Nifty & Bank Nifty Outlook Today – 17 November 2025 | Key Levels, Trend Mix & Straddle Strategies

By CapitalKeeper | Nifty & Bank Nifty | Indian Equities | Market Moves That Matter

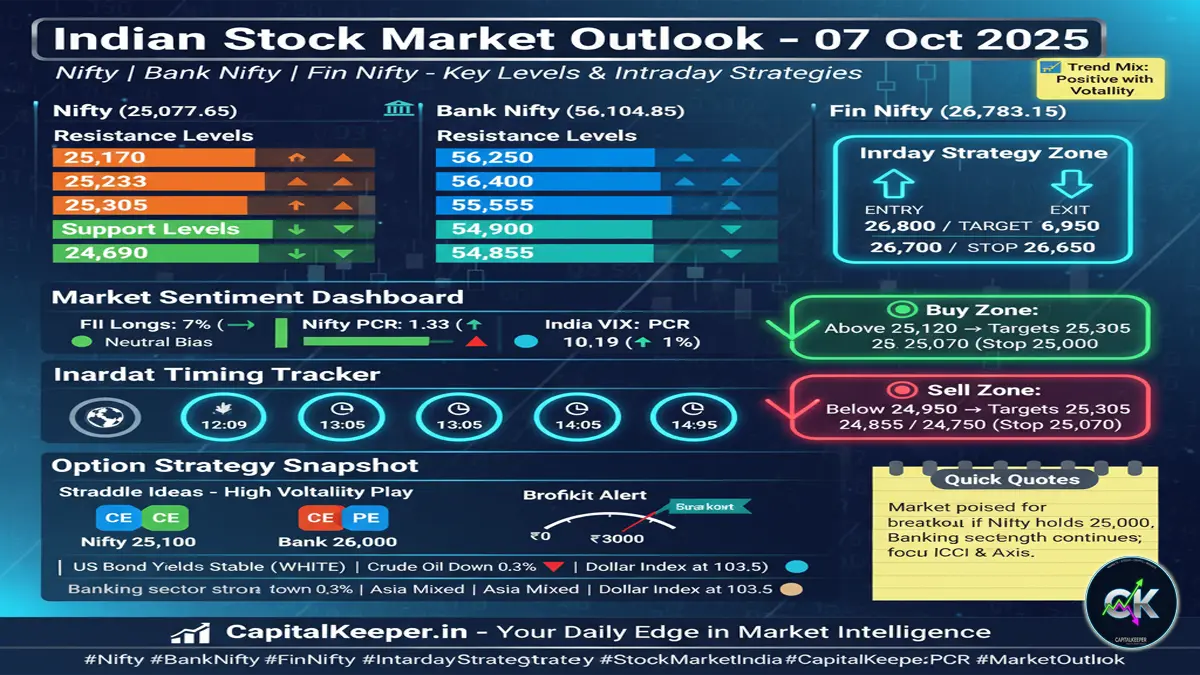

Get a detailed analysis for Nifty, Bank Nifty & Fin Nifty for 17 November 2025. Key support & resistance, short-covering zones, intraday strategy, and straddle tips for high-probability trades.

📌 Market Overview – 17 November 2025

The Indian markets enter the new week with strong underlying momentum. Despite global uncertainties and mixed cues, Nifty and Bank Nifty continue to show resilience, maintaining a steady bullish undertone. Options data signals controlled volatility, and price action suggests that dips are being aggressively bought near support zones.

Today’s session is critical, especially with indices inching toward major breakout levels. The trading landscape is likely to be dominated by short covering, range-to-sideways moves, and intraday volatility around key timings.

Let’s break down the data and build a high-probability trading framework for the day.

🔥 NIFTY 50 ANALYSIS (CMP: 25910.05)

Nifty continues to trade comfortably above its medium-term channel. The index has shown steady strength, especially after reclaiming the 25,700 region last week. Today’s structure indicates tight consolidation before a potential breakout.

🧭 Key Levels for Nifty (17 November 2025)

Support Zone

- 25720 – 25730

- Psychological support: 25700

This zone has been tested multiple times and has held firm. Aggressive buying emerges every time price dips into the 25,700–25,730 band, indicating strong institutional demand.

Resistance Zone

- 26070 – 26080

- Immediate breakout point: Above 26080

This is the major resistance cluster and aligns closely with:

- Previous swing high

- Near-ATH supply

- Option writers’ highest resistance wall

🚀 What Happens Above 26070–26080?

Expect huge short covering, high-velocity upside, and a fast rally into uncharted territory.

If Nifty closes above 26080:

- Next levels: 26210 → 26350 → 26480 (ATH Re-test)

- Momentum stocks should fire

- Call writers likely to unwind

- VIX may stay muted, supporting directional moves

📉 What Happens Below 25720–25730?

Not much downside is visible unless 25700 breaks convincingly.

A slip below 25700 may bring:

- 25550

- 25480

- Max downside for the day remains limited

But the structure still favors buy-on-dips as long as VIX stays contained.

🎯 Intraday Strategy for Nifty

Strategy 1: Buy the Dip

- Buy Zone: 25730–25750

- SL: 25670

- Targets: 25920 → 25980 → 26070

Strategy 2: Breakout Trade

- Buy Above: 26080

- SL: 25990

- Targets: 26150 → 26240 → 26310

Strategy 3: Failed Breakout Short

- Sell Below: 25700

- SL: 25810

- Targets: 25580 → 25480

🧮 Nifty Straddle Tips (For 17 Nov 2025)

Given the low VIX and range-bound volatility before breakout:

🔸 Safe Zone Straddle

Buy 25900 CE + 25900 PE

- Premium: Medium

- Expectation: Move above 26080 or below 25700

- Suitable for: Volatility expansion

🔸 Aggressive Breakout Straddle

Buy 26000 CE + 26000 PE

- Very effective if the 26070–26080 resistance breaks

- Delta expands rapidly, giving excellent upside

Straddle Risk Management

- Exit at 30% SL or 40–70% profit

- Square off if Nifty consolidates excessively

🏦 BANK NIFTY ANALYSIS (CMP: 58,517.55)

Bank Nifty has been the market’s power engine in recent sessions. Heavyweights like HDFC Bank, ICICI Bank, and SBI are showing steady accumulation patterns. The index remains comfortably above its key supports.

🧭 Key Levels for Bank Nifty

Major Support Zone

- 57500

- Secondary support: 57100

Bank Nifty rarely breaks 57500 without a major trigger because:

- It is a demand zone for institution-led buying

- Options OI clusters peak here

- It aligns with short-term moving averages

Major Resistance Zone

- 58800 (Strong Supply Zone)

- Next hurdle: 59000 – 59200

This region has rejected prices multiple times and remains the key ceiling.

If 58800 breaks with strong candles:

- Expect sharp upside toward 59250 → 59520 → 59800

🎯 Intraday Strategy for Bank Nifty

Strategy 1: Buy on Dip

- Buy Near: 57550–57650

- SL: 57380

- Targets: 58050 → 58300 → 58500

Strategy 2: Breakout Long

- Buy Above: 58800

- SL: 58580

- Targets: 59050 → 59300 → 59650

Strategy 3: Range Short (only if reversal candle forms)

- Sell Near: 58800–58900

- SL: 59040

- Targets: 58400 → 58050

🧮 Bank Nifty Straddle Tips

🔸 Neutral Volatility Straddle

Buy 58500 CE + 58500 PE

- Works best before major breakout

- Bank Nifty is known for violent swings — perfect for premium spike

🔸 Breakout Straddle

Buy 58800 CE + 58800 PE

- Only activate on breakout candle

- 1:2 reward-ratio possible

Note:

Bank Nifty is a fast index — maintain tight SL.

💹 Fin Nifty Analysis (CMP: 27,491.85)

Fin Nifty continues to be steady and well-supported. ICICI, HDFC Life, Bajaj Finance, and Kotak are showing early strength.

Intraday Levels

Support:

- 27,350

- 27,250

Resistance:

- 27,650

- 27,780

Fin Nifty Intraday Strategy

Buy Above: 27,550

- SL: 27,480

- Targets: 27,630 → 27,720 → 27,800

Buy on Dip:

- Entry: 27,320–27,350

- SL: 27,250

- Targets: 27,500 → 27,580

📌 Fin Nifty Straddle Tips

Safe Zone Straddle

Buy 27500 CE + 27500 PE

- Suitable for slow trending days

- Low risk, moderate return

Aggressive Straddle

Buy 27600 CE + 27600 PE

- Better if key timings trigger volatility

⏰ Important Timings for Intraday Turns

Today’s cycle is expected to respond strongly to these time windows:

- 12:05 — Major Turning Point

- 13:06 — Mid-session trend shifter

- 14:04 — Pre-closing swing window

- 14:50 — High-impact final move

Watch price action, volume and candle patterns during these timings.

📣 Final Market Outlook

✔ Nifty bias: Bullish above 26070, safe above 25700

✔ Bank Nifty bias: Positive above 58000, major breakout above 58800

✔ Fin Nifty bias: Gradual steady uptrend

✔ Overall theme: Buy on dips, breakout only above key resistance zones

Short covering could dominate the session once Nifty moves above 26070. Similarly, Bank Nifty remains poised for a possible breakout above 58800.

Today is ideal for straddle traders, especially around morning consolidation and breakout windows.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

RWA Tokenization: How Real-World Assets on Blockchain Are Transforming Global Finance in 2025

Leave a Reply