Nifty & Bank Nifty Outlook Today: FII Longs Jump, Market Eyes Breakout – 27 June 2025

By CapitalKeeper | Nifty & Bank Nifty | Indian Equities | Market Moves That Matter

CapitalKeeper Market Pulse – 27 June 2025

Massive FII Long Build-Up Signals Strength – All Eyes on Nifty 25,620+

The Indian market is witnessing a strong bullish shift post-expiry, with FII Index long positions jumping from 23% to a hefty 38%, indicating institutional conviction. Add to that a fall in India VIX to 12.59 (down 3%), and the setup looks ripe for momentum continuation—if Nifty holds above 25,300 and breaks 25,620+.

However, selective caution is advised, especially in Midcap 100/Smallcap 100, as valuations remain stretched. Private Banks, Autos, and Financials are likely to remain in focus.

🔍 Market Sentiment Dashboard – 27 June 2025

| Indicator | Value | Interpretation |

|---|---|---|

| FII Longs | 38% (↑ from 23%) | Strong Institutional Interest |

| Nifty PCR | 1.29 (↑ from 1.13) | Strong Put Writing – Bullish |

| Bank Nifty PCR | 1.14 (↑ from 0.99) | Healthy sentiment |

| India VIX | 12.59 (↓ 3%) | Complacency Risk – Watch for fakeouts |

| Overall View | Bullish with selective caution | Buy on dips with trailing SL |

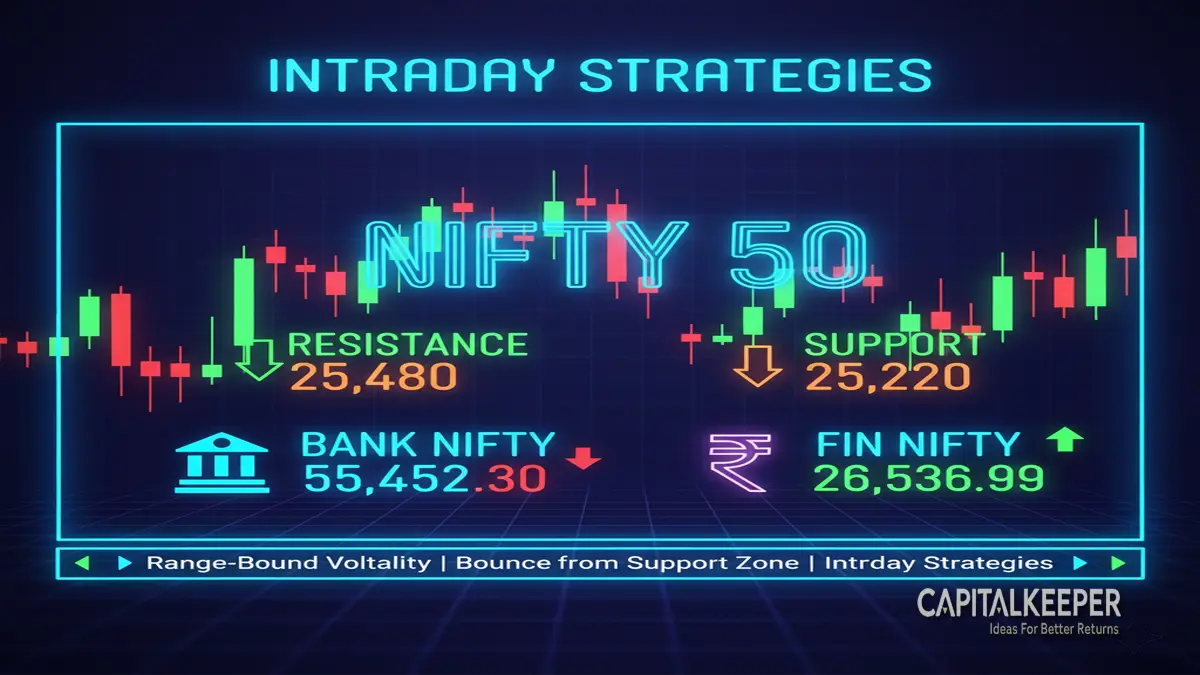

🔐 Nifty 50 – Technical Levels

📍 CMP: 25,549.00

🔻 Support Zones:

- 25,440 / 25,350 – First-line expiry supports

- 25,215 / 25,185 / 25,120 – Strong base support

- ⚠️ Caution if Nifty sustains below 25,300

🔺 Resistance Zones:

- 25,620 / 25,680 / 25,725 / 25,785 / 25,845

📈 A strong close above 25,680–25,725 may lead to explosive upside toward 25,845+.

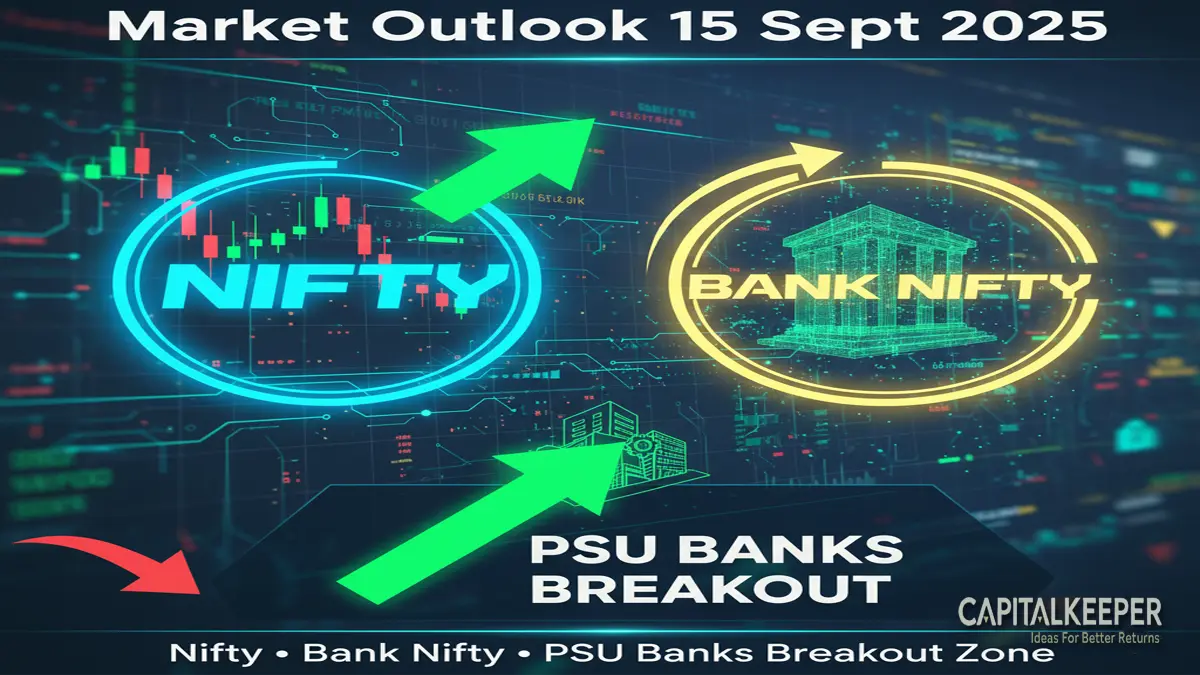

🏦 Bank Nifty – Technical Outlook

📍 CMP: 57,206.70

🔻 Support Zones:

- 57,030 / 56,940 / 56,700 / 56,400 / 56,100 / 55,800

🔺 Resistance Zones:

- 57,300 / 57,450 / 57,600 / 57,840 / 58,065

📈 Private banks driving momentum. Watch for follow-through above 57,450.

🏭 Sectors in Focus Today

| Sector | View | Action Plan |

|---|---|---|

| Nifty / Bank Nifty (PVT Banks) | Bullish | Momentum continuation likely |

| Energy & Power | Bullish | NTPC, PowerGrid holding strength |

| Midcap/Smallcap 100 | Cautious | Avoid overbought names |

| Financial Services | Buy on dips | Trailing profits on strength |

| OMCs (HPCL, BPCL, IOC) | Bullish | Volume + delivery seen |

| Auto Sector 🚀 | Buzzing | Watch Tata Motors, TVS, Hero for trades |

⏰ Intraday Timing Alerts – 27 June

- 🕐 12:57 PM – 🔺 Major move timing

- 🕐 1:20 PM – Trend continuation/failure

- 🕐 1:56 PM – Reversal or spike zone

- 🕓 2:55 PM – Exit/profit booking signal

Use with 15-min candles + VWAP confluence for scalping or expiry trades.

🎯 CapitalKeeper Strategy View

- ✅ Nifty Long above 25,620, add above 25,725 for 25,845 target

- ✅ Bank Nifty above 57,300, target zone: 57,840–58,065

- 🔁 Sideways consolidation likely till breakout confirmed

- ❌ Avoid aggressive longs if Nifty breaks 25,300 or Bank Nifty breaks 56,700

- 📈 Auto, OMCs, and Private Banks offer the best risk-reward

✍️ By CapitalKeeper – India’s Fastest-Growing Financial Research Hub

🌐 www.CapitalKeeper.in | Live Levels | Technical Blogs | Sectoral Reports

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Leave a Reply