Volatile Day Expected | PSU Banks & Pharma in Focus

By CapitalKeeper | Nifty & Bank Nifty | Indian Equities | Market Moves That Matter

CapitalKeeper Market Pulse – 03 July 2025

Market Sentiment Snapshot:

As the week progresses, today’s trade setup signals mild caution with selective bullishness. FII index long positions have dropped to 33% (from 37%), indicating some unwinding, while Nifty and Bank Nifty PCRs are softening, which reflects reduced optimism in options data. However, India VIX remains stable at 12.44, down 0.64%, suggesting calmness in volatility.

🔔 Global Influence:

US markets will observe a half-day today and remain closed tomorrow (04 July) for Independence Day, which may lead to low participation and range-bound trades in the second half of the session.

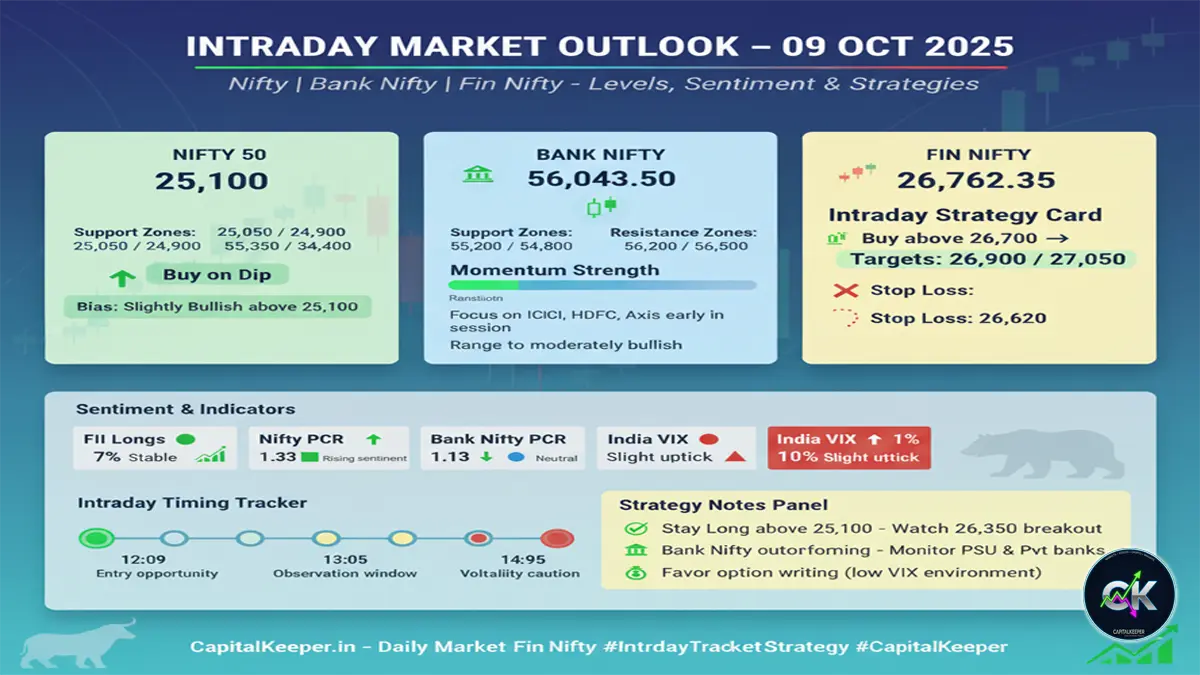

🕒 Important Intraday Timings to Watch:

- 12:57 PM – Possible trend shift or breakout

- 1:29 PM – Volatility spike or trend continuation

- 2:28 PM – Profit booking or reversal zone

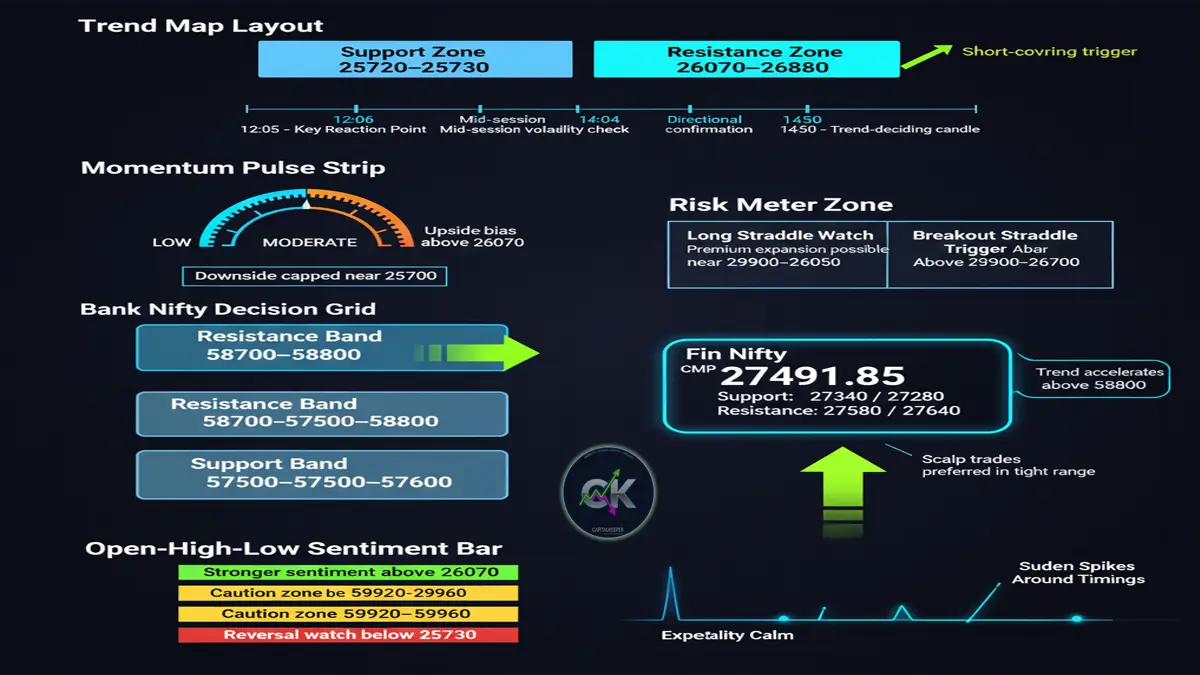

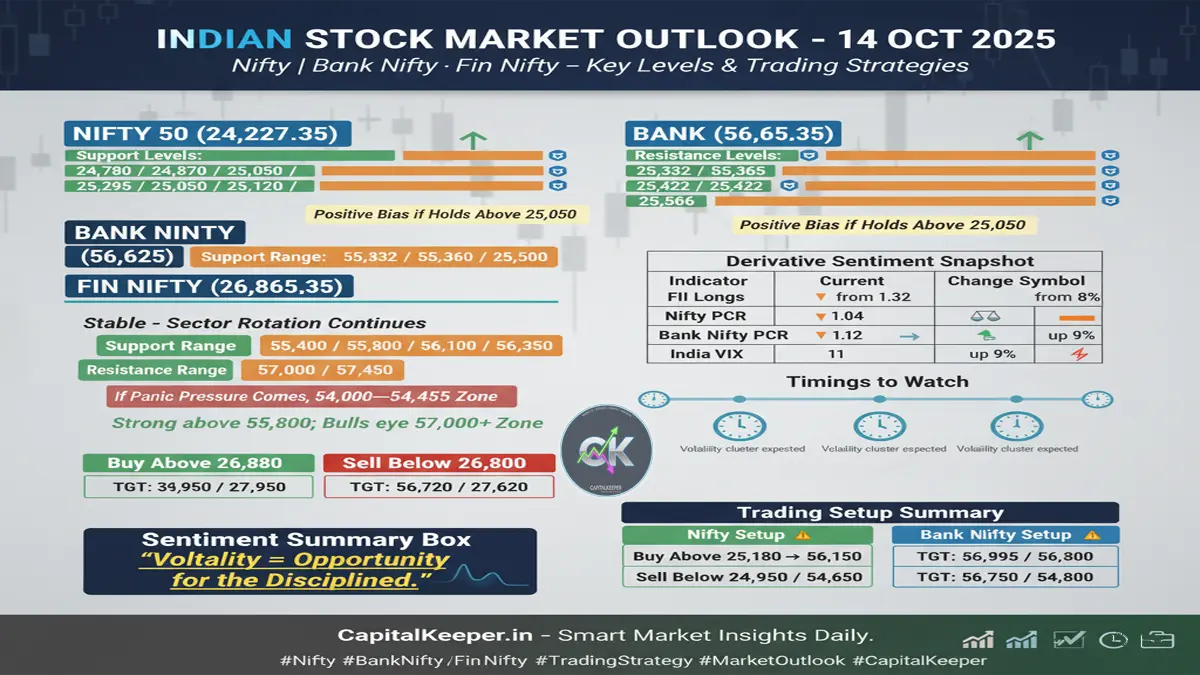

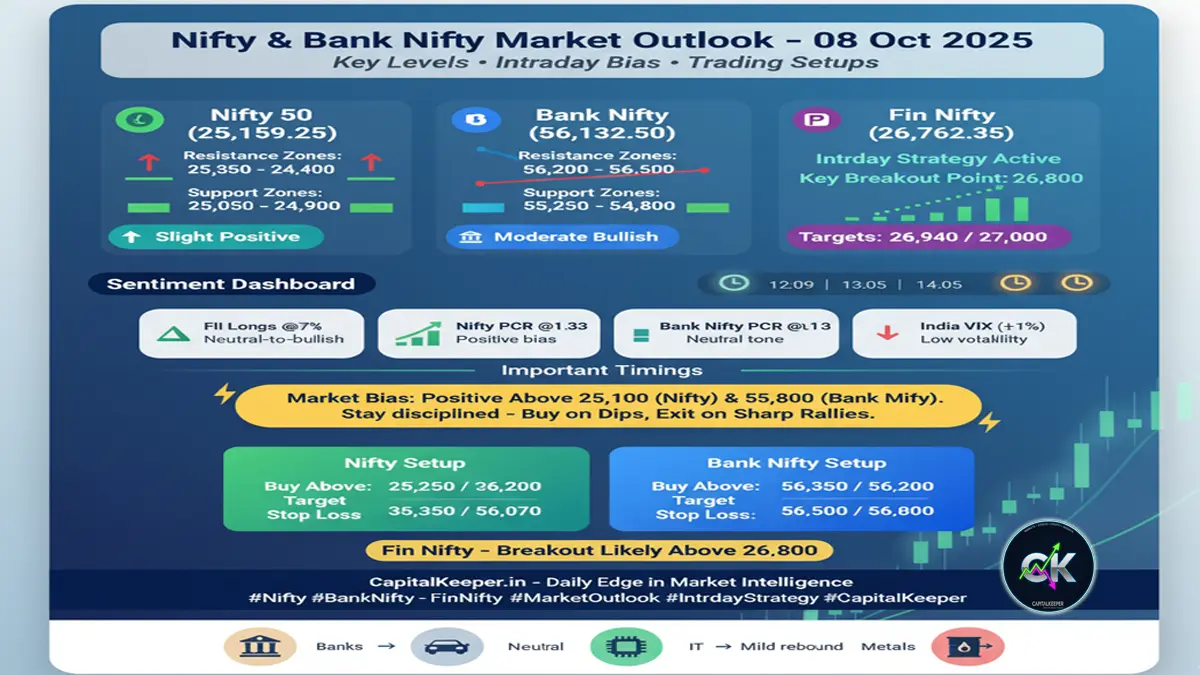

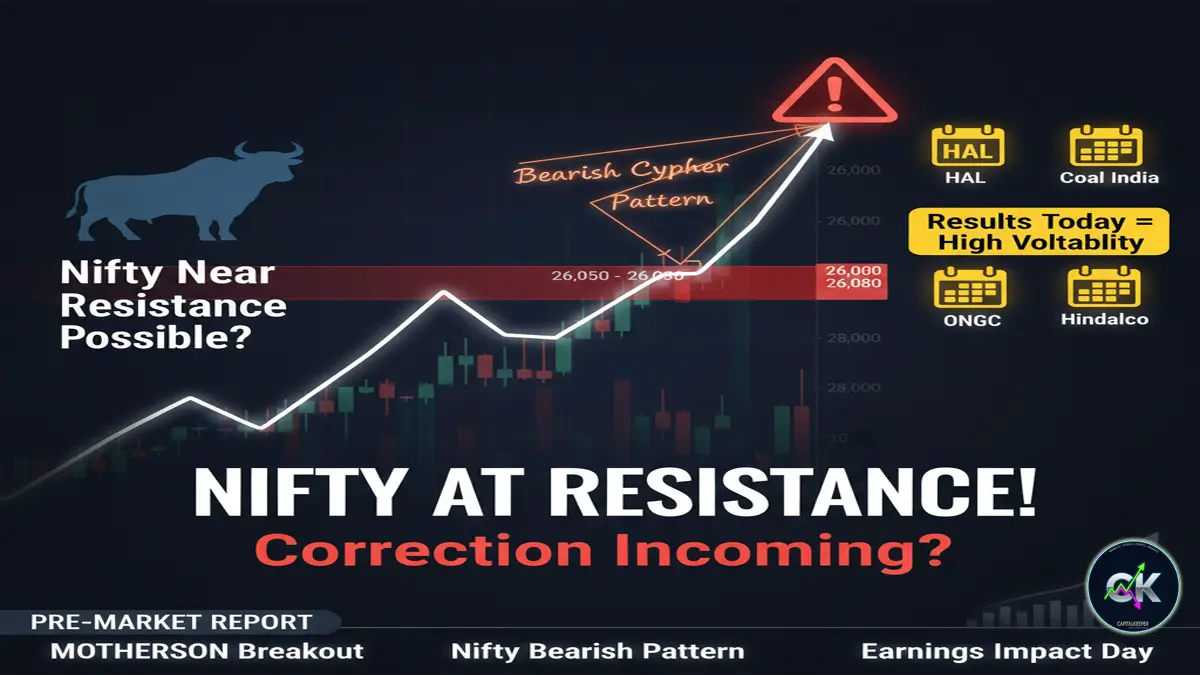

Nifty 50 – Technical Levels:

- Current Price: 25,453.40

- 📉 Supports: 25,185 / 25,215 / 25,350 / 25,440

- 📈 Resistances: 25,605 / 25,680 / 25,725 / 25,785 / 25,845

- 📌 View:

Remain cautious below 25,380. Strength only above 25,725–25,785. A breakout may head toward 25,845+

🏦 Bank Nifty – Technical Levels:

- Current Price: 56,999.20

- 📉 Supports: 55,800 / 56,100 / 56,400 / 56,700 / 56,805

- 📈 Resistances: 57,210 / 57,300 / 57,450 / 57,600 / 57,840 / 58,065 / 58,200

- 📌 View:

Watch for bounce near 56,805. Upside momentum possible above 57,300

Sectoral Trends for Intraday:

🚀 Booming Today:

- PSU Banks – SBI, Bank of Baroda, Union Bank look strong on intraday charts

- Pharma – Sun Pharma, Cipla, and Divi’s Labs could lead defensive rally

- Metals – Watch Tata Steel, Hindalco, and SAIL for momentum trades

⚖️ Mixed Trend Zones:

- Auto: Stock-specific strength (watch M&M, Tata Motors)

- Financial Services: Select NBFCs and insurance players showing mild recovery

Fin Nifty Key Levels:

- 📌 Current Price: 27,415.75 (approximate based on trend)

- 📉 Supports:

27,100 / 27,220 / 27,300 / 27,365 - 📈 Resistances:

27,520 / 27,640 / 27,780 / 27,950

🔎 Trade Bias:

✅ Above 27,520: Scope for a rally toward 27,780–27,950

❌ Below 27,220: May trigger profit booking down to 27,100

📊 What’s Fueling the Move?

🔹 PSU Banks (Strong):

- Names like SBI, BOB, and PNB are leading intraday strength in Fin Nifty

- Supported by increased government capex and stable credit growth outlook

🔹 NBFCs & Broking Stocks:

- M&M Finance, LIC Housing Finance showing range-bound trade

- ICICI Securities, Angel One on watch — volatile but no directional bias yet

🔹 Insurance & AMCs:

- Mild accumulation in HDFC Life, SBI Life, and Nippon AMC

- Sector rotation expected later in the week

Trading Plan:

- 📍 Above 27,520: Look for intraday upside in financial leaders

- 📍 Below 27,220: Avoid longs, look for quick dips or scalps

- Use trailing stoploss and respect reversal timings

Trading Strategy:

- Avoid overtrading near resistance levels

- Use trailing stoplosses around 12:57 PM and 2:28 PM, which may act as turning points

- Focus on sector leaders in PSU Banks, Pharma, and Metals for quick intraday gains

- Expect lower volatility post-1:30 PM due to US market’s early close

⚠️ Risk Management Reminder:

🚫 This blog is for educational analysis only.

✅ Please consult your SEBI-registered financial advisor before trading.

🔐 Always use proper risk-reward and trailing stoplosses

💡 Booking profits quickly is key during mixed market sentiment

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Leave a Reply