By CapitalKeeper | Nifty & Bank Nifty | Indian Equities | Market Moves That Matter

🎯 Will Nifty Cross 25270 and Trigger a Blasting Move? Or Will a Breakdown Below 25030 Spoil the Party?

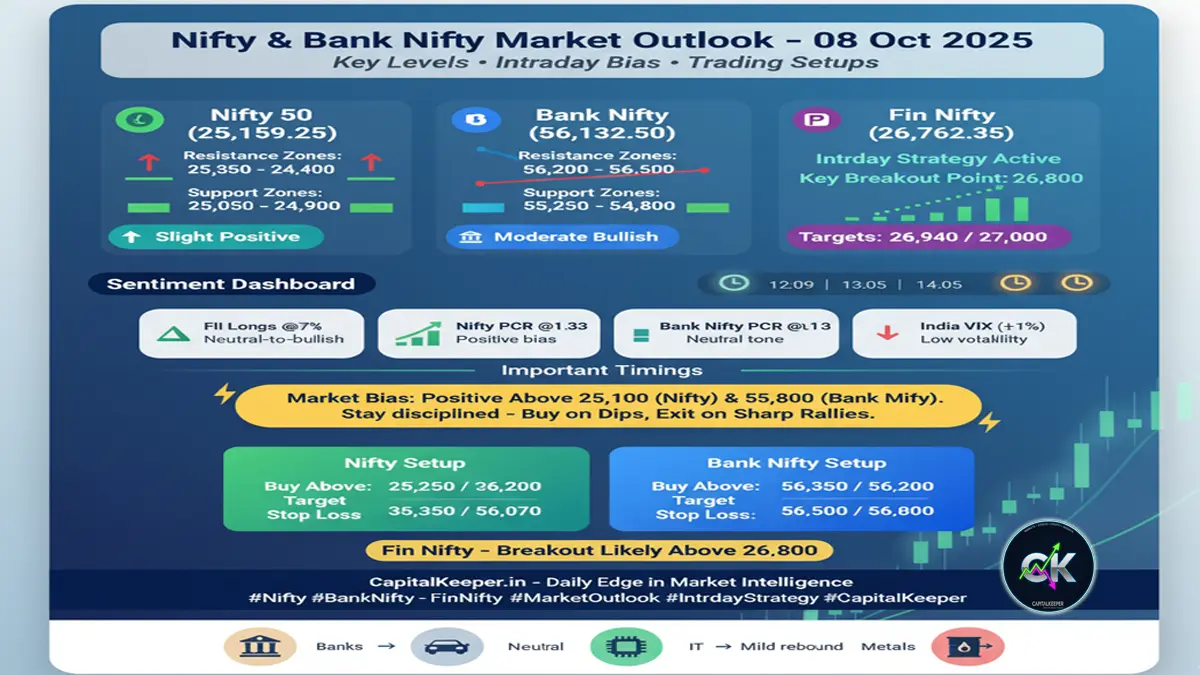

As the Indian market moves into weekly expiry, traders and investors are eyeing critical levels on Nifty and Bank Nifty. Both indices are trapped in narrow ranges, but technical setups suggest that a decisive move is around the corner.

Let’s decode today’s data-driven signals and how they may impact broader indices and sectoral plays.

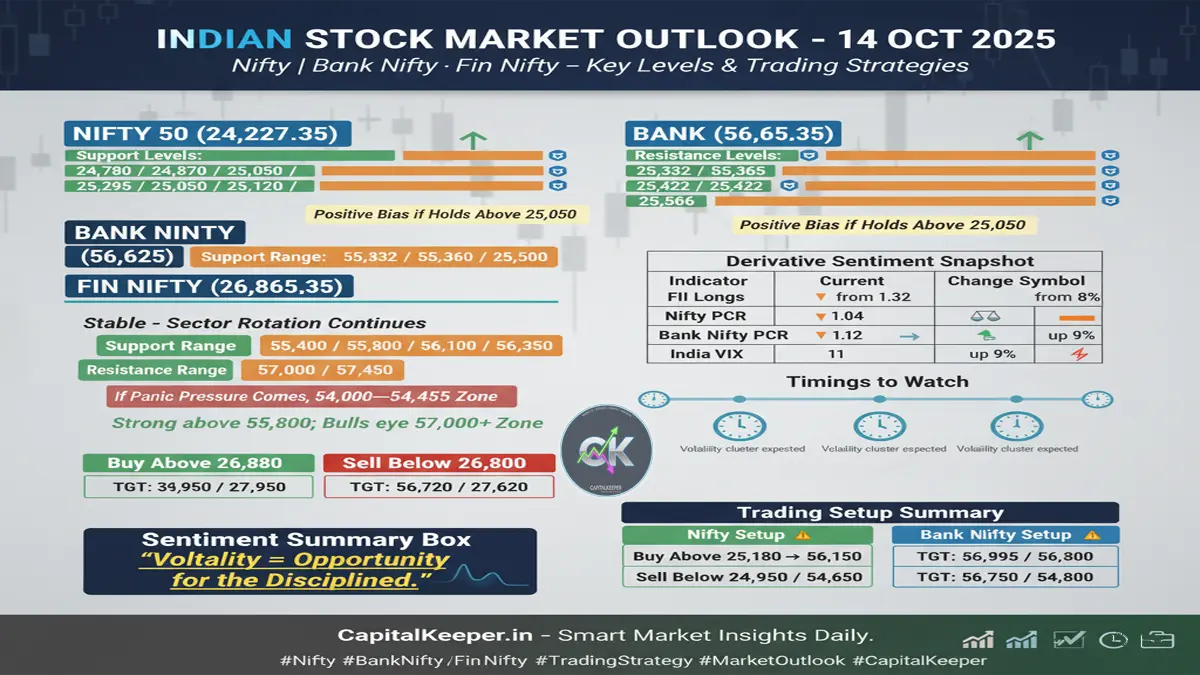

🔍 Nifty 50 – Technical Analysis

| Indicator | Level/Zone | Market View |

|---|---|---|

| Current Price | 25,141 | Mildly bullish in short term |

| Support Zone | 25030–25040 | Strong buying expected if held |

| Resistance Zone | 25270–25280 | Breakout trigger level |

| Breakdown Point | < 25030 (Close) | Triggers potential fall to 24850–24680 |

| Breakout Point | > 25270 (Close) | Likely sharp rally to 25450–25600 |

🔔 “Above 25270, we may see a blasting upside move, potentially triggering fresh short covering and momentum buying.”

🛑 However, a close below 25030 may tilt sentiment bearish again, inviting a dip to 24800 levels.

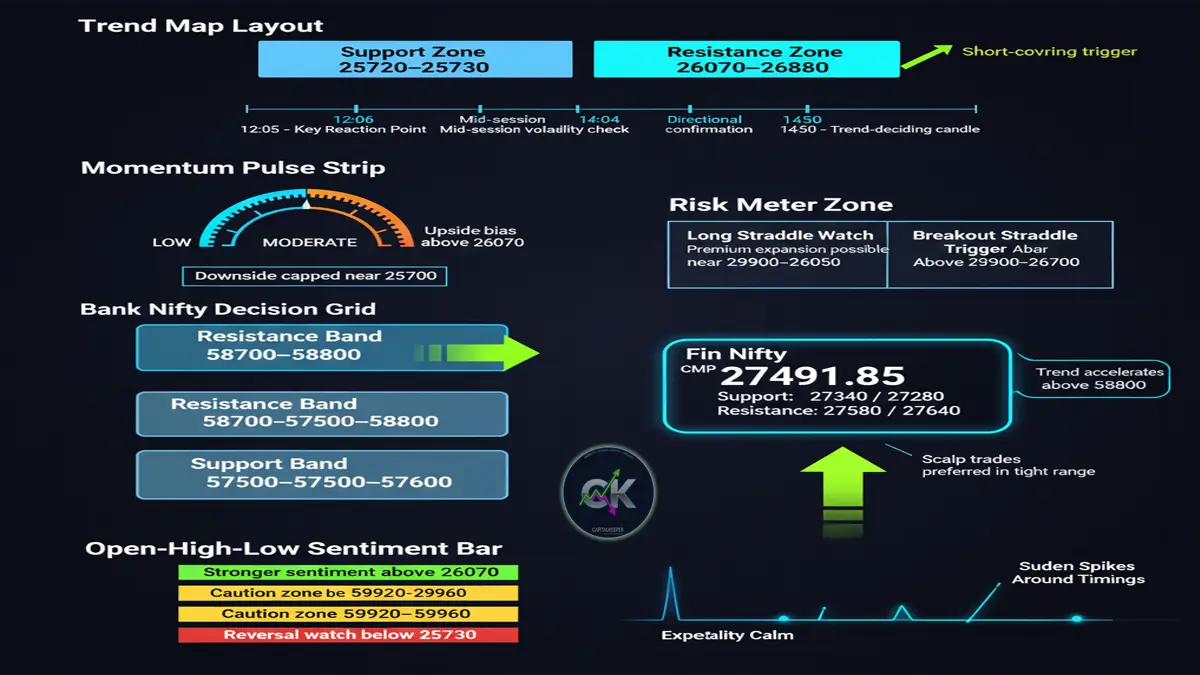

🏦 Bank Nifty – Technical Snapshot

| Indicator | Level | Interpretation |

|---|---|---|

| Current Price | ~56,459 | Range-bound between support/resistance |

| Resistance | 57,000 | Key expiry hurdle, profit-booking likely |

| Support Zone | 56,250 | Crucial intraday zone to protect |

✅ Watch for a breakout above 57,000 for aggressive upside towards 57,300–57,750.

🚫 Break below 56,250 could push the index toward 55,700 in the near term.

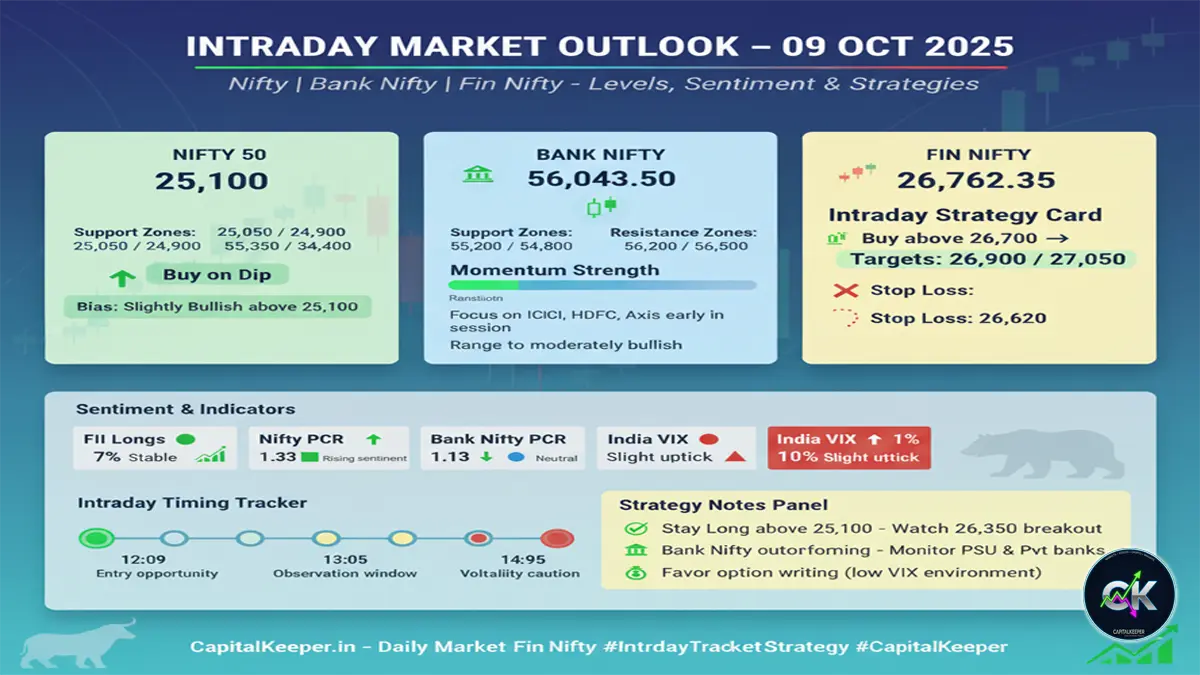

📈 Market Sentiment Indicators

- PCR (Put-Call Ratio): Moderating, reflecting a neutral-to-cautious approach

- India VIX: Around 14, still low – supports breakout scenario

- FII Long Positioning: Gradual build-up but still under 25% – suggests room to rally if breakout confirms

💡 Sectoral Influence: What to Watch

| Sector | Outlook | Driving Stocks |

|---|---|---|

| Auto | Positive bias | Tata Motors, TVS Motor, M&M |

| IT | Bullish momentum | TCS, Infosys, LTI Mindtree |

| Media | Buzzing | Zee, Sun TV – Short covering rally |

| Private Banks | Range-bound | HDFC Bank, Axis, ICICI Bank |

| PSU Banks | Supportive | SBI, Bank of Baroda |

🔍 Any upside in Bank Nifty must be led by private financials. IT and Auto may act as supportive legs for Nifty.

🧠 Conclusion: Market at Tipping Point

The Indian stock market stands at a technical inflection point. With Nifty hovering near the critical resistance of 25270 and Bank Nifty pressing toward 57000, today’s price action could set the tone for the next leg of the move.

🔑 Trading Outlook

- 🔼 Go Long: Above 25280 (Nifty) and 57000 (Bank Nifty) with targets of 25450+ and 57300+

- 🔽 Go Short: Only on closing below 25030 (Nifty) and 56250 (Bank Nifty) for a dip toward 24800/24680 and 55700

📢 Stay alert during today’s expiry moves and watch for closing strength or weakness for positional cues.

Fin Nifty Technical Levels

| Type | Levels | Remarks |

|---|---|---|

| CMP | ~26,790–26,800 | Near midpoint of intraday range |

| Resistance | 26,950 – 27,100 | Breakout level; close above = bullish move |

| Support | 26,550 – 26,600 | Must hold zone to avoid breakdown |

🔔 “Range-bound for now, but a breakout above 27,100 could lead to quick targets at 27,300–27,450.”

📈 Intraday Strategy

- ✅ Long Trade Setup: Buy above 27,100 on strong volume

- 🎯 Target: 27,300 / 27,450

- 🛑 SL: 26,880

- 🚫 Short Trade Setup: Sell only if 26,550 breaks with follow-through

- 🎯 Target: 26,300–26,100

- 🛑 SL: 26,700

📊 Momentum & Indicators

| Indicator | Status | Interpretation |

|---|---|---|

| PCR | 0.98 | Suggests neutrality/range-bound |

| RSI | 52 | Sideways strength |

| MACD | Flat | Awaiting directional momentum |

| VIX | 14.01 ↓ | Low volatility = breakout setup |

⚠️ Market breadth is thinning—any directional push will likely be sharp and fast.

📌 Influencing Stocks in Fin Nifty

| Stock | Trend | Notes |

|---|---|---|

| HDFC Bank | Flat to Mild Bullish | Needs to break ₹1,680+ for momentum |

| ICICI Bank | Holding Uptrend | Eyeing ₹1,210 breakout |

| Bajaj Finance | Under Pressure | Resistance at ₹6,900 |

| HDFC Ltd. | Sideways | Below ₹2,900; wait for confirmation |

| Axis Bank | Positive | ₹1,180–1,190 breakout possible |

🔍 Private banking stocks must lead for Fin Nifty to see sustained upside.

🧠 Final Thoughts

Fin Nifty is coiling up near a critical zone. The longer the consolidation, the stronger the eventual breakout. Traders should stay nimble and watch for volume-supported price movement above 27,100 or below 26,550.

✅ Key Takeaways

- 📌 Sideways to bullish bias, but confirmation needed

- ⚠️ Avoid aggressive positions within the 26,600–27,100 range

- 🔥 Volatility compression = explosive move likely in the next 1–2 sessions

🖊 Written by CapitalKeeper.in – Your Daily Dose of Smart Market Insight

📢 Stay tuned to CapitalKeeper.in for more real-time updates and actionable insights throughout the trading day.

Conclusion:

The Indian equity markets are currently navigating through mixed signals, with Nifty 50 showing signs of consolidation, Bank Nifty exhibiting neutral momentum, and Fin Nifty displaying cautious optimism. Traders and investors should monitor key support and resistance levels, along with global economic developments, to make informed decisions.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Leave a Reply