Nifty & Bank Nifty Technical Outlook Today – Key Levels, Sector Moves & Volatility Zones (01 July 2025)

By CapitalKeeper | Nifty & Bank Nifty | Indian Equities | Market Moves That Matter

CapitalKeeper Market Pulse – 01 July 2025

🔔 Opening Sentiment:

Markets opened on a cautious note as FII long positions dipped slightly to 36% (from 38%) and India VIX spiked by 3.78% to 12.78, indicating higher intraday volatility expectations. With July kicking off and a new monthly cycle in derivatives, traders are advised to keep tight stoplosses and book profits quickly.

🔍 Key Data Snapshot:

- FII Index Long Positions: 36% (Down from 38%)

- Nifty PCR: 0.81 (Down from 1.25) – Bearish Bias

- Bank Nifty PCR: 1.08 (Slightly down from 1.13) – Neutral Bias

- India VIX: 12.78 (Up by 3.78%) – Spike indicates uncertainty

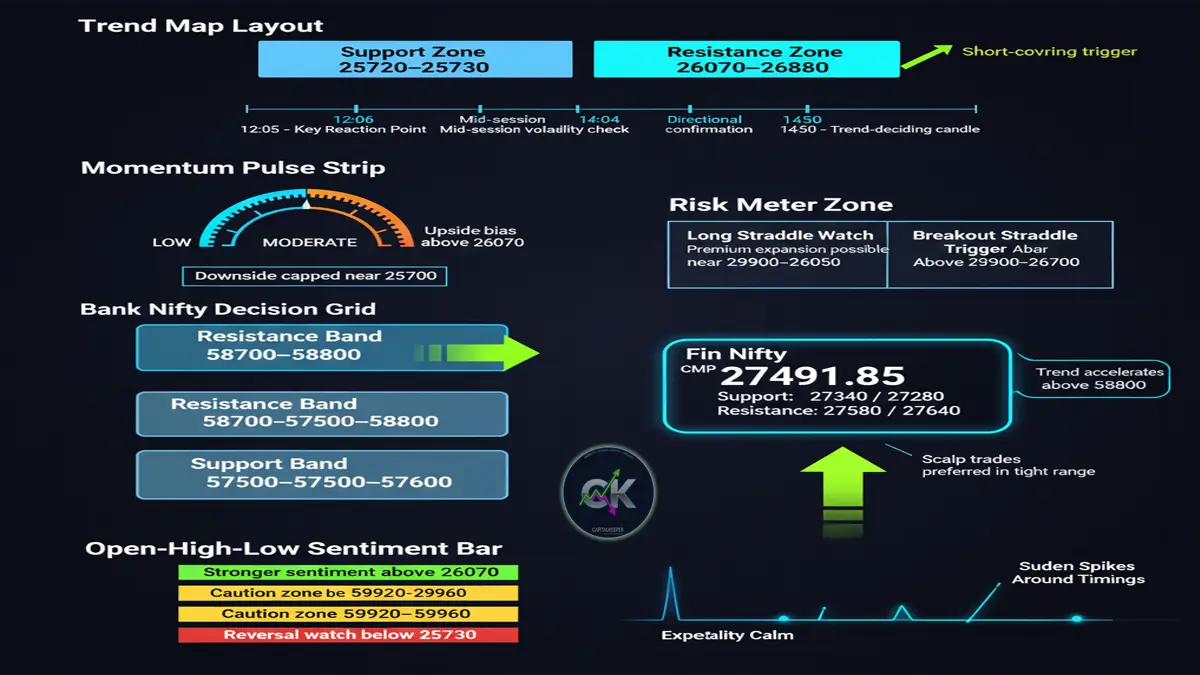

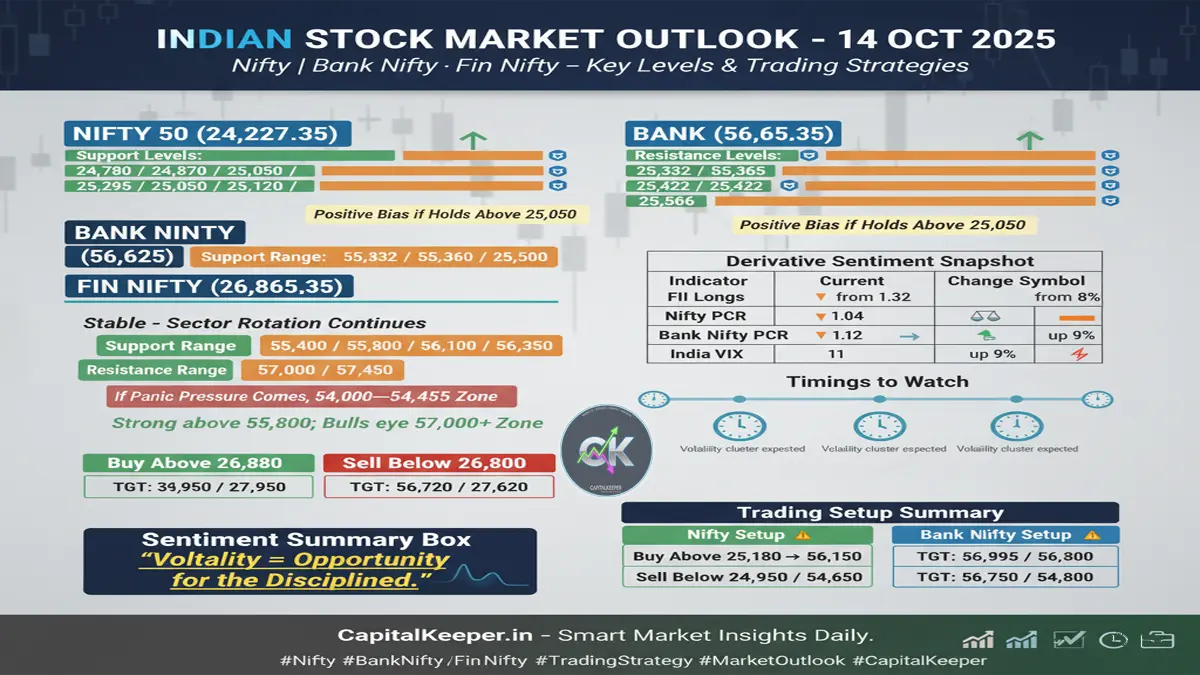

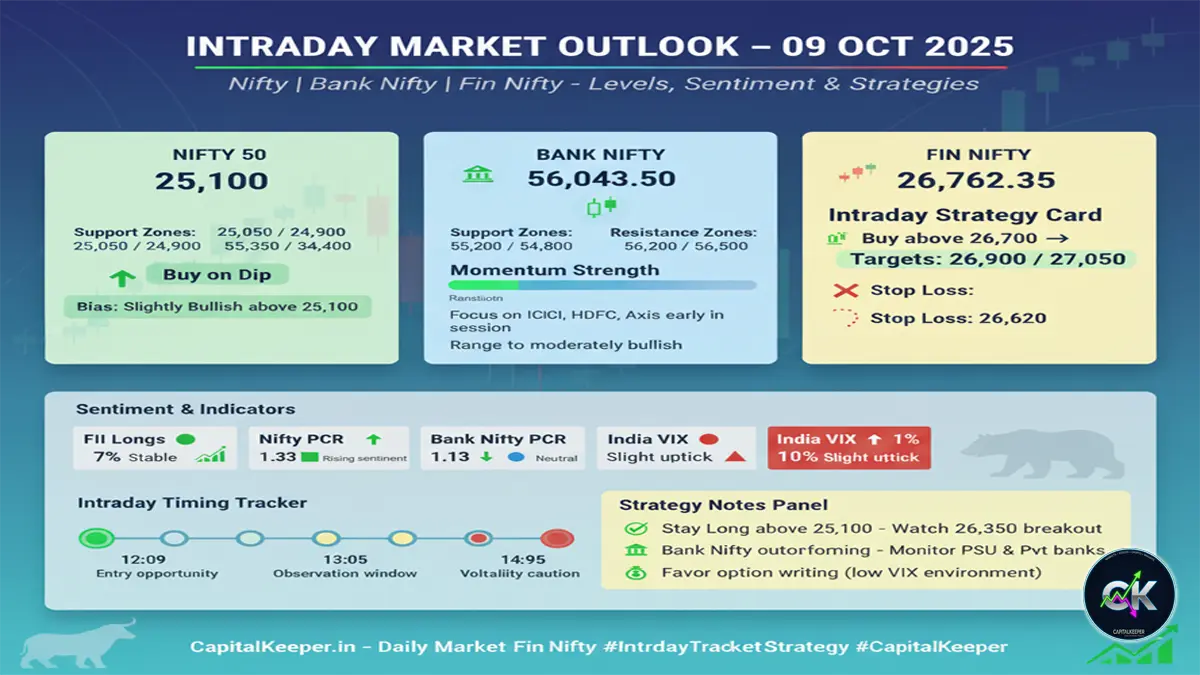

📈 NIFTY 50 – Technical Levels

- Current Price: 25,517.05

- 🔻 Supports: 25,185 / 25,215 / 25,350 / 25,440

- 🔺 Resistances: 25,605 / 25,680 / 25,725 / 25,785 / 25,845

📌 View: Stay cautious below 25,300. A breakout above 25,785 could trigger a strong upside move toward 25,845+.

🏦 BANK NIFTY – Technical Levels

- Current Price: 57,312.75

- 🔻 Supports: 55,800 / 56,100 / 56,400 / 56,700 / 56,940 / 57,030

- 🔺 Resistances: 57,465 / 57,600 / 57,840 / 58,065 / 58,200

📌 View: Holding above 57,030 may keep momentum intact; however, a break below could pull it back to 56,700.

🔁 Important Intraday Timings:

- 10:27 AM: Bullish impulse watch (💚)

- 10:59 AM: Mixed move zone

- 12:00 PM: Likely volatility in Banking/Finance stocks

- 1:06 PM, 2:05 PM, 2:55 PM: Reversal or breakout zones

🧭 Sectoral Outlook:

- Banking & Financial Services:

- Expect stock-specific movements; HDFC Bank, ICICI Bank, and SBI under watch.

- NBFCs like Bajaj Finance and M&M Finance could see volatility near noon.

- Metals:

- Mixed sentiment continues. Monitor Tata Steel and JSW Steel for intraday trades.

- FMCG:

- Mild upmove possible. Britannia, Hindustan Unilever may see steady buying.

⚠️ Trading Strategy:

- Buy on dips near key support zones if market holds above 25,300 (Nifty) and 57,030 (Bank Nifty).

- Use trailing stoploss for intraday trades.

- Book profits near resistance zones and avoid over-leveraging during VIX spikes.

Fin Nifty Technical Snapshot

- Current Price: ~27,364.35 (estimate based on trend; update with live quote)

- 📉 Support Zones:

26,950 / 27,100 / 27,220 / 27,300 - 📈 Resistance Zones:

27,450 / 27,580 / 27,725 / 27,880

🔎 View: Holding above 27,220 can attract buying interest; however, a break below 27,100 may lead to sharp intraday dips.

🔦 Stock-specific Focus:

- Private Banks:

- HDFC Bank, Axis Bank may show range-bound moves.

- Avoid longs if Fin Nifty fails to hold above 27,220.

- NBFCs & Broking Stocks:

- Bajaj Finance, Chola Finance, IIFL may remain volatile; use quick entries & exits.

- Insurance Stocks:

- HDFC Life, ICICI Lombard remain sideways; avoid fresh longs unless volumes spike.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Leave a Reply