Nifty & Bank Nifty Outlook for 27 October 2025 – Buy on Dips, Watch 26070 for Breakout Momentum

By CapitalKeeper | Nifty & Bank Nifty | Indian Equities | Market Moves That Matter

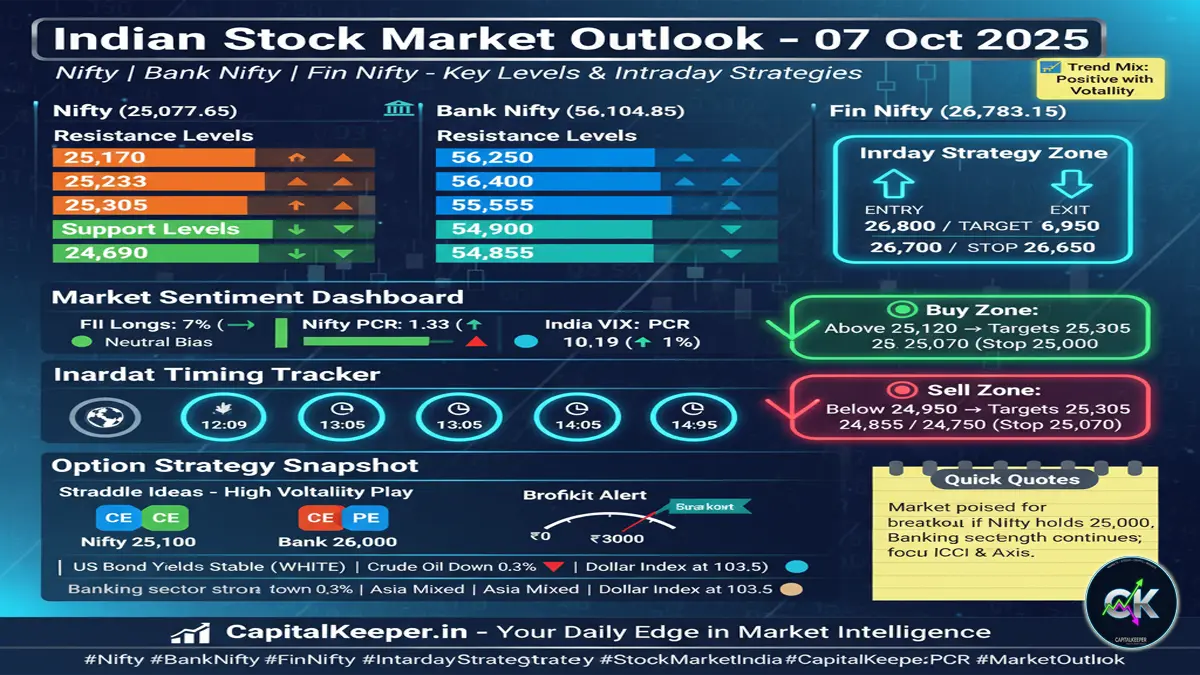

Nifty and Bank Nifty trading strategy for 27th October 2025 – Key support, resistance, intraday levels, and straddle tips for Fin Nifty. Insights on F&O data, PCR, and volatility trends with actionable entry, stop loss, and target zones for the day.

📊 Indian Market Outlook – 27th October 2025

Theme: “Buy on Dips, Cautious on Gap-ups”

After a powerful expiry week, the Indian equity market opens on Friday with resilience and optimism. Both Nifty and Bank Nifty remain in a well-defined trading range, hinting at potential breakout zones above 26070 for Nifty and 58000 for Bank Nifty. Traders are advised to stay tactical the day calls for buy-on-dip opportunities and short-covering momentum if resistance levels are breached.

🔹 Nifty Technical Snapshot

Current Market Price (CMP): Around 25,950.60

The Nifty index continues to show underlying strength, maintaining higher lows on the hourly and daily charts. The index has successfully defended its support zone between 25,820 and 25,830, which now acts as a strong base for intraday traders.

🔸 Key Levels for the Day

- Resistance Zone: 26,070 – 26,080

- Support Zone: 25,820 – 25,830

- Bias: Bullish above support, breakout momentum expected above 26,070.

🟩 Trading Strategy – Nifty

Traders can consider building long positions near support, with tight stop-losses below 25,800. The structure remains positive as long as the index holds above its 20-day moving average, which coincides near 25,750.

👉 Strategy Setup:

- Entry Zone: Buy near 25,830–25,860

- Stop Loss: Below 25,780

- Target 1: 26,050

- Target 2: 26,120

- Target 3: 26,250 (if breakout sustains)

Momentum indicators such as RSI (58) and MACD are showing early signs of bullish crossover, indicating that dips are being absorbed. Traders should, however, be cautious of sharp intraday reversals if global cues turn weak or FII flows reduce.

🔹 Bank Nifty Analysis

CMP: Around 58,100–58,200

The Bank Nifty index continues to lead the sentiment in this expiry phase. The previous session saw healthy buying in heavyweights like HDFC Bank, Axis Bank, and ICICI Bank, propelling the index closer to its resistance zone.

🔸 Key Levels

- Resistance: 58,000

- Support: 57,500

📈 Trading Setup for 27th Oct

A clear and tactical setup exists for intraday traders —

BUY BANKNIFTY 57700 CE @ 425–428, SL –373, TGT –500/550/600++.

The option data shows short covering in 57700CE and 58000CE strikes, suggesting upward pressure if spot levels hold above 57,700. The put writers are seen adding fresh positions at 57,500PE, marking this as a strong support zone for the day.

👉 Strategy Insight:

- A sustained move above 58,000 could trigger a quick 150–200 point rally, possibly testing 58,200–58,400 intraday.

- Below 57,500, weakness may emerge traders should either hedge with puts or exit long positions.

📊 F&O Data View

- Nifty PCR: 1.08 → Neutral to slightly bullish

- Bank Nifty PCR: 1.14 → Stronger bias than Nifty

- India VIX: 11.29 → Low volatility environment (favors controlled intraday moves)

Low VIX levels indicate that markets are in a controlled optimism phase, but traders should not get complacent any spike in volatility near resistance zones can quickly change the intraday narrative.

🔹 Fin Nifty Intraday View

CMP: 27,546

The Fin Nifty continues to trade in sync with Bank Nifty but exhibits more measured moves. The index has seen robust call unwinding near 27,800 and fresh put additions near 27,500, indicating a tight consolidation range.

⚙️ Intraday Straddle Tip

Traders can consider a 27,500 straddle strategy for intraday volatility capture:

- Buy 27,500 CE + 27,500 PE when volatility is low in the morning.

- Exit both legs post 1:30 PM near key intraday breakout timings (12:05, 13:08, 14:04, 14:50).

- Ideal for range expansion or breakout scenarios.

Alternatively, experienced traders may sell straddles with tight stop losses during flat sessions if the index remains range-bound below 27,600.

⏰ Important Intraday Timings (High-Impact Zones)

Keep these time frames on your radar historically, these windows have shown sharp directional movements or trend reversals:

- 12:05 PM – Key reaction zone (post-European sentiment)

- 13:08 PM – Midday retracement window

- 14:04 PM – Pre-closing volatility watch

- 14:50 PM – Critical for end-of-day momentum

Intraday traders can use these time points for managing trailing stop losses or booking profits, especially if a breakout or breakdown aligns with these windows.

🔹 Market Sentiment Overview

The Foreign Institutional Investors (FII) long exposure in index futures remains steady around 19%, reflecting cautious optimism. DII inflows continue to support the market on dips. This combined positioning suggests that while the market is nearing overbought zones, there’s no aggressive unwinding yet meaning every dip still has buying interest.

Sentiment-wise, traders appear more comfortable buying dips rather than chasing rallies, especially as Nifty approaches 26,000+. A breakout above 26,070 could trigger short covering and potentially drive the next leg toward 26,250–26,350.

🔸 Global & Sectoral Influence

- Global Markets: US and Asian markets traded mixed overnight as investors eyed US Treasury yields.

- Sectors in Focus: Private Banks, PSU Banks, and Auto sectors continue to show relative strength, while IT stocks consolidate after recent profit booking.

- Commodities: Crude oil remains below $85, easing inflationary concerns and supporting the bullish bias in Indian equities.

🧭 Trading Psychology for Today

In markets like these where the index is near all-time highs it’s easy to get caught in FOMO (fear of missing out). Remember, gap-ups are meant for profit booking, not fresh entries. Always wait for the market to settle post-open, let the first 30–45 minutes define the direction, and then align with momentum.

For short-term traders, the key is to trade levels, not emotions.

The structure supports buy-on-dip strategies as long as Nifty holds above 25,820 and Bank Nifty remains above 57,500.

📌 Summary Table: Nifty, Bank Nifty, Fin Nifty

| Index | CMP | Support | Resistance | Bias |

|---|---|---|---|---|

| Nifty 50 | 25,868 | 25,820–25,830 | 26,070–26,080 | Bullish on dips |

| Bank Nifty | 57,700 | 57,500 | 58,000 | Cautious buy above support |

| Fin Nifty | 27,546 | 27,400–27,500 | 27,800 | Range-bound, straddle play |

🧠 Pro Insight

“In every gap-up, the real trader doesn’t chase he positions smartly for the next pullback.”

Today’s session is not about aggression but precision.

Hold your bias light, your stop-loss tight, and your conviction flexible.

🏁 Final Word

Friday’s session (24th October 2025) could see limited but volatile range moves. Traders should stick with buy-on-dip strategies, avoid chasing rallies, and prepare for short-covering momentum above 26,070 (Nifty) and 58,000 (Bank Nifty).

Patience and discipline remain your strongest edges in this pre-Diwali market.

📍CapitalKeeper Insight

Stay tuned for Monday’s Pre-Market Pulse to decode whether this breakout sustains or exhausts into consolidation.ains broadly bullish, but as history suggests, big gaps often invite consolidation rather than continuation. Traders who follow discipline and manage risk through timed entries and exits will outperform in this phase of the bull run.

📌 For more real-time updates, trade setups, and investment insights — follow us on [Telegram] and [WhatsApp Channel] subscribe to our newsletter!

📌 Disclaimer

The content provided on CapitalKeeper.in is for informational and educational purposes only and does not constitute investment, trading, or financial advice. While we strive to present accurate and up-to-date market data and analysis, we make no warranties or representations regarding the completeness, reliability, or accuracy of the information.

Stock market investments are subject to market risks, and readers/investors are advised to conduct their own due diligence or consult a SEBI-registered financial advisor before making any investment decisions. CapitalKeeper and its authors are not liable for any loss or damage, direct or indirect, arising from the use of this information.

All views and opinions expressed are personal and do not reflect the official policy or position of any agency or organization. Past performance is not indicative of future results.

By using this website, you agree to the terms of this disclaimer.

Ranjit Sahoo

Founder & Chief Editor – CapitalKeeper.in

Ranjit Sahoo is the visionary behind CapitalKeeper.in, a leading platform for real-time market insights, technical analysis, and investment strategies. With a strong focus on Nifty, Bank Nifty, sector trends, and commodities, she delivers in-depth research that helps traders and investors make informed decisions.

Passionate about financial literacy, Ranjit blends technical precision with market storytelling, ensuring even complex concepts are accessible to readers of all levels. Her work covers pre-market analysis, intraday strategies, thematic investing, and long-term portfolio trends.

When he’s not decoding charts, Ranjit enjoys exploring coastal getaways and keeping an eye on emerging business themes.

📌 Follow Ranjit on:

LinkedIn | Twitter/X | Instagram | ✉️ contact@capitalkeeper.in

Leave a Reply