Nifty & Bank Nifty Reversal: 8 Proven Option Strategies for Short-Term High ROI

By CapitalKeeper | Short-Term Option | Indian Equities | Market Moves That Matter

CapitalKeeper Options Playbook

Nifty & Bank Nifty Reversal – Strategic Basket for Short-Term Gains

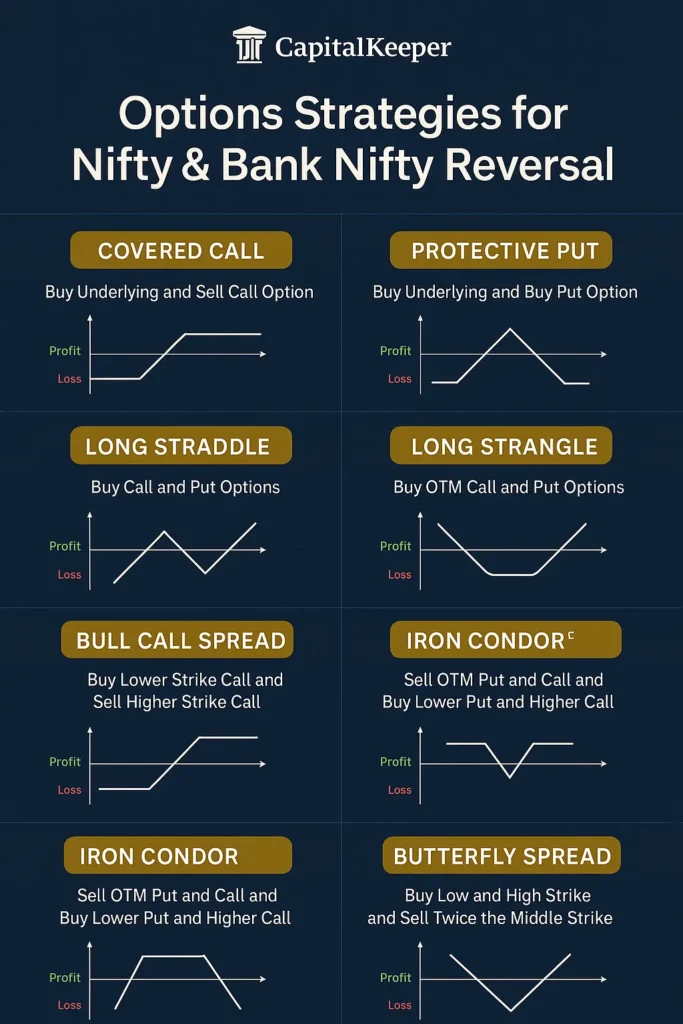

Analyze Nifty and Bank Nifty reversal trends with CapitalKeeper’s option strategy basket — Covered Call, Protective Put, Straddles, Strangles, and advanced spreads for maximum short-term returns.

Market Reversal Insight: Nifty & Bank Nifty

Current Situation

- Nifty 50: Trading near 24,850–25,000; consolidating after profit-booking.

- Bank Nifty: Around 56,400–56,600; showing relative strength vs Nifty with PSU banks leading.

Key Observations

- Support Zones:

- Nifty: 24,700 / 24,450

- Bank Nifty: 55,800 / 55,200

- Resistance Zones:

- Nifty: 25,250 / 25,500

- Bank Nifty: 57,200 / 57,700

- Indicators:

- MACD on daily chart turning upward (bullish divergence).

- RSI near 48–52: neutral but rebounding.

- Open Interest shows put writing at 24,800 and 55,500 levels, signaling strong base formation.

Nifty & Bank Nifty Reversal: 8 Proven Option Strategies

Option Strategy Basket (For Short-Term ROI)

1. Covered Call (Mildly Bullish)

- Instrument: Nifty Futures + Sell 25,200 CE

- Rationale: Generates premium while holding long future position in range-bound move.

- Target ROI: 2–3% in 2 weeks.

- Risk: Upside capped beyond 25,200.

2. Protective Put (Hedged Bullish)

- Instrument: Long Nifty Futures + Buy 24,700 PE

- Rationale: Protects long exposure; good for volatile reversals.

- Target ROI: 3–4% on breakout moves.

- Risk: Put premium cost.

3. Long Straddle (High Volatility Bet)

- Instrument: Buy 25,000 CE + Buy 25,000 PE (Same Expiry)

- Rationale: Profits from large move either side; suitable pre-event (e.g., RBI meet).

- Target ROI: 25–30% if move >300 pts either side.

- Risk: Time decay if market stays range-bound.

4. Long Strangle (Moderate Volatility)

- Instrument: Buy 25,200 CE + Buy 24,800 PE

- Rationale: Cheaper than straddle; wider profit zone.

- Target ROI: 20–25% on >200 pts move.

- Risk: Higher breakeven range.

5. Bull Call Spread (Directional Bullish)

- Instrument: Buy 25,000 CE + Sell 25,300 CE

- Rationale: Lower cost bullish strategy; max profit capped.

- Target ROI: 15–18% if Nifty rallies towards 25,300.

- Risk: Limited loss (net premium).

6. Bear Put Spread (Directional Bearish)

- Instrument: Buy 25,000 PE + Sell 24,700 PE

- Rationale: Profits in controlled downside; ideal if breakdown below support.

- Target ROI: 15–20% if Nifty drops to 24,700.

- Risk: Limited to net premium.

7. Iron Condor (Range-Bound Strategy)

- Instrument:

- Sell 25,200 CE + Buy 25,400 CE

- Sell 24,700 PE + Buy 24,500 PE

- Rationale: Profits in range 24,700–25,200; low risk, steady income.

- Target ROI: 5–7% per expiry cycle.

- Risk: Breach of wings (need adjustments).

8. Butterfly Spread (Low Risk, High Reward)

- Instrument:

- Buy 24,800 CE, Sell 25,000 CE (2 lots), Buy 25,200 CE

- Rationale: Max profit near 25,000; cheap strategy pre-expiry.

- Target ROI: 3–4x payoff if expiry close to strike.

- Risk: Small premium loss.

Basket Allocation Plan

- Directional Bets (Straddle, Strangle, Bull Call, Bear Put) – 50% allocation

- Hedged Income (Covered Call, Protective Put, Iron Condor, Butterfly) – 50% allocation

This mix balances volatility exploitation and range-bound premium capture, crucial in current reversal setups.

Pro Tips for Traders

- Track Implied Volatility (IV):

- Enter straddles/strangles when IV low; exit when IV spikes.

- Adjust on Key Levels:

- Shift strikes if Nifty breaks 25,200 or 24,700 decisively.

- Risk Management:

- Do not risk more than 2–3% capital per strategy.

- Event Calendar:

- RBI policy, Fed commentary, and expiry week are catalysts for big moves.

Conclusion

The ongoing reversal in Nifty and Bank Nifty offers a golden opportunity to deploy structured option strategies instead of outright directional bets. A balanced basket combining straddles, condors, and protective hedges allows traders to capitalize on volatility while managing downside effectively — targeting 15–25% ROI over 2–4 weeks.

📌 For daily trade setups, technical learning, and smart investing tips, stay tuned to CapitalKeeper.in

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.By using this website, you agree to the terms of this disclaimer.