Nifty, Bank Nifty Outlook & Key Levels for 08 Oct 2025 | Intraday Bias & Trading Strategy

By CapitalKeeper | Nifty & Bank Nifty | Indian Equities | Market Moves That Matter

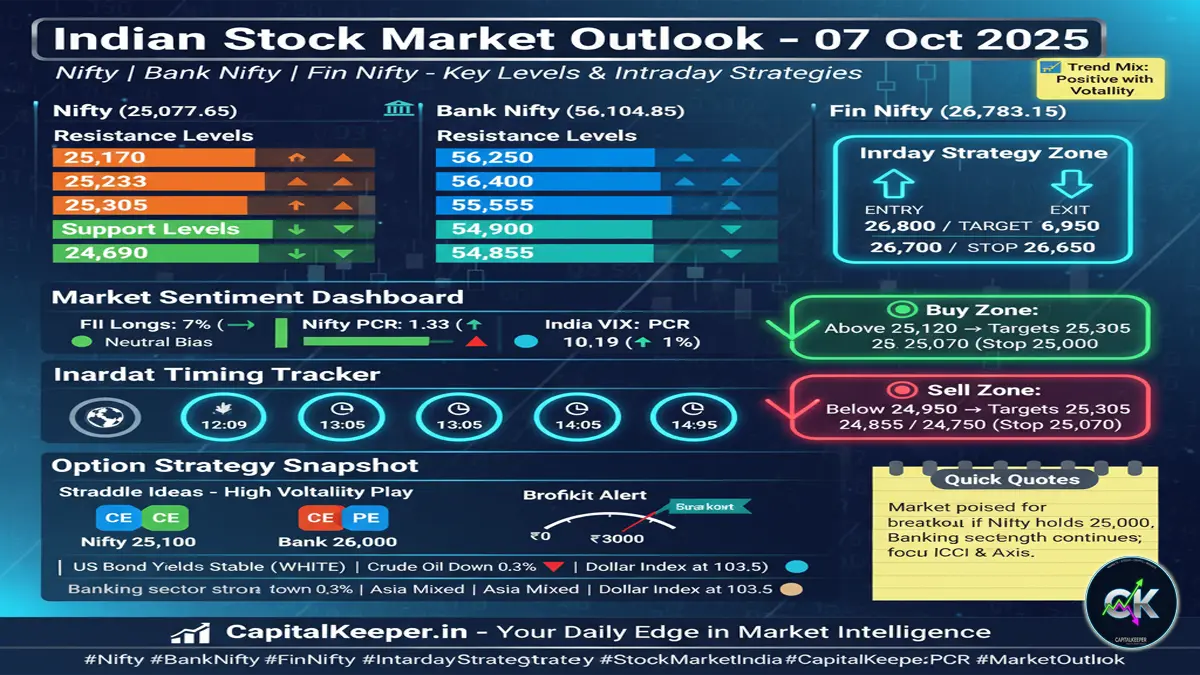

Stay ahead of the market with today’s Nifty and Bank Nifty analysis for 08 October 2025. Discover key support–resistance levels, intraday bias, FII trends, and actionable Fin Nifty strategies for informed trading decisions.

📊 Nifty & Bank Nifty Key Levels and Intraday Bias – 08 October 2025

The Indian equity market continues to trade in a high-volatility but directional structure as both Nifty and Bank Nifty sustain near record-high zones. With Nifty hovering around 25,159.25 and Bank Nifty near 56,132.50, traders are closely monitoring institutional flows, option data, and sectoral rotation cues to determine short-term momentum.

In this blog, we decode today’s key levels, bias, and Fin Nifty intraday setups for 08 October 2025 — providing traders with a structured roadmap to navigate the session efficiently.

🔍 Market Context: Calm Before a Breakout

The broader trend remains constructive, supported by stable global cues, a resilient rupee, and easing India VIX levels below 11. However, intraday volatility remains active near psychological round numbers — 25,000 for Nifty and 56,000 for Bank Nifty.

Despite a flat start expected from GIFT Nifty cues, the undertone is slightly positive provided the indices manage to sustain above their immediate supports.

The FII Index long positions still hover near 7%, indicating neutral to mildly bullish positioning. Meanwhile, Put–Call Ratios (PCR) for both indices suggest a balanced market sentiment with traders adding bullish put writing at lower strikes.

📈 NIFTY 50 CMP: 25,159.25 – Technical Outlook

| Level Type | Price Zone |

|---|---|

| Resistance | 25,350 – 25,400 |

| Support | 25,050 – 24,900 |

| Bias | Slight positive tilt above 25,100 |

🎯 Intraday View:

Nifty managed to close above the 25,100 pivot level, confirming buyer presence in dips. Price action continues to respect higher lows on the hourly chart, suggesting that as long as 25,050–25,100 holds, the bias remains positive.

If momentum builds above 25,350, a quick spike toward 25,420–25,500 cannot be ruled out. On the contrary, a break below 25,000 could trigger a short-term profit-booking phase targeting 24,850–24,780.

🔍 Indicators & Signals:

- RSI (14): 61 → holding above the neutral zone, showing sustained momentum.

- MACD: Bullish crossover active, indicating underlying strength.

- Moving Averages: Price comfortably above 20-DMA (24,880), reinforcing short-term uptrend.

- Volume Profile: Strong accumulation zone between 25,000–25,080 — key demand area.

💡 Intraday Strategy (Nifty):

- Buy Above: 25,200 → Target: 25,350 / 25,400 | Stop Loss: 25,070

- Sell Below: 25,000 → Target: 24,880 / 24,780 | Stop Loss: 25,130

Pro Tip: Watch for momentum during the 12:05–14:10 time window — these hours often define intraday directional moves.

🏦 BANK NIFTY CMP: 56,132.50 – Technical Outlook

| Level Type | Price Zone |

|---|---|

| Resistance | 56,200 – 56,500 |

| Support | 55,200 – 54,800 |

| Bias | Range to moderately bullish |

The banking index has been consolidating just below its previous high, forming a sideways-to-up pattern with a positive structure on higher time frames. Private banks like ICICI Bank, Axis Bank, and HDFC Bank continue to show relative strength, while PSU banks remain stable after a brief round of profit-taking.

If Bank Nifty sustains above 56,200, short covering from call writers may fuel a sharp rally toward 56,500–56,800. Immediate support is seen near 55,800, followed by 55,200, where fresh accumulation is likely.

📊 Indicators & Momentum Setup:

- RSI (14): 58 → Neutral-to-positive, suggesting space for upside continuation.

- MACD: Bullish crossover persists but flattening out — wait for confirmation above 56,250.

- PCR Data: 1.13 → Indicates steady put writing near 56,000 and limited downside risk.

- VIX: 10.19 (up by 1%) → Slight uptick but still comfortably low.

💡 Intraday Strategy (Bank Nifty):

- Buy Above: 56,200 → Target: 56,500 / 56,800 | Stop Loss: 56,000

- Sell Below: 55,600 → Target: 55,350 / 55,200 | Stop Loss: 55,800

Trading Bias: Neutral-to-bullish; ideal to buy on dips near 55,800 if price action remains above 55,600 for two consecutive candles.

💰 FIN NIFTY CMP: 26,762.35 – Intraday Strategies

The Fin Nifty continues to mirror the broader financial index momentum. With positive bias in banking and insurance stocks, the index looks set for an intraday breakout if it sustains above the 26,780–26,800 zone.

🔹 Trading Setups:

- Buy Above: 26,800 → Target: 26,940 / 27,000 | Stop Loss: 26,720

- Sell Below: 26,650 → Target: 26,520 / 26,420 | Stop Loss: 26,740

Focus Stocks:

- HDFC Life, ICICI Lombard, and Bajaj Finance showing early signs of accumulation.

- Avoid aggressive trades near expiry — volatility could spike near closing hours.

🧭 Market Sentiment Summary

| Indicator | Current Reading | Bias |

|---|---|---|

| FII Index Longs | 7% | Neutral to slightly bullish |

| Nifty PCR | 1.33 | Bullish bias maintained |

| Bank Nifty PCR | 1.13 | Stable sentiment |

| India VIX | 10.19 (↑1%) | Low-risk environment |

The combination of strong PCR ratios and low VIX levels continues to support a buy-on-dips strategy, but traders must stay cautious as markets are near all-time highs. A small rise in volatility could trigger rapid intraday swings.

🔔 Sector Watch

- Banks & Financials: Likely to outperform — look for momentum in Axis, HDFC, and SBI.

- Auto & FMCG: Showing mild fatigue; potential for rotational consolidation.

- IT & Metals: Could offer intraday reversal plays after recent correction.

🕒 Important Timings to Watch

Volatility clusters often align with intraday turning points. Watch for momentum at:

12:09 | 13:05 | 14:05 | 14:55

Breakouts or reversals around these time slots can offer lucrative setups, especially when confirmed by price action near key support/resistance zones.

🧩 Conclusion

The market tone for 08 October 2025 remains cautiously optimistic. With Nifty’s bias above 25,100 and Bank Nifty steady near 56,000, traders should maintain a bullish-to-neutral stance while respecting stop-losses on both sides.

Short-term breakout possibilities exist if momentum stocks continue to attract volume — but traders should stay alert for false breakouts due to upcoming result season volatility.

👉 Strategy for the Day:

“Buy on dips above 25,100 in Nifty and 55,800 in Bank Nifty — exit on sharp rallies or trailing stop-loss breaches.”

Stay disciplined, follow timing zones, and monitor global cues before taking positional bets.

📢 Key Takeaway:

- Nifty Bias: Positive Above 25,100

- Bank Nifty Bias: Moderate Bullish Above 55,800

- Fin Nifty: Breakout Likely Above 26,800

- Sentiment: Steady, Low VIX, High PCR → Favoring Bulls

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply