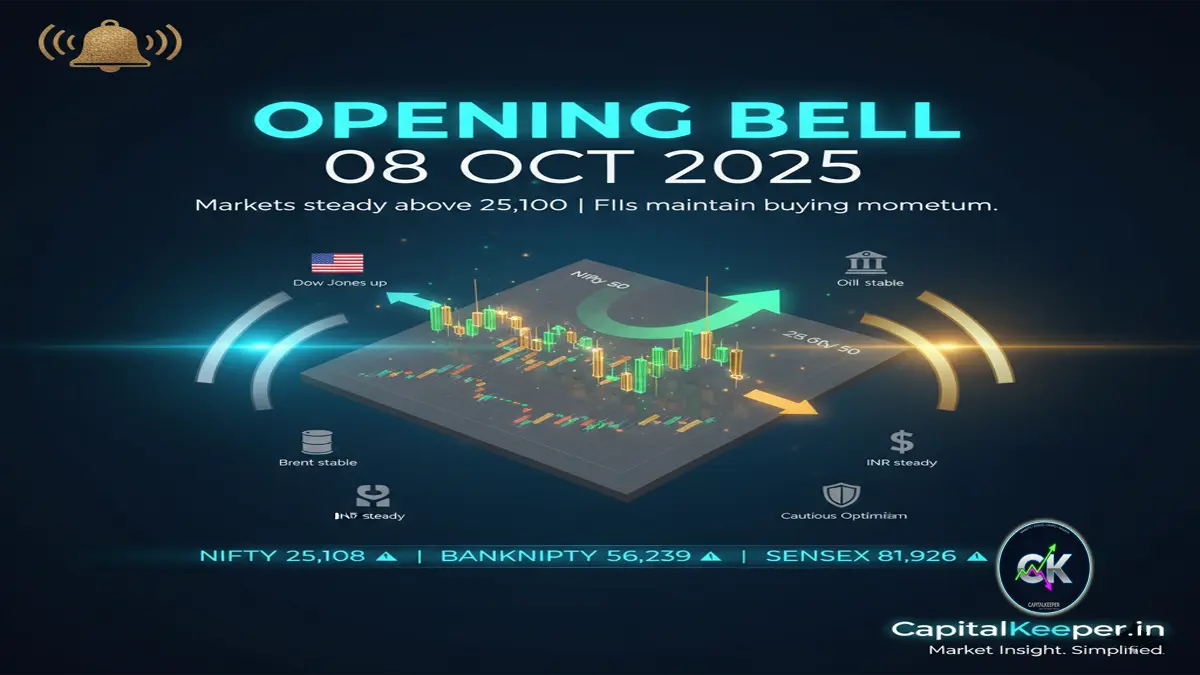

Indian equities closed the previous session with marginal gains, but the undertone remained cautious as benchmark indices reached their upper consolidation zones.

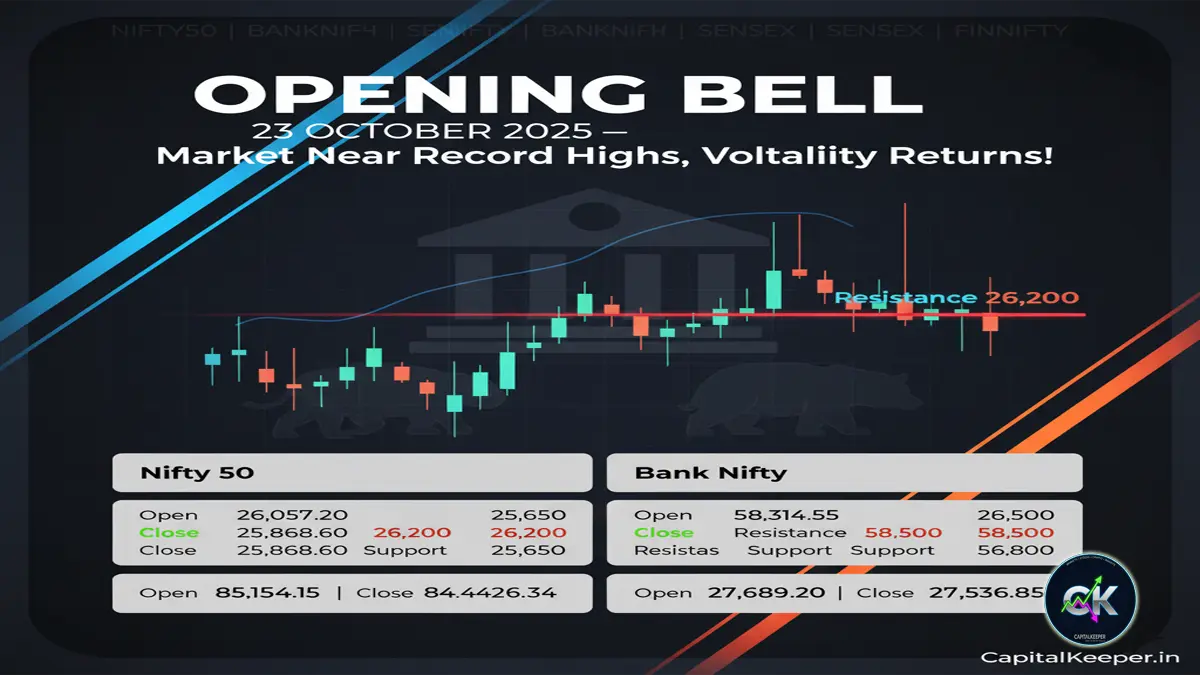

- Nifty 50 closed at 25,114.09 (open: 25,118.90).

- Bank Nifty closed at 54,809.39 (open: 54,884.05).

- Sensex ended at 81,904.70 (open: 81,925.51).

- Fin Nifty settled at 26,363.25 (open: 26,384.25).

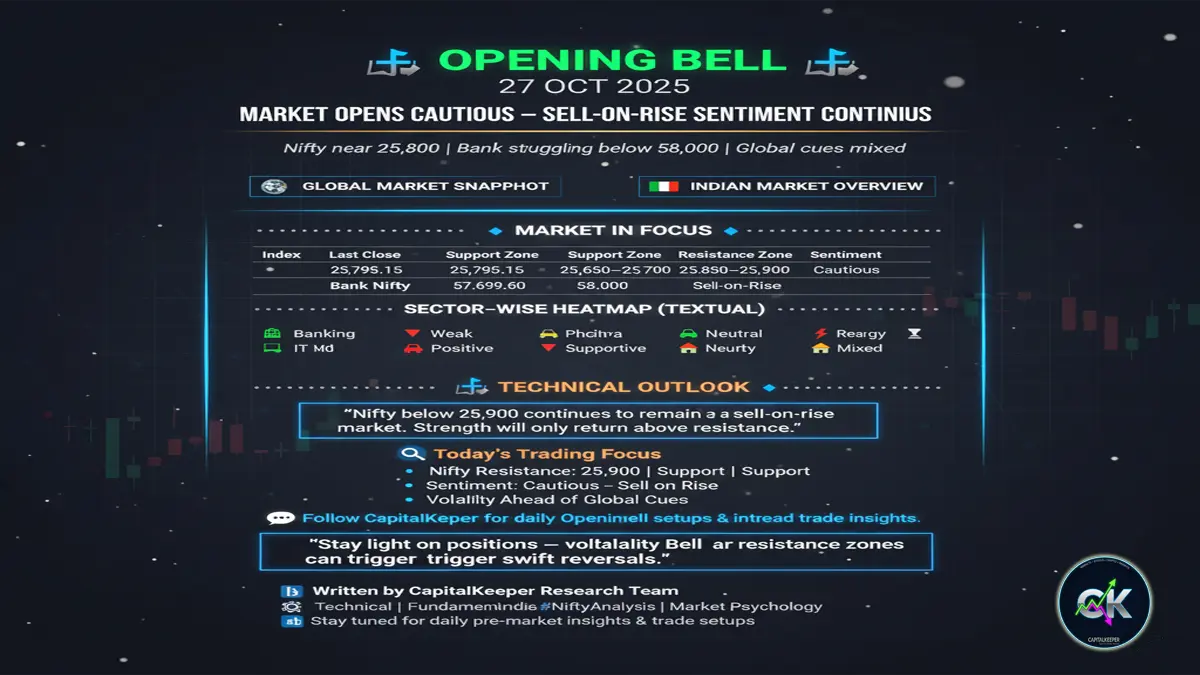

The markets continue to respect technical supply zones, with profit booking visible at higher levels. Today’s session holds special significance as Nifty once again approaches the 25,200 resistance zone, which has capped the index multiple times in the last four months.

Technical Outlook – Nifty 50

Nifty has been consolidating in a wide range between 24,350 and 25,200 for nearly four months. This makes the current level a make-or-break zone for traders.

- Upside Resistance: 25,200 – Strong supply zone, multiple rejections observed.

- Downside Support: 25,000 (immediate) → Below this, weakness may extend towards 24,800 and then 24,350.

📉 Trade Setup:

Given the overhead resistance, sell on rise remains a better strategy until Nifty posts a decisive breakout above 25,200 with heavy volumes. Profit booking is expected around these levels.

Technical Outlook – Bank Nifty

Bank Nifty mirrors the Nifty’s structure, consolidating within a tight range.

- Upside Resistance: 55,000 – strong supply zone.

- Downside Support: 54,500 → If this breaks, expect further weakness towards 54,200–54,000.

📉 Trade Setup:

Intraday traders should look for short positions near 55,000 resistance with a stop-loss above 55,200. Weakness below 54,500 may accelerate selling pressure.

Sectoral Highlights

🔹 Nifty Metals – Range Breakout Confirmed

- Support: 9,600–9,620.

- Target: 10,800–11,000.

- The metal index has broken out of its range and is sustaining at higher levels, indicating strong momentum.

- Stocks like Tata Steel, Hindalco, and JSW Steel may outperform.

🔹 Nifty Financial Services (CMP 26,345)

- Currently facing trendline resistance at 26,400–26,450.

- With a 36% weightage in Nifty 50, this index will play a crucial role in market direction.

- A breakout above 26,500 can flip market sentiment bullish and drag Nifty beyond 25,200.

- Key stocks: HDFC Bank, Bajaj Finance, ICICI Lombard.

🔹 Nifty PSU Banks (CMP 7,055)

- Support: 6,950–6,970.

- Resistance: 7,150 and 7,310.

- Trendline breakout and sustaining above support is a strong positive signal.

- Above 7,310 → expect a sharp rally, with downside limited to 6,700.

- Focal stocks: SBI, Bank of Baroda, Canara Bank.

Global Market Cues

- US Markets: Dow Jones and S&P 500 ended lower amid inflationary concerns and speculation around Fed rate policy. Nasdaq was slightly in the green due to tech strength.

- Asian Markets: Mixed, with Japan’s Nikkei gaining while Hang Seng and Shanghai Composite showed weakness.

- Crude Oil: Stable near $79 per barrel, but traders eye potential supply disruptions due to OPEC+ production cuts.

- INR: Hovering around 83.25 against USD, slightly pressured due to dollar strength.

Stock Radar for Intraday – 15th September 2025

- Tata Steel & Hindalco – Momentum from metals breakout; long positions favorable on dips.

- State Bank of India (SBIN) – Sustaining above ₹831 may trigger a move towards ₹860–880; support ₹816.

- TCS & Coforge – IT names showing relative strength; TCS above ₹3,138 targets ₹3,214–3,270; Coforge looks bullish above ₹1,755.

- RVNL & Texmaco Rail – Rail theme continues to attract volumes; RVNL above ₹344 with SL ₹331, Texrail above ₹147 with SL ₹140.

- Tata Chemicals (TATACHEM) – Breakout on daily charts with strong volume; supports at ₹950–960, upside targets ₹990–1,100++.

Sectoral Watchlist – Where to Focus Today

- Positive Bias: Metals, PSU Banks, IT, select financials.

- Cautious: FMCG, Export-heavy stocks (due to global trade uncertainties).

- Event in Focus: Reliance AGM – announcements in new energy, retail, and digital may swing the stock and influence indices.

Conclusion

The Opening Bell on 15th September 2025 begins with Nifty once again at the upper end of its consolidation band near 25,200. While the short-term setup favors profit booking and sell on rise, sectors like Metals and PSU Banks are showing strong breakout signals.

Investors and traders should keep a close watch on Financial Services Index at 26,500 – a decisive move above this can flip Nifty’s sentiment bullish and potentially drive a breakout above 25,200. Until then, the broader strategy remains cautious and selective with focus on breakout sectors.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply