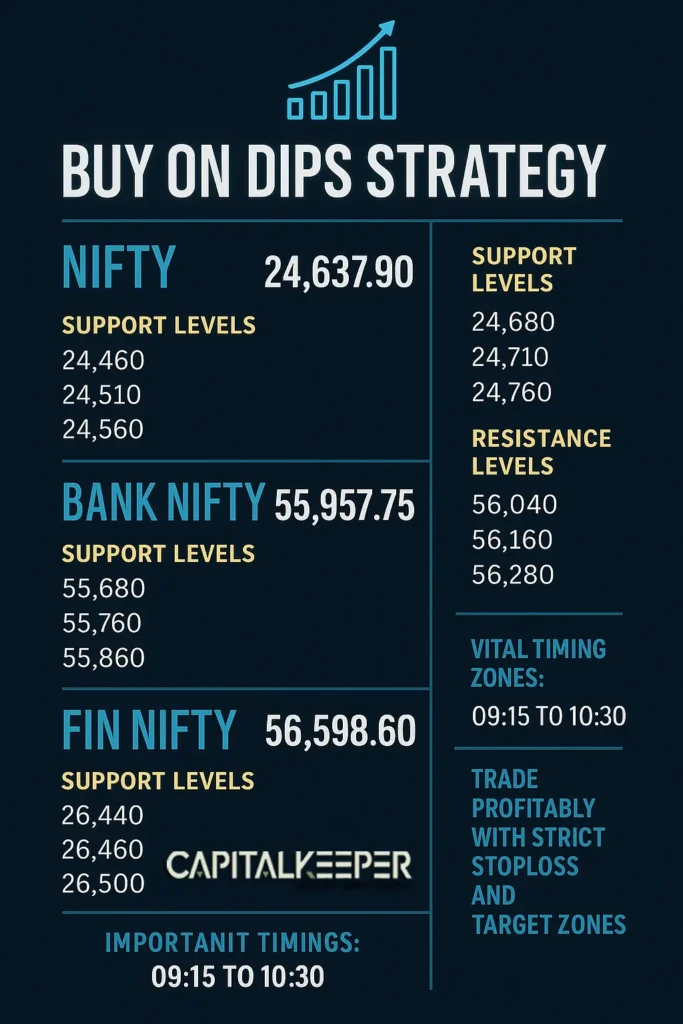

Nifty, Bank Nifty & Fin Nifty Intraday Trading Signals – Buy on Dips Strategy

By CapitalKeeper | Nifty & Bank Nifty | Indian Equities | Market Moves That Matter

Get expert intraday trading strategies for Nifty, Bank Nifty, and Fin Nifty with key support, resistance levels, and timing zones. Learn how to trade volatile markets profitably using buy-on-dips setups with strict stop-losses and target zones.

Nifty, Bank Nifty & Fin Nifty Intraday Strategies – Futuristic Approach

Market Overview

Indian indices opened with mild volatility as traders remain cautious ahead of global central bank updates and domestic derivative positioning. With Nifty at 24,637.90, Bank Nifty at 55,957.75, and Fin Nifty at 26,559.60, the market exhibits sensitive sentiment—demanding precision in entries, strict stop-losses, and quick profit booking.

Key Drivers Today

- Global Cues: Dollar strength and U.S. yields stabilizing; Asian markets mixed.

- FII Data: Long positions remain muted; aggressive build-up yet to begin.

- Volatility Indicator (India VIX): At low levels, potential for sudden sharp moves.

- PCR Data: Near equilibrium, suggesting balanced positioning but possible sharp breakouts on key levels.

Nifty 50 Intraday Levels

Current Price: 24,637.90

- Support Zones:

- 24,600 / 24,555 – Immediate cushion

- 24,480 – Strong buy-on-dips zone; breach may trigger 24,400-24,350 test

- Resistance Zones:

- 24,720 – Intraday barrier

- 24,780 / 24,850 – Bullish breakout confirmation above 24,850 towards 24,930

Strategy:

- Buy on dips near 24,600–24,555 with SL below 24,480; targets 24,720–24,780.

- Aggressive breakout trade: Above 24,850 for 24,930/25,000.

- Caution: Avoid long if trades below 24,480; fresh shorts possible to 24,350.

Bank Nifty Intraday Levels

Current Price: 55,957.75

- Support Zones:

- 55,900 / 55,720 – Key demand zone

- 55,500 – Make-or-break level; breach may accelerate downside to 55,200

- Resistance Zones:

- 56,150 / 56,300 – Intraday hurdles

- 56,500+ – Bullish momentum above this, targets 56,850–57,000

Strategy:

- Longs: Buy near 55,900 with SL 55,720; target 56,300–56,500.

- Breakdown shorts: Below 55,500 for 55,200/55,000.

- Momentum trade: Above 56,500 for 56,850/57,000.

Fin Nifty Intraday Levels

Current Price: 26,559.60

- Support Zones:

- 26,520 / 26,450 – Immediate intraday supports

- 26,300 – Major trendline support; breach weakens structure

- Resistance Zones:

- 26,640 / 26,700 – First hurdle

- 26,820+ – Bullish continuation towards 27,000 possible

Strategy:

- Buy dips near 26,520 with SL 26,450; targets 26,640–26,700.

- Positional bullish trigger: Above 26,820 for 27,000.

- Shorts: Only below 26,300 for 26,150/26,000.

Intraday Timing Clues (High Probability Moves)

- 11:30–12:30 PM: Potential volatility spike (Europe cues).

- 1:20–2:10 PM: Profit-booking/whipsaw zone.

- 2:30–3:00 PM: Final directional push (expiry adjustments ahead).

Pro Trader Tips

- Avoid Over-Leveraging: Sensitive market demands strict capital allocation.

- Scalp, Don’t Swing: Take quick profits; avoid overnight carries.

- Focus on Confirmation Candles: Don’t pre-empt breakouts; wait for volume confirmation.

- Watch PSU Banks & IT Stocks: Likely to lead intraday momentum.

- Stay Alert on Global Headlines: FED/Japan policy can trigger unexpected moves.

Conclusion

Today’s market requires patience and disciplined entries—focusing on buying dips with tight stop-losses while respecting major support/resistance pivots. Profitability lies in fast execution and sectoral rotation tracking (PSU Banks, IT, and FMCG).

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Leave a Reply