Nifty & Bank Nifty Outlook Today (23rd Oct 2025): Gap-Up Opening Near All-Time High | Intraday & Straddle Strategies

By CapitalKeeper | Nifty & Bank Nifty | Indian Equities | Market Moves That Matter

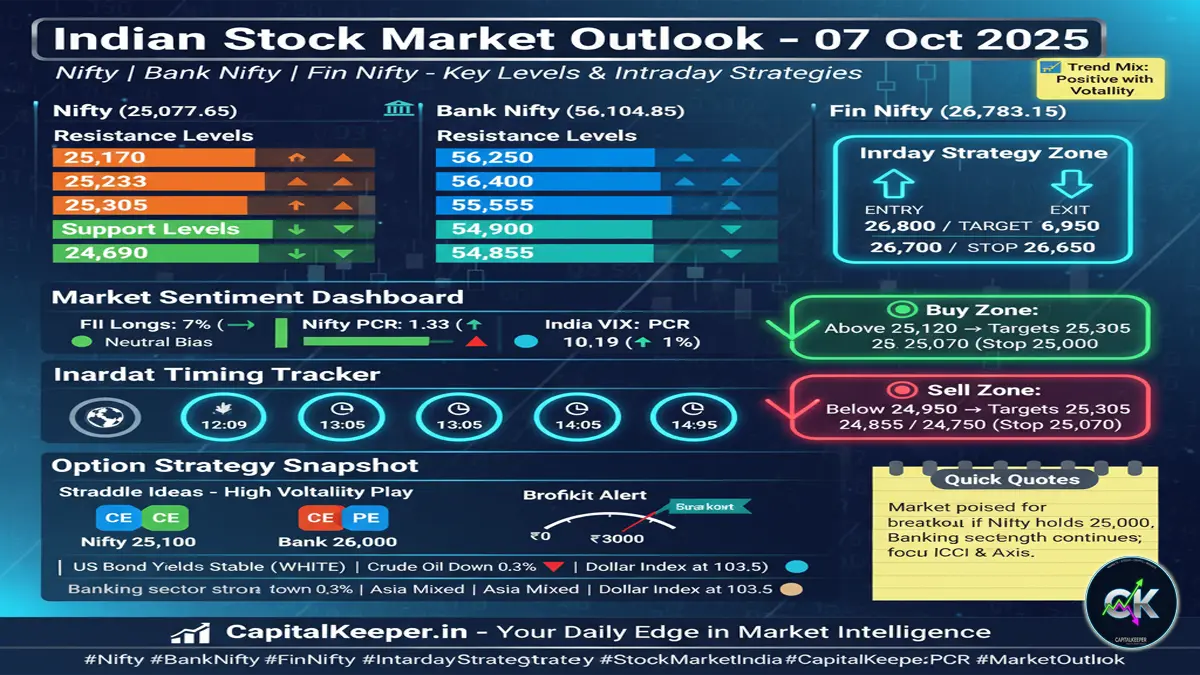

Indian markets opened with a big gap-up on 23rd October 2025 as Nifty approaches its all-time high of 26,277. Read full analysis with key support/resistance levels, FII data, PCR, India VIX trends, and expert intraday & straddle strategies for Nifty, Bank Nifty, and Fin Nifty.

Today🔥 23rd October 2025 – Indian Stock Market Opening Outlook

Cautious Optimism as Nifty Nears Lifetime High – Smart Booking Advised

The Indian equity market kicked off today’s session (Thursday, 23rd October 2025) with a strong gap-up opening, powered by positive global cues, steady FII flows, and easing volatility in global bond yields. Nifty opened close to 25,900 levels, inching dangerously close to its previous all-time high of 26,277 — a level that often acts as both psychological resistance and profit-booking zone.

For active traders, today’s session is likely to be volatile and reaction-driven, with opportunities in both intraday directional and non-directional strategies like straddles and strangles.

📊 Market Overview: Nifty, Bank Nifty & Fin Nifty

Nifty 50 (Now: 25,868.60)

- Support Levels: 25,200 / 25,455 / 25,700 / 25,845

- Resistance Levels: 25,995 / 26,100 / 26,200 / 26,480

- Trend Bias: Cautious to mildly bullish, provided the index sustains above 25,700 zone.

After a week of steady gains, the Nifty’s structure now suggests that the momentum rally may face exhaustion near the upper band of resistance. The RSI on the daily chart has moved into the 70+ zone an early overbought signal. Additionally, FIIs have raised their index long positions to 19%, showing continued confidence but also indicating that most of the easy upside might already be priced in.

Traders are advised to book profits on long positions during a gap-up and re-enter only after observing stability around 25,700–25,800. A sharp fall below 25,700 could trigger a short-term correction toward 25,455 or even 25,200.

Bank Nifty (Now: 58,007.20)

- Support Levels: 56,850 / 57,300 / 57,555 / 57,850

- Resistance Levels: 58,455 / 58,650 / 58,800 / 59,000 / 59,250

- Trend Bias: Range-bound to moderately positive, with focus on PSU & private banks.

Bank Nifty has been a silent outperformer this week, holding ground even as global financials remain mixed. The index structure indicates a consolidation phase, with 58,800–59,000 likely to act as short-term resistance.

Momentum indicators remain strong on HDFC Bank, ICICI Bank, and SBI, while smaller PSU banks may witness profit booking. Any dip near 57,800 could act as a buying zone with a stop below 57,300 for positional trades.

However, after such a sharp rally, traders are recommended to avoid fresh longs on a big gap-up. Wait for retests of lower supports to initiate fresh intraday positions.

Fin Nifty (Now: 27,690.00)

- Bias: Volatile & range-bound

- Key Support: 27,420 / 27,250 / 27,000

- Key Resistance: 27,850 / 28,000 / 28,120

The Fin Nifty index, tracking financial heavyweights, is mirroring the same overbought setup. It’s ideal for straddle or strangle-based intraday strategies today due to expected range expansion and a drop in implied volatility later in the session.

🧩 Intraday Trading Strategies for 23rd Oct 2025

1. Nifty Intraday Setup

Bias: Mildly bullish → volatile above 25,850

Entry Zone: Buy near 25,820–25,860 after first 15 mins confirmation

Target: 25,995 / 26,100 / 26,200

Stop Loss: 25,740

Alternative Setup: If Nifty slips below 25,740 → short with targets 25,600–25,500

Strategy Tip: Avoid chasing breakouts near ATH; buy dips and sell strength near 26,200–26,400.

2. Bank Nifty Intraday Setup

Bias: Sideways to positive

Entry Zone: Buy near 57,850–58,000 with confirmation of support hold

Target: 58,455 / 58,650 / 58,800

Stop Loss: 57,650

Alternative Setup: Short below 57,600 → target 57,300–57,000

Strategy Tip: Monitor Kotak Bank and ICICI Bank for cues — both could dictate index tone.

3. Fin Nifty Intraday Setup

Bias: Range-bound

Entry Zone: Buy near 27,400–27,450 only if price sustains above VWAP

Target: 27,750 / 27,850

Stop Loss: 27,300

Alternative Setup: Sell near 27,850–27,900 for quick 100–150 pts downside

Strategy Tip: Ideal for non-directional option strategies (straddles/strangles).

⚖️ Straddle Strategy for Volatile Expiry Week

With the market opening near record highs and volatility expected around mid-session timings (12:05, 13:08, 14:04, 14:50), the Fin Nifty and Nifty are suitable for intraday straddles.

Example – Nifty 25,900 ATM Straddle

- Buy 25,900 CE + Buy 25,900 PE

- Combined Premium: ~145

- Stop Loss: 105 total premium

- Target: 220–250

- Rationale: Big gap-up opening with low VIX implies potential IV expansion during reversal.

Example – Fin Nifty 27,700 ATM Straddle

- Buy 27,700 CE + Buy 27,700 PE

- Combined Premium: ~180

- Stop Loss: 130 total

- Target: 260+

- Rationale: Expected volatility spikes around key time windows good for short-term gamma gains.

📈 Market Sentiment Indicators

| Indicator | Current Reading | Observation |

|---|---|---|

| FII Index Longs | 19% | Increasing bullish exposure |

| Nifty PCR | 1.08 (↓ from 1.14) | Slight drop → cautious optimism |

| Bank Nifty PCR | 1.14 | Neutral to mildly positive |

| India VIX | 11.29 (↓ 0.5%) | Still low; volatility expansion likely post 12 PM |

The mix of low VIX and near-ATH levels implies a risk of intraday reversal — traders must stay nimble and avoid over-leveraging positions.

🧭 Key Timings to Watch

- 12:05 PM – Crucial volatility zone; likely first reversal

- 13:08 PM – Possible retracement or continuation phase

- 14:04 PM – Momentum breakout watch

- 14:50 PM – Final expiry-related movement (profit-booking or short covering)

🪙 Pro Insight – What Smart Traders Should Do

- Book profits on open gaps; avoid chasing highs.

- Watch the 26,000 zone in Nifty – a decisive break could trigger 26200/26400.

- Hold light positions ahead of weekly expiry.

- Monitor FII index data – further rise above 20% long could signal overheating.

- Stay prepared for a post-gap retracement to re-enter with better risk-reward.

🧠 Summary Outlook

| Index | Bias | Key Support | Key Resistance | Intraday View |

|---|---|---|---|---|

| Nifty 50 | Mildly Bullish | 25,700 | 26,200 | Buy dips, book on highs |

| Bank Nifty | Range-bound | 57,800 | 58,800 | Wait for dips |

| Fin Nifty | Volatile | 27,400 | 27,850 | Straddle suited |

✅ Final Thoughts

The 23rd October 2025 session represents a classic “book-the-gap” day — where cautious optimism should dominate over greed. With Nifty hovering near its previous all-time high of 26,277, the smart play is to lock in gains, observe volatility, and plan fresh trades post retracement.

The market tone remains broadly bullish, but as history suggests, big gaps often invite consolidation rather than continuation. Traders who follow discipline and manage risk through timed entries and exits will outperform in this phase of the bull run.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply